Crypto Weekly Wrap: 22nd August 2025

When the Crypto Market Goes Neutral: Bitcoin Catches Its Breath, Ethereum Catches a Wave

This week in crypto felt less like a full-throttle race and more like a pit stop in a high-stakes endurance event. The market, by most measures, decided to hit the pause button, settling into a "neutral" gear. Bitcoin took a moment to consolidate after its recent highs, while Ethereum, perhaps emboldened by its own set of shiny new ETFs, seemed to be making its own path. As macroeconomic winds continued to blow a mixed bag of inflation fears and Fed anticipation, the digital asset space offered a fascinating study in divergence and cautious optimism.

The Macro Lens

The broader sentiment this week could best be described as "watching paint dry, but with a slight tremor of anticipation." The Crypto Fear & Greed Index, that quirky barometer of market emotions, dipped from "Greed" to a perfectly balanced 50 – squarely in "Neutral" territory. This wasn't a panicked flight, but rather a collective shrug, indicating that investors are currently in a holding pattern.

Behind this equanimity, familiar macroeconomic shadows loomed. Inflation fears continued to whisper unsettling thoughts, and the market held its breath for Jerome Powell's pronouncements at the Jackson Hole Symposium. It’s like waiting for the school principal to deliver a speech; everyone knows it’s important, but no one's quite sure what the takeaway will be.

Unsurprisingly, this led to some correlation with traditional finance, particularly a sell-off in "overvalued technology stocks." When tech stocks sneeze, crypto often catches a cold, and some leveraged positions felt the pressure, leading to liquidations. Yet, in a testament to its evolving narrative, some corners of the market still view crypto as an "alternative safe haven" amidst a global economic slowdown – a notion that, ironically, often comes with its own brand of elevated volatility.

The Crypto Lens

Bitcoin (BTC)

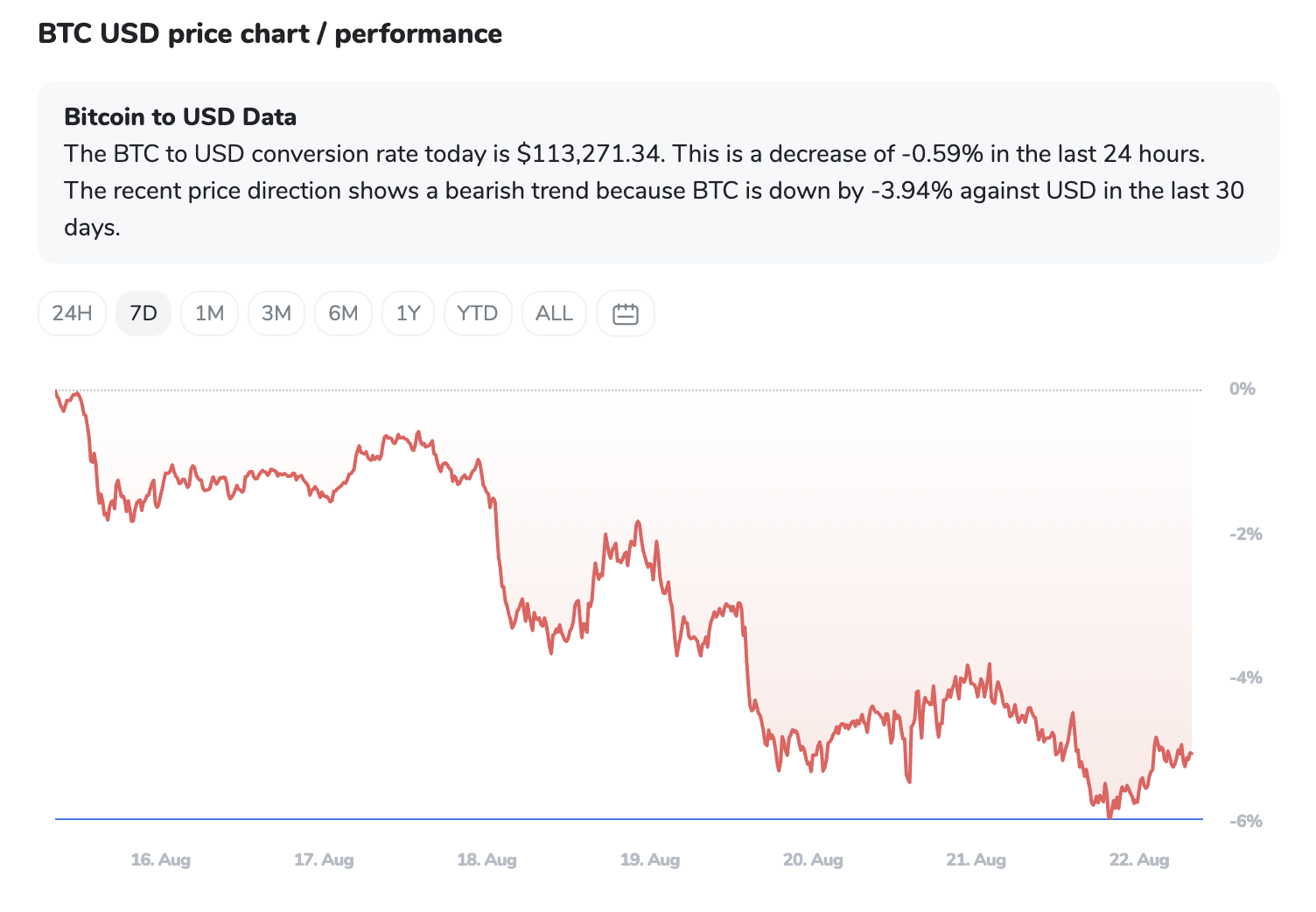

After its impressive run to an all-time high of $124,533, Bitcoin decided it was time for a breather. Trading around $113,091, it's currently in a consolidation phase. Think of it as a marathon runner pausing for water: still in the race, but not sprinting. While some short-term fragility is evident, and retail participation appears to be waning, the big money – large-cap investors and those shiny new ETFs – continues to accumulate. On-chain data suggests the whales are still in the pool, even if the minnows are a bit shy. Options sentiment, however, has turned a touch bearish in the short term, indicating some hedging against further dips. A decisive move above $114,000-$115,000 would be the next hurdle.

