Crypto Weekly Wrap: 24th October 2025

When Crypto Decided to Play Hard to Get (With Macro)

This past week, the crypto market continued its intricate dance, mostly resisting the gravitational pull of some rather weighty macroeconomic news. After a somewhat dramatic "flash crash" earlier in October – largely thanks to a mix of geopolitical tensions and some rather enthusiastic leverage unwinding – Bitcoin has been doing its best impression of a stable, if slightly weary, anchor.

Ethereum is caught in its own battle, and altcoins, as ever, are playing their own tune. The big question remains: Is this resilience, or merely a temporary reprieve before the market acknowledges the broader economic currents?

The Macro Lens

The broader financial landscape certainly didn't make things easy this week.

The ghost of geopolitical tensions reared its head again, with continued murmurs around US tariffs on Chinese imports – the very kind of news that kicked off that early October flash crash and sent ripples through global markets.

It's a reminder that crypto, for all its decentralised allure, doesn't exist in a vacuum. These macro tremors often translate into cautious capital flows and a general "risk-off" sentiment, which typically isn't great for our digital assets.

Adding to the suspense, markets are currently holding their breath for the upcoming US Consumer Price Index (CPI) report. This isn't just a data point; it's practically the Federal Reserve's crystal ball for future interest rate decisions.

Higher-than-expected inflation could prompt a more hawkish Fed, leading to tighter monetary conditions – think less liquidity sloshing around, which tends to be a drag on risk assets like crypto.

Conversely, a softer CPI might signal the Fed could ease up, potentially sparking a rally. It’s a classic "wait and see" scenario, and crypto is very much in the waiting room.

The Crypto Lens

In the thick of this macro stew, the crypto market exhibited a fascinating blend of caution and underlying stability.

The Crypto Fear and Greed Index clocked in at a rather telling 30, firmly placing us in the "Fear" zone. This isn't surprising given the recent volatility. Imagine the market as a crowded theatre: everyone's a bit nervous, looking for the fire exits, but no one's quite willing to panic yet.

Long-term holders, ever the contrarians, appear to be selling into strength – a classic move during consolidation to reduce exposure.

Meanwhile, the options market is decidedly defensive, indicating traders are hedging against further downside.

Bitcoin (BTC)

Bitcoin (BTC), currently trading around $111,200, showed commendable tenacity.

After that early October liquidation event, it managed to reclaim the $110,000 level, settling into a consolidation phase. It's like Bitcoin decided to catch its breath after a sprint. Technicals, which we won't bore you with the minutiae of, suggest that the recent correction might be losing its downward steam.

What's truly interesting is the continued institutional accumulation during dips – a strong signal that the big players are still very much in the game, treating these pullbacks as buying opportunities.

