Monthly Crypto Market Overview – April 2025

April was a defining month for the cryptocurrency market, marked by explosive price action, ETF speculation, rising DeFi activity, and shifting macroeconomic factors. From Bitcoin nearing six figures to altcoins like Solana and Sui posting double-digit gains, investors witnessed a robust resurgence across digital assets. Below is a detailed breakdown of the top developments, market trends, and technical outlooks shaping the crypto space.

Bitcoin Eyes $100K as Institutional Momentum Builds

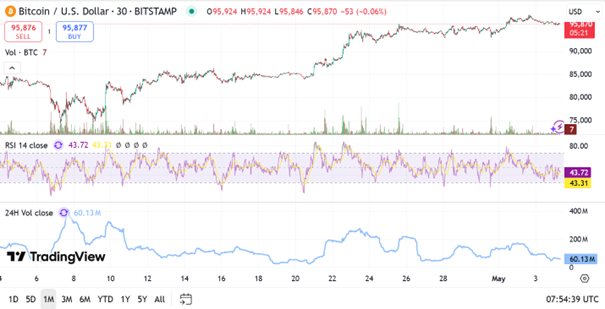

Bitcoin (BTC) maintained a solid uptrend in April, peaking near $97,000 and holding above the critical $95,000 support. The 1-month chart shows a consistent rise from mid-month, with momentum driven by institutional accumulation and market confidence. Notably, BTC respected key levels, consolidating around $95,870 while forming higher lows—a bullish signal for the months ahead.

Technical indicators are neutral at the moment, with the Relative Strength Index (RSI) hovering near 43.7, suggesting neither overbought nor oversold conditions. Trading volume is moderate, with 24-hour volume at 60.13 million, indicating steady market participation but not yet signaling breakout conditions. Investors are now closely watching macroeconomic triggers like the upcoming U.S. Nonfarm Payrolls report, which could influence interest rate expectations and propel BTC toward the psychological $100,000 milestone.

Source: TradingView

Sui Leads Altcoin Surge with DeFi Expansion and sBTC Integration

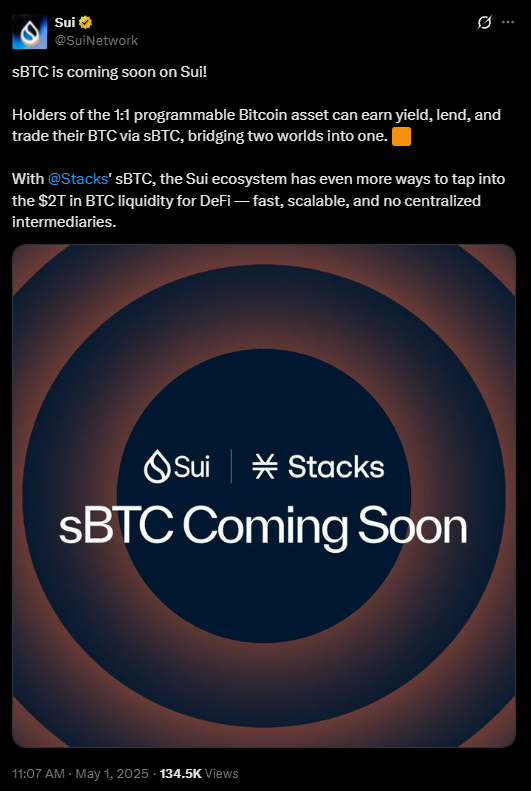

Sui (SUI) emerged as April’s breakout altcoin, soaring over 70% in weekly gains and outperforming the top 100 cryptocurrencies. Fueling its rally was a surge in DeFi activity, with total value locked (TVL) rising to $1.81 billion. Stablecoin liquidity jumped to $882 million, and daily DEX volumes frequently surpassed $500 million. Strategic partnerships—most notably with Babylon Labs, Lombard Protocol, and the Bitcoin-focused Stacks network—are driving increased developer and user engagement.

