Monthly Crypto Market Overview – May 2025

Market Momentum Cools After Early Surge

May began with a surge in optimism as the total crypto market cap climbed toward $3.6 trillion, driven by bullish price action in Bitcoin and Ethereum. However, that momentum faded by month-end, with the market cap retreating to $3.28 trillion and daily trading volume dropping to $84.44 billion. The Fear and Greed Index settled at a neutral 56, reflecting indecision among investors amid tightening macroeconomic conditions and rising U.S. regulatory scrutiny.

Altcoins struggled to gain traction, as evidenced by an Altcoin Season Index score of just 19—well below the threshold that would signal strong altcoin outperformance. The landscape remains firmly in “Bitcoin Season,” with most capital rotating into large-cap assets, leaving smaller tokens lagging behind.

Source: Coinmarketcap

Bitcoin and Ethereum: Diverging Technical Signals

Bitcoin demonstrated resilience throughout May, trading mostly between $104,000 and $111,000. The Relative Strength Index (RSI) hovered around 55, peaking at 58.24 toward the end of the month, indicating moderate bullish momentum without entering overbought territory. Despite a mid-month surge, the price retreated from local highs near $108,000 and settled at $104,778 by month-end. Volume also declined from earlier spikes, with the 24-hour average closing at 49.99 million, signalling waning short-term momentum. As BTC continues to hold its key support zones, traders remain watchful for signs of a breakout—or a deeper correction—heading into June.

Source: TradingView

Ethereum (ETH) wrapped up May trading at $2,515.89, reflecting a strong month despite recent cooling from its highs above $2,600. The Relative Strength Index (RSI) closed near 49.15, slightly below neutral, indicating a short-term dip in momentum. However, a mid-month rally and consistent price support above $2,500 underscore structural bullishness.

Daily trading volume stood at 113.32 million, suggesting sustained interest even amid consolidation. While the RSI has slipped below the 55 level, Ethereum’s positive fundamentals—such as the completed Pectra upgrade and ongoing EVM enhancements—could renew upside pressure, with the $2,800–$3,000 range remaining a valid target if market sentiment improves.

Source: TradingView

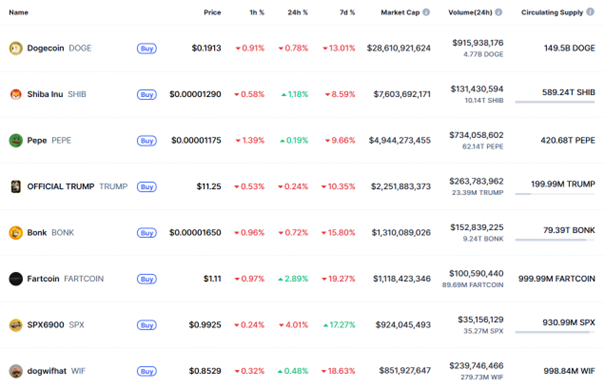

Shiba Inu and Meme Coins See Renewed Speculation

Meme coins made a strong return in May, particularly Shiba Inu (SHIB) and Pepe (PEPE), which captured retail and whale attention. SHIB briefly surged on the back of increasing Shibarium activity and burn rates, with over 55 billion SHIB removed from circulation. SHIB is trading around $0.00001298 with a bullish RSI of 63.57 and increasing volume of 2.62M, supporting analyst expectations that SHIB could mount a recovery and test higher resistance zones. PEPE outperformed, jumping over 34% in May, buoyed by Elon Musk's viral posts and heavy whale activity. With a current price of $0.00001190 and a market cap of $5.01B, PEPE now leads meme coin sentiment, drawing comparisons to Dogecoin’s early days.

Source: Coinmarketcap

DeFi Sector Builds Steam: AAVE and Pendle Lead the Pack

The DeFi sector gained meaningful traction in May, with total value locked (TVL) climbing to $112.66 billion—marking a steady uptrend throughout the month despite slight daily fluctuations. Daily DEX volume closed around $19.56 billion, while perpetuals trading volumes hit $7.34 billion, reflecting growing user participation and on-chain activity. AAVE remained a cornerstone protocol, with $24.32 billion TVL and over $473 million in annualized fee revenue, solidifying its lead in decentralised lending. The GHO stablecoin’s strategic deployment by the Ethereum Foundation further elevated AAVE’s credibility.

Meanwhile, Pendle surged to $4.11 and displayed strong bullish momentum with an RSI of 72.59, backed by a double bottom reversal and breakout confirmation. Pendle’s rise in tokenized yield markets and continued ecosystem growth positioned it as one of May’s most compelling DeFi narratives, helping to anchor investor confidence in the sector’s evolution.

Source: DefiLlama

Altcoin Landscape: Mixed Results for Layer-1 and AI Tokens

Altcoins posted mixed results in May, reflecting shifting investor sentiment across sectors. Solana (SOL) managed a 4.06% monthly gain, closing at $155.67, supported by steady ecosystem activity and growing institutional usage. Cardano (ADA), however, declined by 3.44% to $0.6803, as bullish whale accumulation was offset by broader market weakness. NEAR Protocol traded at $2.45 with a modest 0.23% daily dip, while Render (RNDR) saw only a 0.14% gain despite significant interest in AI narratives. Polkadot (DOT) dropped 3.72% to $4.04, weighed down by selling pressure, though upcoming protocol upgrades like Elastic Scaling continue to underpin its long-term value. Meanwhile, tokens like SUI (-4.62%) and HBAR (-10.46%) underperformed, revealing fragility among newer L1s despite technical promise.

Source: Quantifycrypto

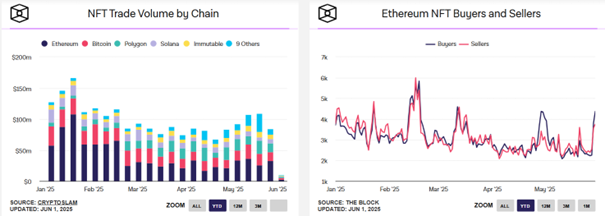

NFT and Ecosystem Trends: Activity Drops but Core Metrics Hold

NFTs faced a sharp correction in May, with daily sales volume dropping 21% to $3.95 million and total sales down 33% to 20,632. Despite the pullback, the market cap for active NFT collections remained high at $8.86 billion. Engagement on Ethereum-based NFTs remained relatively strong, while Polygon and Solana-based collections gained traction among budget-conscious users. Collections like Courtyard and STRAT Option stayed in focus, and the rise of asset-backed NFTs, such as real estate tokenization on Hedera and Neo, continued to gain momentum. This suggests a maturing ecosystem where utility and community engagement increasingly drive adoption.

Source: TheBlock

Conclusion

May was a month of contrasts in the crypto world—early momentum gave way to market-wide consolidation, yet underneath the surface, ecosystem growth, DeFi innovation, and altcoin development remained vibrant. Bitcoin and Ethereum continue to anchor the market technically, while meme coins and DeFi projects like PEPE, Pendle, and AAVE led in user engagement and gains. Looking ahead, June offers a potential turning point, especially if macroeconomic clarity and regulatory updates provide catalysts. For now, cautious optimism defines the crypto narrative as technical setups across multiple assets prepare for possible breakout scenarios in the coming weeks.