Crypto Weekly Wrap: 23rd May 2025

Bitcoin Breaks $110K: A Historic Milestone Fueled by Institutions

Bitcoin has officially crossed the $110,000 threshold, reaching an all-time high of $110,788.98 late on May 21. The rally represents a 3% daily gain and a remarkable 47% rise since its April low of $75,000, driven largely by institutional demand rather than retail speculation. This is reinforced by low Google Trends search interest and a Crypto Fear & Greed Index reading of 73—slightly up from earlier in the month, reflecting rising investor confidence. At the same time, the total crypto market cap has surged to $3.51 trillion with daily trading volume hitting $171.48 billion, signalling widespread market participation beyond Bitcoin alone.

Source: TradingView

The CoinMarketCap 100 Index rose 4.2% to $216.93, showing that broader altcoin interest is also gaining traction even as the Altcoin Season Index remains low at 28, confirming Bitcoin’s dominance. The latest 5-day BTC chart shows consolidation around $111K, with RSI at 54.21 and daily volume cooling to $184.57 million—both pointing to a balanced momentum that may precede either a healthy continuation or a short-term pullback.

Source: Coinmarketcap

Senate Crypto Rift Grows Amid Stablecoin Vote Drama

A contentious Senate vote on stablecoin regulation has laid bare a widening split within the Democratic Party. On May 19, 16 Democrats broke rank to advance the GENIUS Act, legislation designed to regulate payment stablecoins. Their move sparked backlash, as many had previously withdrawn support due to corruption concerns linked to former President Donald Trump’s crypto dealings.

While centrist Senators like Mark Warner argued that “blockchain technology is here to stay” and that imperfect regulation is better than none, progressive voices such as Elizabeth Warren fiercely opposed the bill. Warren warned that the bill “undermines national security and consumer protections” by empowering actors like Trump. Meanwhile, Senator Michael Bennet introduced a counterproposal—dubbed the STABLE GENIUS Act—that would bar politicians from issuing or promoting crypto assets while in office. The dispute reflects a fundamental disagreement over how to handle crypto’s growing political influence.

Source: X

Meme Coin Controversy: Trump’s $TRUMP Token Sparks Outrage

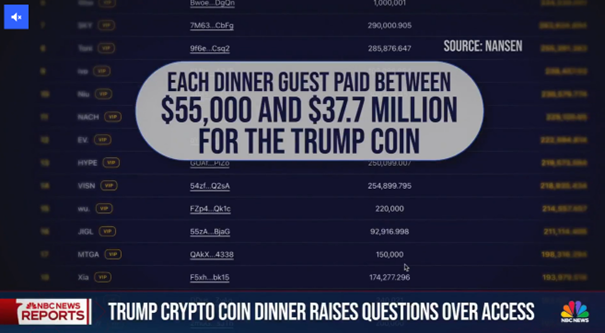

In a controversial move, Donald Trump has offered top holders of his meme coin, $TRUMP, the chance to attend an exclusive dinner and even secure a White House tour. Critics, including Democratic lawmakers and ethics watchdogs, claim the offer commodifies political access and blurs the lines between governance and personal gain. Blockchain data suggests the token has raised around $150 million, with some individuals spending millions for access.

The backlash has led to a protest organised under the banner “America Is Not for Sale,” drawing participation from groups like Public Citizen and Our Revolution. Senator Jeff Merkley and other lawmakers plan to speak at the event, accusing Trump of “crypto corruption.” In response to rising concern, legislation is being drafted to regulate political involvement in cryptocurrency fundraising. The unfolding drama shows just how politically charged crypto has become as it increasingly intersects with mainstream power structures.

Source: NbcNews

Ethereum Poised for Breakout: Could $5K Be Next?