Sui’s planned integration of sBTC brings decentralized Bitcoin liquidity to its ecosystem, positioning the blockchain as a key player in BTCfi. With upcoming unlocks worth over $300 million, all eyes are on whether SUI can absorb the new supply. So far, momentum remains intact, with the price hovering near $3.50 after briefly touching $3.77. Technically, the trend remains bullish, but RSI and volume metrics suggest a short-term consolidation may be due.

Source: X

Solana’s 55% Rebound Sparks Renewed ETF Hype

Solana (SOL) recorded a dramatic rebound in April, climbing from $95 to nearly $150—a 55% gain that reignited talk of a spot ETF approval. With Bloomberg Intelligence now projecting a 90% likelihood for such an approval, institutional enthusiasm has returned. The price rally reclaimed the 21-day and 50-day moving averages, forming a bullish short-term structure of higher highs and higher lows.

If momentum persists, analysts believe Solana could revisit its all-time high of around $300. However, caution remains due to macro risks like tightening liquidity and mixed economic signals. Traders are watching ETF headlines closely, as an approval could send Solana into its next major rally.

Source: X, Bloomberg Intelligence

XRP, Cardano, and SUI Lead the ETF-Driven Surge

XRP and Cardano (ADA) continued to ride a wave of optimism driven by ETF speculation and improving market conditions. XRP climbed 3.93% over the past month, stabilizing around $2.21 as investors positioned for a potential breakout. Its steady performance reflects growing confidence, particularly as the token trades above key moving averages and attracts institutional interest. Cardano posted a 5.64% monthly gain, with trading volume spiking amid a technical breakout attempt. If ADA can flip $0.70 into support, it could target $1.40 in the near term.

However, the standout performer in this ETF-fueled altcoin rally was SUI, which exploded by 42.49% this month, surging to $3.20. The token benefited from both strong DeFi fundamentals and institutional exposure, including the launch of the Grayscale SUI Trust. Other notable gainers included Solana (SOL), up 19.44% on ETF anticipation, and Bitcoin Cash (BCH), which surged 20.34% likely due to capital rotation into large-cap altcoins. Meanwhile, underperformers like Toncoin (TON, -8.2%) and LEO (-5.52%) lagged behind, highlighting a selective market rally focused on coins with strong narratives and technical momentum.

Source: Quantifycrypto

Dogecoin Holds Ground After Monthly Rebound

Dogecoin (DOGE) posted a modest but steady 6% gain over the past month, climbing back toward the $0.18 level. The memecoin showed renewed strength after rebounding from support near $0.14, where it previously formed a double bottom pattern—often considered a bullish reversal signal. Despite brief overbought conditions late in April, DOGE maintained higher lows and is now consolidating with RSI levels hovering near 40, suggesting room for a potential upward move.

Volume trends remain relatively stable, currently at 16.96 million, while short-term momentum indicators are neutral. The price is holding above its 30-day average, and consistent demand from whale wallets supports a positive outlook. If buying pressure returns, DOGE could target $0.22 next, with the $0.20 psychological zone acting as a short-term resistance. The broader market mood and retail sentiment will play a key role in determining whether the rally can extend into May.

Source: TradingView

Trump Coin Surges on Gala Invitation and Policy Moves

Trump Coin (TRUMP) skyrocketed over 70% this month after the project’s website revealed that the top 220 holders would be invited to a private gala dinner with former President Donald Trump on 22 May. The top 25 investors will also gain access to an ultra-exclusive VIP reception at Trump National Golf Club in Washington, D.C., making it one of the most high-profile meme coin events to date. This announcement dramatically shifted market sentiment, drawing in both speculators and supporters.

Beyond the dinner invite, Trump has reinforced his pro-crypto stance by calling himself the "crypto president" and backing executive orders to create a Strategic Bitcoin Reserve and Digital Asset Stockpile. While the Trump Coin still sits well below its all-time high of over $74, the renewed media buzz and political alignment have re-energized interest in the token. Despite criticism from some industry voices calling the move a "stunt," TRUMP's momentum reflects growing crossover between politics and digital assets.

