Crypto Weekly Wrap: 17th October 2025

When Geopolitics Casts a Shadow: Crypto's Volatile Week

This week, the crypto market felt less like a smooth sailing ship and more like a rowboat caught in an unexpected squall.

After a period of relative calm, or even enthusiastic ascent, geopolitical headwinds - specifically, a sudden gust of trade tension - swept through global markets, pulling crypto along for a rather dizzying ride.

What started with the promise of new all-time highs for Bitcoin has culminated in a significant recalibration, reminding us that even in the decentralised digital realm, old-world politics still hold sway.

The Macro Lens

The primary culprit for this week's market jitters appears to be a rather unceremonious re-ignition of US-China trade tensions. Fresh announcements regarding 100% tariffs on Chinese imports by the U.S. President sent ripples of uncertainty across global financial markets.

For crypto, this wasn't just background noise; it triggered a substantial $19-20 billion liquidation event across various digital assets, akin to pulling the rug out from under highly leveraged positions.

Beyond the tariffs, the usual suspects in macroeconomic pressure continued their subtle but persistent influence. Rising Treasury yields and a strengthening U.S. dollar typically don't play well with risk assets like crypto, contributing to a broader deleveraging trend. It's a classic case of capital flowing from speculative ventures back to perceived safe havens, or at least less volatile ones.

While we don't fully know the full scope of the impact of these macro forces versus the direct geopolitical shocks, it's clear that the market decided to dial down its risk appetite.

