Crypto Weekly Wrap: 5th September 2025

September's Quiet Shuffle: Why Bitcoin Held Its Ground Amidst a Shifting Tide

This week, the crypto markets played a more nuanced tune than the usual fanfare or dirge. While September traditionally carries a reputation for market doldrums, the narrative felt less like a full-blown crisis and more like a strategic reshuffle. Bitcoin demonstrated a notable resilience, stubbornly clinging to its hard-won ground.

Meanwhile, the ETF landscape told a tale of diverging fortunes, with significant capital flowing back into Bitcoin products even as Ethereum ETFs experienced notable outflows. It's a period of "neutral" sentiment, that oddly uncomfortable middle ground where the fear has subsided but outright greed hasn't quite taken hold.

The question on everyone's mind: is this the market finding its footing, or just gathering its thoughts before the next move?

The Macro Lens

The broader economic stage continues to set the tempo, albeit with a muted beat this week. The prospect of Federal Reserve rate cuts in September remains a dominant theme, with probabilities hovering impressively high. Markets are keen on the idea of more liquidity, viewing rate cuts as a green light for risk assets, including crypto.

However, the Fed's dance with inflation is far from over. Upcoming U.S. economic data releases, particularly the Nonfarm Payrolls and CPI figures, are looming large. These aren't just numbers on a page; they're the indicators that could either cement expectations for rate cuts or send policymakers back to their hawkish notes.

Geopolitical risks continued to simmer, adding a dash of unpredictability. With a crucial vote of confidence scheduled for September 8th, French political turmoil injected a familiar dose of European uncertainty. While seemingly distant, such events can ripple through global markets, reminding us that no asset class, not even decentralised ones, exists in a vacuum. The underlying message from the macro front is one of cautious optimism, heavily contingent on the data yet to arrive.

The Crypto Lens

The crypto market itself presented a study in contrasts this past week.

