Crypto Weekly Wrap: 9th January 2026

Why Bitcoin is High, but Sentiment is Hollow

If you told us five years ago that Bitcoin would be trading north of $90,000 and the market sentiment would be labelled "Fear," someone would have sent you to a compliance officer for a drug test.

Yet, here we are.

It is January 2026, Bitcoin is comfortably sitting at peaks that used to be fever dreams, yet the Fear & Greed Index is flashing a frosty 27. This disconnect tells us something vital about the current cycle: we aren't in a mania; we are in a migration. The chaotic retail parties of 2021 are gone, replaced by the quiet, tense functionality of institutional capital.

Boring? Maybe. But in finance, boring is usually where the real money is made.

The Macro Lens

The broader financial dashboard is flashing a clear signal: Debasement Defence.

While the headlines focus on tech earnings, the real story is in the commodities market. Gold is trading at a staggering $4,474. Read that again. When the "barbarous relic" is nearly double its historical averages, it implies that the fiat denominator is weaker than central banks admit.

The VIX Anomaly: The "Fear Index" for equities is incredibly low (12.83), signalling complacency in stocks. Contrast that with crypto's "Fear" rating (27). Traditional markets are sleepwalking; crypto markets are hyper-alert. I prefer the alert market—it prices in risk more accurately.

Currency Check: The Dollar (against the Euro and Pound) is softening slightly (-0.17%). In a high-gold environment, a soft dollar usually acts as rocket fuel for digital assets, yet crypto remains cautious. This suggests the market is waiting for a trigger—likely the next liquidity injection or policy shift.

The "flight to safety" is no longer just bonds. It's Gold and Bitcoin. The correlation is strengthening, validating the "digital gold" thesis more than ever.

The Stocks Lens

The equity markets are showing cracks in the "Tech Only" trade, forcing investors to look elsewhere for yield.

NVIDIA Stumbles (-2.15%): The chip giant is cooling off. When the market leader sneezes, the AI-speculation trade usually catches a cold. This rotation out of hardware stocks often pushes risk capital toward software or alternative assets, including crypto.

Tesla Resilience (+1.85%): TSLA continues to decouple from the rest of the "Magnificent Seven." Its distinct movement often mirrors crypto volatility more than the S&P 500.

The Divergence: The S&P 500 is flat (+0.25%) while the Nasdaq dips. This is a classic "risk-off" within equities.

Why it matters: Crypto has historically correlated tightly with the Nasdaq. If tech stocks continue to slide while Bitcoin holds the $90k line, we are witnessing a decoupling event—a holy grail for portfolio managers looking for non-correlated assets.

The Crypto Lens

The crypto market is currently defined by consolidation at altitude.