The Crypto Lens

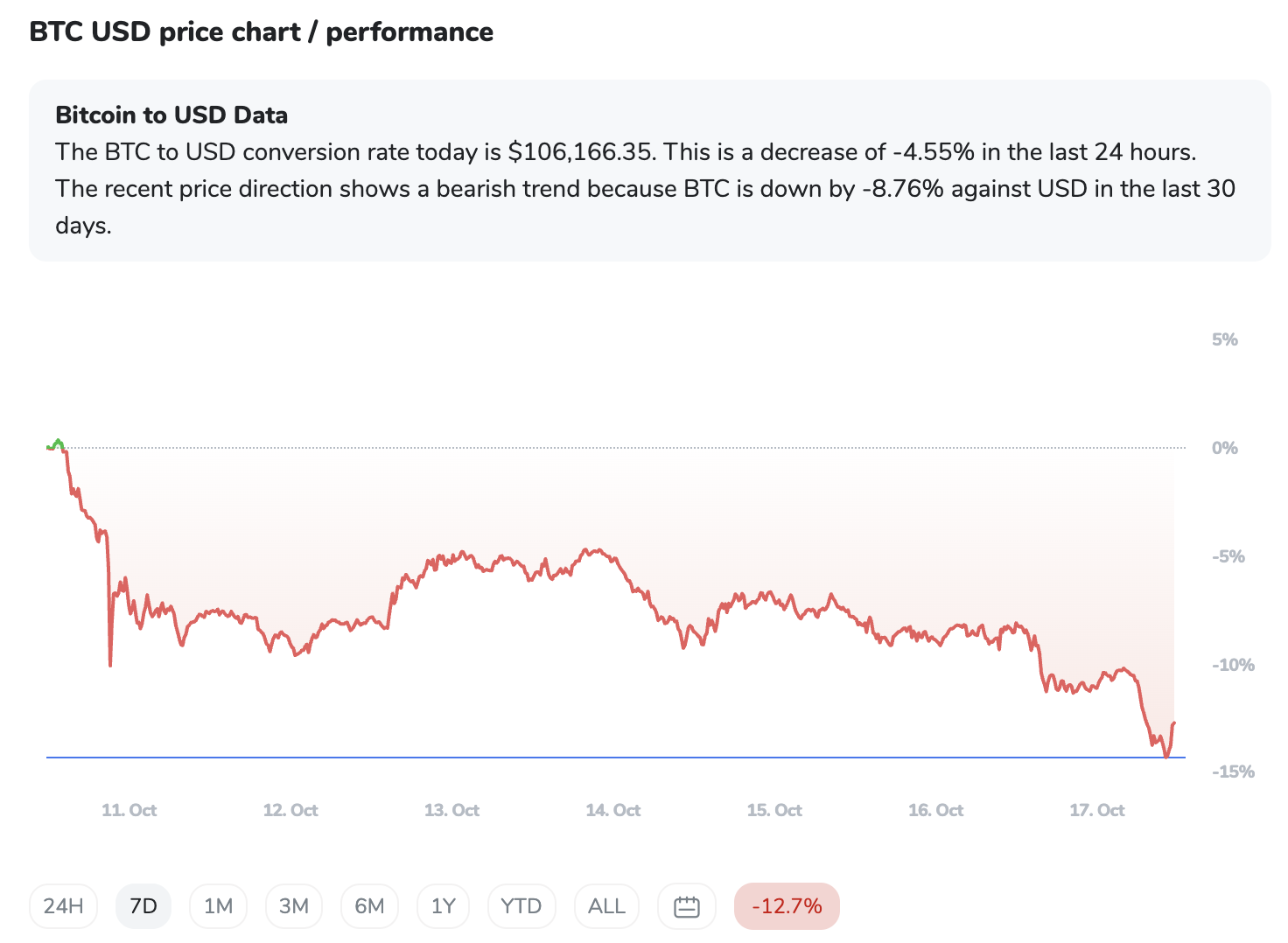

Bitcoin (BTC)

In the immediate aftermath of the macro tremors, the crypto market responded with a rather emphatic "ouch." Bitcoin (BTC), after flirting with new record highs earlier in October, found itself tumbling by 5.43% in the last 24 hours to around $105,416.

The technical indicators are flashing warning signs, with BTC piercing its lower Bollinger Band - a signal of short-term exhaustion - and momentum remaining weak.

The market has seen a sharp tumble recently due to resurfacing trade tensions and market fatigue after hitting fresh record highs earlier in October.

A recent major resistance was identified at $126,293, corresponding to a new all-time high achieved around October 10th.

Buyers are currently defending the $108,000 to $110,000 zone, which previously acted as an ATH support.

The price has pierced the lower Bollinger Band, indicating short-term exhaustion risk, and momentum remains weak with a bearish RSI (14) at 34.43.

