Crypto Weekly Wrap: 11th July 2025

The ETF Tide Lifts All (Most) Boats

Another week, another surge in crypto prices, and once again, the familiar refrain of institutional money flowing into Bitcoin and Ethereum ETFs echoes through the market. This isn't just background noise anymore; it's the primary engine, pushing Bitcoin to dizzying new heights and dragging Ethereum along for a considerable ride. While the charts might whisper of overbought conditions, the sheer force of traditional finance allocating capital seems content to simply buy the dip – or, perhaps more accurately, buy the everything.

The Macro Lens

The Fed, Elections, and the Inexorable Flow of Capital

Stepping back from the immediate glow of green candles, the macroeconomic backdrop continues to exert its complex, often contradictory, influence on the crypto landscape. At the forefront, as ever, is the United States Federal Reserve. Their ongoing internal debate about the timing and magnitude of interest rate cuts remains a dominant theme in global financial markets. On one hand, any hint of a less hawkish stance – meaning fewer rate hikes, or sooner cuts – is generally interpreted as bullish for risk assets, including equities and, by extension, cryptocurrencies. This is because lower interest rates make borrowing cheaper, encourage investment, and decrease the relative attractiveness of 'safe' assets like bonds, pushing capital into areas promising higher returns.

However, the path forward is far from clear. Inflation, while having come down significantly from its peaks, still lingers above the Fed's target. This sticky inflation presents a dilemma: cut too early, and you risk reigniting price pressures; wait too long, and you could stifle economic growth. The disagreements within the Federal Open Market Committee (FOMC) are not merely academic; they translate directly into market uncertainty. A divided Fed means investors are constantly trying to read the tea leaves, and this uncertainty can lead to bouts of volatility across asset classes.

Beyond interest rates, the upcoming U.S. election is beginning to loom larger on the horizon. While not a direct daily driver of market movements *yet*, the potential shifts in regulatory policy depending on who occupies the White House and controls Congress are significant for an asset class as sensitive to government intervention as crypto. Hints of potentially more favourable regulatory clarity in the U.S., alongside established frameworks like the EU's MiCA (Markets in Crypto Assets) regulation, are currently contributing positively to sentiment. However, regulatory risk remains a two-sided coin; potential actions by bodies like the SEC regarding future crypto ETF approvals could introduce headwinds. The policy environment, therefore, is a slow-burn macro factor that requires careful monitoring.

Global markets outside the U.S. are presenting a mixed picture. While U.S. equity indices, particularly those heavily weighted towards technology and utilities, have continued their seemingly relentless climb to new record highs, other markets tell a different story. India's Nifty 50, for instance, has seen declines, influenced by cautious global cues and potentially domestic factors. This divergence highlights that while U.S. tech dominance is a powerful force, the global economic recovery is uneven, and various regions face their own specific challenges and investor sentiment dynamics. Geopolitical tensions, while not explicitly detailed in the provided data, always sit in the background, capable of injecting sudden volatility into interconnected global markets.

So, how does all this macro swirling impact crypto? The primary channel right now appears to be through the institutional embrace facilitated by the ETF structure. In a world where traditional investors and money managers are grappling with inflation, uncertain growth prospects, and shifting central bank stances, Bitcoin and Ethereum are increasingly being viewed through a new lens: as legitimate, albeit volatile, alternative assets that offer diversification and potential uncorrelated returns (though the correlation to tech stocks has been notable at times). The structural product of the ETF makes allocation straightforward for these large pools of capital.

The narrative isn't just about retail enthusiasm anymore, although that certainly plays a role. It's about asset allocators making strategic decisions to gain exposure. The sheer scale of inflows into spot Bitcoin and Ethereum ETFs – with near-record days recently, seeing hundreds of millions or even over a billion dollars pouring in – demonstrates that this is serious capital at work. This institutional demand acts as a powerful counter-force to potential sell-offs or macroeconomic jitters, creating a significant demand sink that helps absorb new supply and underpin prices.

In essence, while the traditional macro factors create a complex and sometimes uncertain environment for many asset classes, they seem to be currently highlighting the perceived value proposition of digital assets for a segment of large-scale investors, turning macroeconomic uncertainty in traditional markets into a catalyst for capital flows *into* the crypto market via familiar investment vehicles. It’s a fascinating dynamic where old-world financial plumbing is channelling new-world assets into portfolios.

