Crypto Weekly Wrap: 10th October 2025

Crypto's Greed Index Rises as Institutions Double Down (Again)

This past week felt like a masterclass in resilient optimism. While the broader macroeconomic backdrop often serves as crypto's grumpy landlord, demanding rent in the form of price corrections, the digital asset market largely shrugged off any lingering uncertainties.

Instead, we saw Bitcoin firmly eyeing its all-time high, Ethereum navigating its own significant resistance, and institutional capital continuing its steady, almost relentless, march into the space.

The prevailing sentiment? A healthy dose of "Greed," suggesting investors are less concerned about what could go wrong and more focused on what's already going right. The question, as always, is whether this is a sustainable conviction or merely a momentary lapse in market vigilance.

The Macro Lens

The market's prevailing "Greed" sentiment (Crypto Fear & Greed Index hitting 64) isn't happening in a vacuum; it’s largely a response to shifting macroeconomic winds that seem, for now, to be blowing in crypto's favour.

A dovish stance from the Federal Reserve, hinting at potential rate cuts, coupled with a weakening U.S. dollar, has a certain gravitational pull on non-yielding assets like Bitcoin. When traditional interest-bearing investments become less attractive, the opportunity cost of holding something like Bitcoin decreases, making it look a bit more like a safe haven in a stormy sea – particularly with the added drama of a U.S. government shutdown.

This isn't just retail enthusiasm, either. The robust institutional inflows into spot Bitcoin and Ethereum ETFs speak volumes. BlackRock, Fidelity, and Bitwise aren't dabbling; they're deploying significant capital. Think of it like a new, highly anticipated shopping mall opening, and suddenly all the anchor stores are queuing up.

That kind of commitment from traditional finance (TradFi) giants lends a certain gravitas, reinforcing the narrative that digital assets are maturing beyond speculative curiosities into legitimate portfolio components.

The Crypto Lens

Zooming into the digital asset space itself, it's been a mixed but generally upward-leaning bag.