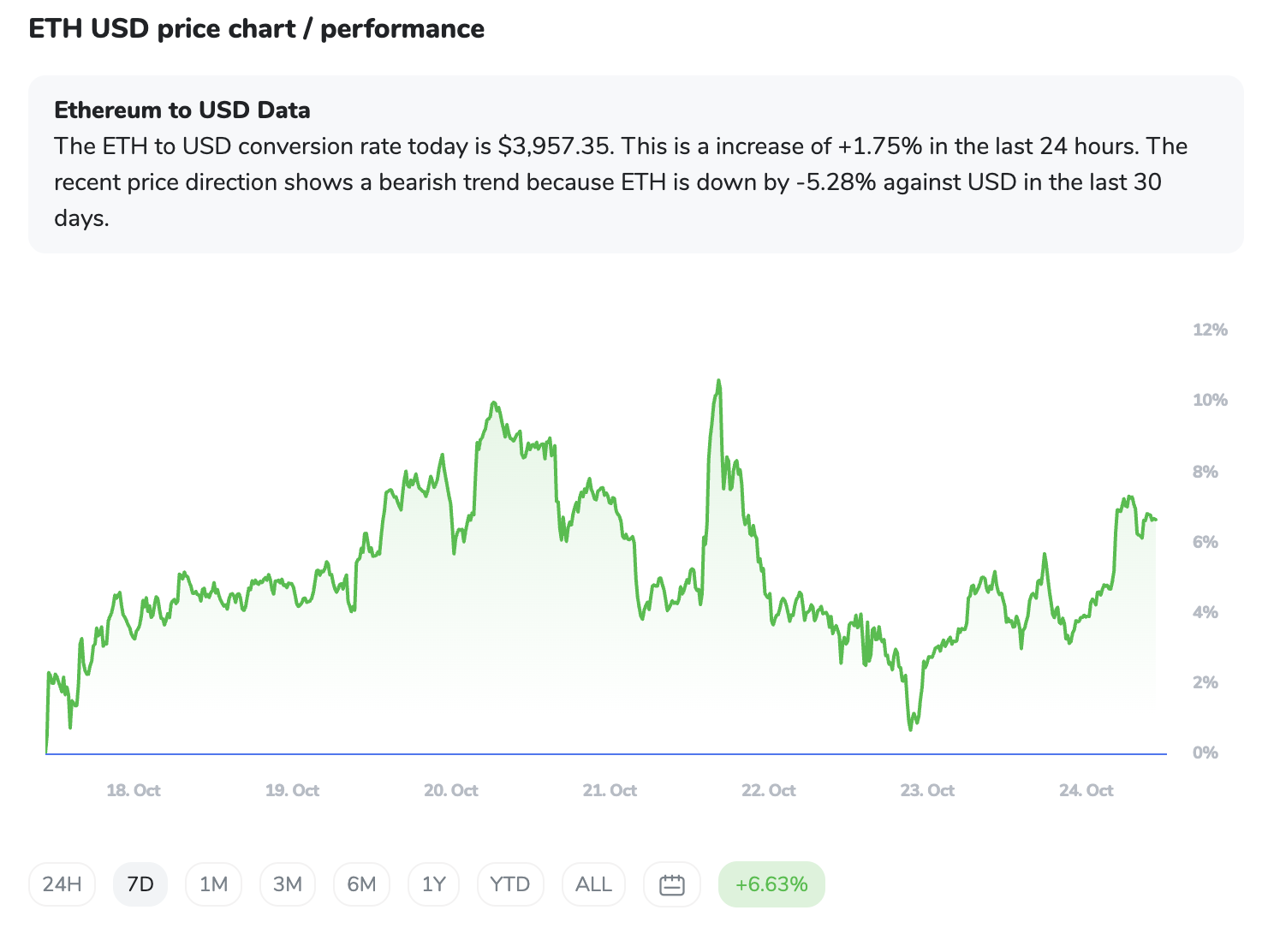

Ethereum (ETH)

Ethereum (ETH), hovering near $3,957.64, has been a bit of a mixed bag. It's navigated some choppy waters, consolidating within a descending channel. There's chatter about a "bull flag" formation on the weekly chart, which, if it plays out and the $3,600 support holds, could propel ETH towards $6,000 by year-end. However, the path isn't clear-cut.

Speaking of clarity, ETF flows provided a stark divergence this week. Spot Bitcoin ETFs, particularly BlackRock's IBIT and Ark & 21Shares' ARKB, saw renewed, albeit mixed, inflows on certain days (like $210.9M for IBIT and $162.8M for ARKB on Oct 21), somewhat reversing earlier outflows.

This suggests a persistent institutional appetite for Bitcoin as a strategic allocation. However, spot Ethereum ETFs had a tougher go, experiencing significant outflows, notably on Oct 23 (with total outflows exceeding $127M). This indicates institutions might be re-evaluating their Ethereum exposure, perhaps waiting for more clarity on its regulatory status or future catalysts.