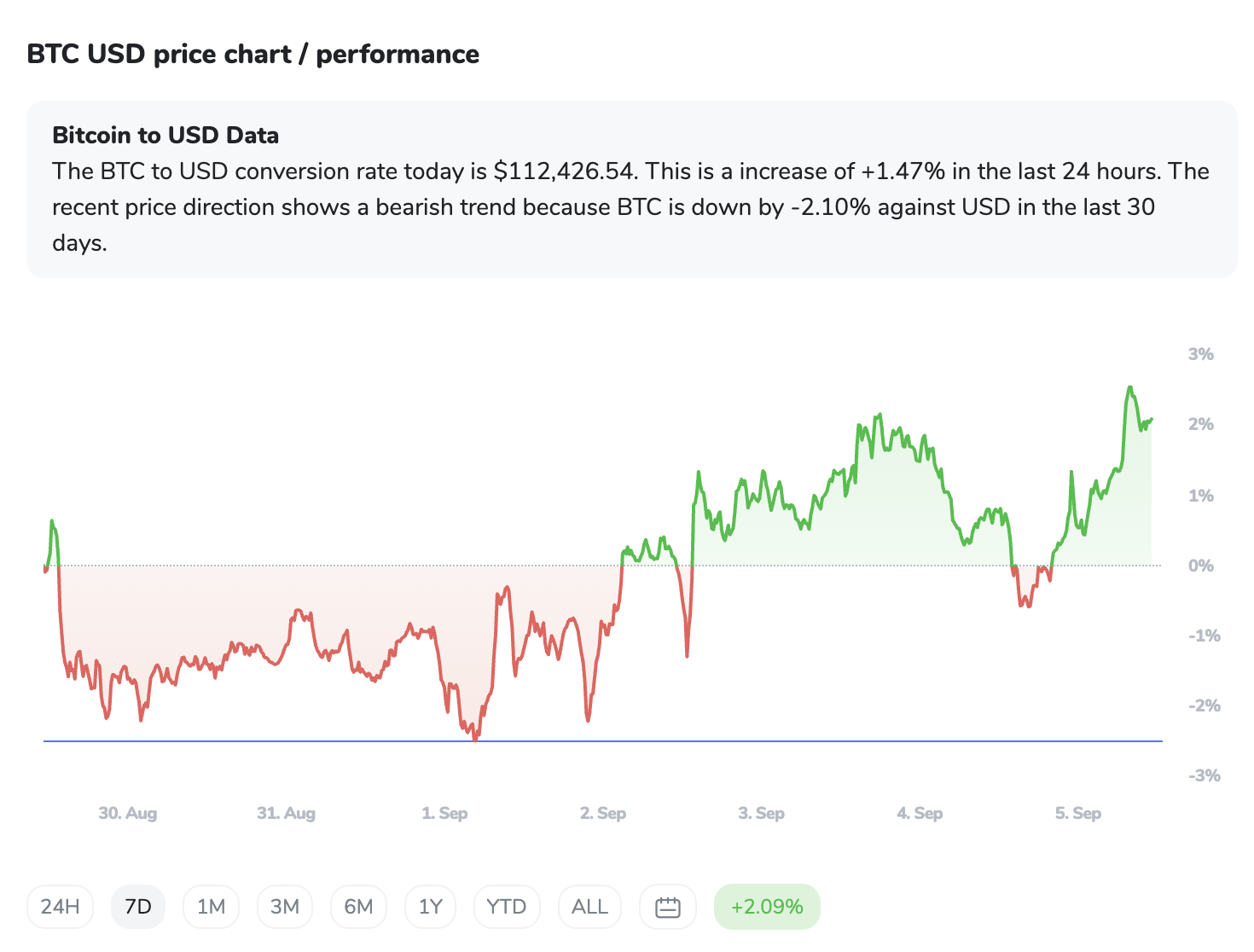

Bitcoin (BTC)

The digital behemoth continued its impressive display of resilience. Despite some technical indicators suggesting a slightly bearish outlook, like the 4H MA 50 crossing below the MA 200, Bitcoin has primarily held firm above the $110,000 mark. It’s like watching a tightrope walker perfectly balancing, navigating immediate resistance levels around $112,000-$114,500 while indicators like the RSI hint at a "hidden bullish divergence," suggesting underlying demand might be stronger than the immediate price action lets on. The overall sentiment around BTC is cautious consolidation near its previous all-time high support.

