Crypto Weekly Wrap: 19th December 2025

Fear at $88k: The Curious Case of a Bull Market Correction

It’s December 19, and the markets are giving us a masterclass in psychology. Bitcoin is trading at $88,000, a price that, just a few short years ago, would have sparked euphoria. Yet, the Fear & Greed Index is flashing a blinking red "16" (Extreme Fear). Why? Because we were at $92,000 last week. In traditional finance, a 4% pullback is a Tuesday afternoon; in crypto, it feels like the sky is falling. But for those of us who have been through actual crises, this week smells less like a crash and more like a necessary reset. Liquidity is thinning out for the holidays, and the weak hands are folding right before the year-end close. The smart money isn't panicking; they're shopping.

The Macro Lens

The end of the year brings a unique flavour of macro pressure: Tax-Loss Harvesting.

When you see widespread red across the board in late December without a catastrophic news catalyst, you are often watching institutional and retail investors effectively "cleaning up" their balance sheets. Investors sell losing positions to offset gains elsewhere, creating artificial selling pressure.

The Liquidity Vacuum: As trading desks in New York and London skeleton-staff for the holidays, volume typically drops. Lower liquidity means higher volatility—small sells can move the price further than usual.

The Gold Signal: Interestingly, while crypto assets dipped, on-chain gold (PAXG) remained a fortress. This suggests capital isn't leaving the ecosystem entirely; it's just moving to the "safe room" until January.

Central Bank Watch: We are in a holding pattern. With no major volatility-inducing FOMC meetings slated for this specific holiday week, the market is left to its own internal mechanics.

The takeaway: Don't mistake seasonal housekeeping for a change in fundamentals.

The Stocks Lens

Traditional equity markets are shifting into "cruise control" for the holiday-shortened weeks, but the correlation narrative is shifting.

The Year-End window dressing: Fund managers are locking in their annual performance. If they are winning, they aren't taking risks now. This risk-averse stance in the S&P 500 often spills over into crypto, capping upside momentum for high-beta assets like Bitcoin.

Tech Sector Jitters: As the Nasdaq processes its yearly gains, profit-taking is the name of the game. Crypto, often trading in sympathy with aggressive tech stocks, is feeling that secondary continued pressure.

Why it matters: If the S&P 500 closes the year strong, it sets a "risk-on" tone for January, which is historically bullish for digital assets. Watch the closing levels this Friday—it’s the psychological anchor for Q1 2026.

The Crypto Lens

The market is currently a sea of red ink on the weekly timeframe, but green shoots are appearing on the daily timeframe.

