Crypto Weekly Wrap: 15th August 2025

When Ethereum Decided to Go for Gold (Again)

This week in crypto felt a bit like watching a classic heist movie, but with the roles reversed. Instead of meticulously planned moves and synchronised action, we saw Ethereum burst through a few doors with surprising force, while Bitcoin held its ground with stoic consistency, leaving the rest of the market in a state of watchful consolidation.

The broader market sentiment, having flirted with outright "Greed" recently, settled into a more thoughtful "Neutral to Greed" zone. So, what exactly happened when the market took a collective breath, and why does Ethereum seem to be operating on its own highly caffeinated schedule? Let's unpack it.

The Macro Lens

The general air this week was one of cautious recalibration. The Crypto Fear & Greed Index, that rather useful barometer of collective sentiment, dipped from a "Greed" reading of 68 to a more measured 59, landing us squarely in "Neutral to Greed." This wasn't a panic, mind you, but more of a gentle easing off the accelerator.

What nudged us here? A couple of usual suspects. Recent inflation reports have kept central bankers in a thoughtful, if not entirely hawkish, mood, meaning the prospect of easy money isn't quite the sure thing it once seemed. Then there’s the subtle policy uncertainty surrounding the U.S. Treasury's potential Bitcoin purchases, which, while hypothetical, adds a layer of 'wait-and-see' to the market's digestion.

However, it wasn't all tightening belts and furrowed brows. On the more optimistic side, the authorisation of 401(k) retirement plans to invest in cryptocurrencies served as a quiet but significant nod from the institutional world. It's like the mainstream financial system is slowly but surely adding crypto to its recommended reading list, which, for long-term investors, is precisely the kind of incremental adoption that matters.

So, a bit of a tug-of-war between macroeconomic caution and structural adoption, resulting in a market that's less manic, but still decidedly not bearish.

The Crypto Lens

Now, let's get to the digital assets themselves.

