Monthly Crypto Market Overview – June 2025

June Crypto Market Overview: Shifting Sentiment and Institutional Resilience

June presented a dynamic mix of cautious optimism and investor selectivity in the crypto market. Bitcoin and Ethereum remained dominant, navigating through macro uncertainty and regulatory developments with relative stability.

Bitcoin closed the month near $107,650, slightly down by 0.55%, while Ethereum hovered around $2,461 with a modest 0.25% gain. Market capitalisation stood firm at $3.31 trillion, with daily trading volume around $89.6 billion.

The Fear and Greed Index registered a neutral score of 52, indicating indecision among investors. Meanwhile, the Altcoin Season Index dropped to 19, signalling clear Bitcoin dominance in capital flows.

ETF trends reinforced this sentiment — Bitcoin attracted over $300 million in net inflows, while

Ethereum saw a $2 million outflow, breaking its 19-day inflow streak. This divergence highlights investors' strategic preference for BTC in times of elevated volatility and regulatory recalibration.

Source: CoinMarketCap

Policy Moves in Washington: Regulation Enters the Spotlight

U.S. lawmakers have taken noticeable steps toward establishing a long-term framework for digital assets. Senator Cynthia Lummis reiterated her commitment to pushing both the GENIUS Act and a comprehensive crypto market structure bill through Congress this year, calling for clarity on stablecoins and broader digital asset governance.

At the same time, senior Republicans on the Senate Banking Committee unveiled a foundational set of principles to regulate cryptocurrencies, aiming to create consistency across token classifications, investor protections, and compliance mandates. Meanwhile, the intersection of crypto and politics gained attention with the introduction of the COIN Act by Senator Adam Schiff, aimed at limiting political figures' involvement in promoting or profiting from digital assets.

This push for regulation was complemented by President Trump’s increasingly public support for Bitcoin, including a statement that the cryptocurrency "takes pressure off the dollar" and "is a great thing for the country."

These developments signal that crypto will remain a prominent legislative focus into the second half of 2025.

Source: X

Solana Rebounds Strongly as Layer-1 Attention Grows

Solana ended June on a strong note, gaining 11.21% over the past week to trade at $150.16. After dipping to $134 earlier in the week, SOL mounted a robust recovery, supported by rising volume and renewed investor optimism.

With a market cap of $80.26 billion and a daily trading volume of $2.86 billion, liquidity remains solid. This short-term rebound reinforces Solana’s long-term potential, bolstered by upcoming upgrades like Alpenglow and Firedancer.

The outlook for the rest of 2025 remains bullish, with analysts maintaining price targets between $250 and $500—especially if ETF-related developments gain traction and broader market sentiment improves.

Source: CoinMarketCap

Aptos Rallies on ETF Hopes and Technical Breakout

Aptos saw a robust performance in late June, climbing 18.13% over the past seven days to reach $4.78. The rally followed renewed investor enthusiasm triggered by Bitwise’s APT ETF filing with the SEC, as well as growing on-chain adoption. APT’s market cap now stands at $3.08 billion, with a 25.95% rise in daily volume reflecting intensified trading activity. Technical patterns point to a bullish breakout, with the price rebounding sharply from the $4.01 level. If current momentum persists, analysts see potential for Aptos to revisit the $8 mark in the coming weeks.

