Solana’s Strategic Push: Kazakhstan Partnership and Global Expansion

Solana has taken a significant leap forward in its global expansion with a new partnership in Central Asia. The Solana Foundation recently signed a Memorandum of Understanding with Kazakhstan's Ministry of Digital Development, Innovation, and Aerospace Industry. This partnership is set to enhance the region's blockchain ecosystem by supporting startups building on the Solana blockchain and strengthening crypto education. The move includes advancing tokenised capital markets and bringing new investment opportunities to the Astana International Exchange (AIX).

Foundation President Lily Liu expressed that the collaboration aligns with Solana’s broader mission to promote financial infrastructure and Web3 adoption through strategic global partnerships. Liu highlighted Kazakhstan as a forward-thinking partner, ready to implement next-generation digital financial systems. The announcement comes just weeks after the country established the first Solana Economic Zone (SEZ KZ) in Central Asia, which is aimed at fostering innovation, talent, and practical blockchain applications within the region.

Source: X

ETF Momentum and Regulatory Optimism Surrounding Solana

Solana is riding a wave of institutional attention following a series of updated filings for Solana-based ETFs in the United States. In response to the recent approval of Ethereum spot ETFs, major asset managers including VanEck, Bitwise, 21Shares, and Canary Capital have revised their proposals to better align with SEC requirements. These updated applications reflect a growing belief that Solana may be the next major crypto asset to gain ETF approval.

ETF providers argue that Solana’s value goes beyond speculation, citing its real-world use cases, such as instant payments and efficient infrastructure for decentralised apps and online gaming. While regulators have yet to make a definitive call, proponents believe the blockchain’s proven speed, scalability, and widespread use give it a compelling case. If approved, a Solana ETF could open the door for further institutional adoption and set a precedent for other altcoins to follow.

Source: X

Real-World Use and Validator Growth Fuel Long-Term Interest

The foundation for Solana’s increasing legitimacy in financial circles lies in its growing use beyond simple transactions. Solana’s architecture supports high-speed, low-cost transactions that make it attractive to industries such as online casinos, gaming, and DeFi platforms. Its ability to process thousands of transactions per second at low fees has made it an ideal choice for developers and businesses alike.

In Canada, Sol Strategies Inc. is a clear example of institutional confidence in Solana. The firm manages around 3.6 million SOL tokens and operates as the 19th largest validator on the network. Their validator empire is not merely speculative but income-generating, securing the blockchain and supporting its infrastructure. This reflects a more mature investment model, shifting focus from mere price appreciation to long-term revenue through blockchain operations.

Source: X

Technical Analysis: Bullish Breakout Shifts Market Tone

Solana's recent 5-day price action marks a notable shift from its previously bearish posture, as the token staged a significant recovery after dipping to around $126. The rebound gained strong momentum, with SOL decisively breaking above the key $140 resistance level, now trading around $145.66. This breakout invalidates the earlier bearish outlook and signals growing bullish pressure, supported by surging volume and improved momentum indicators.

RSI has spiked above 80, entering overbought territory, which may point to a short-term cooling off. However, the upward RSI trajectory and sustained price rally suggest buyers remain in control. Volume has steadily increased over the past sessions, with 24-hour volume climbing above 163 million, confirming strong participation behind the move.

The price has now moved comfortably above its previous resistance levels, and the chart shows a clear bullish structure with higher lows and higher highs. If SOL can hold above $143–$145, further gains toward $150 or even $155 may follow. Conversely, if a rejection occurs and SOL drops below $140 again, a re-evaluation of trend strength would be necessary. For now, the short-term technical picture has shifted to bullish, and further confirmation could come from daily closes above $145.

