PEPE: Latest Developments, Price Trends, and Technical Analysis in June 2025

Trump’s Cryptic Meme Sparks Market Frenzy

The memecoin world saw a fresh surge in speculation following a cryptic post from U.S. President Donald Trump on May 29. The image, shared via Truth Social, featured a dramatic street backdrop and included a frog-like figure—an obvious allusion to the Pepe meme. Although Trump made no direct mention of $PEPE, traders quickly interpreted it as a soft endorsement, much like Elon Musk’s earlier Dogecoin tweets. The result? A 5% rally within three hours, quickly tempered by an 18% correction as macroeconomic concerns reasserted themselves.

This isn’t the first time political or cultural moments have catalysed interest in meme coins. Trump’s “mission from God” phrase paired with the dramatic setting was enough to ignite renewed attention for PEPE. But the timing was also critical—coming just as the U.S. Court of International Trade reversed tariff suspensions, adding further volatility to an already hypersensitive market. As traders try to parse political theatre from financial signals, PEPE remains a top name in the meme coin space.

Source: X

Whale Activity Paints a Bullish Backdrop

Amid the social buzz, blockchain data reveals a far more strategic story. Late May saw a major transaction involving 2 trillion PEPE tokens—worth over $27 million—transferred from Bybit to a private wallet. In total, 11.75 trillion tokens were moved among top addresses during this period, signalling large-scale accumulation by whales.

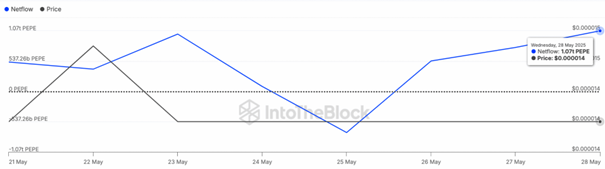

A complementary view comes from IntoTheBlock data, which shows a clear increase in netflows to accumulation addresses. By May 28, net inflows surpassed 1.07 trillion PEPE in a single day, just as the price touched $0.000015—suggesting rising demand paired with upward price pressure. This activity aligns with a broader market trend: investors withdrawing PEPE from exchanges and opting to hold. Supply on centralised exchanges has dropped from 160 trillion to just over 104 trillion this year, reinforcing the view that long-term conviction is building.

Source: the block

Market Fundamentals and Price History

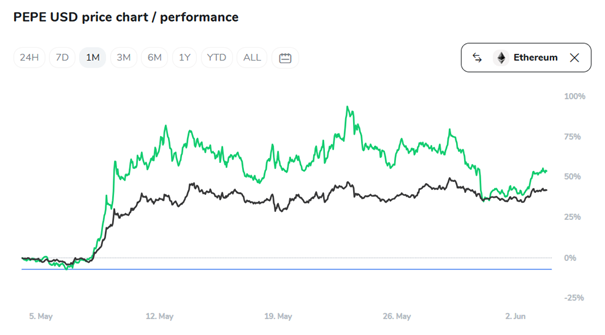

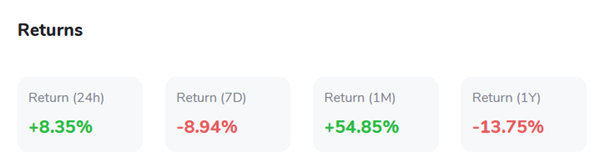

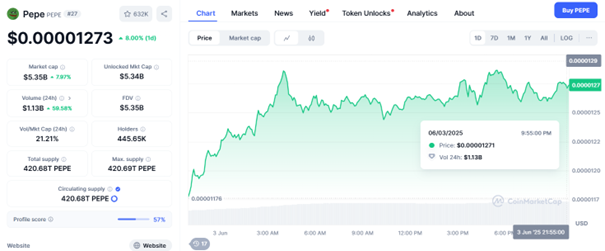

PEPE has consistently demonstrated high volatility since its inception, but that hasn't prevented it from reaching significant market milestones. A key catalyst for PEPE’s revival has been Ethereum’s breakout above the $2,600 resistance level. As the second-largest meme coin on the Ethereum blockchain, PEPE typically mirrors ETH’s market movements. Over the last month, PEPE has climbed from $0.000011 to a recent high of $0.00001285, and as of June 3, 2025, it's trading at around $0.00001273. The token’s 24-hour trading volume has surged to $1.13 billion—up nearly 60%—with the market cap holding steady at $5.35 billion.

This rally has been supported by a healthy rise in trading activity, with the volume-to-market cap ratio at 21.21%. The number of holders now exceeds 445,000, reflecting growing retail and institutional interest. With 420.68 trillion tokens in circulation and the entire supply effectively unlocked, PEPE’s liquidity remains high, enabling swift execution even in volatile conditions. These fundamentals, coupled with social buzz and whale accumulation, suggest PEPE is staging a robust recovery—one that could gain further steam if bullish momentum in the broader market continues.

Source: Coinmarketcap

Technical Analysis: Bulls Eye Resistance Break

PEPE appears poised at a pivotal technical juncture. Currently trading at approximately $0.00001272, the token is pressing against a key resistance zone just under $0.000013. This classic setup often foreshadows significant bullish breakouts, particularly if the price manages to close above the handle with strong momentum.

Recent price action reflects a rebound from the $0.000010 zone, supported by climbing volume. As shown in the one-month chart, the daily volume now stands around 28.2 million, a recovery from late-May lows. The 30-minute RSI indicator is holding steady at 53.73, while the yellow signal line is slightly higher at 55.98—hovering near the overbought threshold. This reflects healthy bullish momentum, albeit with caution against exhaustion.

The technical backdrop also features a golden cross on higher timeframes, where the 50-day moving average has crossed above the 200-day—reinforcing long-term bullish potential. On-chain metrics support this outlook, with open interest in PEPE futures rising from $650 million to $735 million and the long/short ratio surpassing 1.0. These trends suggest that leveraged traders are increasingly betting on further upside.

Nevertheless, warning signs remain. The 0.618 Fibonacci level at $0.00001 remains critical support; a break below it would invalidate the bullish structure. A further drop to the $0.000008 support could trigger broader liquidation. Traders should look for high-volume confirmation above $0.000013 and structural closes beyond $0.00001604 and $0.00001702 before expecting a move toward the $0.000026 target.

Source: TradingView

Can Hype Sustain the Rally or Will Reality Check In?

While optimism runs high, PEPE remains firmly in speculative territory. Still, meme coins operate under different rules. Their value is often driven by cultural relevance, not utility. With figures like Trump and Musk indirectly fuelling interest, and ongoing whale accumulation under the hood, PEPE has shown an uncanny ability to command attention and capital alike.

Source: X

Looking ahead to June 2025, analysts predict a 20–25% upside if current momentum holds. That would bring the price toward $0.000015–$0.000016 in the short term, with potential for more if resistance breaks. On the flip side, any breach below $0.00000956 would threaten to unravel bullish momentum.

In conclusion, while PEPE is unlikely to reach prices like $0.01 or $1 soon, it continues to lead the meme coin narrative with volatility, social dominance, and an active trading community. As long as the hype holds, it remains one of the most dynamic assets to watch.

Source: X