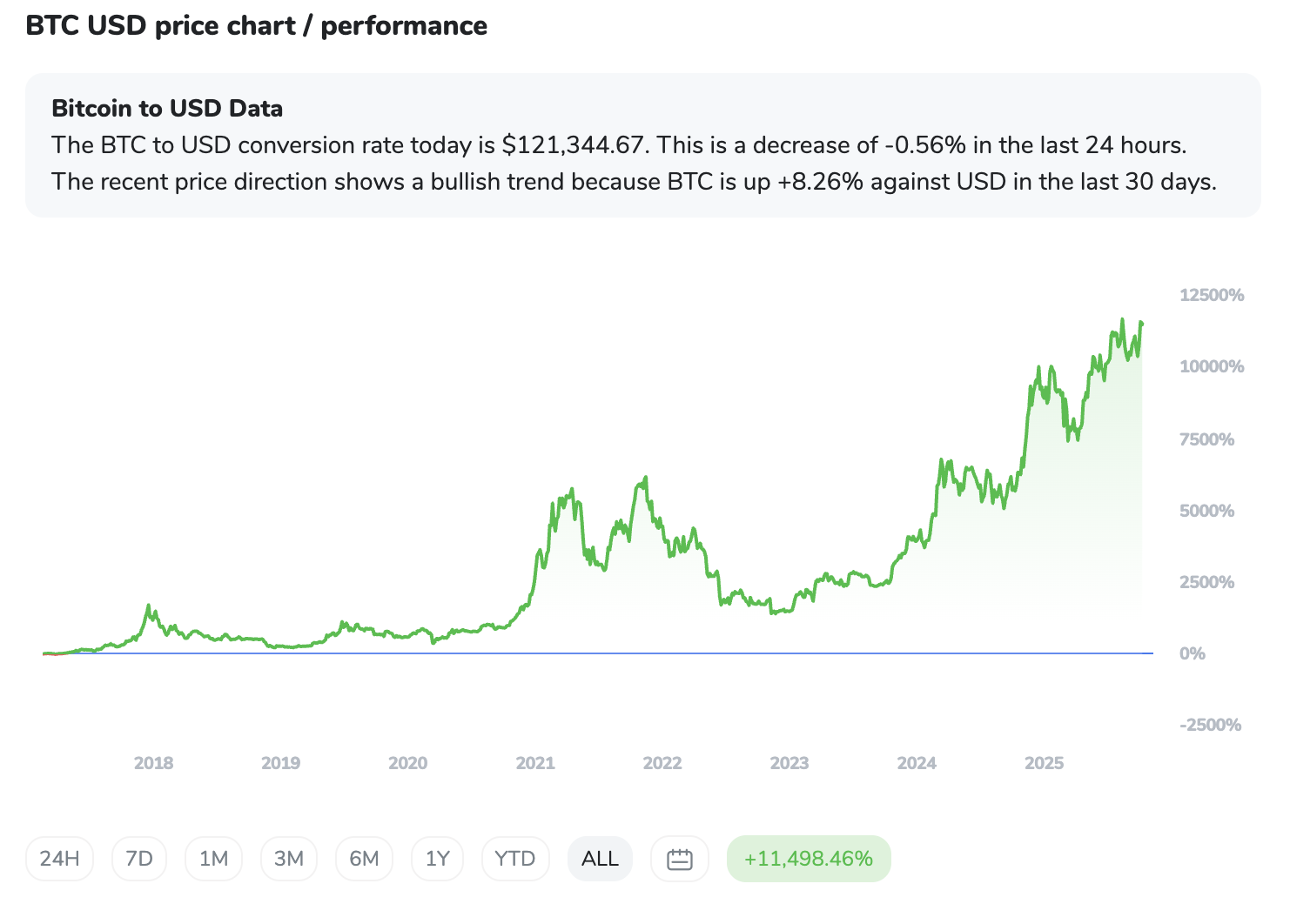

Bitcoin (BTC)

Bitcoin (BTC), currently dancing around $121,291, is doing what it does best: consolidating near its all-time high. It's like a seasoned athlete catching its breath after a sprint, preparing for the next leg. The underlying market structure remains undeniably bullish, buoyed by those aforementioned institutional inflows.

However, a peek under the hood reveals short-term oscillators hinting at "overbought" conditions, suggesting a natural period of consolidation or profit-taking might be on the cards. It recently broke out of a descending channel, which is a textbook bullish signal, indicating strong buying interest stepped in.

Ethereum (ETH)

