Crypto Weekly Wrap: 9th May 2025

Institutional Bitcoin Adoption Faces Basel Rule Hurdles

Institutional interest in Bitcoin continues to grow, but restrictive capital requirements under Basel Committee rules are keeping traditional banks from fully participating in the market. The current framework classifies unhedged Bitcoin holdings as high-risk assets, assigning a 1,250% risk weight — effectively treating Bitcoin as highly speculative and deterring banks from holding it on their balance sheets.

Arnab Sen, CEO of UK-based digital asset derivatives exchange GFO-X, voiced these concerns at the Financial Times’ Digital Assets Summit in London. He noted that banks are eager to provide Bitcoin trading and collateral services but are hamstrung by punitive regulations. “The market is crying out for banks to intermediate Bitcoin trading, but the existing rules make it almost impossible,” Sen stated.

Despite increasing institutional demand, banks are unable to justify the capital costs associated with holding Bitcoin under the current framework. This regulatory bottleneck is redirecting trading activity toward non-bank intermediaries, raising concerns about market oversight and systemic risks.

Conversations are reportedly underway to reassess Bitcoin’s classification under Basel rules, with Sen expressing optimism that regulatory changes could be on the horizon.

Source: TheBanker, Fernando Braz/FT Live

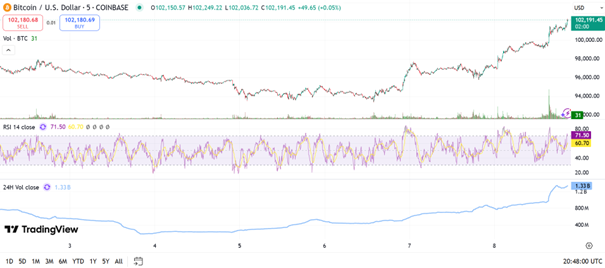

Bitcoin Technical Analysis and Price Prediction: Eyeing $105,000 Amid Bullish Momentum

Bitcoin (BTC) has extended its rally, trading at $102,191 after three consecutive days of gains. The surge follows US President Donald Trump's announcement of a significant trade deal with the UK, which has boosted market sentiment.

Technical Analysis

RSI Analysis: The Relative Strength Index (RSI) is at 71.50, indicating that BTC is in overbought territory. This suggests the possibility of a short-term pullback; however, if the RSI remains elevated, BTC could continue its upward trajectory.

Volume Analysis: Trading volume has surged to 1.33 billion, reflecting increased buying interest as BTC approaches a critical resistance zone.

Price Targets: Immediate resistance is seen at $105,000, aligning with a key psychological level. A breakout above this zone could propel BTC to its all-time high at $109,588. On the downside, support is observed at $97,700, where BTC previously encountered resistance.

While the RSI warns of potential overbought conditions, the prevailing bullish momentum and strong trading volume suggest further upside potential. BTC could target $105,000 in the short term, with $109,588 as the next key level if bullish momentum persists. However, caution is advised as the overbought RSI may trigger a corrective pullback toward $97,700.

Source: TradingView

LockBit Ransomware Breach Exposes 60,000 Bitcoin Addresses

A significant data breach has struck the notorious LockBit ransomware group, exposing nearly 60,000 Bitcoin addresses associated with ransom payments. The attack, discovered on May 7, targeted LockBit’s dark web infrastructure, resulting in the leak of internal records, affiliate credentials, and extensive ransomware infrastructure details.

Cybersecurity experts initially flagged the breach after a message reading “Don’t do crime CRIME IS BAD xoxo from Prague” was discovered, alongside a MySQL database dump titled paneldb_dump.zip. Analysis revealed that the database included Bitcoin addresses believed to be linked to ransom payments, each typically assigned to specific victims to obscure the flow of illicit funds.

LockBit’s operator, known as “LockBitSupp,” confirmed the breach but asserted that no private keys or sensitive data were compromised. However, the incident is a significant reputational blow to the ransomware group, already under pressure from international law enforcement efforts.

The breach follows a coordinated crackdown in early 2024 led by the U.S. Department of Justice and Europol, which resulted in the freezing of over 200 crypto accounts linked to LockBit. Key infrastructure, including negotiation panels and websites, was seized, and several LockBit affiliates were arrested in Poland, Ukraine, and the U.S.