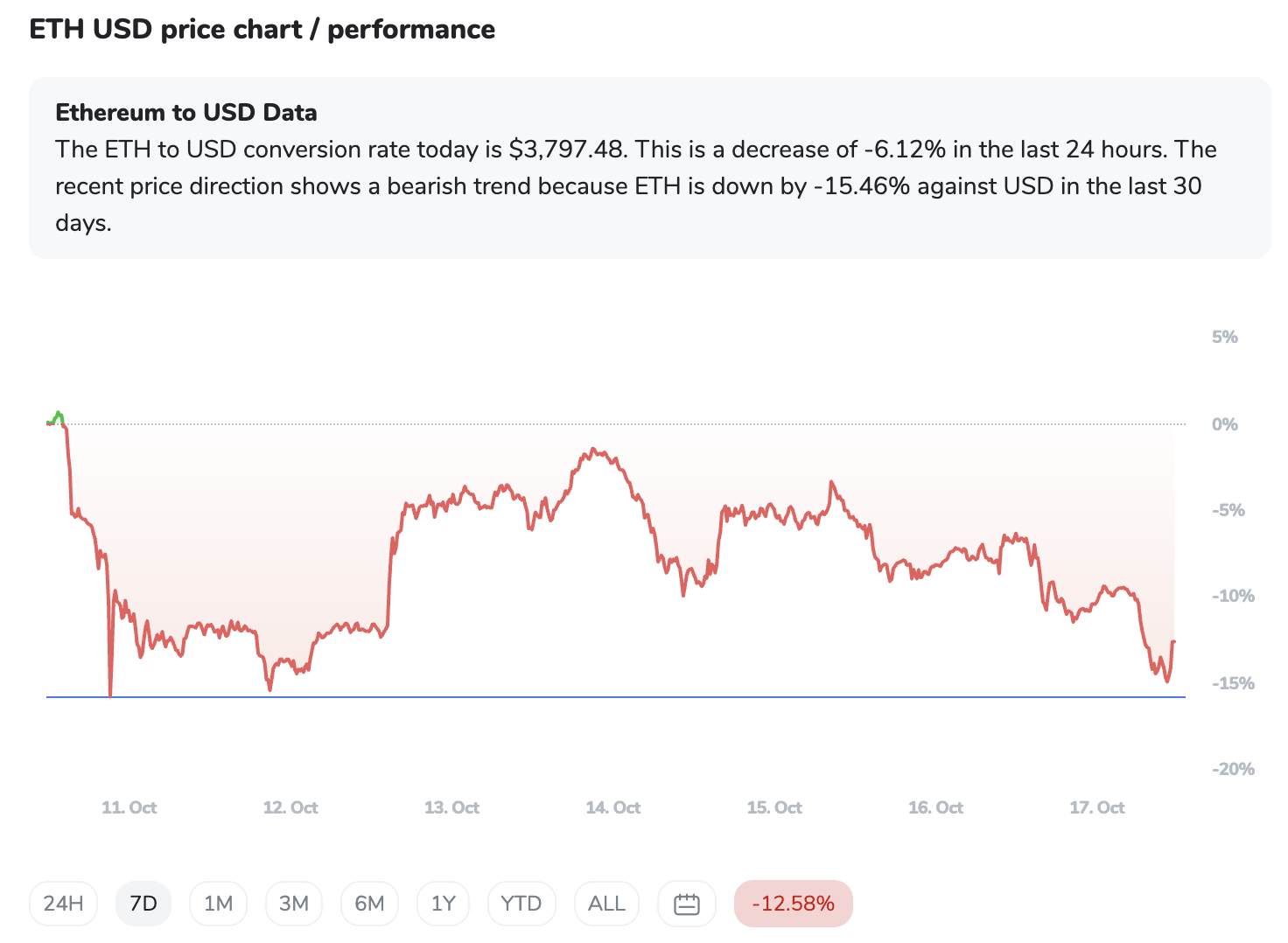

Ethereum (ETH)

Ethereum (ETH) fared slightly worse, dropping 7.22% to $3,758.24. It's been a struggle to stay above the psychological $4,000 mark, with the aforementioned US-China tariff tensions specifically cited as a trigger for a steep intraday decline.

It is largely trading within a broad descending channel after reaching highs around $4,956 in August 2025.

Despite the recent dip, the technical structure suggests a potential recovery if key support levels hold, with analysts noting ETH successfully reclaimed $3,825, a key support zone from July.