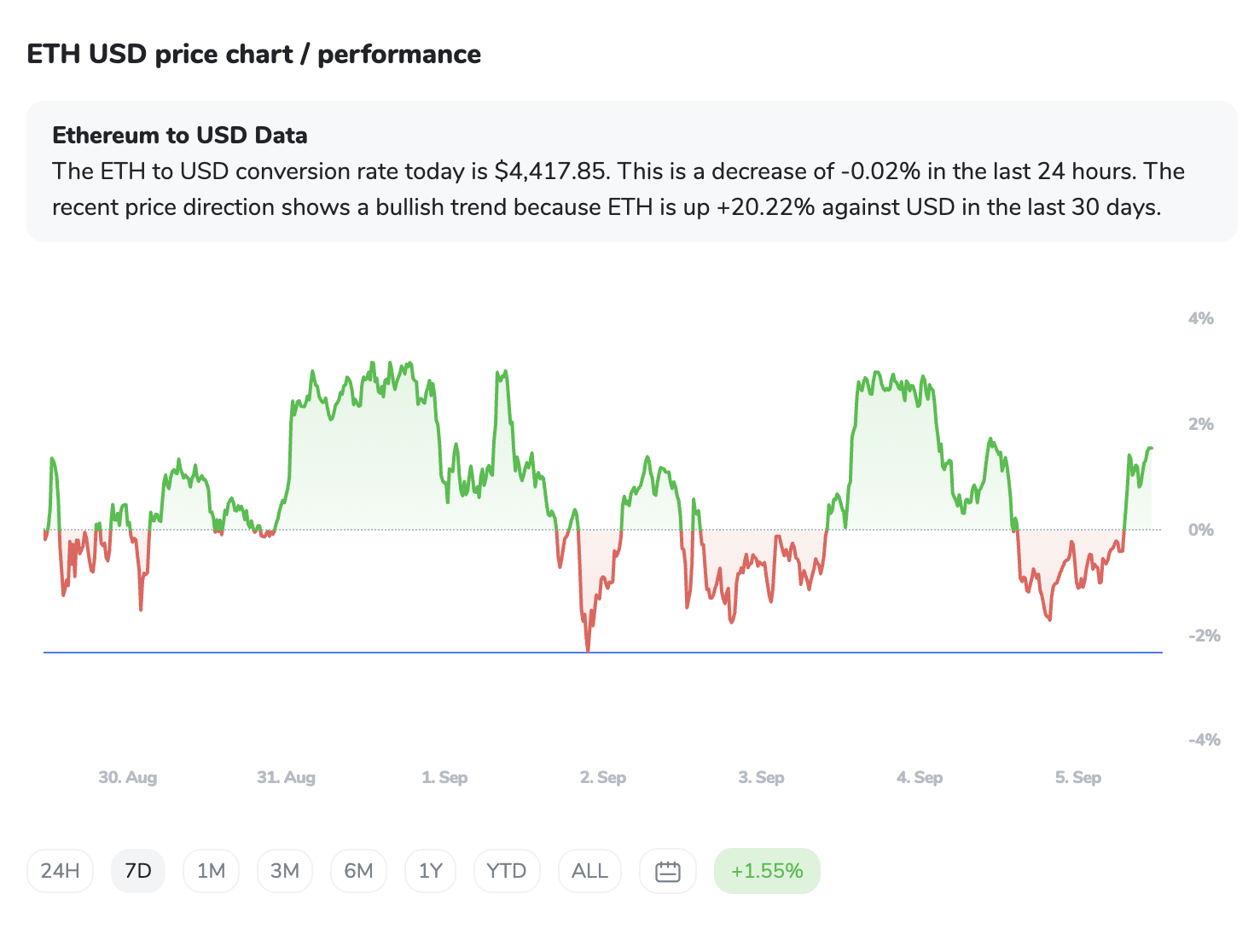

Ethereum (ETH)

By contrast, has been more of a consolidator, settling into a defined trading range. While it enjoys strong foundational support at levels like $4,340 and $4,200-$4,000, it’s currently bumping its head against resistance around $4,460 to $4,650, flirting with its all-time high zone. Interestingly, despite short-term volatility, whale accumulation has been observed, a subtle nod from larger players who seem to be betting on a September rally should ETH decisively break current resistance.