Source: X

Changpeng Zhao Confirms Pardon Request Amid Binance Fallout

Changpeng Zhao (CZ), former CEO of Binance, confirmed on May 6 that he has formally applied for a presidential pardon weeks after initially denying such plans. Speaking on the Farokh Radio podcast, Zhao explained that he decided to proceed after media speculation suggested he was seeking a pardon from former U.S. President Donald Trump.

Zhao, who pleaded guilty to violating the Bank Secrecy Act in 2023, was sentenced to four months in prison as part of a settlement with U.S. regulators. Binance also paid $4.3 billion in fines, with Zhao personally contributing $50 million.

Despite serving his sentence, Zhao remains a significant shareholder in Binance. A successful pardon could theoretically open the door for him to resume a leadership role, though he has publicly stated that he has no intention of returning as CEO.

Zhao cited Trump’s previous pardons of three BitMEX executives as a motivator for his application. The former Binance chief also acknowledged that he may be the only individual to have served time for a Bank Secrecy Act violation.

Source: Farokh Radio, Youtube

Bhutan Partners with Binance for National Crypto Payments System

Bhutan has taken a bold step in crypto adoption, partnering with Binance Pay and DK Bank to launch a national crypto tourism payment system. The initiative, powered by Binance’s infrastructure, allows tourists to pay for a wide range of services — from flights and hotels to roadside purchases — using digital assets.

The system supports over 100 cryptocurrencies and enables real-time QR code transactions, which are instantly settled in local currency by DK Bank. More than 100 Bhutanese merchants, including rural artisans and small vendors, have joined the system, allowing even remote businesses to accept crypto payments through smartphones.

Bhutan’s move to embrace digital assets is part of a broader strategy to attract crypto-savvy tourists and position itself as a crypto-friendly destination in South Asia.

Source: X

Ethereum’s Pectra Upgrade: Wallet Flexibility and Validator Incentives

Ethereum’s Pectra upgrade, which went live on May 7, brings significant changes to wallet functionality, staking, and scalability. Combining the Prague and Electra updates, Pectra includes 11 Ethereum Improvement Proposals (EIPs) aimed at enhancing network efficiency.

EIP-7702 introduces account abstraction, allowing wallets to act more like smart contracts. This feature enables multi-transaction signing and potential gas fee reductions but also raises security concerns regarding contract permissions.

EIP-7251 increases the staking cap from 32 ETH to 2,048 ETH, attracting more institutional validators and reducing hardware demands. Additionally, EIP-7691 boosts Ethereum’s blobspace, facilitating cheaper and faster transactions for layer 2 networks.

Pectra’s focus on functionality over price sets the stage for long-term network improvements but also introduces new security risks that users must navigate carefully.

Source: X

Ethereum Technical Analysis: Post-Pectra Rally and RSI Overbought Signal

Ethereum (ETH) has experienced a strong upward surge, pushing the price to $2,127, as shown in the 5-day chart. The price breakout is accompanied by a notable spike in volume, indicating increasing buying pressure.

The Relative Strength Index (RSI) has entered the overbought zone, currently at 81.62, suggesting that ETH may face a potential short-term correction or consolidation before continuing its upward momentum. However, the RSI remains elevated, reflecting strong bullish sentiment.

ETH is now trading well above its recent support at $1,830, with immediate resistance at $2,150. If ETH breaks above this level, the next target would be the $2,200 - $2,250 range. Conversely, failure to maintain the current momentum could lead to a pullback toward $2,000 or even the previous support zone near $1,900.

Overall, the bullish momentum remains intact, but traders should monitor the RSI closely for signs of overextension and potential profit-taking.

Source: TradingView

Conclusion: Positive Market Momentum and Strategic Developments

The crypto market is witnessing a strong bullish wave, with major assets like Bitcoin, Ethereum, and Solana recording significant gains. Bitcoin’s climb above $102,884 reflects rising institutional interest amid easing trade tensions, while Ethereum’s 20.28% surge underscores the impact of its Pectra upgrade.

Altcoins are also gaining traction, with SUI, HYPE, and ADA posting notable weekly gains. Meanwhile, regulatory concerns persist as Binance’s Changpeng Zhao seeks a presidential pardon and ransomware group LockBit faces increased scrutiny after a major data breach.

Despite regulatory and security challenges, broader adoption signals are evident with Bhutan embracing crypto payments and Robinhood expanding services in the EU. As the market evolves, infrastructure upgrades and regulatory clarity will be pivotal in maintaining the current momentum.

Source: QuantifyCrypto