SUI: Latest Developments, Price Trends, and Technical Analysis in May 2025

SUI Network in Crisis: $162 Million Recovered Amidst Exploit Fallout

The SUI blockchain recently found itself in the spotlight after a major security breach targeted Cetus, a decentralised exchange operating on the network. On May 22, 2025, attackers exploited a smart contract vulnerability to siphon $223 million in digital assets. Thanks to swift intervention by Cetus, the SUI Foundation, and network validators, roughly $162 million has been successfully frozen, limiting further damage.

This rapid recovery was made possible by the validators' collective decision to block transactions from the compromised addresses. While celebrated as a win for community-led defence, this action raised serious questions about decentralisation on SUI. Critics argue that the ability of 114 validators to unilaterally freeze wallets undermines core blockchain values like censorship resistance. Regardless, the recovery is a relief for affected users, and Cetus is now undergoing a full audit and codebase overhaul to bolster its smart contract security.

Source: X

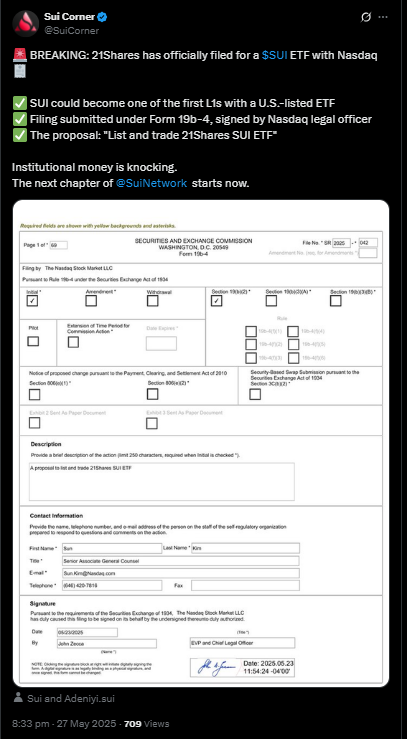

ETF Filing Fuels Price Momentum: SUI Sets Eyes on $5

The SUI token has recently gained traction, not only because of its recovery efforts post-hack but also due to Nasdaq’s 19b-4 filing to list a spot SUI ETF via 21Shares. This is a significant milestone—SUI would become one of the first altcoins to have a spot ETF on the table. While approval by the SEC remains pending, the proposal alone has helped improve investor sentiment.

The ETF filing coincided with a 5.16% rise in trading volume to $12.21 billion and a surge in SUI’s market capitalisation to $12.42 billion. As a result, many investors are eyeing price levels around $3.80 and, potentially, the psychologically important $5 mark. Regulatory approval would not only legitimise SUI further but also broaden access to institutional capital.

Source: X

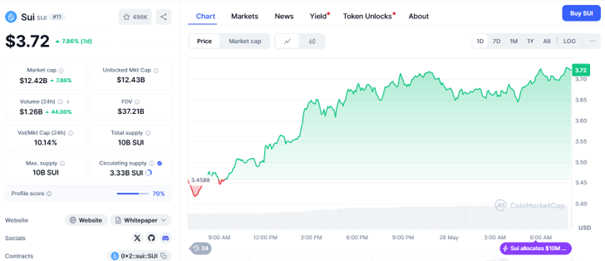

Strong Price Action Sparks Investor Optimism

SUI has shown robust upward momentum, now trading at $3.72 after a 7.86% gain in the last 24 hours. Trading volume has surged by 44% to $1.26 billion, signalling renewed interest and liquidity in the market. The token’s market cap has also climbed to $12.42 billion, further supporting its bullish narrative. This strong price action comes on the heels of SUI’s $10 million allocation to bolster network security, a reassuring move for investors after the Cetus incident. With the current price consolidating above key support zones, bullish sentiment remains intact. If momentum continues, a breakout above $3.80 could open the door to $4.56 in the near term. However, any shift in sentiment may lead to a short-term correction toward $3.50 or the psychological support at $3.00.

Source: Coinmarketcap

Technical Analysis: Volatility or Launchpad?

Over the last five days, SUI has shown signs of consolidation while slowly regaining upward momentum. The asset is currently trading just under $3.71 after forming a rounded recovery from its $3.45 support level. Price action is testing the upper band of its recent $3.50–$3.80 range, with the market preparing for a decisive move. The Relative Strength Index (RSI) sits at 49.53, with the RSI signal line at 58.09, suggesting moderate bullish pressure without entering overbought territory.

Volume has remained relatively low at 73.12 million, a factor that tempers the bullish outlook unless further volume confirms continuation. Still, short-term technicals remain constructive. The recent upward slope in price alongside rising RSI may indicate a slow accumulation phase rather than a full breakout.

However, caution is warranted. The lack of a strong surge in trading activity and past price reversals near this level hint at potential liquidity traps. Traders should be alert for false breakouts—especially as the chart shows a sharp price spike that failed to hold above $3.72 earlier. For SUI to decisively break out and target levels like $4.20, it must sustain above $3.80 with volume confirmation and bullish candle structures. Otherwise, another dip toward the $3.50 or $3.30 zone could unfold if the market fails to attract sustained buying interest.

Source: TradingView

Community at a Crossroads: Governance and Decentralisation Debates Intensify

While the network has shown remarkable resilience following the Cetus breach, the swift action taken by SUI validators—freezing compromised wallets—has sparked intense debate around decentralisation and governance. While effective in protecting assets, this intervention has raised philosophical questions about the balance between decentralised ideals and operational authority. Critics suggest that granting validators this level of control edges SUI toward centralisation, undermining the trustless principles upon which many blockchains are built.

That said, the efficient coordination among validators and ecosystem participants has highlighted the strengths of a responsive governance model. This event reinforces that decentralisation need not mean inaction; rather, adaptive, community-aligned governance can deliver results without fully compromising on ideals. The recent post by Sui Network teasing the upcoming Sui Connect: Paris event serves as a timely reminder that the project remains focused on fostering genuine community ties and ecosystem growth. These gatherings help reinforce transparency, connection, and trust across the broader SUI community.

With ETF developments advancing and community engagement ramping up, SUI has a chance to not only recover its momentum but redefine what secure decentralisation looks like in practice. However, the coming months will be pivotal as the protocol must demonstrate it can scale and evolve without losing sight of the foundational values that drew in its supporters.

Source: X