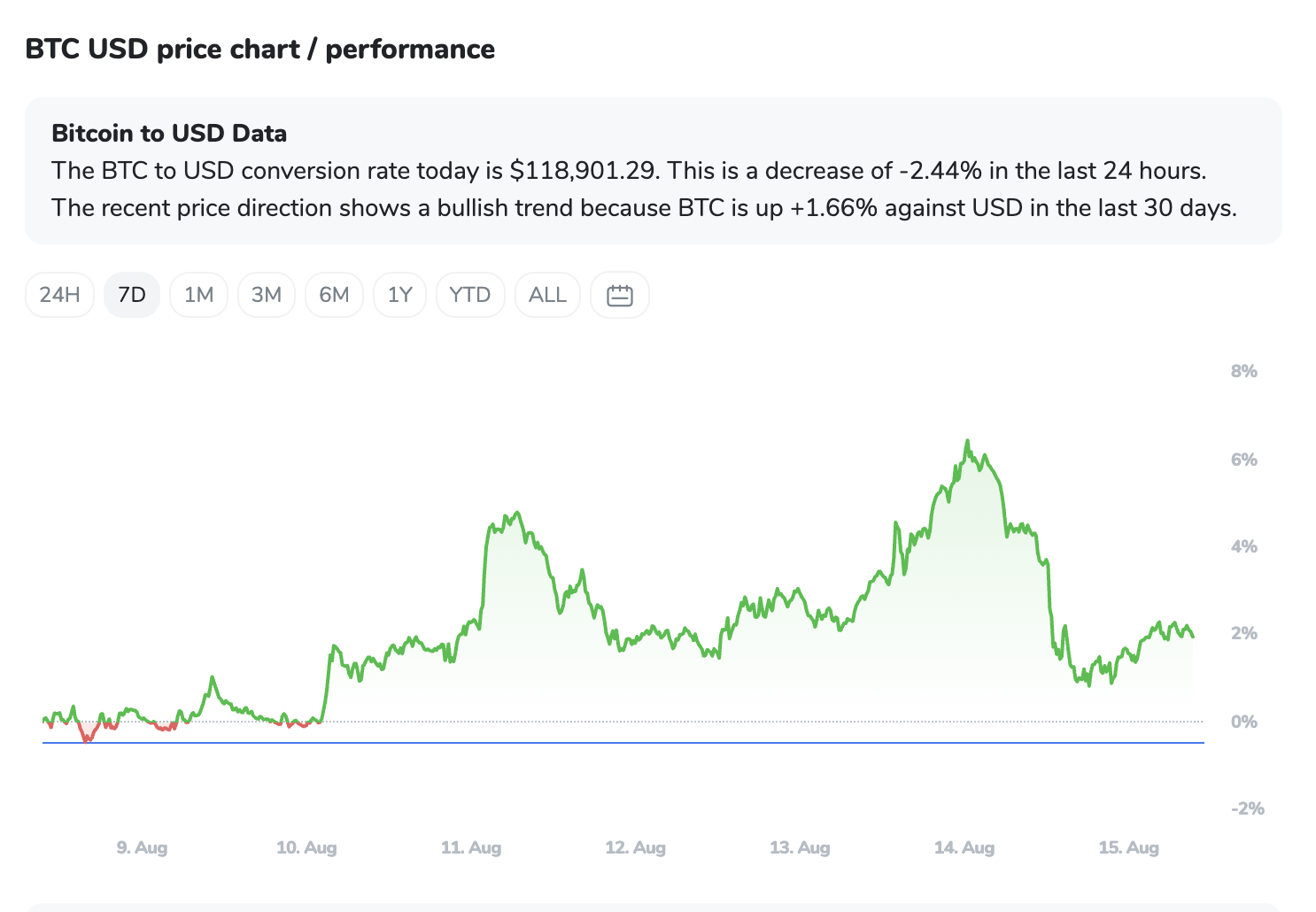

Bitcoin (BTC)

Bitcoin has been the picture of measured strength. After a minor pullback from its recent all-time highs, it’s proving rather stubborn about holding its critical support levels. Think of it as Bitcoin saying, "I've been here before, I know these roads."

Its underlying trend remains bullish, comfortably trading above its key daily moving averages, suggesting the big picture is still very much constructive. The slight dip this week looks more like profit-taking—a natural consequence of a good run—than any fundamental shift.

Crucially, Bitcoin spot ETFs continued their impressive streak, marking their seventh consecutive day of net inflows, adding a solid $231 million on August 14th alone. BlackRock's IBIT fund, for example, raked in a cool $524 million. Even with some outflows from Ark Invest and Grayscale, the net story is one of steady, institutional appetite.