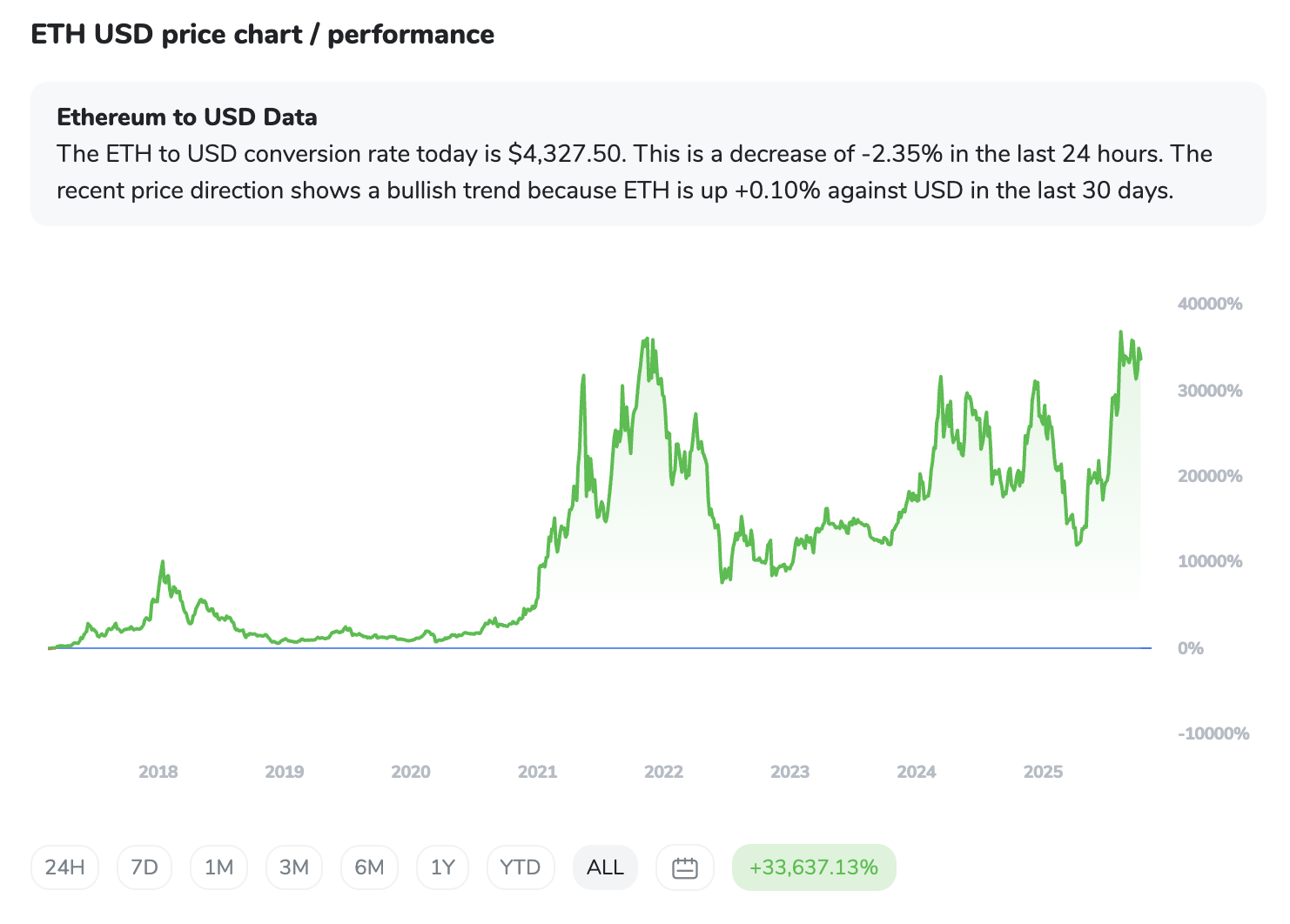

Ethereum (ETH), trading at approximately $4,324.13, finds itself in a similar consolidation phase, albeit with a neutral-to-bullish tilt. ETH is currently testing the waters around the $4,700-$4,800 resistance range. A decisive breach of this level, ideally on strong volume, could uncork a new uptrend.

Below the surface, however, things look robust: institutional staking continues to grow, and on-chain activity remains vibrant. With the Fusaka upgrade slated for December 2025, promising enhanced scalability, ETH is effectively building its launchpad while navigating current market dynamics.

Solana (SOL)

Then there’s Solana (SOL), trading around $218.77, which presents a fascinating dichotomy. On one hand, the technical charts are flashing a potential bullish "cup and handle" pattern, eyeing a lofty $425 target. This is the kind of formation that gets technical analysts quite excited.

On the other hand, the data tells us that network activity has seen a significant 50% drop. This is akin to a restaurant showing great revenue growth, but half its tables are empty. It raises a legitimate question: Is the price action fundamentally justified, or is it riding on speculative momentum and the broader altcoin tide?

It's a point of uncertainty that smart investors would do well to monitor.

ETFs

Finally, the ETF flows have been nothing short of eye-opening. Bitcoin ETFs, particularly BlackRock's IBIT, saw a monumental $969.95 million inflow on October 6th, briefly eclipsing Ethereum ETFs in daily net inflows.

This hints at a potential rotation of institutional interest back towards Bitcoin, or perhaps just a broader expansion of the "buy the dip" mentality from big money. Solana ETFs are also starting to see their own modest inflows, a sign that the institutional embrace is widening beyond the top two.