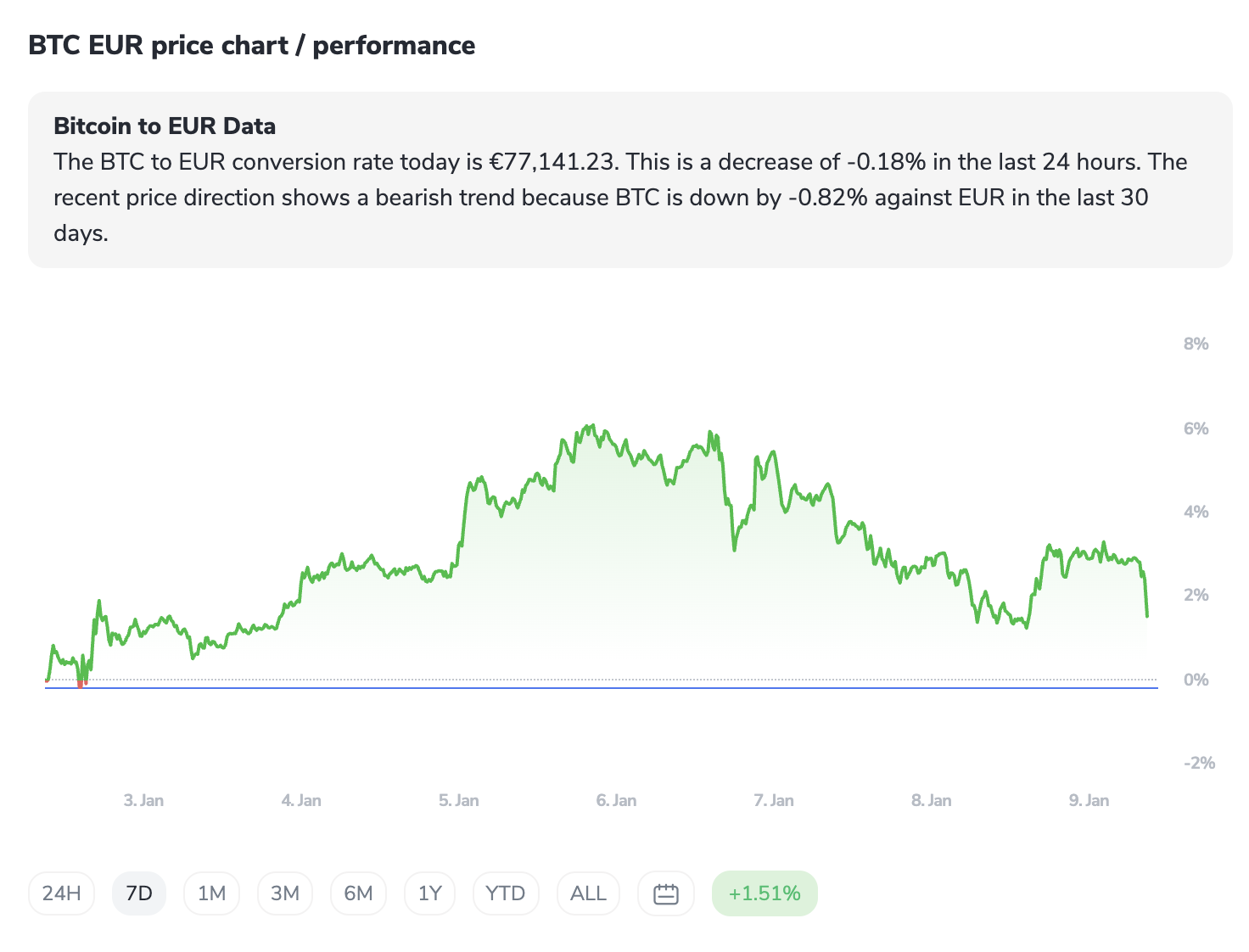

Bitcoin

Bitcoin ($90,529) is essentially a stablecoin right now, moving less than 0.2% in 24 hours. In trading terms, this is a "coiling" pattern. Volatility is compressing. When it expands, the move will be violent. The fact that it maintains $90k despite "Fear" sentiment indicates strong spot buying demand absorbing leverage.

