Ethereum (ETH): Latest Developments, Price Trends, and Technical Analysis

Ethereum's Recent Surge: What’s Behind the Rally?

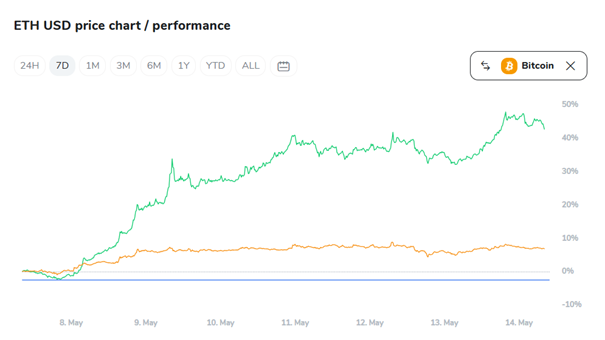

Ethereum (ETH) has experienced a remarkable price rally, surging by over 35% in the past week, marking its strongest performance since December 2020. The recent price action has pushed Ethereum to trade around $2,450, a significant recovery from its previous lows of approximately $1,800. Analysts attribute this rise to a combination of positive macroeconomic news, notably the announcement of a trade deal between the United States and the United Kingdom, and the successful rollout of Ethereum’s Pectra upgrade.

Comparing Ethereum’s performance to Bitcoin over the past week, ETH significantly outpaced BTC, registering a much steeper rise as seen in the attached chart. While Ethereum soared by over 35%, Bitcoin's gains were more subdued, highlighting a shift in investor focus towards altcoins amidst renewed optimism in the Ethereum ecosystem.

The trade agreement, announced by former U.S. President Donald Trump, has injected renewed optimism into the broader market, boosting risk assets like Ethereum. Additionally, Pectra’s implementation has brought key network upgrades aimed at improving staking mechanisms, transaction efficiency, and wallet functionality, further fuelling the rally. However, despite the recent surge, Ethereum still lags behind its 2021 all-time high of $4,878, suggesting that more substantial gains may require further market catalysts.

Pectra Upgrade: Ethereum’s Path to Network Improvement

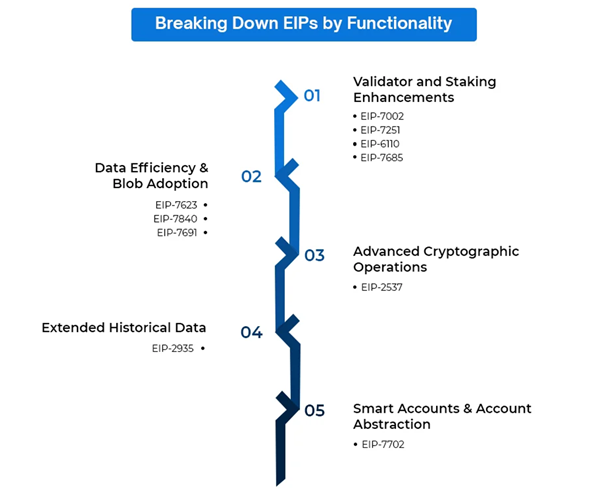

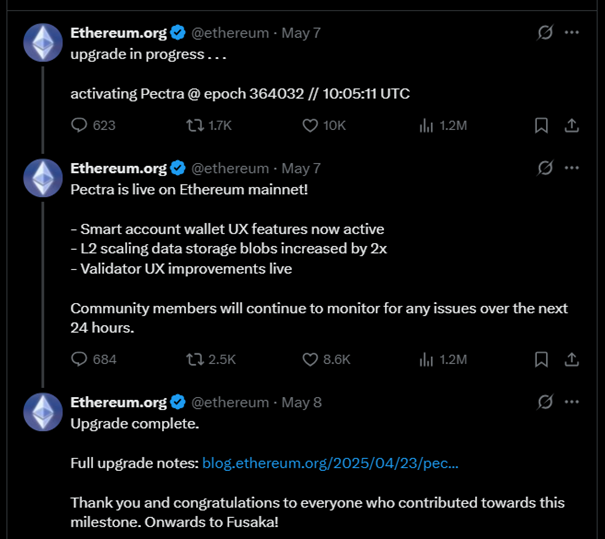

On May 7, 2025, Ethereum successfully activated the Pectra upgrade, which is considered the network’s most ambitious update since the Merge in 2022. The upgrade introduced several major Ethereum Improvement Proposals (EIPs), including EIP-7702, EIP-7251, and EIP-7691, aimed at enhancing wallet capabilities, expanding staking limits, and improving transaction efficiency on Layer 2 networks.

