Crypto Weekly Wrap: 30th May 2025

Bergen County Leads Historic Blockchain Push with $240B Deed Tokenisation

In a major leap for real-world asset (RWA) adoption, Bergen County in New Jersey has announced plans to tokenise 370,000 property deeds on the Avalanche blockchain. The project, valued at approximately $240 billion, marks the largest deed tokenisation initiative in U.S. history. This five-year partnership with blockchain records platform Balcony aims to revolutionise how property titles are recorded, verified, and transferred.

Bergen County, which generates around $500 million annually in property tax revenue, is set to benefit from faster deed processing—slashing administrative timelines by over 90%. With backing from the Avalanche-native Blizzard fund, this effort also promises reduced fraud and title disputes through a tamper-proof ledger shared across all 70 municipalities in the county.

Avalanche's growing prominence in the RWA sector coincides with technical signals that suggest price stabilisation. Over the last five days, AVAX has consolidated around the $22.50–$23.00 range, showing signs of support after a recent pullback. The Relative Strength Index (RSI) currently sits near neutral at 51.64, indicating neither overbought nor oversold conditions, while short-term RSI (14 close) of 41.72 suggests room for upward movement. Volume has steadily climbed to 12.48 million, reflecting renewed interest in the token amid growing institutional attention.

If AVAX holds above the $22.50 support level, bulls may attempt to push toward the $24.50–$25.00 resistance range. However, any failure to defend the lower trendline could expose it to further downside. Given its strong fundamentals and headline-making adoption in government-level projects like Bergen County, Avalanche remains one of the most promising platforms in the tokenisation narrative.

Source: TradingView

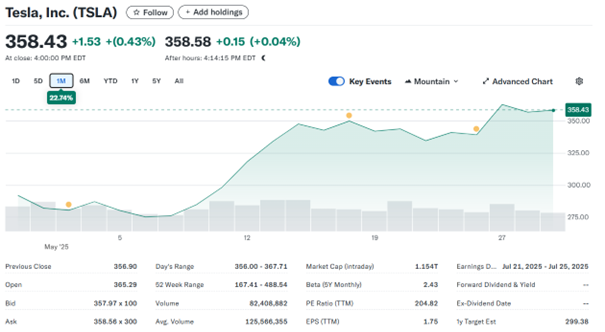

Tesla Surges as Musk Bows Out of Political Role

Tesla stock rose 23% in a month to $358 following Elon Musk’s announcement that he is stepping down from his role in the federal DOGE (Department of Government Efficiency) programme. His departure, shared via social media platform X, comes amid investor concerns that Musk’s growing political affiliations were diverting his attention from Tesla.

Source: YahooFinance

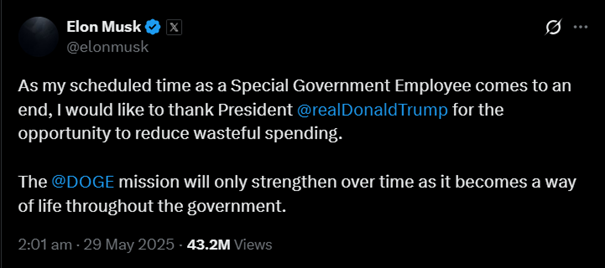

DOGE, initiated under the Trump administration to combat government waste, had recently drawn controversy. Musk criticised inefficiencies in Washington and clashed with White House officials over trade and tax issues. He also revealed frustrations with being sidelined in AI negotiations, including a deal involving OpenAI and Abu Dhabi.

Despite shrinking the federal civilian workforce by 12% under his tenure, investors are welcoming Musk’s shift back to corporate leadership. His exit could signal a return to Tesla-focused priorities and a cooling of his political involvement, especially after last year’s $300 million spent supporting GOP campaigns. With this pivot, Tesla may gain firmer footing in the EV market without the baggage of policy entanglements.

Source: X

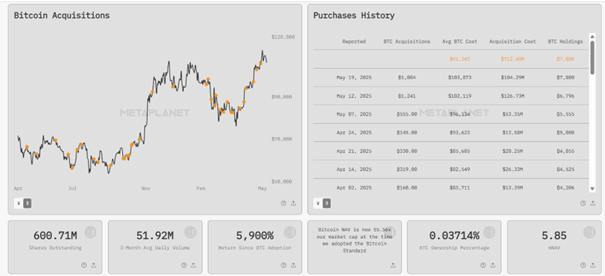

Metaplanet Doubles Down on Bitcoin with Zero-Interest Bonds

Japanese investment firm Metaplanet continues its aggressive Bitcoin acquisition strategy by issuing $21 million in no-interest bonds—entirely sold to Evo Fund. The Cayman Islands-based investor has been a major backer of Metaplanet’s Bitcoin treasury programme, helping it accumulate 7,800 BTC so far, worth over $839 million.

This latest issuance marks the firm’s 17th bond series, and comes just one day after a $50 million issuance, showing a relentless pace of growth. Although the bonds are set to mature in November 2025, the company states they will have minimal impact on its 2025 earnings.