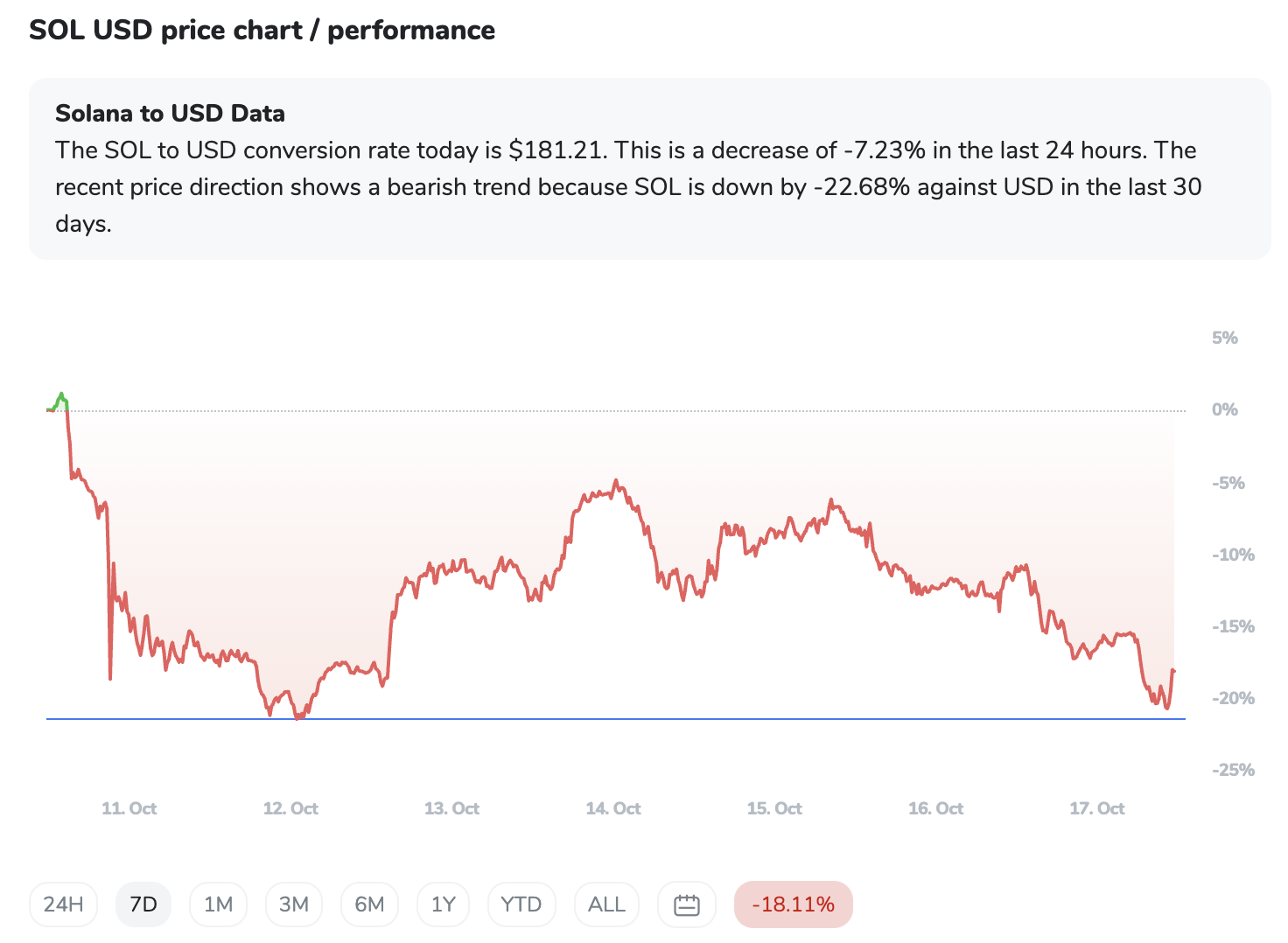

Solana (SOL)

Not to be outdone in the volatility stakes, Solana (SOL) saw the steepest decline among the majors, shedding 8.53% to $179.35.

SOL is selling off aggressively after retesting the $210 levels post-crash. It is still evolving within an ascending channel, but is currently challenging important support at $195.53, with a further drop possible if this level doesn't hold.

The lower bound of the ascending channel is around $170, and a break below this could signal bearish territory.

Unsurprisingly, investor sentiment has taken a nosedive. The Crypto Fear & Greed Index plummeted to a "Fear" reading of 22-24, a stark contrast to the "Greed" level of 71 observed earlier in October.

This isn't just a number; it reflects genuine anxiety and caution across the market. Retail interest, often a bellwether for speculative fervour, has cooled, with Google searches for "Bitcoin" hitting multi-month lows.

On the institutional front, the narrative is equally cautious. After robust inflows, Spot Bitcoin ETFs experienced significant net outflows in mid-October, marking the largest single-day negative flow since early August.

Despite seeing strong inflows through mid-October, Ethereum ETFs also succumbed to the broader downturn, recording outflows. Interestingly, while long-term Bitcoin holders have been selling off (over 265,000 BTC in the past 30 days) and miners have increased deposits to exchanges (a potential sell signal), some analysts, notably from Bitwise, suggest this period of "Fear" could present an accumulation opportunity for long-term investors.