EIP-7702 allows wallets to act more like smart contracts, enabling features such as bundling multiple transactions, recovering lost wallets, and paying gas fees in assets other than ETH.

EIP-7251 significantly increases the staking cap from 32 ETH to 2,048 ETH, reducing hardware requirements for validators and promoting greater institutional staking participation.

EIP-7691 expands blob space, allowing Layer 2 solutions like Optimism and Arbitrum to handle larger transaction volumes at lower fees.

Source: Antiersolutions

While the upgrade was deployed without technical issues, experts caution that the introduction of new features also raises security risks, particularly regarding contract permissions and wallet integrations.

Source: X

Spot Buying Over Leverage: Ethereum's Changing Market Dynamics

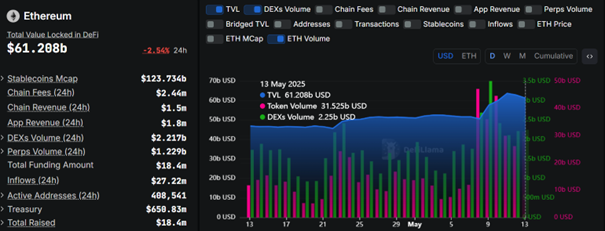

Ethereum’s recent rally has been characterized by a shift away from leverage-driven speculation towards spot buying and increased staking activity. According to the latest data, the Total Value Locked (TVL) in Ethereum DeFi stands at $61.208 billion, reflecting a 2.54% decline over the past 24 hours. Despite the slight drop in TVL, the overall market sentiment remains bullish as the network continues to see strong spot demand.

DEX Volume in the past 24 hours reached $2.217 billion, while the Perpetual Contracts Volume stood at $1.229 billion, highlighting active trading in DeFi protocols. Additionally, Ethereum inflows over the last 24 hours amounted to $27.22 million, a sign that investors are still directing funds into Ethereum-based platforms.

Meanwhile, the Stablecoins Market Cap on Ethereum is recorded at $123.734 billion, indicating significant liquidity and investor interest in maintaining stable holdings amid market fluctuations. As spot buying remains a dominant factor, Ethereum appears to be consolidating gains, driven by long-term investor confidence rather than speculative leverage trading. However, with active addresses at 408,541, market participants remain vigilant as further price movements could be triggered by shifts in institutional demand and staking inflows.

Source: Defillama

Technical Analysis: Ethereum Faces Key Resistance at $2,850

Ethereum's recent rally has met a critical resistance level at $2,633, as indicated in the 5-day technical analysis. After reaching a peak, ETH is now showing signs of consolidation and is testing key support levels. Immediate resistance is observed at $2,650, with a stronger barrier around $2,700.

If Ethereum manages to break through these levels, the next target could be $2,850, though the RSI suggests that bullish momentum may be losing steam. On the downside, the first support zone is situated at $2,500, aligning with the 100-day SMA, while a more substantial support range lies between $2,400 and $2,350.

A failure to hold these levels could see ETH revisiting the $2,260 - $2,110 range, marking the lower bound of the current consolidation phase. The Relative Strength Index (RSI) has dropped to 28.61, indicating oversold conditions and potentially signalling a rebound in the near term. Meanwhile, trading volume remains steady at 578.79M, suggesting ongoing market interest despite waning momentum.

Ethereum’s immediate outlook will depend on whether it can reclaim $2,700 resistance or find stable footing around $2,500 before making another upward move.

Source: TradingView

Looking Ahead: Is Ethereum Set for Further Gains?

The Ethereum network is entering a critical phase of development as it implements extensive upgrades while facing mounting competition from other blockchain ecosystems like Solana and Binance Smart Chain. The successful rollout of Pectra has renewed investor interest, and upcoming developments, including the proposed Fusaka upgrade, are expected to further bolster Ethereum’s network capabilities.

However, analysts remain divided on Ethereum’s price trajectory. While some expect the token to break above $3,000 if it can maintain support above the 200-day SMA, others caution that Ethereum’s recent gains could be short-lived if spot demand diminishes and leverage trading resurges.

In conclusion, Ethereum’s ability to sustain its rally will largely depend on institutional inflows, broader market sentiment, and successful implementation of its proposed upgrades. The next few weeks will be crucial in determining whether ETH can consolidate recent gains or succumb to profit-taking and market uncertainty.

Source: X