The Crypto Lens

Crypto Lens: Bitcoin's New Peak, Ethereum's Ascent, and the Greed Gauge

Alright, let's zoom back into the digital realm. This past week saw Bitcoin do what it does best – defy expectations (or perhaps, fulfil the expectations of the relentlessly bullish) and push to a new all-time high, trading comfortably above $118,000 at the time of this writing. Ethereum wasn't far behind, reaching multi-month highs and showing renewed vigour.

The technical picture for both majors, according to the data, looks unambiguously bullish on longer timeframes. Bitcoin is trading above all major moving averages – the 7, 20, 50, and even the mighty 200-day – a classic sign of a strong, sustained upward trend. The MACD, another momentum indicator, shows a bullish crossover and positive momentum building. For Ethereum, the story is similar; it has broken a downtrend and is trading above key moving averages like the 21-week SSMA, with bullish MACD signals emerging.

However, there's a small yellow flag fluttering in the breeze. The Relative Strength Index (RSI), which measures the speed and change of price movements, is flashing 'overbought' signals for Bitcoin, sitting in the 73-79 range. This doesn't mean a crash is imminent, but it does suggest that the price rise has been rapid and a short-term pullback or consolidation period wouldn't be a surprise. Ethereum's RSI is also elevated (57-70) but not quite as stretched as Bitcoin's, indicating strong but potentially less overheated momentum depending on the timeframe.

The dominant narrative driving this price action is, without a doubt, the institutional money flooding into spot ETFs. We've discussed the macro reasons for this flow, but the scale is truly noteworthy. Just recently, Bitcoin ETFs saw their second-highest daily inflow ever, a staggering $1.18 billion. Ethereum ETFs also had a massive day, pulling in $383.1 million, their second-highest daily inflow as well. These aren't just small trickles; they are tidal waves of capital, primarily from major players like BlackRock and Fidelity, who are hoovering up Bitcoin and Ethereum at an incredible pace. Think of it this way: a significant chunk of the newly mined Bitcoin supply, plus coins from sellers, is being absorbed by these institutional buyers via the ETF structure. This creates sustained buying pressure that makes it difficult for prices to drop significantly, even on negative news or profit-taking.

The market sentiment reflects this bullish fervour. The Crypto Fear & Greed Index, a popular gauge, is registering 'Greed', though it has slightly cooled from peak levels, sitting around 71. This suggests enthusiasm is high, bordering on exuberance, but perhaps not yet at stratospheric levels of irrational FOMO (Fear Of Missing Out). Social media sentiment remains largely positive, fueled by the price rallies and the constant drumbeat of positive ETF flow news.

What about the altcoins? Solana (SOL), often seen as a bellwether for the broader altcoin market's risk appetite, has been trading above key support levels, indicating a bullish underlying trend, although its 24-hour performance in the provided data shows a slight dip after a strong run. The Solana ecosystem, and altcoins in general, tend to follow Bitcoin and Ethereum's lead. When the majors rally, capital often rotates down the risk curve into smaller-cap tokens, seeking higher percentage gains. The current environment, characterised by strong institutional demand for the majors and positive sentiment, is generally conducive to altcoin performance, though they remain significantly higher risk and more volatile.

Liquidity appears robust, supported by the strong inflows. Trading behaviour seems to be characterised by dip-buying and momentum chasing, as traders follow the institutional lead and the positive price action. There haven't been major, unexpected surprises beyond the sheer persistence and scale of the ETF inflows, which continue to exceed many analysts' expectations.

In summary, the crypto market this week was a story of institutional demand meeting limited supply, resulting in significant price appreciation for Bitcoin and Ethereum. While technical indicators suggest the rally has been fast and some caution is warranted in the short term, the fundamental driver of large-scale ETF inflows remains firmly in place, providing a strong floor and potential runway for further gains. The sentiment is one of cautious greed, a potent mix that can sustain rallies but also leave the market vulnerable to sudden shifts.

