Crypto Weekly Wrap: 8th August 2025

The Greed Gauge Rises: Are Crypto Markets Shifting Gears?

This week in crypto felt less like a rollercoaster and more like a carefully orchestrated ascent, at least for the major players. After a period that had some wondering if the crypto market was taking a prolonged nap, we've seen a notable shift.

Bitcoin held its ground, Ethereum stretched its legs, and altcoins generally followed suit, all while the market's emotional barometer swung decidedly towards "Greed." The question now isn't just what happened, but why the sudden burst of collective optimism, and whether it has the legs to carry us higher.

The Macro Lens

While specific, headline-grabbing macroeconomic data releases were perhaps subdued this week, their absence allowed the underlying optimism to surface. Think of it like this: the market often reacts to the absence of bad news as if it were good news, especially when it's already bracing for impact.

The pervasive influence of potential Federal Reserve interest rate decisions and the ever-looming US Consumer Price Index (CPI) data continue to cast long shadows, of course. For now, however, the crypto market appears to be pricing in a cautiously optimistic future, perhaps anticipating an eventual easing of monetary policy or simply showing remarkable resilience.

It's a bit like a plant leaning towards the sunlight, even if the clouds haven't fully cleared yet. This general air of "things aren't getting worse, so they must be getting better" seems to have contributed to the improved sentiment, laying a more stable foundation for crypto assets.

The Crypto Lens

If you were waiting for a sign that the market was shaking off its cautious demeanour, the past week delivered it with a flourish. The most glaring signal? The Crypto Fear & Greed Index, which rocketed from a middling 62 to a rather enthusiastic 74, firmly planted itself in the "Greed" zone. This isn't just academic; it reflects a palpable shift in risk appetite, a sort of collective "let's buy" mentality emerging from the shadows.

Bitcoin (BTC)