The ICONOMI Angle

Amidst the market's turbulence, the ICONOMI platform offers a fascinating look at how diversified strategies navigated the choppy waters.

Pecun.io Cryptocurrency emerged as a standout, delivering a respectable +4.2% weekly return. This is largely attributable to its significant allocation to PAX Gold (PAXG), a gold-backed token, which often acts as a safe haven during periods of broader market uncertainty. Its strong stablecoin (USDC) presence further cushioned against the downturn.

The HODLers strategy, a pure-play 100% Bitcoin allocation, still managed a positive +2.21% weekly return, underscoring Bitcoin's relative resilience over a weekly timeframe, despite the recent 24-hour plunge captured in the broader market data.

Conversely, strategies with more diversified exposure to the broader crypto market felt the brunt of the correction. Wisdom Stable and Wisdom Balanced saw weekly returns of -5.33% and -12.38% respectively. While they also held stablecoins and PAXG, their allocation to a wider array of altcoins (Ethereum, Solana, and many others) meant they were more exposed to the general market decline.

Similarly, COINBEST INDEX, despite its heavy BTC weighting, recorded a -13.24% weekly return, demonstrating that even with Bitcoin as its anchor, the presence of other assets, even in smaller percentages, can significantly impact overall performance during a broad market correction.

This data clearly illustrates the value of strategic composition in volatile markets. Defensive assets like PAX Gold and stablecoins proved their worth, while broad market exposure led to deeper corrections.

What to Watch Next

As we look ahead, the market is a canvas of contrasts: short-term volatility against long-term optimism. Here's what smart investors will be monitoring:

Geopolitical Barometer: Keep a close eye on any further developments in global trade relations, particularly between the U.S. and China. These tensions remain a potent catalyst for market-wide risk-off sentiment.

Regulatory Rhyme and Reason: Continued movement towards regulatory clarity, especially in the U.S. (think SEC guidance, potential staking ETF approvals for Ethereum), could unlock significant institutional capital currently on the sidelines.

The Fed's Next Move (or Lack Thereof): While far off, anticipated Federal Reserve interest rate cuts in October 2025 are still expected to act as a significant liquidity injection for risk assets, including crypto. Any shifts in this timeline could impact sentiment.

Institutional Adoption & ETF Flows: Monitor the flow data for spot Bitcoin and Ethereum ETFs. Sustained robust inflows signal growing institutional confidence, while continued outflows could indicate prolonged risk aversion.

Innovation Trajectory: Developments in Layer 2 scalability, real-world asset (RWA) tokenisation, and the burgeoning intersection of AI and blockchain are crucial for fundamental growth and could drive new narratives.

Whale Activity and Miner Behavior: Keep an eye on significant movements from large holders ("whales") and miner deposits to exchanges, which can often precede significant sell-side pressure.

FAQs

Why did crypto markets experience such a sharp downturn this week?

The primary driver was a resurgence of geopolitical tensions, particularly renewed US-China trade disputes and announced tariffs, which triggered a significant $19-20 billion liquidation event across crypto assets. Broader macroeconomic factors like rising Treasury yields and a strong U.S. dollar also contributed to a general risk-off sentiment.

What does the "Fear" reading on the Crypto Fear & Greed Index signify for investors?

A "Fear" reading indicates heightened investor anxiety and caution in the market. While it typically precedes price drops, some long-term investors view such periods as potential accumulation opportunities, buying assets at a discount when others are selling.

Are institutional investors still interested in Bitcoin and Ethereum despite the recent outflows from ETFs?

Despite recent outflows from spot Bitcoin and Ethereum ETFs, the overarching trend points to accelerating institutional adoption. Many analysts anticipate that further regulatory clarity and anticipated macroeconomic tailwinds (like future Fed rate cuts) will continue to drive robust institutional inflows in the medium to long term.