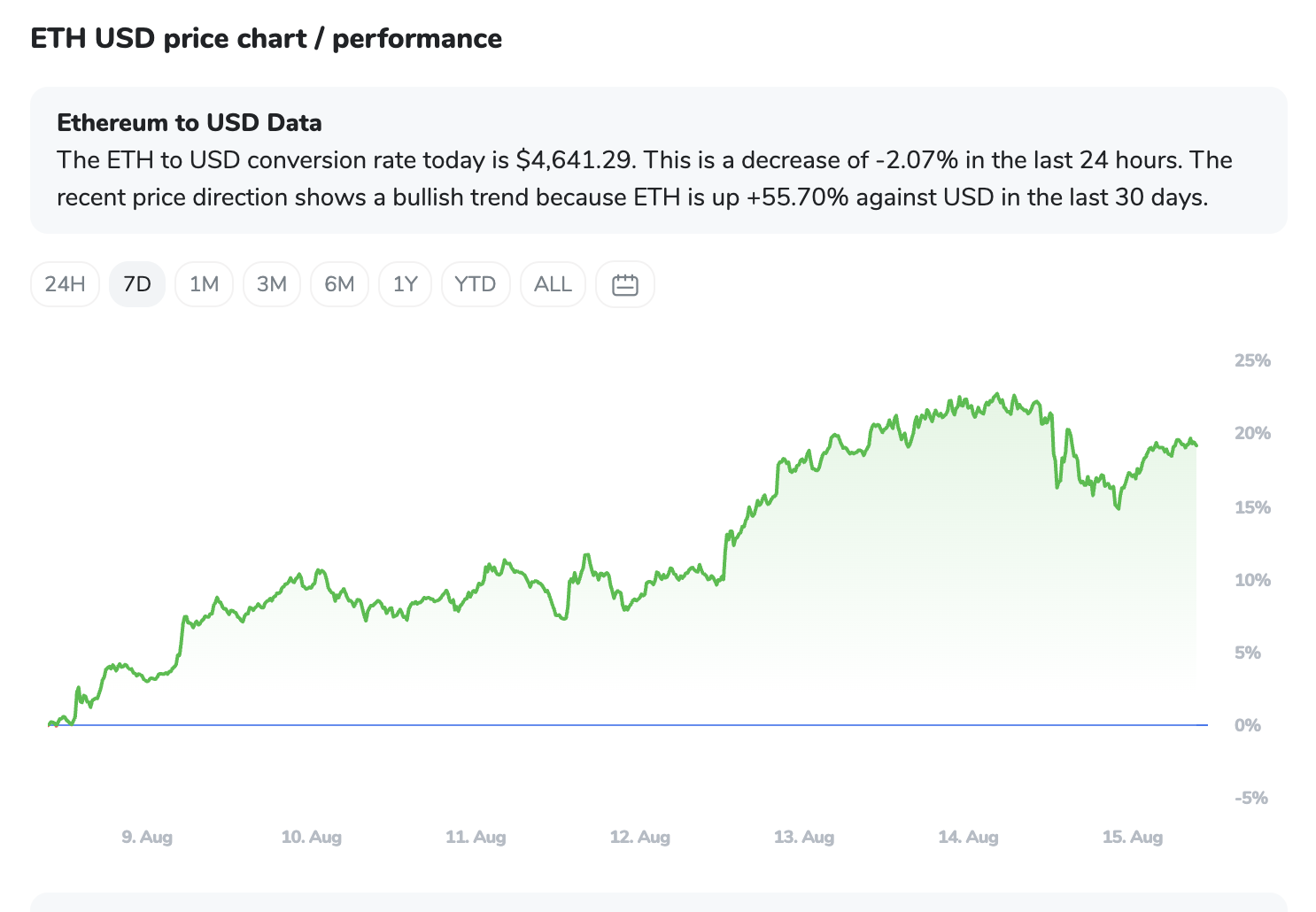

Ethereum (ETH)

Ethereum clearly decided it had better things to do than consolidate. It didn't just break through multi-year resistance levels; it practically pole-vaulted over them and is now within shouting distance of its all-time high.

If Bitcoin is the steady locomotive, Ethereum is the sleek, high-speed train, seemingly fueled by an unprecedented torrent of ETF inflows. Spot Ethereum ETFs have seen an astonishing $3.07 billion in net inflows over seven consecutive days, with BlackRock's ETHA pulling in $640 million and Fidelity's FETH adding $277 million.

This isn't just a trickle; it's a flood, driving a genuine "Fear Of Missing Out" (FOMO) among institutions and individual investors alike. Active buyers are stepping in at every dip, and prediction markets are placing high odds on ETH reaching $5,000 by month-end. Its technical indicators are screaming "bullish," and while its Relative Strength Index is certainly signalling strong momentum, perhaps flirting with the "overbought" zone, sometimes, when the momentum is this strong, things just keep running hot.

