BNB: Latest Developments, Price Trends, and Technical Analysis

Binance Coin (BNB) Targets Breakout as ETF Filing and AI Integration Boost Momentum

Binance Coin (BNB), the native token of the world’s largest cryptocurrency exchange by trading volume, has made headlines again. A blend of groundbreaking developments—including a new spot ETF filing, strategic AI integrations, and renewed technical indicators—has reignited investor interest. As BNB flirts with key resistance levels, traders and institutions alike are keeping a close eye on the token’s next move.

Plug-and-Play AI Integration: BNB Chain’s “AI-First” Vision

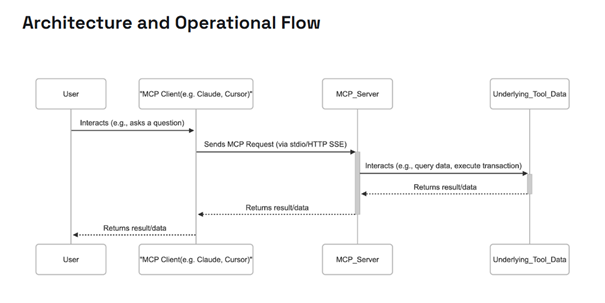

BNB Chain, the blockchain ecosystem supporting Binance Coin, has taken a significant step in embracing artificial intelligence. The recently announced Model Context Protocol (MCP) brings plug-and-play AI integration to the BNB ecosystem, positioning it to tap into the rapidly growing intersection between AI and blockchain technology.

MCP functions as an open protocol standard that enables seamless, secure, and two-way communication between AI agents and external systems. Rather than requiring bespoke code, MCP offers a unified interface that allows AI to operate with the necessary context and access essential tools. This is particularly relevant for high-stakes use cases like DeFi, blockchain security, and algorithmic trading.

With MCP, developers can build AI-powered applications that interact directly with decentralized protocols. Whether evaluating risk, executing strategies, or analyzing real-time data, AI agents are now empowered to act intelligently and autonomously within BNB Chain’s framework. This move aligns with Binance’s broader push toward expanding Web3 infrastructure and AI-powered financial services.

Source: BnbChain

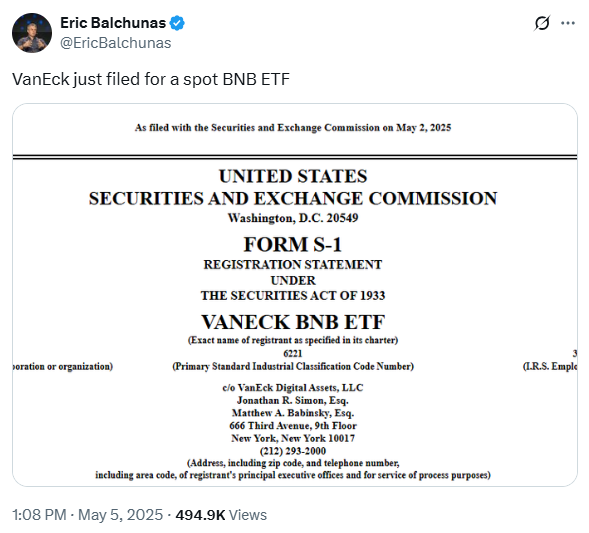

VanEck Files for First Spot BNB ETF in the United States

In another major development, asset management giant VanEck has submitted a filing to the U.S. Securities and Exchange Commission (SEC) to launch the first spot Binance Coin (BNB) exchange-traded fund (ETF). The move follows growing demand from institutional investors seeking secure exposure to altcoins without the burden of direct custody.

Filed on May 5, 2025, just days after VanEck’s CEO reportedly met with Binance founder Changpeng Zhao (CZ) at the TOKEN2049 conference in Dubai, the proposal has stirred optimism across crypto markets. The ETF, if approved, would allow investors to gain regulated exposure to BNB in a similar fashion to VanEck’s existing Bitcoin and Ethereum products.

Source: X

This announcement comes at a pivotal time. Following years of regulatory scrutiny, including CZ’s resignation and Binance’s $4 billion legal settlement with U.S. authorities, the company appears to be regaining its footing. The prospect of a BNB ETF has already shifted sentiment, helping BNB outperform Bitcoin and Ethereum over a 24-hour span shortly after the filing.