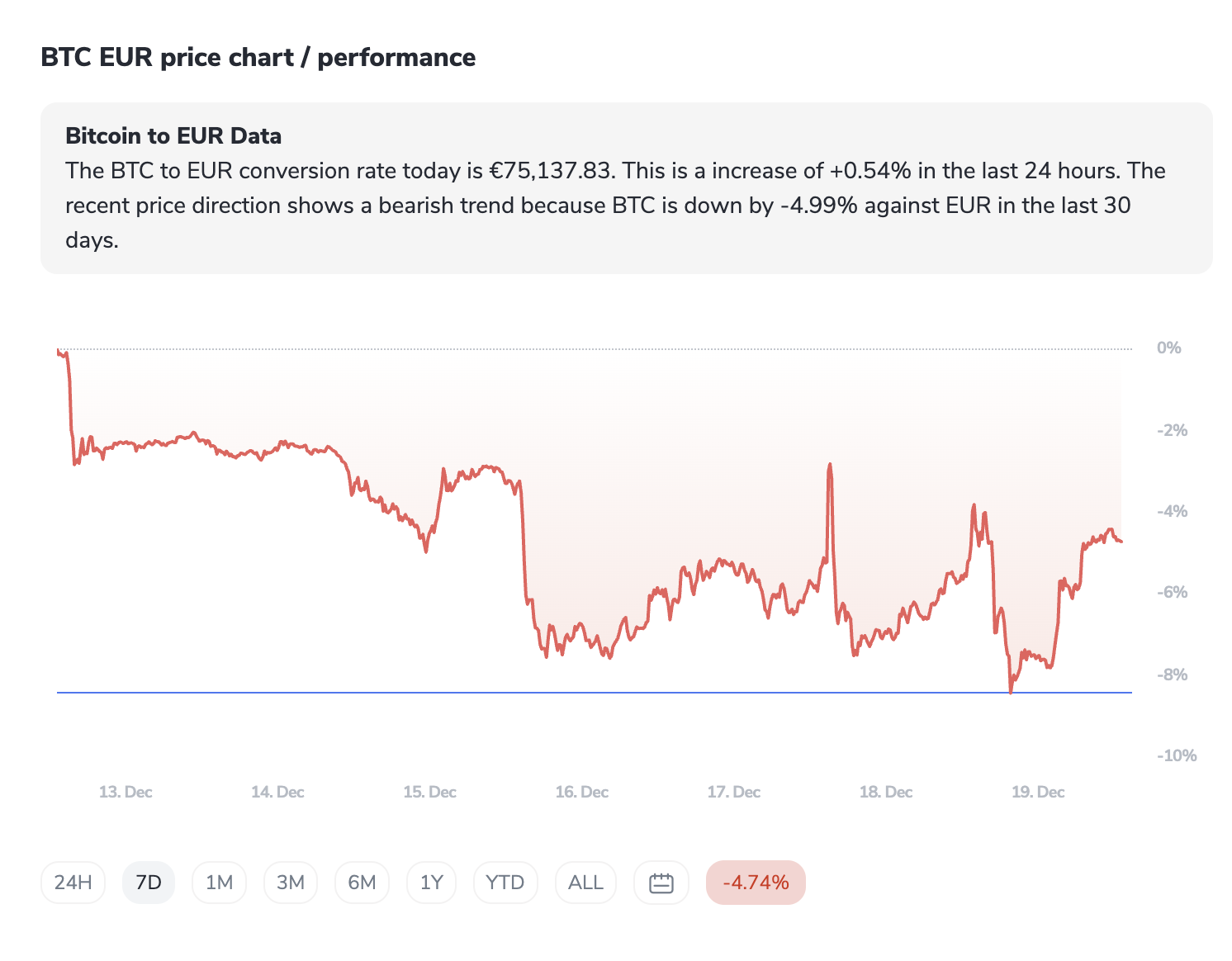

Bitcoin (BTC)

BTC is down 4.6% on the week to $88,153, recovering from a dip toward $85k. The structure is classic consolidation. We tested the $92k resistance, failed, and are now checking for demand at lower levels. The fact that we haven't violently broken below $85k is constructive.