The ICONOMI Angle

Riding the Institutional Wave with ICONOMI Strategies

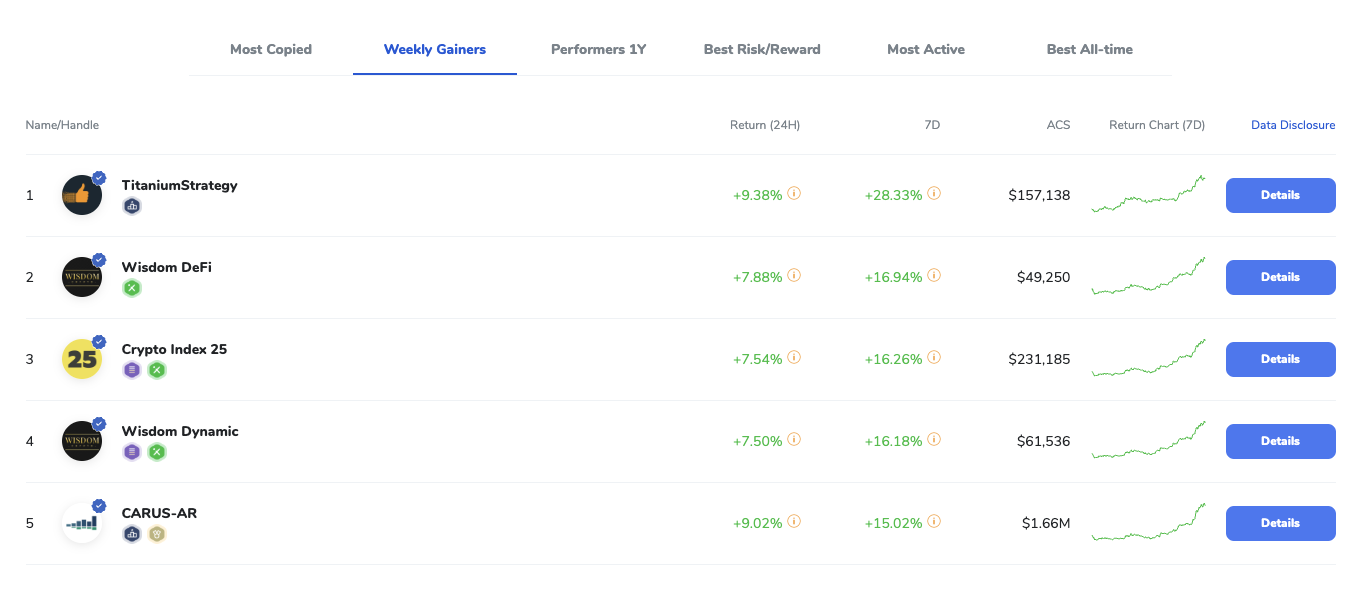

Now, let's bring this picture back to the ICONOMI platform and see how real user strategies are navigating these market dynamics. Given the powerful narrative of institutional money flowing into Bitcoin and Ethereum via ETFs and the subsequent strong performance of these major assets, it stands to reason that ICONOMI strategies with significant exposure to BTC and ETH would be among the top performers this year.

The leading strategies are not necessarily chasing obscure, micro-cap tokens (though some might hold a diversified basket); rather, they are fundamentally positioned to benefit from the dominant market trend. This composition directly leverages the massive inflows we discussed in the Crypto Lens section. As BlackRock, Fidelity, and others pour billions into their spot BTC and ETH ETFs, the price of these underlying assets is naturally pushed higher. Strategies holding a substantial percentage of these assets are therefore seeing their net asset values appreciate significantly.

The key takeaway here is that in a market being significantly shaped by large-scale institutional allocation, the simplest strategies – those focused on holding the assets being accumulated by traditional finance – are often the most effective. These top ICONOMI strategies aren't trying to outsmart the market with complicated manoeuvres; they are riding the wave of the most significant demand catalyst we've seen in recent times.

Their success underscores the current market structure where institutional inflows into BTC and ETH ETFs are the primary game in town, and strategies aligned with this trend are reaping the rewards. It highlights the power of simply being in the right assets at the right time, particularly when those assets are the target of unprecedented institutional interest via accessible traditional financial products. For ICONOMI users, this provides a clear signal: exposure to the market leaders, especially Bitcoin and Ethereum, has been a crucial factor in achieving superior returns over the past year.

What to Watch Next

What to Watch Next: Navigating the Wake of the ETF Tide

Okay, we've established that the institutional ETF flow is the undeniable main character of this market rally. But what happens next? Staring into the crystal ball is always a hazardous exercise in crypto, but based on the current data and trends, we can identify a few key areas to keep a close eye on.