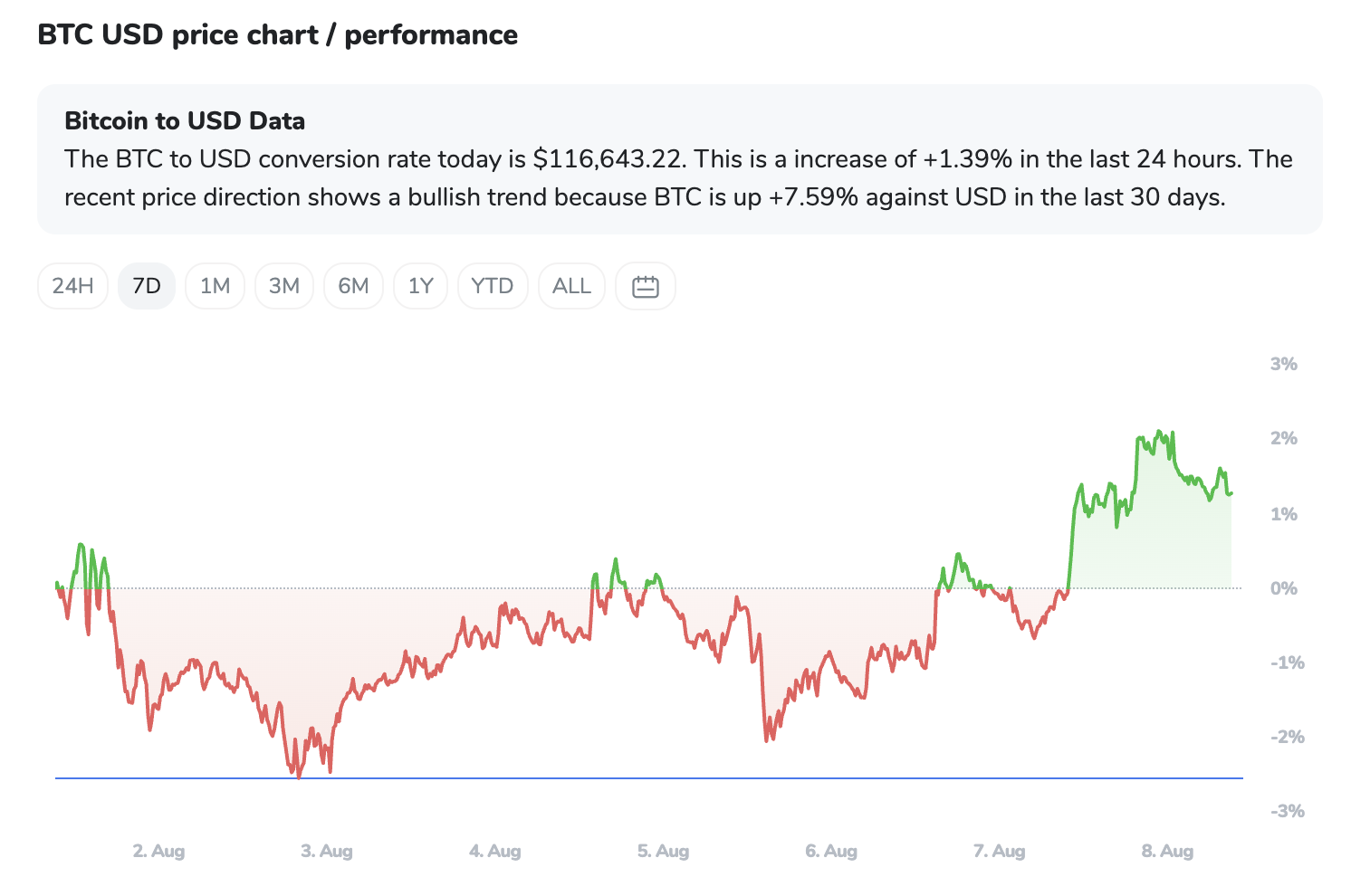

Ever the stoic elder, BTC is currently found at $116,832, marking a 1.78% bump in 24 hours. More importantly, it's back to retesting a significant macro trendline that stretches all the way back to 2017. Imagine a marathon runner hitting a familiar landmark – it's a critical moment.

Will it be a springboard for higher levels, or a wall to bounce off? Analysts are eyeing a convincing close above $117,000 as the next big confirmation of sustained bullish pressure, especially given its consistent "higher lows" on the daily charts, indicating a gradual build-up of buying interest.

Ethereum (ETH)

Meanwhile, ETH has been putting in an impressive shift, currently sitting at $3,917.39 with a hefty 5.71% gain in the last 24 hours. It's comfortably above its $3,800 support and the 100-hourly Simple Moving Average, which is crypto-speak for "looking quite healthy."

ETH successfully tested the $3,920 resistance, and the psychological $4,000 mark is now firmly in its sights. What's truly interesting is that despite some chatter about ETF outflows (yes, one specific Grayscale ETH fund did see some), the overall narrative is dominated by significant net inflows into Ethereum ETFs, signalling renewed institutional appetite. Coupled with network transactions hitting a one-year high, it suggests real activity underpins the price action.

The overarching theme? A significant reversal in ETF flows. After a period of investor hesitation, both spot Bitcoin and Ethereum ETFs have seen substantial net inflows. BlackRock's IBIT alone scooped up $156.6 million for BTC, and their ETHA fund pulled in $104 million for ETH. This re-engagement from institutional and retail investors via ETFs is a critical endorsement, suggesting that the "smart money" isn't just watching from the sidelines anymore; it's getting back into the game. It’s a good week when the money managers are lining up at the crypto door, not rushing for the exit.

The ICONOMI Angle

While the broader market was busy with its shift towards greed, ICONOMI strategies were, as usual, quietly doing their job, delivering solid returns across the board. It's a testament to diversified and actively managed approaches that they not only participated in the market's upside but often led the charge.

The Asymmetry Active Performance strategy took the top spot this week, boasting an impressive +9.76% return at the time of this writing. Its composition, heavily featuring assets like Lido DAO (LDO), Pendle (PENDLE), and Fetch.ai (FET) alongside traditional strong performers like Solana (SOL) and Ethereum (ETH), clearly capitalised on the renewed vigour in specific altcoin sectors. This isn't just a broad market beta play; it's a finely tuned engine.