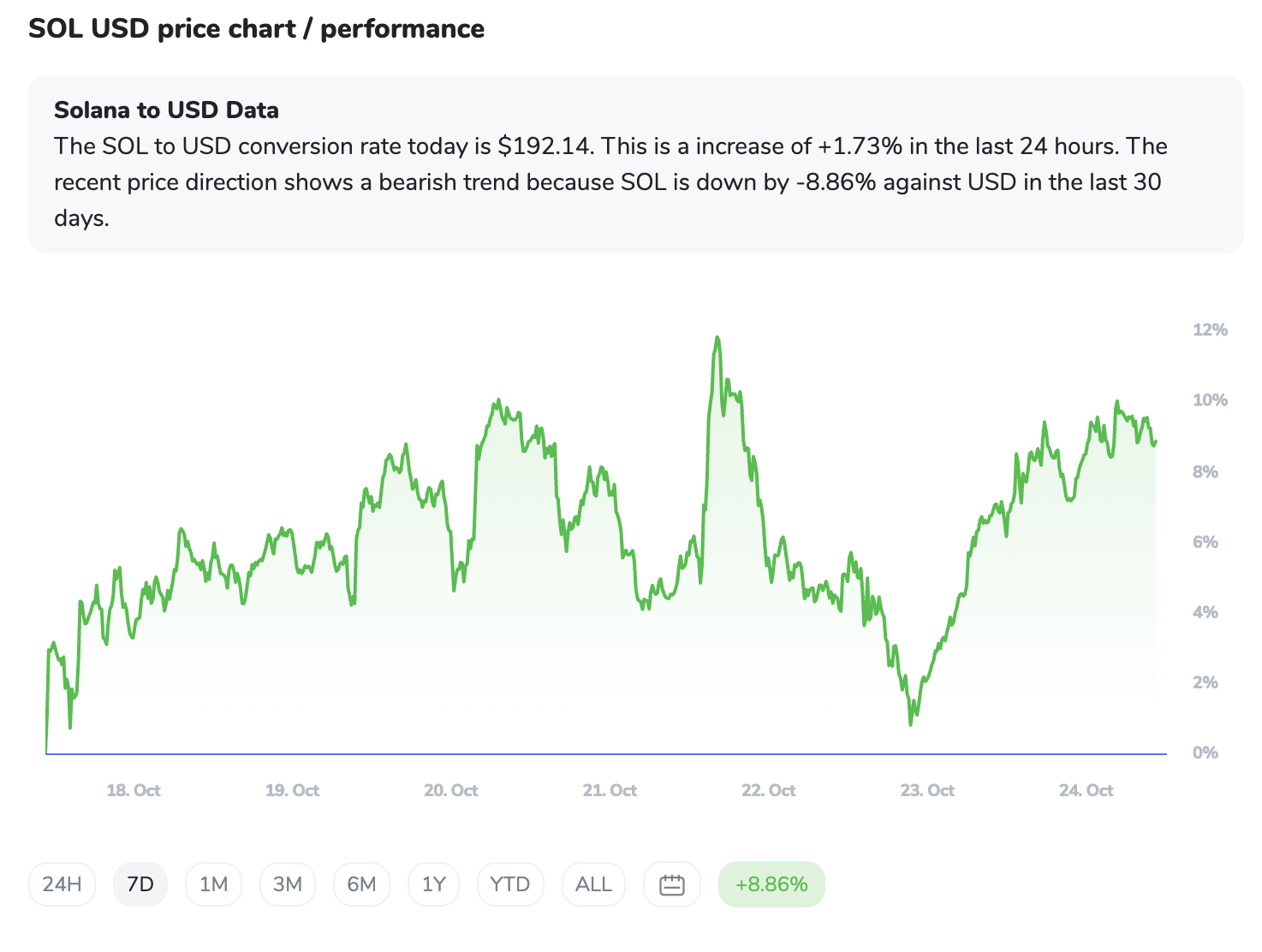

Solana (SOL)

Then there's Solana (SOL), currently at $191.84, which found itself in a correction phase, mirroring the broader market's cautious mood. It's consolidating within a tightening symmetrical triangle pattern – basically, the price is squeezing into a narrower range, building tension for a potential breakout.

However, derivatives data points to speculative unwinding and seller dominance, highlighting its short-term fragility. The $170 support level is crucial here; lose that, and we might see a deeper dive.

The ICONOMI Angle

Amidst this cautious market environment, the ICONOMI platform showcased some impressive resilience and alpha generation from its actively managed strategies. It's a testament to the power of experienced strategists navigating choppy waters.

The Metastrategy led the pack with a stellar +12.72% weekly return, proving that shrewd management can significantly outperform the general market sentiment of "Fear."

Not far behind, the TITANIUM STRATEGY delivered a robust +11.81%, while the FENERATOR Crypto Strategy secured a solid +9.6%. Even diversified index strategies like the 2100newsCryptoLargecap Index (+8.92%) and the 2100news Ethereum Tokens Index (+8.84%) showed strong positive returns, demonstrating that even in a consolidating market, strategic exposure to key assets can yield substantial gains.

These figures underscore the value of curated, professional management, especially when the overall market narrative is one of uncertainty and hesitant recovery.

What to Watch Next

The Fed's Next Move: The highly anticipated US CPI report will be crucial. Softer-than-expected data could soften the Federal Reserve's stance, creating a more favourable liquidity environment for risk assets. Conversely, hotter inflation could lead to a tighter policy and renewed market jitters.

ETF Flow Persistence: Keep an eye on Bitcoin and Ethereum spot ETF flows. While Bitcoin has seen renewed interest, sustained outflows from Ethereum ETFs could signal a deeper shift in institutional sentiment. Any turnaround in ETH ETF flows would be a significant bullish catalyst.

Geopolitical Stability (or lack thereof): The impact of global trade disputes and political tensions on market sentiment is undeniable. Any escalation could quickly reverse positive momentum.

Key Price Levels: For Bitcoin, a decisive break above $116,000-$117,000 resistance would be a strong bullish signal. For Ethereum, maintaining the $3,600 support and breaching the $4,000-$4,200 range is critical. Solana's $170 support and $195 resistance are key thresholds.

Ethereum's Fusaka Upgrade: The impending Fusaka upgrade, which includes EIP-7825 to introduce a transaction gas limit cap, is a significant technical development. Its successful implementation could bolster confidence and efficiency within the Ethereum ecosystem.

FAQs

Why did the market experience a "flash crash" earlier in October, and what was its impact?

The early October flash crash was primarily triggered by escalating geopolitical tensions, specifically the announcement of increased US tariffs on Chinese imports. This macroeconomic shock led to widespread liquidations of over-leveraged positions in the crypto market, causing a rapid, sharp decline in prices. Its impact was a reset of market sentiment to "Fear" and forced a deleveraging among traders.

Are institutional investors losing interest in crypto, especially with mixed ETF flows?

Not necessarily, but their interest appears to be diverging. While Bitcoin Spot ETFs have seen renewed positive inflows on several days, indicating continued strategic accumulation, Ethereum ETFs have experienced significant outflows recently. This suggests a selective institutional approach, with a preference for Bitcoin's established role as a store of value amidst uncertainty, while awaiting more clarity or specific catalysts for Ethereum.

What does "consolidation phase" mean for Bitcoin and other cryptos?

A "consolidation phase" means that the price of an asset is trading within a relatively narrow range after a significant price move (either up or down). It's a period where the market is effectively "digesting" recent events, with neither buyers nor sellers having a clear upper hand. This can lead to lower volatility and often precedes another significant price move once a clear direction is established.