Firstly, the relentless march of ETF inflows. Can it continue at this pace? The near-record daily figures are impressive, but they can't surge infinitely every day. We need to watch if the *pace* of inflows is sustained, increases, or begins to plateau. A significant slowdown, while not necessarily bearish, could remove some of the immediate upward pressure. Conversely, continued strong inflows signal that the institutional adoption narrative has further room to run. Pay attention to the daily flow reports; they are the market's pulse right now.

Secondly, the macroeconomic picture, specifically the Federal Reserve's stance. While crypto is currently enjoying its own narrative, a sudden hawkish shift from the Fed due to persistent inflation or unexpected economic strength could dampen enthusiasm for all risk assets. Similarly, clear signals of impending rate cuts or a softer economic landing could provide further tailwinds. Upcoming inflation data releases (CPI, PCE) and Fed commentary will be crucial events. The market is sensitive to these signals, and a surprising print or statement could inject volatility.

Thirdly, watch the technicals, particularly for Bitcoin. The overbought signals from the RSI (sitting high at 73-79) suggest that while the trend is strong, the market might be 'due' for a breather. This doesn't mean a crash, but a period of consolidation or a shallow pullback to test support levels (like $113,000 or $107,000) is a distinct possibility and would be a healthy development after such a rapid ascent. Failure to hold key support levels could signal a deeper correction, though the strong institutional bid might make significant dips short-lived.

Fourthly, regulatory developments, especially in the United States. We've seen positive hints, but the regulatory landscape remains complex. Any clarity, positive or negative, regarding stablecoins, decentralized finance (DeFi), or the possibility of spot altcoin ETFs could significantly impact different sectors of the market. The outcome of ongoing legal cases and potential new legislative proposals are worth tracking.

Fifthly, the altcoin market's behaviour. While Bitcoin and Ethereum are leading, a healthy bull market typically sees capital eventually rotate into smaller, more speculative altcoins. Watch if volume and price action in the altcoin space start picking up significantly, particularly in specific narratives (like AI, GameFi, DePIN, etc., although the provided data didn't highlight specific narratives this week). A broad-based altcoin rally often signals peak euphoria, while selective pumping might indicate specific sector rotations. Solana's ability to break and hold key resistance levels (like $164-$166 and aiming for $180) could be a good indicator for altcoin strength.

Finally, keep an eye on major security events or exchange issues. While less frequent now, these 'black swan' events can still cause sudden, sharp price drops across the market. The infrastructure is maturing, but risks remain.

In summary, the immediate future hinges on the interplay between sustained institutional demand via ETFs, the evolving macro picture, and whether the market takes a necessary breather after its rapid climb. The catalysts for further upside are clear – continued inflows, positive regulatory news, and a more dovish Fed. The risks are equally apparent – a sharp macro downturn, unexpected regulatory hurdles, or simply a technical pullback from overbought conditions. The trend is your friend until it isn't, and right now, the trend is heavily influenced by TradFi's embrace of digital assets.

FAQs

Why are Bitcoin and Ethereum prices going up so much right now?

The primary driver is strong institutional demand, particularly through U.S. spot Bitcoin and Ethereum Exchange-Traded Funds (ETFs). Large asset managers are buying significant amounts of BTC and ETH via these easy-to-access investment products, creating substantial buying pressure that is pushing prices higher.

What are spot Bitcoin and Ethereum ETFs, and why are they important?

Spot ETFs are investment funds that hold the actual underlying asset (Bitcoin or Ethereum) and trade on traditional stock exchanges. They are important because they provide a regulated and familiar way for large institutional investors, financial advisors, and even retail investors to gain exposure to crypto without directly holding the digital assets themselves. This accessibility is unlocking significant capital flows into the market.

Is the crypto market currently overbought?

According to technical indicators like the Relative Strength Index (RSI), Bitcoin is showing signs of being overbought (RSI around 73-79), which suggests the price has risen very quickly. This doesn't guarantee a price drop, but it does increase the probability of a short-term pullback or consolidation period. Ethereum's RSI is also elevated but less so.

How is the broader economy affecting the crypto market?

Macroeconomic factors like inflation and central bank interest rate policy create the environment in which all assets, including crypto, trade. While crypto has its own specific drivers (like ETF flows), uncertainty in the traditional economy can influence investor sentiment and capital allocation decisions. Currently, perceived uncertainty or lower return potential in traditional assets seems to be contributing to the flow of capital into crypto via ETFs.