Ethereum is trading around $2,645, posting a modest 0.19% daily gain as bullish momentum builds following its successful Pectra upgrade. The network’s transition to a deflationary model—thanks to fee-burning mechanics—has revived investor optimism, especially among institutions. A “golden cross” has formed on the 12-hour chart, traditionally signalling strong upside potential. In addition, Ethereum appears to be consolidating within a bullish flag pattern, with a breakout above the $2,600–$2,700 zone likely to trigger a rally toward $3,600.

On the 5-day technical chart, ETH has shown resilience near the $2,640 mark despite sharp intraday dips, backed by consistent volume around $515 million. The RSI sits at 40.68, suggesting mildly oversold conditions, while the signal line at 46.11 points to a stabilising trend. The price is testing the upper bounds of its recent consolidation, and a breakout here—especially with a 21-day EMA crossing above the 200-day EMA—would offer a compelling bullish confirmation.

Source: TradingView

VanEck Eyes Avalanche with New RWA Crypto Fund

Global asset manager VanEck is deepening its crypto exposure with a new private fund targeting Web3 projects on the Avalanche blockchain. Set to launch in June, the VanEck PurposeBuilt Fund will be available to accredited investors and will focus on liquid tokens, venture-backed Web3 initiatives, and Avalanche-native real-world asset (RWA) products.

Source: rwa.xyz

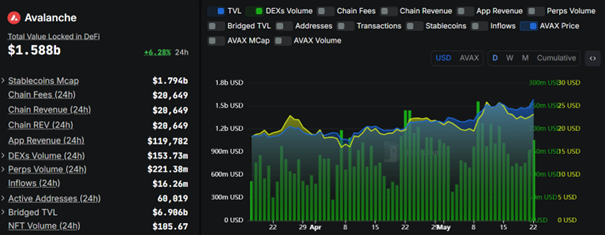

Avalanche’s ecosystem has attracted institutional interest thanks to its subnet technology, which allows customisable, Ethereum-compatible networks. It has around $1.6 billion in total value locked, according to DefiLlama. VanEck’s portfolio team believes the next wave of crypto growth will stem from real-world applications and utility-based token economies, moving beyond speculative hype. As traditional finance converges with blockchain, the Avalanche ecosystem appears well positioned to serve as a bridge between these worlds.

Source: DefiLlama

ETF-Driven Momentum Pushes Bitcoin to New Heights as Institutional Demand Surges

Spot Bitcoin ETFs have continued to prove instrumental in driving Bitcoin’s record-setting rally, with $609 million in net inflows recorded in a single day as BTC broke past $111,000. Led by BlackRock’s IBIT, which pulled in over $530 million, the twelve spot ETFs collectively reached a trading volume of $7.64 billion—marking their busiest day since February. This wave of institutional demand underlines how ETFs are fueling Bitcoin’s momentum, pushing year-to-date inflows to $7.5 billion and reinforcing market confidence. According to analysts, elevated open interest and deep liquidity are supporting further upside, while macro factors like inflation and rate cut expectations are amplifying Bitcoin’s hedge appeal. With momentum building and ETF-backed capital surging, the foundation appears strong for Bitcoin’s next potential move toward $113,000.

Source: Coinmarketcap

Conclusion: Crypto Market Enters a New Phase of Maturity

From Bitcoin’s historic breakout to Ethereum’s bullish technical setup and Avalanche’s push into real-world assets, the crypto market is undergoing a transformation. Institutional adoption, regulatory clarity, and real-world utility are becoming the primary drivers of growth. The weekly heatmap further reflects this momentum, with BTC up 8.72% to $111,533 and ETH climbing 5.18% to $2,640.20. Notably, HYPE surged over 32%, AVAX gained 7.8%, and BCH jumped 11.8%, highlighting broad-based altcoin strength. However, political controversies—especially surrounding Trump’s meme coin and the Senate stablecoin debate—suggest that crypto’s integration into mainstream systems won’t be without friction. As volatility persists, one thing is clear: crypto has matured into a multifaceted force in finance, politics, and technology.

Source: QuantifyCrypto