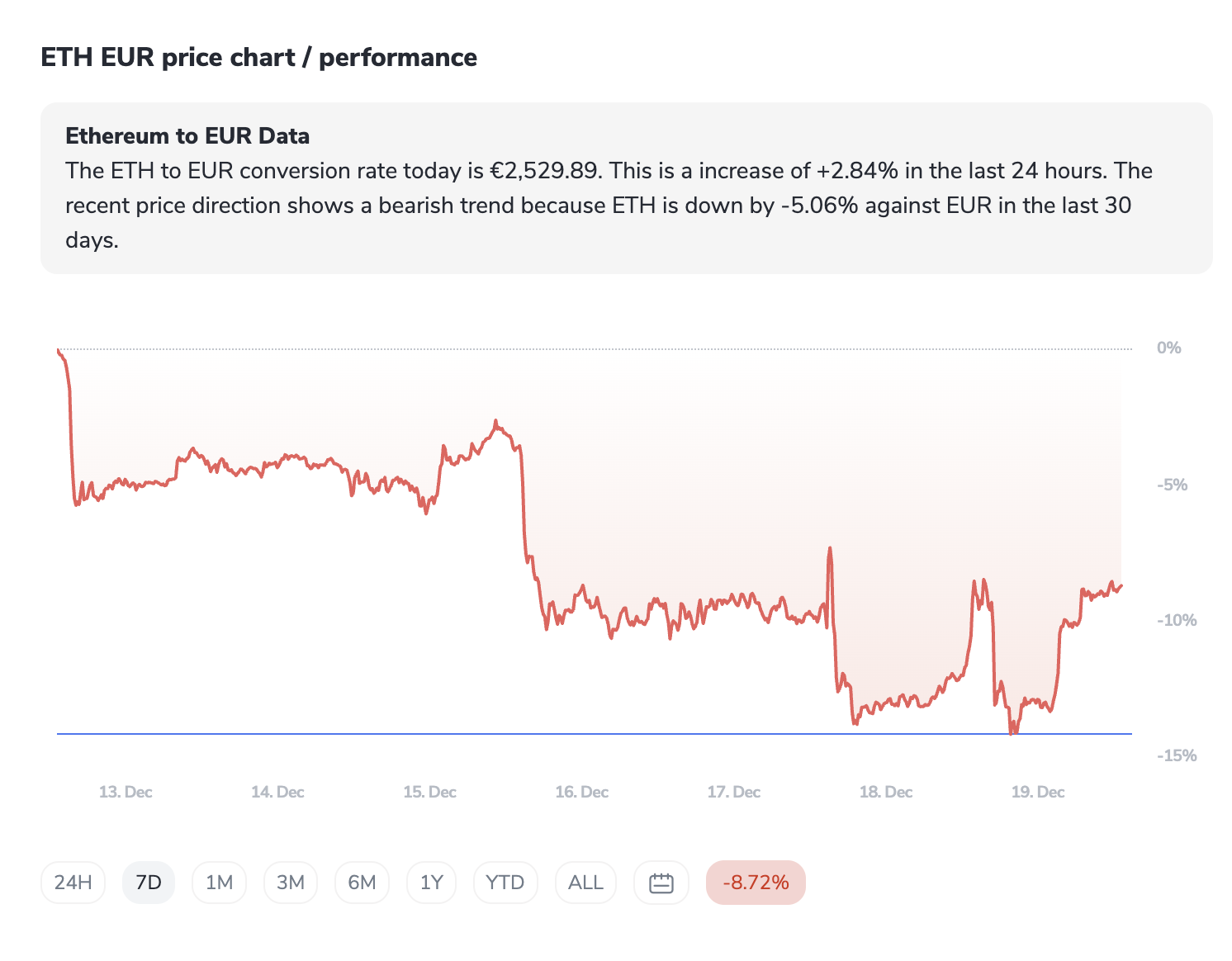

Ethereum (ETH)

ETH, the second-largest asset, is having a rougher time, down 8.9% this week to $2,956. It's struggling to maintain the $3k psychological floor. However, a 3.6% bounce in the last 24 hours suggests sellers might be exhausted.

The Outliers

While majors bleed, Bitcoin Cash (BCH) is up 11%. Often, when the bleeding stops in BTC, capital rotates strangely into older, high-liquidity forks or "dino-coins" as a short-term trade. It's rarely a fundamental shift, usually just traders seeking volatility where they can find it.

Volatility cuts both ways. Here is who defied the gravity of the market this week:

Winners

LEO Token (+18%)

LEO often moves independently of the broader market due to its connection to Bitfinex exchange mechanics and buybacks. In a red week, exchange tokens often act as defensive plays or idiosyncratic runners.

Bitcoin Cash (BCH) (+11%)

A legacy play. When the shiny new toys (SOL, HYPE) take a beating, liquidity sometimes flows back to the "old guard" assets that are perceived as oversold.

Losers

Hyperliquid (HYPE) (-16%)

The Story: A classic "high flyer" correction. HYPE had a massive run recently; in risk-off weeks, the highest flyers get their wings clipped first as traders lock in profits to cover losses elsewhere.

Hedera (HBAR) (-16%)

Heavily momentum-driven. When momentum fades across the market, coins like HBAR often see deeper retracements than the majors.

Sentiment

An index of 16 (Extreme Fear) with BTC at $88k is a bullish divergence. Usually, extreme fear is reserved for market bottoms. Having it near all-time highs suggests the market is incredibly skittish and likely washed out of leverage.

