Ripple (XRP): Latest Developments, Price Trends, and Technical Analysis in June 2025

Ripple (XRP) Navigates Legal Developments, Whale Activity, and ETF Momentum Amid Market Volatility

Legal Tug-of-War: Ripple and SEC Push for Appeal Pause

Ripple and the U.S. Securities and Exchange Commission (SEC) have jointly requested a pause in their ongoing legal battle, seeking abeyance in the Second Circuit Court until August 15. This move follows a revised motion for an indicative ruling submitted to Judge Analisa Torres, aimed at dissolving an injunction and releasing over $125 million in escrowed XRP. While Judge Torres had previously rejected a similar motion due to insufficient public interest justification, both parties are now pushing for a more refined resolution.

The significance of this pause cannot be overstated. If approved, it could solidify a legal precedent confirming that programmatic sales of XRP do not constitute securities, based on Torres’ 2023 ruling. This would ease regulatory uncertainty and potentially lay the foundation for broader institutional adoption. Until the court delivers its decision, the crypto community remains cautiously optimistic, aware that any judicial delay prolongs the cloud of uncertainty surrounding XRP’s long-term classification.

Source: X

Derivatives Market and Whale Activity Signal Growing Confidence

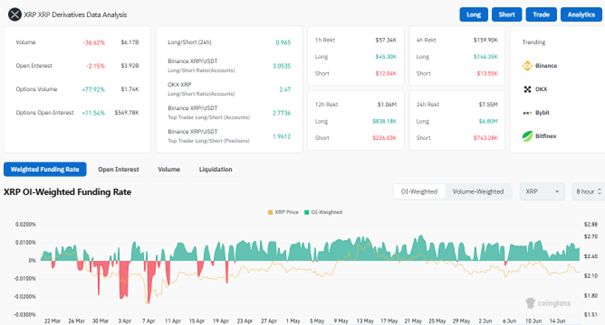

The XRP derivatives market remains firmly bullish, despite ongoing legal uncertainties. According to the latest data, Open Interest (OI) currently sits at $3.92 billion, showing only a minor dip of 2.15%. Notably, Options Open Interest is up 11.54%, and Options Volume surged 77.92%, signaling increased speculative interest. Although total derivatives volume fell 36.62% to $6.17 billion, long positions remain dominant. The funding rate has hovered in positive territory—visible on the chart with consistent green OI-weighted bars—indicating traders are willing to pay a premium to maintain long positions. This is confirmed by the strong long/short ratios across Binance and OKX, which range between 1.94 and 3.05.

Whale behavior is also underscoring market confidence. XRP’s 24-hour liquidation data reveals that long liquidations reached $6.80 million compared to just $743K in shorts, suggesting bulls are enduring corrections rather than exiting entirely. Meanwhile, retail and institutional traders appear to be recalibrating positions for potential upside, spurred by the anticipation of a spot ETF and the ongoing abeyance in Ripple’s legal battle with the SEC. With a surge in active addresses, long-term confidence in XRP’s trajectory appears resilient.

Source: CoinGlass

Canada Approves First Spot XRP ETF Ahead of U.S. SEC

While the U.S. lags on ETF approval, Canada has taken the lead by greenlighting the first spot XRP ETF. Toronto-based Purpose Investments announced the Purpose XRP ETF will list on June 18 under the ticker XRPP. The fund will be available in multiple currency units—CAD-hedged, non-hedged, and USD—enabling exposure through registered accounts like TFSAs and RRSPs. This development mirrors Purpose’s earlier launch of Canada’s first spot Bitcoin ETF, positioning the firm as a trailblazer in regulated crypto investment vehicles.

This ETF could mark a major milestone for XRP, making it more accessible to traditional investors while reinforcing its legitimacy as an institutional asset. Meanwhile, several U.S.-based asset managers, including Grayscale, are awaiting SEC decisions on their own XRP ETF proposals. On Polymarket, crypto bettors have placed an 88% probability on a U.S. spot XRP ETF being approved this year—underscoring widespread market anticipation. As the SEC gradually warms to crypto ETFs, Ripple’s progress on the legal front may be the final piece needed for U.S. regulatory alignment.

Source: X

Market Dynamics and Expanding Utility

XRP continues to reinforce its position as a core infrastructure asset in digital finance, especially within the domain of cross-border payments and tokenized assets. As of June 2025, XRP’s market capitalization stands at around $127.82 billion, with the token trading near $2.17. Ripple’s On-Demand Liquidity (ODL) solution—rebranded as Ripple Payments—has emerged as a transformative force, now operating in over 55 countries. With notable partners such as Santander, Tranglo, and Bank of America, the platform has surpassed $50 billion in transaction volume, highlighting the global demand for capital-efficient and near-instant settlement rails.

Ripple is also broadening its enterprise utility by integrating real-world tokenization into the XRP Ledger (XRPL). A notable example is the partnership with Ondo Finance, which introduced tokenized treasuries (OUSD) on XRPL, settled in Ripple’s compliant RLUSD stablecoin. This move was featured by RippleX, marking it as a breakthrough for institutional adoption. Ripple’s 2023 acquisition of Metaco further enhances this momentum by providing bank-grade digital asset custody. With stablecoins like RLUSD, EURØP, and XSGD now leveraging XRPL’s compliance-first architecture, Ripple is positioning itself as a foundational layer for regulated, tokenized financial ecosystems that are both scalable and accessible on-chain.

Source: X

Technical Analysis: XRP Cools Off After Sharp Reversal

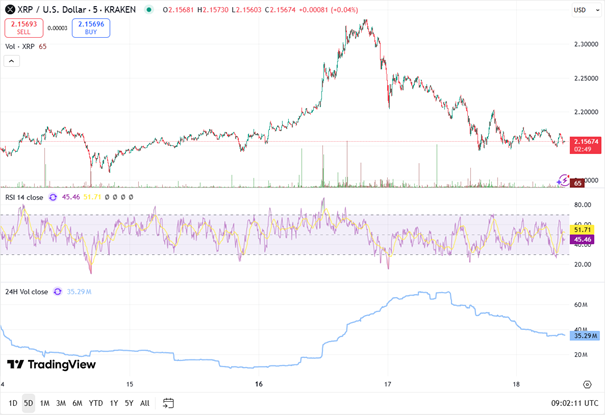

XRP’s recent rally has lost momentum as the price now consolidates around $2.15 following a sharp reversal from its June 16 high near $2.33. The asset faced significant resistance above $2.30, leading to profit-taking that triggered a sell-off. As shown in the 5-day chart, XRP is now trading sideways, forming lower highs while struggling to reclaim short-term bullish momentum. The Relative Strength Index (RSI) reflects this cooling sentiment, hovering near neutral at 45.46, with a modest uptick to 51.71—suggesting neither strong buying nor selling dominance.

Volume has also declined, with 24-hour trading activity dropping to $35.29 million, indicating reduced market participation. While XRP maintains support above the $2.10–$2.15 range, upside potential remains limited unless buyers reclaim the $2.20 resistance area. The RSI’s failure to break convincingly above 60 and persistent selling pressure seen in long upper wicks signal that bulls may remain sidelined until stronger fundamental news—such as a court ruling or ETF update—sparks renewed momentum. For now, XRP appears locked in consolidation, with $2.09 as near-term support and $2.22–$2.24 as the immediate resistance zone to watch.

Source: TradingView

Altogether, Ripple's XRP stands at a pivotal juncture, driven by a mix of legal breakthroughs, expanding use cases, and deepening investor interest. Whether through institutional adoption or legal clarity, XRP’s next major move will likely be determined in the courtroom just as much as on the charts.