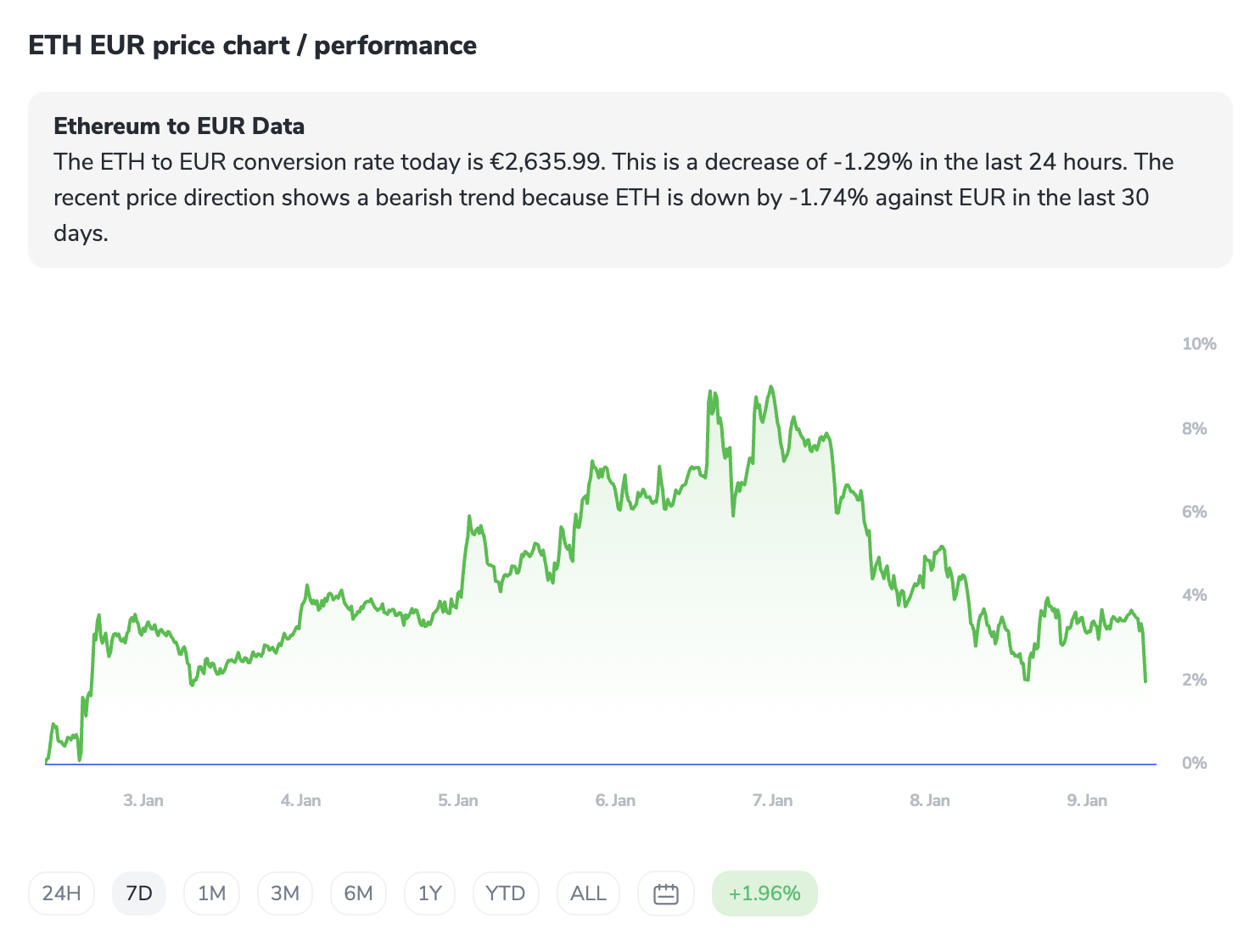

Ethereum

Ethereum ($3,101) remains the frustrating middle child. Down slightly on the day (-0.74%), it struggles to reclaim the narrative dominance it held in previous cycles. However, with staked ETH (stETH) and wrapped variants showing massive volume, the utility is there, even if the price action is lethargic.

Liquidity Flows: Volume is decent ($42B on BTC), but not explosive. We are seeing capital rotate within the ecosystem rather than new retail floods. Money is moving from lagging alts into "winners" like Solana and specific DeFi protocols.

Notable Outliers

In a flat market, the outliers reveal where the smart money is betting.

SUI (+20% 7-day): The clear winner of the week despite a slight daily pullback. SUI is effectively capturing the "high-performance L1" narrative that Solana started. Investors are hedging their SOL bets with SUI.

TAO / Bittensor (+16% 7-day): Even with NVIDIA down, the decentralised AI narrative is thriving. TAO is proving to be less correlated to the stock market's AI sector and more driven by on-chain utility.

