Crypto Weekly Wrap: 20th June 2025

Bitcoin Faces Mounting Pressure Amid Hacks, ETF Flows, and Institutional Accumulation

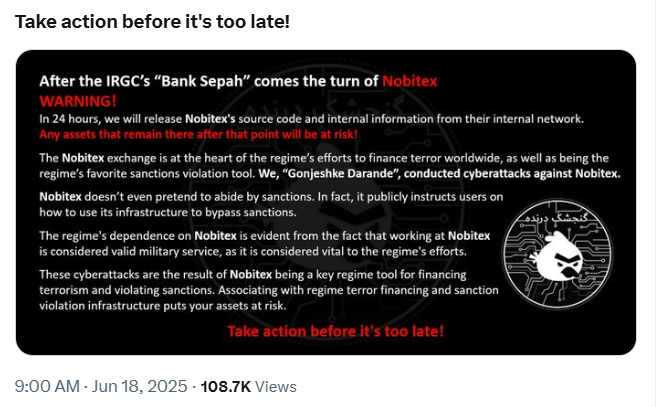

Bitcoin has been caught in a tug-of-war between bullish institutional developments and rising geopolitical tension. While the market has largely shrugged off the recent $90 million hack of Iran’s Nobitex exchange, the incident underscores the persistent vulnerability of digital assets in politically sensitive regions. The attack, allegedly carried out by pro-Israel hackers, saw millions in BTC and TRX burned in a symbolic act of cyberwarfare. Yet, Bitcoin's resilience remains intact—trading stable despite the scale of the breach, which highlights growing maturity and confidence in the asset among institutional holders.

Source: X

Meanwhile, bullish sentiment was bolstered by the announcement that Hong Kong-listed Prenetics acquired over 187 BTC at an average price of $106,712. Backed by $117 million in liquidity, the company is positioning itself as an emerging player in institutional crypto exposure. With support from pro-Bitcoin political figures and ex-OKEx executives, this move adds a layer of credibility to BTC adoption beyond traditional finance. As companies like Prenetics join the Bitcoin narrative, BTC's long-term investment case gains broader traction.

