Cardano (ADA): Latest Developments, Price Trends, and Technical Analysis

Cardano Navigates ETF Speculation and Market Sentiment

Cardano (ADA) has recently entered the spotlight as anticipation builds over a possible exchange-traded fund (ETF) approval by the end of 2025. According to Polymarket betting data, odds of an ADA ETF approval surged from 45% to 64% in just three days. This uptick reflects broader market enthusiasm following speculation around a Solana ETF, although delays in SOL's filing have tempered some of that optimism.

Cardano now finds itself in a delicate position — poised for a breakout if regulatory clarity improves, yet vulnerable to setbacks if the SEC takes a cautious stance similar to that of Solana. Despite this uncertainty, macroeconomic developments like a positive inflation report in April have lifted risk sentiment overall, although Jerome Powell’s hawkish stance on interest rates continues to keep the crypto market grounded.

Source: Polymarket

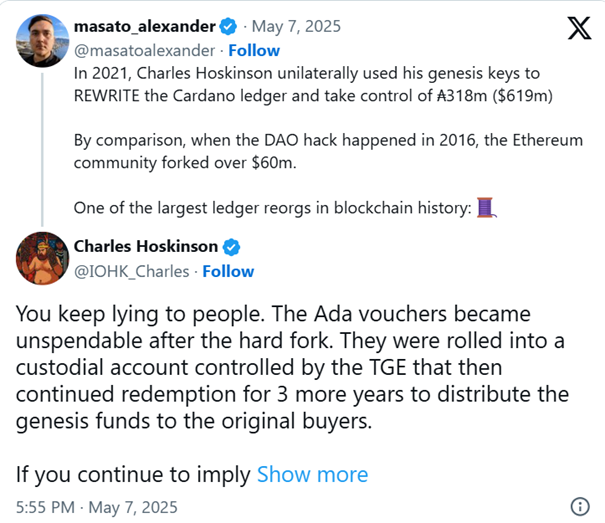

Cardano Under Scrutiny Amid Treasury Embezzlement Allegations

Amid this ETF buzz, Cardano is also facing one of the most significant controversies in its history. Accusations emerged from NFT artist Masato Alexander, who claims Charles Hoskinson misappropriated nearly $600 million in ADA during the 2021 Allegra hard fork. The allegations stem from a 318 million ADA transaction reportedly made using a “genesis key,” which critics allege was an unannounced reallocation from unredeemed tokens. Hoskinson has denied any wrongdoing, stating that the funds were part of a transparent reclamation process for unclaimed ICO tokens and were ultimately assigned to Intersect, Cardano’s governance body. The founder has promised a full third-party audit tracing all token movements since 2015, aiming to restore public trust. If the audit confirms Hoskinson’s version of events, it may establish a new standard of transparency in blockchain governance. However, the ongoing debate has underscored how trust — not just code — remains foundational to crypto legitimacy.

Source: X

Strategic Developments: GITEX, DeFi, and a Litecoin Alliance

Looking beyond the controversy, Cardano continues to push forward with strategic initiatives. ADA representatives will participate in GITEX Europe 2025 in Berlin, where they plan to showcase blockchain applications in AI, digital identity, and decentralised education. This aligns with Cardano’s layered architecture and stakeholder-focused governance model, which separates the settlement and computation layers to maximise security and flexibility. In parallel, founder Charles Hoskinson recently confirmed exploratory talks with Litecoin on a DeFi integration through Cardano’s Midnight protocol. This potential collaboration could establish a bridge for cross-chain decentralised applications (dApps), amplifying ADA’s utility in the DeFi space. With the Brave browser integration also expanding ADA’s reach to over 85 million users, the groundwork is being laid for a robust DeFi and user ecosystem that supports Cardano’s $3 price goal in the longer term.

Source: X

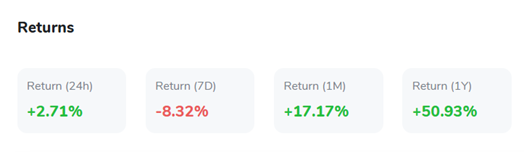

Price History and Whale Activity Signal Accumulation

Cardano’s price action over recent months has reflected both the drama and promise surrounding the project. ADA has risen more than 17% in the last month, currently hovering near the $0.78–$0.80 range.

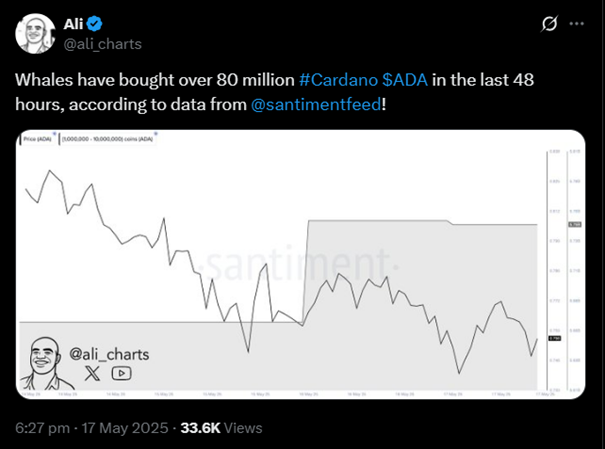

On-chain data from Santiment highlights whale accumulation during this period, with large holders acquiring over 80 million ADA in just two days. These wallets, holding between 1 million and 10 million ADA, are using price dips to build long-term positions, suggesting that institutional and “smart money” players see value in Cardano at current levels. Notably, ADA has experienced nearly $1 billion in exchange outflows during 2025, indicating that tokens are increasingly moving to cold storage — a classic bullish sign of reduced short-term sell pressure and growing confidence in ADA’s medium-term price prospects.

Source: X

Technical Analysis: Cardano Faces Resistance Despite Gradual Rebound

Over the past five days, Cardano (ADA) has seen moderate recovery attempts, but technical indicators reflect ongoing market hesitation. ADA is currently trading near $0.75, showing signs of consolidation just below key resistance, with bulls struggling to maintain momentum. The 14-period Relative Strength Index (RSI) has dropped to 34.84, moving closer to oversold territory and suggesting weakening short-term buying pressure.

Volume has also decreased significantly to 20.81 million, hinting at reduced trader engagement and potential volatility suppression. Despite a series of higher lows, the price failed to break through $0.76, indicating that ADA may remain range-bound unless fresh bullish catalysts emerge. If the price holds above $0.74, a retest of $0.78 remains on the table; otherwise, a slide toward the $0.72–$0.70 support zone could unfold. The technical structure suggests a cautious tone, with any breakout dependent on increased volume and RSI reversal.

Source: TradingView

Rebuilding Confidence Through Transparency and Governance

In response to the recent accusations and broader questions around governance, Cardano’s leadership is emphasising transparency and community trust. Charles Hoskinson has announced that he will delegate management of his X account to a media team and restructure how he communicates through livestreams. Meanwhile, the Cardano Foundation and Emurgo have issued public statements supporting the forthcoming third-party audit.

Emurgo, the project's commercial arm, detailed the rigorous seven-year token redemption process and criticised what it called excessive “fear, uncertainty, and doubt” driven by partial facts. These developments, along with Cardano’s commitment to research-driven development and robust stakeholder participation, aim to position ADA as not only a strong technological platform but also an ethical and community-focused project. If Cardano can weather this storm and validate its claims through the audit, it may emerge as a model for decentralised governance and sustainable crypto development in 2025 and beyond.

Source: X