Source: CoinMarketCap

North Korea’s Shadow in Crypto: High-Profile Exploits Uncovered

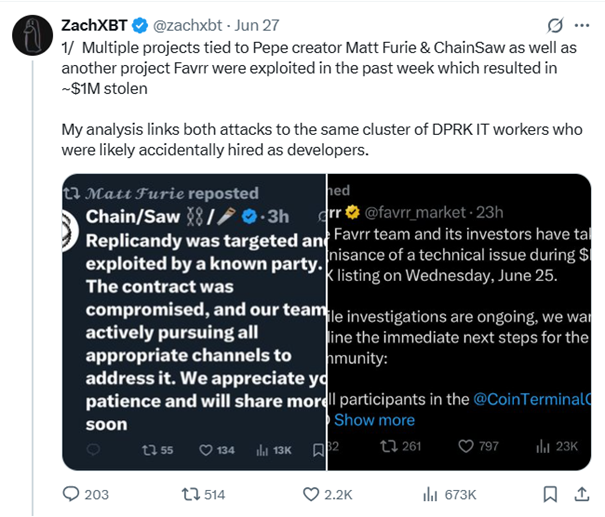

In one of the more alarming narratives of the month, blockchain investigator ZachXBT revealed that a network of North Korean IT workers is likely responsible for an exploit that drained over $1 million from several NFT projects tied to Pepe creator Matt Furie. Attackers gained control over smart contracts of projects such as Replicandy, Peplicator, and Hedz, minting and dumping NFTs, thereby collapsing floor prices.

The stolen funds were traced to various wallets and centralised exchanges, raising questions about internal security and developer vetting processes. Another affected project, Favrr, lost more than $680,000, with suspicions that at least one team member was a covert DPRK operative. The investigation underscores the growing need for rigorous due diligence in hiring and smarter contract access controls.

ZachXBT criticised the lack of transparency from project creators post-attack, pointing to a systemic issue of avoiding public accountability in the crypto space.

Source: X

Bitcoin (BTC) Technical Analysis

Bitcoin continued to attract institutional attention in June, with over $300 million in ETF inflows despite a turbulent macro backdrop. The price hovered near $107,000, showing resilience but remaining range-bound as it failed to break key levels. Technically, BTC is facing significant psychological resistance around $111,980. A confirmed breakout above this level could pave the way toward the $130,000 region, reinforcing bullish sentiment. However, the RSI is currently at 42.68—suggesting weakened buying momentum—and the trading volume has cooled to approximately 56.84 million, reflecting caution among traders. If BTC dips below the $100,000 support level, a retracement toward $92,000 becomes increasingly likely, with volume and RSI trends serving as crucial indicators for the next major move.

Source: TradingView

Ethereum (ETH) Technical Analysis

Ethereum closed June with a monthly gain of 4.8%, finishing around $2,500, even though it recorded a minor ETF outflow of $2 million—ending its 19-day inflow streak. The price faced resistance near $2,738 and is currently consolidating just below $2,500, constrained within a narrowing range. The RSI stands at 42.59, pointing to weakening bullish momentum, while the recent volume of 179.69 million highlights a decline in trading activity since mid-month peaks. A decisive move above the $2,738 resistance could reignite buying interest and drive ETH toward $3,150, reviving bullish confidence. However, if Ethereum fails to hold above the $2,323 support level, the next likely stop is $2,111—a zone aligned with long-term support and critical for preventing a deeper correction. As Ethereum’s market action tightens, traders will be watching for breakout signals and macro cues to confirm the next trend direction.

Source: TradingView

Source: CoinMarketCap

Outlook for Q3: Momentum, Regulation, and Market Structure

As Q3 begins, the crypto sector appears poised at a critical juncture. Momentum is shifting toward institutional-grade assets, driven by rising ETF adoption, improving regulatory clarity, and mainstream endorsements. The U.S. is leading on regulatory momentum, with both parties signalling readiness to engage in meaningful dialogue. President Trump’s vocal support and affiliated firms' growing exposure to digital assets indicate that crypto will be deeply interwoven with the upcoming political cycle.

On the technical front, Bitcoin and Ethereum remain in strong positions, with sideways consolidation suggesting accumulation phases. Altcoins like Solana and Aptos show potential for breakout, though they remain vulnerable to broader market trends. With macro uncertainty lingering and regulation evolving, investors are likely to favour fundamentals-driven plays—making BTC and ETH the prime candidates for capital rotation in the months ahead.