Source: X

Kyrgyzstan Talks and Global Expansion

Adding to the momentum, CZ recently met with Kyrgyzstan’s president and proposed including BNB and Bitcoin as core components of the country’s crypto reserve strategy. During his visit, Zhao participated in a council session on blockchain development, suggesting BNB could play a foundational role in the nation's virtual asset policies.

Such diplomatic outreach not only enhances Binance's global reputation but also positions BNB as a token with both domestic utility and international strategic value.

Source: X

Price Analysis: BNB Struggles at $600 Amid Mixed Technical Signals

BNB is currently trading slightly above the $600 mark, reflecting a recovery effort following a period of consolidation. Despite the recent uptick, BNB is struggling to maintain momentum as it hovers just below its 50-day Exponential Moving Average (EMA), suggesting that resistance remains a formidable barrier for the bulls.

The Relative Strength Index (RSI) is currently at 49.43, indicating a neutral stance with a slight bearish tilt. Momentum has slowed down, and the volume remains relatively high at 128.65 million, suggesting that traders are actively positioning themselves for the next move.

A breakout above the $612 level, where both the 100-day and 200-day EMAs converge, could signal the onset of a more pronounced uptrend. If bulls succeed in reclaiming this zone, BNB may test the $640 resistance area, with a further target set at $660—previously a strong cycle high.

However, failure to maintain above $600 could expose BNB to downside risk, with potential support levels seen at $580 and $570, aligning with recent lows. Traders should closely monitor the $612 confluence zone as a critical pivot for determining BNB’s near-term direction.

Source: TradingView

ETF Impact: Could BNB Hit $1,000?

The VanEck ETF filing has stirred predictions that BNB might not only reclaim previous highs but also establish new ones. Some analysts suggest the token could eventually climb toward $1,000 or beyond if institutional demand intensifies and regulatory hurdles are cleared.

However, several caveats remain. While the SEC has approved spot Bitcoin and Ethereum ETFs, it has yet to officially classify BNB as a commodity. Without this regulatory clarity, the approval process for a BNB ETF may be prolonged or face complications. Additionally, questions about whether the ETF will support staking remain unanswered, which could affect yield-focused investor appetite.

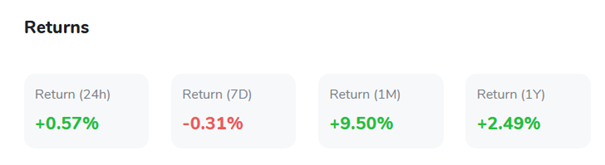

Monthly Chart: Testing Support and Eyeing Resistance

BNB’s monthly performance shows a notable 10.17% gain, climbing to $602.69 as of May 7, 2025. The token has maintained a steady upward trajectory since April 7, reflecting a 9.50% monthly return despite a minor 0.31% decline in the past week.

The price remains below the critical $650 resistance level, which aligns with prior cycle highs and marks a key barrier for further gains. Technical indicators present a cautiously optimistic outlook, with the RSI hovering near neutral territory, indicating potential for continued upward movement.

Short-Term vs. Long-Term Outlook

In the short term, all eyes are on whether BNB can break through $612 and hold above $640. If this occurs, bullish sentiment could accelerate rapidly, especially with ETF excitement and global headlines reinforcing demand.

Over the longer term, however, questions remain. Regulatory uncertainty, competition from rival chains like Solana and Ethereum, and lingering reputational issues from Binance’s legal saga could temper gains. Nonetheless, the launch of MCP and developments like Kyrgyzstan’s crypto initiative demonstrate BNB's staying power as both a utility token and a strategic asset.

Conclusion: Cautious Optimism as BNB Builds a Case for Recovery

Binance Coin enters May with renewed energy, driven by a string of bullish headlines and favorable technical patterns. From AI integration via the Model Context Protocol to VanEck’s ambitious ETF filing, the narrative around BNB is shifting toward innovation, global adoption, and institutional legitimacy.

However, the road to $1,000 won’t be without obstacles. BNB must overcome stubborn resistance levels, regulatory ambiguity, and macroeconomic headwinds. For now, the $600 to $660 range serves as a critical battleground. If bulls prevail, BNB could embark on a new leg of its journey—one that finally closes the gap between past controversies and future potential.