World Liberty Financial (WLFI) (+16% 7-day): A reminder that narrative and political affiliation can drive price action effectively in 2026.

Zcash (-15% 7-day): The privacy sector is bleeding. Likely due to renewed regulatory scrutiny on "dark coins." In 2026, compliance compatibility is a price driver; obfuscation is a liability.

Sector Spotlight

While new L1s get the hype, look at the leaderboard this week. High-cap, established utility tokens are quietly dominating. XRP is trading at $2.12 (up significantly over the medium term), and Stellar (XLM) is moving in tandem.

Why? In a high-interest-rate, mature crypto environment, enterprise solutions (payments, settlement) are valued higher than speculative "governance" tokens. The market is pricing in actual usage over the potential roadmap. If you are building a portfolio for 2026, ignore the flashy whitepapers and look at who is actually moving value across borders.

The Contrarian Take

The "Alt Season" Myth is Dead.

Everyone is waiting for the moment when Bitcoin dominance drops and everything pumps 10x. I don't think it's coming.

The market has matured. We now have ETFs, institutional custody, and regulatory clarity. Capital is efficient now. It doesn't spray and pray into garbage assets anymore. It picks winners. We will see "Asset Seasons" (like Real World Assets or DePIN), but a rising tide that lifts every dead project? That belongs to 2021. If you are holding "zombie coins" from the last cycle waiting for a bailout, you might be the liquidity release valve for someone else.

The ICONOMI Angle

The data from ICONOMI Strategists this week reinforces the "Heritage" thesis mentioned above.

The Winners: The top two performing strategies, BYC CAPITAL (+14.36%) and BYC CAPITAL 2 (+13.82%), are not diversified into hundreds of small caps. They are heavily concentrated in XRP (75-80%).

The Runners Up: CARUS-AR and TITANIUM (+6-10%) are sticking to the majors: SOL, ETH, and BTC.

The Insight: Diversification preserves wealth, but concentration creates it if you pick the right sector. Right now, strategies avoiding the long tail of small-cap alts and focusing on high-liquidity, high-utility winners are outperforming the broader market.

The Week Ahead

Mon, Jan 12: US Inflation Expectations – If expectations rise, Gold and BTC likely bid higher.

Wed, Jan 14: Global Liquidity Report – Central bank balance sheet updates. Critical for BTC correlation.

Fri, Jan 16: Options Expiry – A massive batch of BTC options expires mid-month; expect volatility around the $90k strike price.

What to Watch Next

The $88.5k Support: If BTC dips, watch the reaction at $88,500. A strong bounce confirms the bull market structure. A break below opens the door to $82k.

Gold vs. BTC Correlation: Watch if they continue to move in tandem. If Gold keeps hitting ATHs ($4,500+) and BTC doesn't follow, something is broken in the crypto liquidity plumbing.

ETH/BTC Ratio: It remains weak. Watch for a reversal. If ETH doesn't wake up soon, Solana may permanently cement itself as the preferred utility layer for retail.

FAQs

Why is the Fear & Greed Index "Fear" if Bitcoin is at $90k?

This is actually bullish. It means the price is high because of real demand (likely institutional and DCA), not retail hype. When price is high, and sentiment is low, it usually means the market is climbing a "wall of worry," leaving room for upside when sentiment finally shifts to greed.

Should I sell my NVIDIA (NVDA) for Crypto AI tokens like TAO?

They are different bets. NVDA is a hardware infrastructure bet deeply tied to traditional equity flows. TAO (and similar tokens) are bets on decentralised software networks. As seen this week, they can move in opposite directions. Treat them as non-correlated hedges, not direct swaps.

Is the bull run over?

Unlikely. Consolidation at all-time highs ($90k range) is typically a pause, not a top. Tops are usually formed by euphoria and blow-off tops, neither of which we are seeing right now.