Source: TradingView

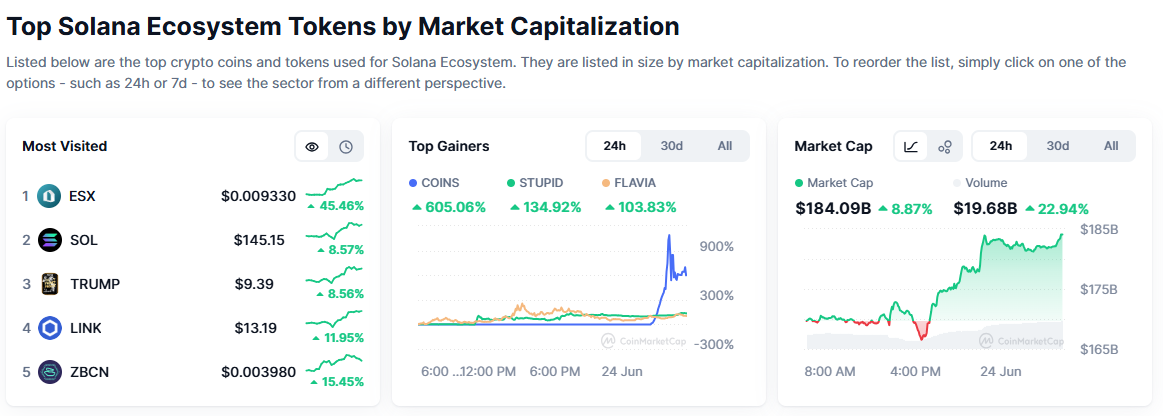

Price History and Market Sentiment: SOL Regains Momentum Amid Ecosystem Surge

Solana has staged a notable recovery, with the token climbing 8.57% over the last 24 hours to trade around $145.15. This rebound comes after a turbulent period where SOL faced macroeconomic headwinds and geopolitical tensions that dragged its price down. The broader Solana ecosystem is also showing strength—tokens such as ESX, ZBCN, and LINK have posted significant gains, with ESX leading at over 45% in daily growth.

Meanwhile, market capitalisation has jumped 8.87% to $184.09 billion, accompanied by a 22.94% surge in daily trading volume, which now stands at $19.68 billion. This uptick in both price and volume signals a return of investor confidence, likely driven by renewed interest in Solana-based assets and speculation around potential ETF approvals.

Although meme tokens like BONK and SPX6900 previously faced steep declines, the latest ecosystem momentum and top gainer activity suggest that sentiment is improving. That said, the Fear and Greed Index recently dropped to 37—reflecting lingering caution in the broader market after standing at 76 just a month ago. As macro uncertainty persists, including the Fed’s hawkish tone, investors remain selective. Yet, Solana’s strong on-chain fundamentals and expanding real-world use cases could lay the groundwork for sustained upside if market conditions further stabilise.

Source: CoinMarketCap

Solana at a Crossroads of Innovation and Uncertainty

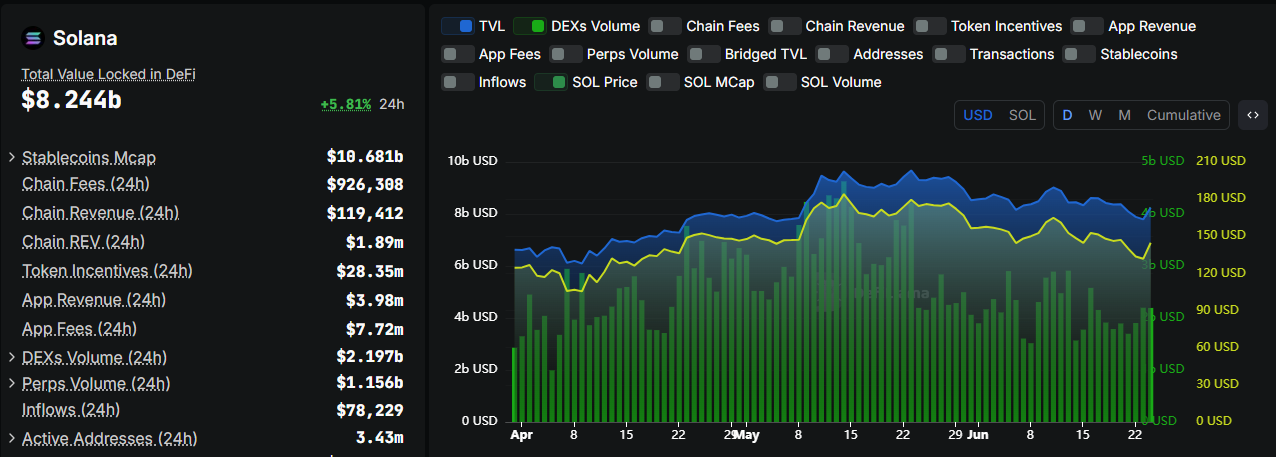

Solana stands at a pivotal juncture—straddling cutting-edge blockchain innovation and macroeconomic uncertainty. Recent strategic moves, including its partnership with Kazakhstan’s Ministry for tokenised capital markets and education, validator expansion, and ETF filings, underscore the network's growing institutional maturity. These developments suggest Solana is increasingly being positioned not just as a high-performance blockchain but as a foundational layer for global financial infrastructure.

At the same time, on-chain data highlights significant network activity and growing DeFi adoption. Solana's total value locked (TVL) in DeFi has climbed to $8.24 billion—up 5.81% in the last 24 hours—signalling renewed engagement. Daily DEX volume exceeds $2.19 billion, while perpetuals trading has reached $1.15 billion.

However, technical indicators remain mixed. While SOL has recovered from recent lows, analysts note critical resistance levels ahead. For now, the blockchain’s trajectory depends on whether it can convert its expanding utility into sustainable price action. The stage is set—regulatory clarity and stabilising global markets could be the ignition Solana needs to surge ahead. Until then, it remains a story of high promise, cautiously awaiting its next bullish chapter.

Source: DefiLlama