The ICONOMI Angle

While the macro narratives and institutional flows paint the big picture, a glance at ICONOMI's top-performing strategies provides a window into how real investors are navigating these currents. This week, several strategies delivered solid returns, showcasing a diverse range of approaches.

Metastrategy led the pack with a +3.83% weekly return, demonstrating a preference for diversification with significant allocations to Ethereum (27.95%), Solana (16.88%), and Zcash (12.17%), alongside a healthy Bitcoin allocation. This suggests a belief in a broader altcoin rally, with ETH taking the lead.

Following closely, FENERATOR Crypto Strategy (+2.81%) and Crypto Global Management (+2.73%) showed strong performance with more Bitcoin-centric compositions, but still maintaining significant exposure to Ethereum and other altcoins like BNB and Chainlink. This speaks to a blend of foundational crypto exposure with a strategic diversification into promising alts.

Perhaps most interesting are the strategies like Pecun.io Cryptocurrency (+2.65%) and HODLers (+2.28%), which achieved positive returns while being heavily weighted in stablecoins (USDC) and PAX Gold. This isn't just about profiting from volatile price movements; it reflects a sophisticated approach to capital preservation and yield generation, even within a "Greed" market.

These strategies remind us that not everyone is chasing the next moonshot; some are intelligently managing risk and seeking stable growth, demonstrating the versatility of crypto investment strategies available on ICONOMI.

What to Watch Next

The Continued Institutional Onslaught: Keep an eye on daily ETF inflow figures for Bitcoin, Ethereum, and now Solana. A sustained deceleration or, conversely, an acceleration, will be a key indicator of market momentum.

Regulatory Rulings: Any advancements in regulatory clarity, especially for stablecoins (e.g., GENIUS Act) or spot ETF approvals for other altcoins in various jurisdictions, could unlock new tranches of institutional capital.

Ethereum's Fusaka Upgrade: Slated for December 2025, this upgrade's success and impact on scalability and transaction efficiency could be a significant catalyst for ETH and the broader ecosystem.

Solana's Network Activity vs. Price: The divergence here is a fundamental tension. Will network activity recover to justify the price, or will technical patterns eventually give way to fundamental realities?

The Fed and the Dollar: The persistent dovish stance from the Federal Reserve and any further weakening of the U.S. dollar will likely continue to make non-yielding assets, including crypto, more attractive.

Q4 Seasonality: Historically, the fourth quarter has often been a period of strong performance for the crypto market. Will this seasonality hold true this year, or will new macro factors disrupt the trend?

FAQs

Why is the Crypto Fear & Greed Index showing "Greed" when there are still global uncertainties like a potential government shutdown?

The "Greed" sentiment largely stems from a combination of factors that have historically favoured crypto. A dovish Federal Reserve, a weakening U.S. dollar, and even a U.S. government shutdown can lead investors to view Bitcoin as a safe-haven asset. More significantly, robust and consistent institutional inflows into spot Bitcoin and Ethereum ETFs are a strong vote of confidence, overshadowing some of the broader macroeconomic worries.

Solana's price is looking bullish, but its network activity has dropped significantly. What does this mean?

This divergence is a point of contention. While Solana's chart shows a potential bullish "cup and handle" pattern, a 50% drop in network activity raises questions about the fundamental health and utility driving that price action. It suggests that while technical momentum might be strong, the underlying usage and engagement on the network haven't kept pace. Investors should monitor whether network activity recovers to validate the price or if speculative forces are temporarily at play.

Are institutional investors rotating their focus from Ethereum back to Bitcoin, given recent ETF flow data?

Recent data shows that Bitcoin ETFs, particularly BlackRock's, briefly saw higher daily net inflows than Ethereum ETFs. This could indicate a short-term rotation of institutional capital, or simply a broader expansion of institutional interest that ebbs and flows between the two largest assets. It's too early to declare a definitive long-term shift, but it highlights Bitcoin's continued role as a primary institutional entry point and a potential leader in periods of renewed institutional confidence.