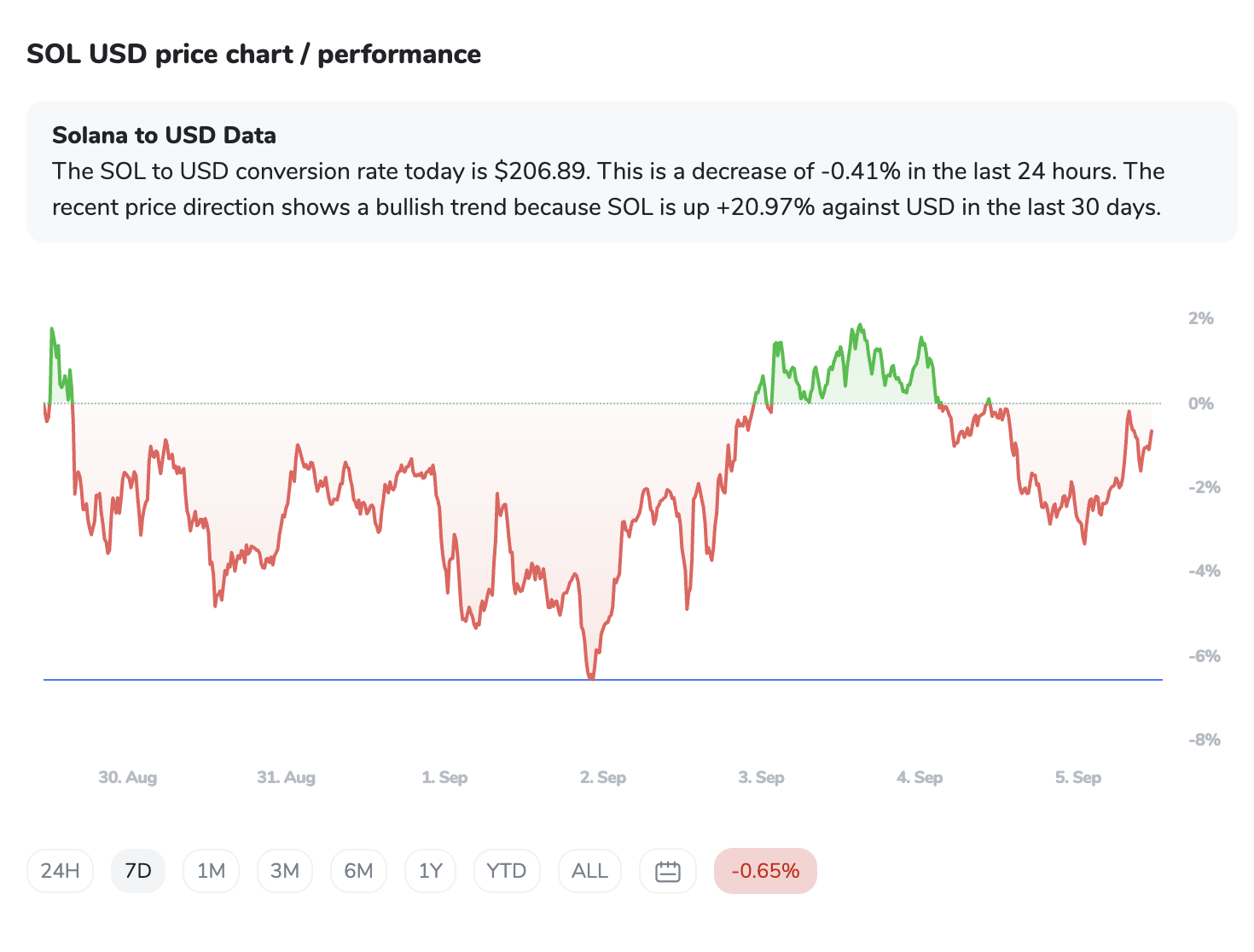

Solana (SOL)

Solana found itself at a pivotal juncture. After a recent recovery, it’s now battling significant resistance around the $210-$212 zone. While a break above this could open the door to higher targets, some technical signals, like RSI divergence and signs of "ascending wedge exhaustion," suggest buyer interest might be waning, raising the spectre of a breakdown below $200.

Perhaps the most telling story came from the ETF flows. After a challenging August, Spot Bitcoin ETFs saw a significant rebound in inflows. BlackRock's IBIT and Fidelity's FBTC were particularly busy, pulling in $148.8 million and $132.69 million, respectively.

This is a clear signal of renewed institutional interest in BTC. However, it wasn't a universal embrace; Spot Ethereum ETFs experienced substantial net outflows, with Fidelity's FETH seeing a hefty $217 million outflow.

This isn't just a blip; it points to a capital rotation, where institutional money might be moving out of ETH products, perhaps in anticipation of upcoming regulatory clarity or simply reallocating within the crypto space.

As reflected by the Crypto Fear & Greed Index, the market sentiment has quietly shifted from 'Fear' to a more composed 'Neutral,' suggesting that while the immediate panic has receded, the market is still in a wait-and-see mode.

The ICONOMI Angle

On the ICONOMI platform, our strategists have been navigating this nuanced market with a steady hand, reflecting the resilient mood of the broader crypto landscape. The top-performing strategies this week showcased a blend of conviction in market leaders and judicious diversification.

Leading the pack was COINBEST INDEX, delivering a respectable +2.44% weekly return. Its composition heavily favours Bitcoin at 81.94% and Ethereum at 10.70%, with a touch of stability from PAX Gold (5.50%) and smaller allocations to other assets like Ethereum Classic and Litecoin, showing a belief in core assets with a dash of risk mitigation.

Following closely, Bitcoin Ether Risk Adjusted lived up to its name with a +2.27% return, almost exclusively focused on the two giants: 90.02% Bitcoin and 9.98% Ethereum. This strategy exemplifies a direct approach to capturing the performance of the market's heavyweights.