Metaplanet’s recent surge in stock value—up nearly 2,000% year-over-year—has put it at a $5 billion market cap. The company has also revealed plans to expand to the U.S., aiming to raise $250 million from institutional investors and support round-the-clock global operations. With a target of holding 10,000 BTC by the end of 2025, Metaplanet positions itself as Asia’s top corporate Bitcoin holder and 11th globally.

Source: Metaplanet

Solana Eyes $300 as Alpenglow Upgrade Promises Lightning Speed

Solana has captured renewed trader interest thanks to its newly unveiled consensus upgrade, dubbed "Alpenglow." Developed by Solana-native developer Anza, Alpenglow is engineered to reduce transaction latency by up to 100 times—bringing confirmation times down to just 100–150 milliseconds. The upgrade swaps out Solana’s current Proof-of-History and Tower BFT systems in favour of newer, faster algorithms named Votor and Rotor, aimed at significantly boosting scalability and responsiveness. Although no firm release date has been announced, the roadmap has sparked enthusiasm within the community.

Technically, however, SOL’s near-term chart shows more cautious movement. Over the past five days, the token has seen a gradual decline, with its price slipping to $167.27 at the latest close. The Relative Strength Index (RSI) remains relatively neutral at 46.38, with a short-term reading of 38.35—indicating that SOL is not yet in oversold territory but lacks strong bullish momentum. Meanwhile, daily volume has climbed to 155.38 million, signalling consistent trader engagement even amid sideways price action.

The golden cross on the 30-day and 200-day moving averages remains a positive macro indicator, but in the short term, Solana appears to be in a consolidation phase. If buyers reclaim the $170–$175 zone and the RSI strengthens above 50, the next key resistance sits at $185, with further upside toward $200 by mid-June. However, a failure to hold current levels could see SOL revisiting support near $160 before its next leg up. The ETF speculation and upcoming Alpenglow upgrade continue to provide bullish long-term catalysts.

Source: TradingView

BlackRock Poised to Back Circle’s $624M IPO

In a notable convergence of traditional finance and crypto, BlackRock is reportedly set to purchase 10% of shares in Circle Internet’s upcoming IPO. Circle, issuer of the USDC stablecoin, aims to raise $624 million and is attracting serious institutional interest.

Source: YahooFinance

According to SEC filings, BlackRock already plays a crucial role in managing Circle’s reserves—its government money market fund holds about 90% of USDC’s backing. The IPO has drawn interest well above the supply of shares available, with Cathie Wood’s Ark Invest also signalling plans to invest $150 million.

This public listing signals a major milestone for Circle and the broader stablecoin market. With major financial institutions like J.P. Morgan, Goldman Sachs, and Deutsche Bank involved in underwriting the deal, the IPO is poised to set the tone for the next generation of publicly traded crypto companies. The offering is scheduled to price on June 4.

Source: X

Technical Outlook: Diverging Trends Across Major Cryptos

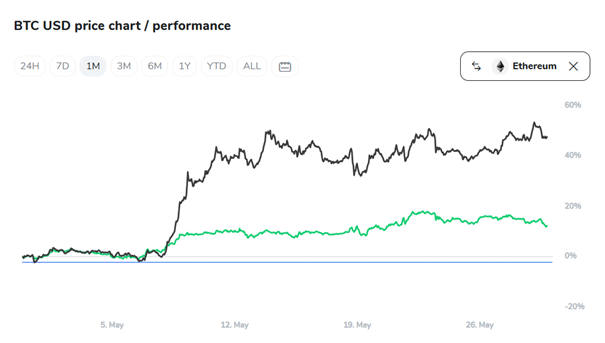

The broader crypto market is showing increasingly fragmented signals across top assets. Bitcoin, now stabilising near $106,200, has retraced from its recent high of over $111K. The 5-day chart reveals declining momentum, with the RSI hovering around 53.3 and volume holding steady near 989 million. This indicates potential short-term consolidation unless bulls can push the price above resistance zones with renewed strength.

Source: TradingView

Ethereum, trading at $2,656, shows relatively stronger resilience. The RSI sits slightly higher at 55.23, suggesting a modest bullish tilt, while trading volume has reached nearly $495 million. ETH is benefiting from continued optimism post-Pectra upgrade and a gradual bullish EMA crossover. Price action remains healthy, and should it sustain momentum, a breakout toward $2,800 or $3,000 could be on the cards.

Source: TradingView

Altogether, the technical landscape reflects a market in transition—where hype is giving way to real-world adoption. While Bitcoin and Solana are pausing, Ethereum and Avalanche are attracting capital with strong utility narratives.

Conclusion: Institutions Take the Wheel While Innovation Expands

This week in crypto has highlighted a clear trend—institutions are driving the next phase of growth. From BlackRock’s growing involvement in stablecoins to Bergen County’s adoption of Avalanche for public records, we are seeing real-world use cases emerge. Meanwhile, retail interest remains cautious, as traders evaluate whether recent gains can be sustained without a broader correction.

Innovations like Solana’s Alpenglow and Metaplanet’s bond-based Bitcoin strategy signal a maturing market. But as decentralised systems grow, questions around governance, political influence, and transparency continue to surface. Whether it’s Elon Musk stepping away from DOGE or Circle testing public market appetite, the coming months will shape how crypto balances credibility, decentralisation, and global expansion.