Close behind, the Wisdom DEFI strategy delivered a healthy +6.38%, demonstrating the continued strength and potential within the decentralised finance ecosystem. Its focus on names like Chainlink (LINK), Uniswap (UNI), and Aave (AAVE) shows that the underlying utility of these protocols is translating into tangible performance.

Our broadly diversified strategies also shone through. Metastrategy and Crypto Index 25 both saw returns just north of +6.2%, with Metastrategy hitting +6.27% and Crypto Index 25 at +6.26%. The fact that these strategies, which include larger allocations to Bitcoin and Ethereum but also a spread across numerous other assets, performed so strongly indicates a broad-based market recovery rather than just a narrow rally. Wisdom Dynamic, with its similar diversified approach, also posted a strong +6.03%.

What this tells us is that whether investors leaned into more specialized, higher-conviction altcoin plays or opted for broader market exposure, the week rewarded a positive stance. The ICONOMI platform allows for these varying appetites for risk, and this week, pretty much all of them found something to like.

What to Watch Next

Macroeconomic Headwinds (or Tailwinds): Keep an eye on the Federal Reserve's stance and upcoming US CPI data. A hotter-than-expected inflation print or a surprisingly hawkish Fed commentary could quickly temper the current optimism. Conversely, signs of disinflation or dovish shifts could fuel further rallies.

ETF Flow Persistence: Are the recent net inflows into spot Bitcoin and Ethereum ETFs a flash in the pan or the beginning of a sustained trend? Continued institutional absorption is a key ingredient for long-term price stability and growth.

Bitcoin's "$117k Problem": Can Bitcoin decisively break and hold above the $117,000 resistance? This technical level is crucial, and its resolution (breakout or rejection) will dictate much of the market's near-term direction.

Ethereum's Fundamental Strength: Beyond price, monitor Ethereum's network activity and the progress of its "Prague–Electra (Pectra)" upgrade. Strong fundamentals often precede sustained price appreciation, even after ETF excitement fades.

Regulatory Clarity: Watch for any legislative developments, particularly in the U.S. The "GENIUS Act" for stablecoins or clearer guidance on other digital assets could provide significant tailwinds by reducing regulatory uncertainty.

Altcoin ETF Approvals: While BTC and ETH ETFs are here, the discussion around potential spot Solana or XRP ETFs remains. Such approvals would unlock new capital flows and bring further legitimacy to the broader crypto asset class.

Cybersecurity & Systemic Risk: As the market heats up, so too does the potential for bad actors. Keep a cautious eye on any major security breaches or signs of overleveraged firms, which can introduce unexpected volatility.

FAQs

Why is everyone suddenly so "Greedy" in the crypto market?

The shift to "Greed" is primarily driven by recent price recoveries in major assets like Bitcoin and Ethereum, combined with a significant influx of capital into spot crypto ETFs. It indicates growing investor confidence and a reduced tendency for short-term profit-taking, leading to a general increase in risk appetite.

What does it mean for Bitcoin to be retesting a "major macro trendline"?

In technical analysis, a major macro trendline is a historical price level that has acted as significant support or resistance over a long period, sometimes years. When Bitcoin retests such a line, it's at a crucial juncture. Breaking above it can signal a strong continuation of an uptrend, while failing to do so could lead to a pullback. It's essentially a big decision point for the market's direction.

Ethereum's technical analysis mentioned some ETF outflows, but the summary said net inflows. Which is it?

It's a bit of both, but the net effect is positive. While a specific fund (like Grayscale's Mini Ethereum Trust) might experience individual outflows, other, larger funds (like BlackRock's ETHA or Fidelity's FETH) have seen substantial inflows. When you combine all the ETF data, the overall picture is one of significant net positive inflows, indicating a growing institutional appetite for Ethereum exposure through these regulated products.