Wisdom World returned +2.14%, diversifying its exposure beyond BTC (61.13%) and ETH (28.94%) to include altcoins like Avalanche, Solana, Fetch.ai, and Injective Protocol. This highlights a strategy looking for growth across a broader spectrum of the ecosystem.

Pecun.io Cryptocurrency returned +1.86% for those prioritising stability. It is uniquely composed primarily of USDC (52.28%) and PAX Gold (47.70%), with a minimal Bitcoin holding. This indicates a strong preference for capital preservation and hedging against volatility, a pragmatic choice in uncertain times.

Finally, WistCap Flagship Long delivered +1.84%, maintaining a strong allocation to BTC (66.78%) and ETH (20.38%), while also dipping into DeFi and L2 tokens such as Aave, Pendle, Tron, PancakeSwap, and Render Token. This reflects an appetite for innovation within the broader crypto space.

These diverse strategies underscore a market where conviction in Bitcoin and Ethereum remains high, but also where thoughtful diversification, whether through stablecoins, gold-backed tokens, or a curated selection of altcoins, plays a crucial role in managing returns.

What to Watch Next

September, often a month of market recalibration, presents a fascinating array of factors for crypto investors to monitor:

The Federal Reserve's Next Move: The highly anticipated 25 basis point rate cut in September (with probabilities near 90%) is a major potential tailwind. However, any deviation or hawkish commentary from the Fed could quickly shift sentiment. Keep an eye on the U.S. economic data releases (Nonfarm Payrolls, CPI) as they will be critical inputs for the Fed's decision-making.

Geopolitical Ripples: French political turmoil and the upcoming vote of confidence on September 8th could trigger broader market instability. The ongoing Russia-Ukraine peace talks, while hopeful, also carry the potential for sudden market shifts.

Ethereum's Regulatory Path: While Bitcoin ETFs are enjoying fresh inflows, the situation for Ethereum ETFs is more ambiguous. Speculation and potential approval, particularly concerning staking mechanisms and institutional custody, could be a significant catalyst or a continued headwind.

Altcoin Specifics: Solana's 'Alpenglow' upgrade aims to boost network performance, and its success (or lack thereof) will be closely watched. Beyond that, over $1 billion in token unlocks and major token launches in early-to-mid September could introduce both volatility and opportunities.

The "Red September" Ghost: Historically, September has been a challenging month for Bitcoin, averaging a decline of -3.77% since 2013. While past performance is no guarantee, this seasonal headwind, often attributed to portfolio rebalancing and reduced liquidity, is worth acknowledging.

Regulatory Evolution: Increased clarity in the U.S. through proposed legislation (like the BITCOIN Act and CLARITY Act) could foster greater institutional adoption and de-risk the market, though the legislative process is notoriously slow.

Leverage Levels: Elevated leverage in perpetual futures markets continues to make Bitcoin vulnerable to sharp liquidations, particularly if unexpected macro news hits.

FAQs

Why are Spot Bitcoin ETFs seeing inflows while Ethereum ETFs are experiencing outflows?

This divergence suggests a capital rotation. Institutional investors appear to be re-engaging with Bitcoin, possibly seeing it as a more stable or clearer bet in the current environment, while funds are being pulled from Ethereum ETFs. This could be due to differing regulatory clarity, specific fund strategies, or a perceived short-term opportunity cost in Ethereum.

Market sentiment shifted to 'Neutral' – what does that mean for investors?

A 'Neutral' sentiment, as indicated by the Crypto Fear & Greed Index, means that the intense 'Fear' has subsided, but the market isn't yet in a state of 'Greed' or euphoria. For investors, it suggests a period of calm caution, where panic selling is less likely, but aggressive buying is also muted. It's often a phase of consolidation where market participants are waiting for clearer signals before committing strongly.

Is "Red September" a real concern for Bitcoin's price this month?

"Red September" refers to a historical trend where Bitcoin has, on average, seen negative returns in September. While it's a historical observation and not a guaranteed outcome, it's a point of caution for many traders. Factors like portfolio rebalancing after summer and generally lower trading volumes can contribute to this trend. However, significant positive catalysts, like a Fed rate cut, could override this historical pattern.