Source: gettrumpmemes.com

Crypto Market Holds Steady as Altcoins Lag Behind Bitcoin Surge

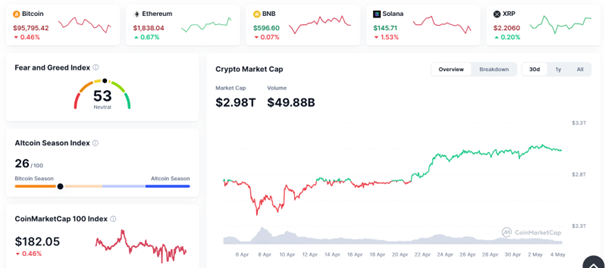

April closed with a steady but cautious crypto market. The total market capitalization rose to $2.98 trillion, but the month was largely dominated by Bitcoin, which surged nearly 15%, solidifying its dominance as altcoins struggled to keep pace.

The Fear and Greed Index remained neutral at 53, showing no clear investor sentiment trend, while the Altcoin Season Index sat at 26/100—indicating we are still firmly in a Bitcoin-led cycle. Trading volumes hovered around $49.88 billion, reflecting healthy market activity but not euphoric levels. Despite notable ETF-related developments—such as Grayscale launching its SUI Trust and pending ETF filings for XRP, Solana, and Litecoin—the broader altcoin market has yet to see the same traction.

Until ETF approvals expand beyond BTC and ETH, and macro conditions shift more clearly in favour of altcoins, market leadership remains with Bitcoin. The next breakout may depend on a spark—either regulatory clarity or a macroeconomic trigger—to rotate capital back into altcoins.

Source. Coinmarketcap

BTC Decouples from Gold, Reconnects with Equities as Macro Shifts Loom

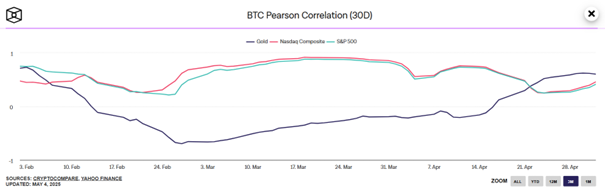

Bitcoin’s correlation dynamics have taken an interesting turn. As shown in the Pearson correlation chart, BTC's historical link with gold has inverted since mid-February, falling into negative territory. Meanwhile, its correlation with equity benchmarks like the S&P 500 and Nasdaq Composite rose steadily through March and April, signaling that Bitcoin is currently behaving more like a risk asset than a safe haven.

This shift highlights how macroeconomic conditions—particularly inflation data, rate expectations, and labor market trends—are heavily influencing crypto flows. Bitcoin's alignment with equities suggests that investors are treating it as part of broader speculative exposure rather than as a hedge. However, with BTC dominance still climbing and altcoins lagging behind, Bitcoin remains the lead indicator for crypto market direction.

Looking ahead, any dovish tilt from the Federal Reserve—especially following weak Nonfarm Payrolls or CPI data—could reinforce BTC’s upward momentum. If macro signals continue to favor looser policy, Bitcoin may once again attempt to decouple, potentially reasserting its inflation hedge narrative.

Source: TheBlock

Final Thoughts: Crypto Spring Strengthens

April reaffirmed that the crypto market has moved past its winter phase, with prices, sentiment, and adoption trends all turning sharply upward. Bitcoin’s approach toward $100K, Solana’s ETF momentum, and Sui’s explosive DeFi growth are just a few signs that the ecosystem is entering a new expansion phase.

Still, volatility remains. Token unlocks, regulatory uncertainty, and broader economic signals will continue to influence price action. Investors are advised to stay informed and nimble, as crypto’s next leg higher could be fast—and potentially game-changing.