AAVE: Latest Developments, Price Trends, and Technical Analysis in June 2025

AAVE Aims for $300 as DeFi Momentum Gathers Pace

Political Engagement and Market Sentiment Boost AAVE’s Surge

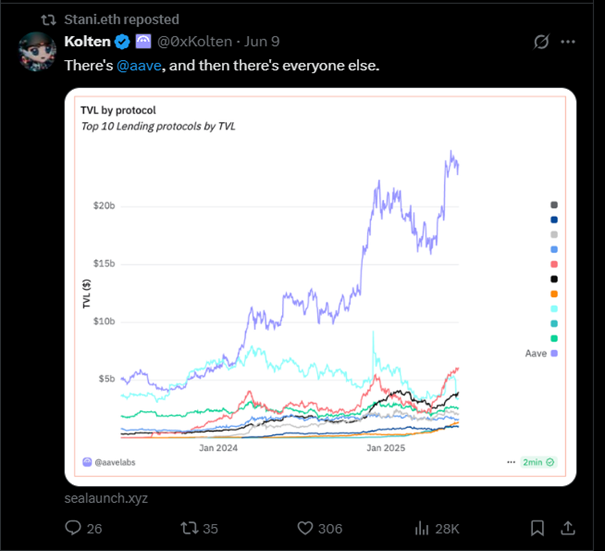

AAVE has seen renewed investor enthusiasm following an unexpected boost in political visibility. Its rally aligns with a wider crypto upswing, bolstered by Bitcoin touching $110,000. What might add fuel to AAVE’s momentum was the high-profile White House visit by Avara founder Stani Kulechov. He met with Bo Hines, Executive Director of the Trump administration’s digital assets advisory council, signalling political support for decentralised finance (DeFi) in the U.S. Kulechov noted the meeting centred on safeguarding DeFi innovation. This coincided with an SEC roundtable where Chairman Paul Atkins advocated for regulatory exemptions to support DeFi product growth—offering a bullish backdrop for AAVE and related tokens.

Source: X

Lending Growth and Institutional Activity Reinforce AAVE’s Fundamentals

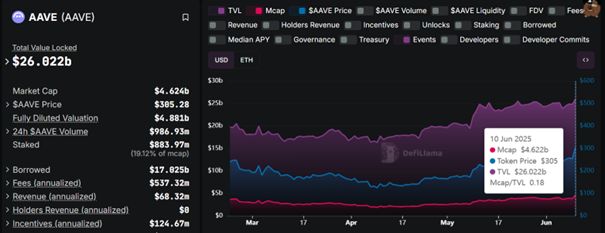

Aave’s fundamental metrics continue to impress, reflecting strong protocol health and growing user engagement. As of June 10, Aave’s Total Value Locked (TVL) has climbed to $26.02 billion, according to DeFiLlama, indicating sustained confidence in its lending infrastructure. AAVE is trading at $305.28, with a market cap of $4.62 billion and nearly $884 million staked (19.12% of market cap), highlighting growing investor participation in governance and security. The protocol generated $537.32 million in annualised fees and $68.32 million in revenue, while distributing $124.67 million in incentives.

Source: DefiLlama

Institutional adoption is also expanding. On June 10, World Liberty Financial (WLFI)—a DeFi entity aligned with the Trump administration—secured a $7.5 million USDT loan through Aave, collateralised by over $52 million in crypto assets including ETH, WBTC, and stETH. This deal exemplifies a growing trend among institutions leveraging DeFi platforms to raise capital without liquidating core crypto holdings.

Source: X

Umbrella Upgrade Revolutionises Aave’s Risk Management System

Aave’s technical infrastructure has undergone a transformative upgrade with the launch of its “Umbrella” staking mechanism. Replacing the previous Safety Module, Umbrella brings autonomous, on-chain risk coverage tied to specific staked assets. This allows for real-time slashing of collateral in the event of bad debt without the need for governance votes. The system supports interest-bearing tokens such as aUSDC, aWETH, and GHO, giving stakers both lending yield and safety rewards. If defaults occur, slashing is triggered automatically after a predefined buffer is exceeded. This design limits risk to specific assets while maintaining protocol solvency.

Source: X

The transition includes new token structures: stkGHO has migrated to sGHO (risk-free), while a new stkGHO-Umbrella vault offers higher yield but includes slashing risk. Initial vaults offer APYs of over 10% on USDC and USDT, though a yield imbalance has sparked governance discussion around adjusting reward flows.

Source: X

Technical Analysis: Breakout Potential Above Key Resistance Zone

Source: TradingView

Soneium Integration Signals AAVE’s Mainstream Expansion

Aave’s latest strategic move came on June 10 with its official deployment on the Soneium blockchain, a consumer-centric Layer 2 developed with Sony, now reaching over 6.6 million unique wallet addresses. This expansion opens the door to a vast new user base and reinforces Aave’s mission to make decentralised finance accessible on a global scale. The launch includes core assets like USDT0, USDC.e, WETH, and Aave’s own stablecoin GHO—designed to explore real-world payment and savings applications.

Backed by a 100 million ASTR allocation through the Astar Contribution Score, Aave’s Soneium launch also aligns with wider Web3 growth initiatives including DeFi, gaming, NFTs, and digital commerce. Founder Stani Kulechov framed the move as a natural step: “Aave wants to be where consumers are, in trusted, accessible environments.” With its deepening institutional ties, evolving insurance mechanisms like Umbrella, and new ecosystem integrations, Aave continues to position itself at the forefront of next-generation decentralised finance.

Source: X