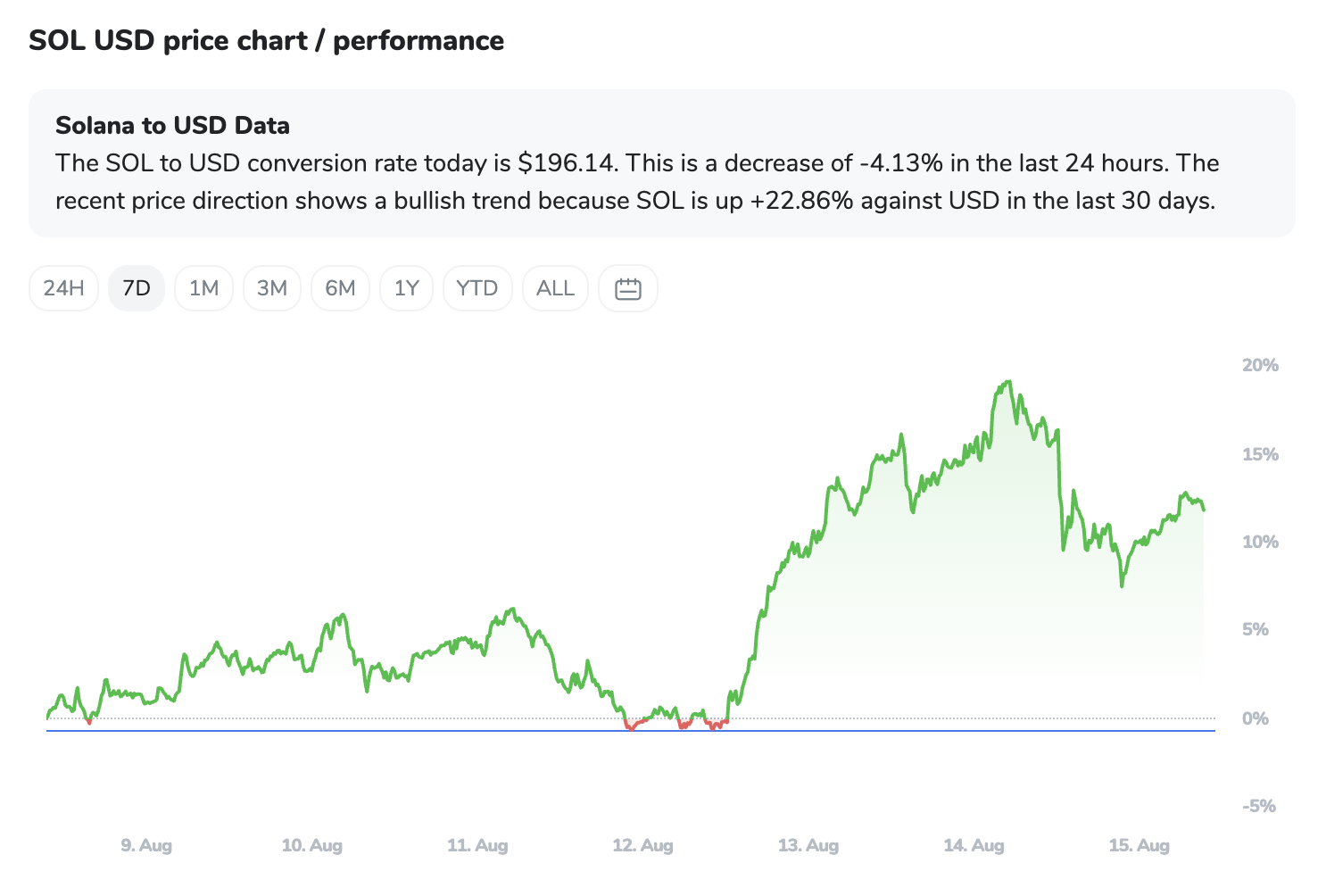

Solana (SOL)

Solana, by contrast, has seen a more conventional market response: a pullback after hitting resistance. But don't mistake consolidation for capitulation. This looks like a healthy breather rather than a reversal.

Its technical signals suggest strengthening bullish momentum beneath the surface, and its broader trend remains constructive, bolstered by growing institutional interest and the ever-present whispers of potential future ETF developments. So while it's currently trading below its immediate pivot point, suggesting a short-term bearish bias, the longer-term story remains quite compelling.