Source: ir.prenetics.com

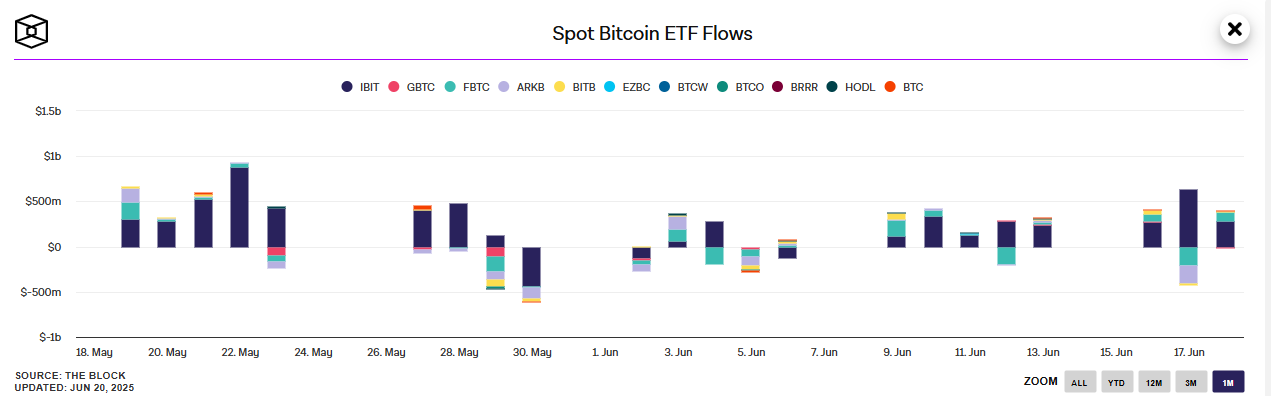

ETF Momentum Grows

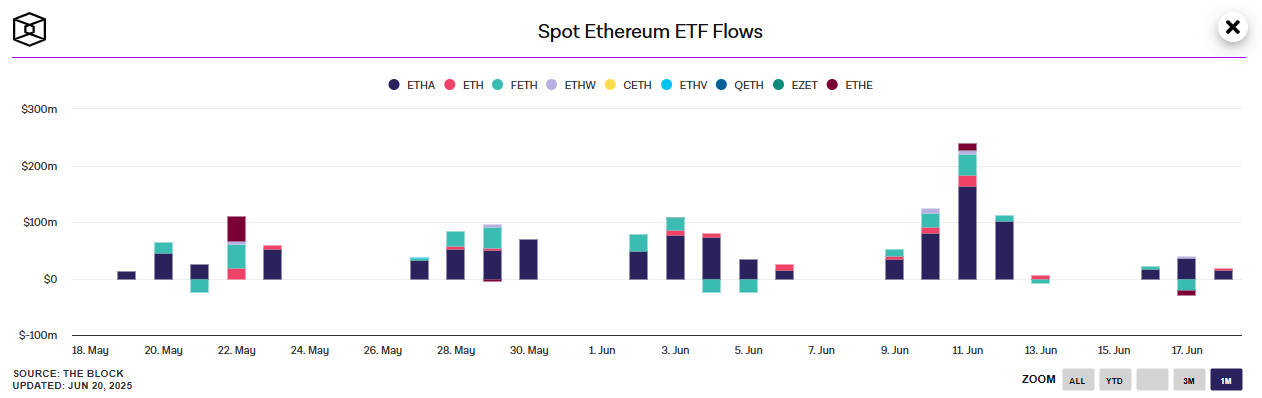

The latest divergence between Bitcoin and Ethereum ETFs underscores a notable shift in investor sentiment. While Bitcoin spot ETFs have witnessed a staggering $2.4 billion in inflows over just eight days—driven heavily by BlackRock’s IBIT and Fidelity’s FBTC—Ethereum ETFs might be showing some signs of cooling off after a strong start of the June. Despite ETH ETFs pulling in $1.4 billion during their initial 19-day run, inflows have since decelerated sharply, with only $19.1 million recorded on a recent Wednesday. This suggests that while Bitcoin is being embraced as a long-term institutional hedge, Ethereum’s demand is more sensitive to macroeconomic headwinds and the lack of a near-term catalyst. The market is increasingly viewing BTC as a core asset in diversified portfolios, whereas Ethereum may be entering a consolidation phase until renewed momentum emerges.

Source: TheBlock

Source: TheBlock

GENIUS Act Passes: Stablecoins Set for Regulatory Integration

One of the most consequential developments for the crypto industry came from Washington D.C., where the U.S. Senate passed the GENIUS Act. This bipartisan bill lays the foundation for federal oversight of stablecoins, ensuring they are fully backed and subject to a clear regulatory framework. With the stablecoin market ballooning from under $10 billion to over $239 billion in just five years, the legislation addresses urgent concerns around consumer protection, financial stability, and systemic risk.

Industry advocates have applauded the move, viewing it as a key milestone in integrating digital assets with the traditional financial system. Organizations like Stand With Crypto and Elliptic emphasised that the bill enhances clarity and trust, which could lead to wider stablecoin adoption by banks, PSPs, and fintech platforms. Moreover, the GENIUS Act is seen as a bid to restore the U.S.'s leadership in blockchain innovation, following years of regulatory ambiguity that drove developers overseas. With the House expected to review the bill next, all eyes remain on whether this clarity will translate into a more vibrant and secure crypto ecosystem.

Source: ABCNews

Bitcoin Price Analysis: Breakout Surges Through $106K, But RSI Flashes Overbought Warning

Bitcoin has decisively broken out of its prior consolidation zone, surging past the $106,000 resistance and reaching an intraday high of $106,131. The sharp move upward follows a lengthy sideways range and confirms bullish momentum in the near term. However, traders should be cautious—technical indicators are signaling an overextended rally. The 14-period Relative Strength Index (RSI) has spiked to 92.87, firmly into overbought territory, and the fast RSI line at 82.00 suggests the price may be ripe for a near-term cooldown.

Despite rising volume, which supports the strength of this breakout, market participants should monitor closely for any bearish divergence or quick pullback. The next key level to watch is $107,000, which if breached, could open a pathway toward $108,300. However, if the rally falters, a retracement toward $105,000 or $104,400 could provide a healthier base for continuation. The current move marks a strong bullish reaction, but given the extreme RSI readings, profit-taking may soon kick in unless accompanied by a fundamental catalyst.

Source: TradingView

Ethereum Technical Outlook: Breakout Begins, but RSI Flags Overheated Conditions

Ethereum has surged past the $2,560 level, reaching an intraday high of $2,569.20, signaling a potential end to its prior consolidation phase. The breakout comes after several failed attempts to reclaim this key resistance zone, and today’s price action suggests bullish momentum may be building. However, warning signs are emerging—the 14-period RSI has jumped to 86.69, indicating that ETH is in overbought territory. The fast RSI line at 77.04 also supports this view, suggesting price may be overextended in the short term.

Volume has slightly picked up alongside the rally, but not enough to fully confirm a sustained breakout. If Ethereum can maintain support above $2,550, it could aim for the next resistance near $2,738. A decisive move past that level would open the path toward $2,879 and even $3,153. However, if buying pressure fades and RSI begins to decline, ETH could pull back toward $2,500 or even $2,460 to retest prior support. For now, traders should watch for volume confirmation and RSI cooling before expecting a continuation of this move.

Source: TradingView

Solana Fundamentals Strengthen as Sol Strategies Targets Nasdaq

Solana is drawing institutional attention, with Canadian asset manager Sol Strategies filing to list its common shares on the Nasdaq under the ticker “STKE.” The firm currently holds over 420,000 SOL tokens and aims to expand its footprint in the U.S. digital asset market. As a “foreign private issuer,” Sol Strategies enjoys exemptions from certain U.S. regulatory requirements, offering flexibility as it navigates cross-border compliance.

The company also filed a $1 billion shelf prospectus in May to allow future capital raises and secured a $500 million convertible note facility linked to Solana staking. These funds will be used to acquire and delegate SOL on their own validator nodes. Notably, Sol Strategies is also exploring tokenizing its own equity on the Solana blockchain in partnership with Superstate, signalling a bold push into on-chain public equity.

Source: X

Solana (SOL) is currently trading at $147.82 after a modest bounce from the $144 support zone. While price has reclaimed some ground, it continues to face strong resistance below the critical $150–$160 area. Despite the slight uptick, RSI values at 77.86 and 76.47 suggest that the asset is overbought in the short term, potentially limiting further upside unless confirmed by rising volume and continued bullish conviction.

Technical structure shows a prior downtrend, followed by consolidation and a sharp push upward. However, the price remains under pressure from its previous lower highs. If SOL can decisively break above $150 and hold, bulls could attempt to target $160. Conversely, failure to maintain momentum might see the token revisit $144 support—and a breakdown there could reignite a bearish scenario toward $140 or lower. The RSI overheating reinforces caution, and unless follow-through buying emerges, traders should remain on alert for a potential pullback.

Source: TradingView