Ethereum (ETH)

ETH seemed to be on a slightly different wavelength. Trading around $4,330, it's been consolidating within its own channel, but the story here is one of quiet strength. Spot Ethereum ETFs have been the belle of the ball, attracting record-breaking inflows in August. We're talking over $1 billion monthly since July 2025, consistently outpacing Bitcoin ETFs in both volume and velocity. While even ETH ETFs saw some daily outflows (Grayscale's ETHE notably), the overall institutional appetite for Ethereum is undeniable. With its utility-driven nature, staking growth, and exchange balances hitting a nine-year low (meaning less ETH available for sale), the underlying bullish structure looks robust for the medium-to-long term. It seems institutional investors are increasingly seeing ETH as a "productive reserve asset."

Solana (SOL)

Solana found itself in a bit of a tussle around $184.13. After a rejection from the $208 resistance, it's facing some short-term turbulence. However, peering past the immediate bumps, the medium-term outlook remains constructive. Technical patterns are hinting at potential upward momentum, with some analysts eyeing a rally toward the $260 mark. The caveat? Some weakness in momentum indicators and a slight dip in network activity – a reminder that even promising altcoins need constant fuel.

Overall, the picture is one of divergence: Bitcoin finding its footing, Ethereum drawing significant institutional interest, and altcoins like Solana navigating their own micro-climates. The shift of whale activity towards altcoins, especially Ethereum, hints at a broader, more sophisticated allocation strategy emerging in the market.

The ICONOMI Angle

The "Neutral" market sentiment painted by the Fear & Greed Index this week found a practical reflection in ICONOMI strategies. For those playing it safe, strategies like HODLers (100% USDC) delivered a modest +0.69%, proving that sometimes, doing nothing is doing something. Similarly, Pecun.io, with its significant allocation to USDC and PAXG (digital gold), posted a respectable +0.46%, showcasing the appeal of capital preservation in uncertain times.

However, for those with more skin in the game, the market's recent consolidation translated into slight retracements. Wisdom Stable, a broadly diversified strategy holding a mix of stablecoins, gold, and smaller allocations to a wide array of cryptocurrencies, saw a -0.86% return. Its more aggressive sibling, Wisdom Balanced, with higher crypto exposure across a similar diversified basket, naturally experienced a larger dip at -2.23%. And for those betting on the blue-chip altcoins, Diversitas (heavily weighted in ETH, BTC, BNB, and LINK) recorded -2.82%.

This illustrates the ongoing tension in the market: the comfort of stability versus the higher volatility of growth-oriented crypto assets. It’s a good week to remember the value of risk management and strategic diversification, even as the market figures out its next direction.

What to Watch Next

The Fed's Next Move: Will Jerome Powell's remarks at Jackson Hole confirm or quell inflation fears? This will be a significant directional cue for both traditional and crypto markets.

Ethereum's ETF Endurance: Can spot Ethereum ETFs maintain their impressive inflow velocity and continue to outpace Bitcoin, potentially driving further capital rotation into the broader altcoin market?

Bitcoin's Consolidation Breakout: Will Bitcoin's large-cap accumulation eventually overcome the current retail caution and push it decisively above its key resistance levels, potentially reigniting bullish momentum?

Altcoin Resilience: Watch how altcoins, particularly Solana, respond to this mixed market. Can they consolidate their gains and push towards new targets, or will declining network activity become a more significant headwind?

The De-Correlation Debate: Is the current divergence between Bitcoin and Ethereum, particularly in ETF flows, a temporary anomaly or the early signs of a more mature, de-correlated crypto market?

FAQs

Why are Bitcoin ETFs seeing outflows while Ethereum ETFs are booming?

Bitcoin ETFs are experiencing outflows, likely due to profit-taking after its recent rally and broader macroeconomic concerns. Ethereum ETFs, on the other hand, are a newer phenomenon and are attracting fresh institutional capital, with investors keen on ETH's utility-driven growth and staking potential. It's a tale of two assets finding different stages of adoption.

What does a 'neutral' market sentiment, like the Fear & Greed Index at 50, mean for investors?

A neutral sentiment indicates that investors are neither overly optimistic ("Greed") nor overly pessimistic ("Fear"). It suggests a period of consolidation, caution, and indecision. For investors, this often translates into sideways price action and increased volatility as the market searches for its next directional catalyst.

Are macroeconomic factors like inflation still strongly influencing crypto prices?

Yes, absolutely. Despite crypto's narrative as a separate asset class, it remains significantly correlated with traditional financial markets, especially tech stocks. Persistent inflation fears, interest rate speculation, and central bank policies continue to be major drivers, impacting investor risk appetite and leading to liquidation pressures in the crypto market.