In essence, while the market as a whole took a step back from peak exuberance, the institutional on-ramp remains wide open, particularly for Ethereum, creating distinct performance narratives within the crypto landscape.

The ICONOMI Angle

The market's dynamics this week, particularly Ethereum's sprint, were clearly reflected in the performance of ICONOMI strategies, showcasing how active management and strategic composition can capture these shifts.

Leading the pack was the Ethereal Strategy, which, with its pure 100% ETH composition, delivered a staggering +18.88% weekly return. This is a prime example of high conviction paying off when a single asset breaks out.

Close behind, the diversified strategies also saw impressive gains. Diversitas, holding a significant chunk of ETH (51.50%) alongside BTC, BNB, and LINK, posted a robust +12.34%. Similarly, WMX Crypto, with its 52.25% ETH allocation, plus BTC and SOL, achieved +11.43%. These returns underscore the benefit of having exposure to Ethereum's powerful surge while also maintaining broader market participation.

Even more diverse strategies like Asymmetry Active Performance (+9.16%) and the Blockchain Index (+8.97%) performed admirably. Asymmetry's eclectic mix, including ETH, SOL, XRP, and various DeFi tokens, showed how broader market strength can elevate a diverse portfolio. The Blockchain Index, a wide basket of top cryptocurrencies, captured the overall market uplift, demonstrating the enduring value of broad exposure.

What these performances highlight is a clear trend: strategies with meaningful exposure to Ethereum were particularly well-positioned to capitalize on its remarkable week. It's a real-time illustration of how active rebalancing and thoughtful composition within ICONOMI strategies can translate directly into strong returns during periods of market differentiation.

What to Watch Next

1. ETF Flow Sustainability: Can Ethereum's ETF inflows maintain their torrid pace, and will Bitcoin continue its steady, positive streak? The institutional appetite is currently a primary driver, and any significant deceleration or reversal would be a key signal.

2. Solana's ETF Prospects: Keep an eye on any regulatory chatter or formal filings for Solana ETFs. Approval could unlock a new wave of capital for SOL, mimicking ETH's recent boom.

3. Macroeconomic Tea Leaves: The interplay between stubborn inflation reports and central bank policy will continue to cast a long shadow. A more definitive shift towards dovish policies could provide another tailwind for risk-on assets like crypto.

4. Regulatory Clarity (or lack thereof): Further guidance from U.S. regulators, especially regarding stablecoins or new "Project Crypto" initiatives from the SEC, could either solidify confidence or introduce new uncertainties.

5. Ethereum's Ecosystem Development: Beyond ETF hype, continued progress in Ethereum's DeFi and tokenised real-world assets narratives will be crucial for sustaining its long-term fundamental strength.

FAQs

Why is Ethereum outperforming Bitcoin right now, despite Bitcoin also seeing positive ETF inflows?

While both are benefiting from institutional interest, Ethereum is currently experiencing unprecedented, massive inflows into its newly approved spot ETFs, which is fueling a stronger "FOMO" dynamic and pushing its price closer to an all-time high. Bitcoin's inflows, though consistent, are more mature and currently contributing to stability rather than a dramatic surge. Ethereum's robust ecosystem and dominance in DeFi and tokenised assets also contribute to its unique narrative.

The market sentiment index dipped from "Greed" to "Neutral to Greed." Does this mean a major correction is coming?

Not necessarily. A shift from high "Greed" to "Neutral to Greed" often indicates healthy profit-taking and a cooling off of overheated sentiment rather than an impending crash. It suggests the market is taking a breather. Institutional inflows continue to provide a significant floor, preventing sharper downturns, and the sentiment is far from fearful.

What's the significance of 401(k) plans being authorised to invest in crypto?

This is a major long-term validation. It means mainstream retirement funds can now allocate a portion of their capital to cryptocurrencies, potentially unlocking a vast pool of passive, long-term investment. It signals increasing regulatory comfort and institutional acceptance, laying the the groundwork for broader adoption beyond speculative trading.