Sector Spotlight

The "Boring" Defensive Sector: On-Chain Gold & Stables

It rarely gets the headlines, but this week, the winner was Safety.

While meme coins and L1s bled out double digits, the sector that truly outperformed was tokenised value preservation, specifically, PAXG (Paxos Gold) and Staked Ether.

Why now? In a week yielding -5% to -15% losses for most portfolios, holding flat (or gaining slightly against USD) is a massive relative win.

The Lesson: This sector proves that crypto isn't just about $100k candles. It's about infrastructure for value. The ability to switch from volatile BTC to stable Gold on-chain in seconds, without leaving the ecosystem, is a feature the traditional banking system simply cannot match.

The Contrarian Take

The "Extreme Fear" is a Buy Signal.

The crowd is currently terrified. The Fear & Greed Index is at 16. The last time the index was this low, Bitcoin was likely trading 50% lower than it is today.

Here is the contrarian truth: Price is high, but Sentiment is at rock bottom.

This is a rare anomaly. Usually, high prices bring high greed. Seeing high prices paired with extreme fear suggests that the market is "climbing a wall of worry." There is no euphoria to punish here. If anything, the market is overly hedged. If the price doesn't collapse, those hedges will have to be unwound—buying back into result in a squeeze upwards.

The ICONOMI Angle

The data from ICONOMI's top-performing Strategists this week confirms the "flight to safety" thesis perfectly.

Look at the top 3 performers over the last 7 days:

Pecun.io (PCC): -1.01% (Top holdings: 50% PAXG, 25% BTC, 25% USDC)

Ethereal (BIF): -4.20% (Top holdings: 50% USDC, 50% PAXG)

Bitcoin Vault: -4.40% (100% BTC)

The best performers didn't find a magical altcoin that pumped; they simply didn't lose money. They held Gold (PAXG) and Cash (USDC).

The strategists holding high percentages of PAXG outperformed the pure crypto indexes by 3-4%. This is portfolio management 101: You don't need to win every week; you just need to survive the red ones. If you are copying these Strategies, you just saved significant capital compared to holding raw large-cap alts.

The Week Ahead

Dec 25 (Wednesday): Christmas Day. Expect extremely low volume. Historically, "Santa Rallies" happen before or after this day, but the day itself is often a ghost town.

Dec 26 (Thursday): US Jobless Claims. A minor data point, but in a thin market, even small economic surprises can cause wicks.

Dec 27 (Friday): Monthly Options Expiry. A massive amount of BTC and ETH options contracts will expire. Volatility typically spikes in the 24 hours leading up to the "Max Pain" price settlement.

Dec 31 (Tuesday): Tax Year Close. The final deadline for tax-loss harvesting. Expect selling pressure to abate significantly after this date.

What to Watch Next

The $85,000 Support: If BTC loses this level, the fear index is justified. If we hold it, this week was a bear trap.

ETH vs. SOL dominance: ETH took a harder hit than SOL this week. Watch if capital rotates back into Ethereum near $2,900 or if Solana continues to eat its lunch.

USDT Dominance: If Tether's market cap rises or price action stabilises, it implies traders are sitting in cash waiting to deploy.

The "Jan 1" Narrative: Markets often front-run the new year allocations. Watch for buying activity starting as early as Dec 29th.

FAQs

Why is the Fear Index at "Extreme Fear" if Bitcoin is at $88,000?

Sentiment is relative, not absolute. Investors react to the rate of change*, not just the level. A drop from $92k to $88k feels like a loss of momentum, triggering fear of a trend reversal, even though the price is historically high.

What exactly is PAXG and why are strategies holding it?

PAXG (Paxos Gold) is a crypto token backed 1:1 by physical gold ounces. In uncertain times, Strategists use it to hedge against crypto volatility without converting back to fiat currency, maintaining liquidity on the blockchain.

Should I be worried about the 7-day drop?

In the grand scheme, a 5-10% correction after a massive yearly run-up is healthy. It flushes out "leverage" (gamblers borrowing money) and resets indicators for the next leg up.