Crypto Weekly Wrap: 19th September 2025

The Great Crypto Consolidation: Ethereum Takes Centre Stage, Bitcoin Bides Its Time

This past week in crypto felt a bit like watching a finely tuned engine idle – lots of moving parts, but the vehicle itself barely shifted. Bitcoin, ever the stoic patriarch, largely consolidated just shy of its all-time high, seemingly content to watch the world go by. Meanwhile, Ethereum quietly, yet dramatically, soaked up billions in ETF inflows, sparking whispers of a changing guard in investor preference. Solana, bless its heart, continued its upward trajectory but is now flashing "overbought" signals like a frantic traffic light. Overall sentiment? A perfectly balanced "Neutral" on the Fear & Greed Index, suggesting the market is either incredibly Zen or just waiting for someone else to make the first move.

The Macro Lens

The macroeconomic backdrop continued its dance between expectation and reality. The Federal Reserve, having finally delivered on a much-anticipated interest rate cut, was expected to unfurl a green carpet for risk assets like crypto. Instead, we observed a somewhat muted reaction, with some profit-taking in existing crypto ETFs. It appears the market, much like a seasoned poker player, chose not to show its full hand immediately.

This phenomenon of a "sell-the-news" reaction, or at least a "meh-the-news" reaction, is a recurring theme in financial markets. Traders, anticipating a move, often price it in well before the official announcement. When the news finally hits, there's little left to buy into, and some decide to cash out. This leaves us with an interesting paradox: good news, but flat lines.

Regulatory clarity, or the ongoing lack thereof in the US, continues to be a low hum in the background. While Europe's MiCAR framework offers a degree of certainty, the US remains a patchwork of agencies and opinions. This regulatory fog still acts as a subtle dampener on institutional enthusiasm, creating a ceiling for broad-based capital inflows despite the occasional surges into specific, approved products.

The Crypto Lens

Bitcoin (BTC)

Bitcoin (BTC), currently around $116,737, had a week of dignified consolidation. It slipped a mere -0.35% in 24 hours, patiently maintaining its position approximately 5% below its all-time high. Technical indicators suggest a period of thoughtful introspection, with strong support levels forming. It’s like Bitcoin is meditating, gathering its strength before its next big enlightenment. Retail investors, it seems, have been the primary drivers of recent BTC rallies, while the institutional "whales" have largely been playing it cool, contributing to this stable, if somewhat unexciting, phase.

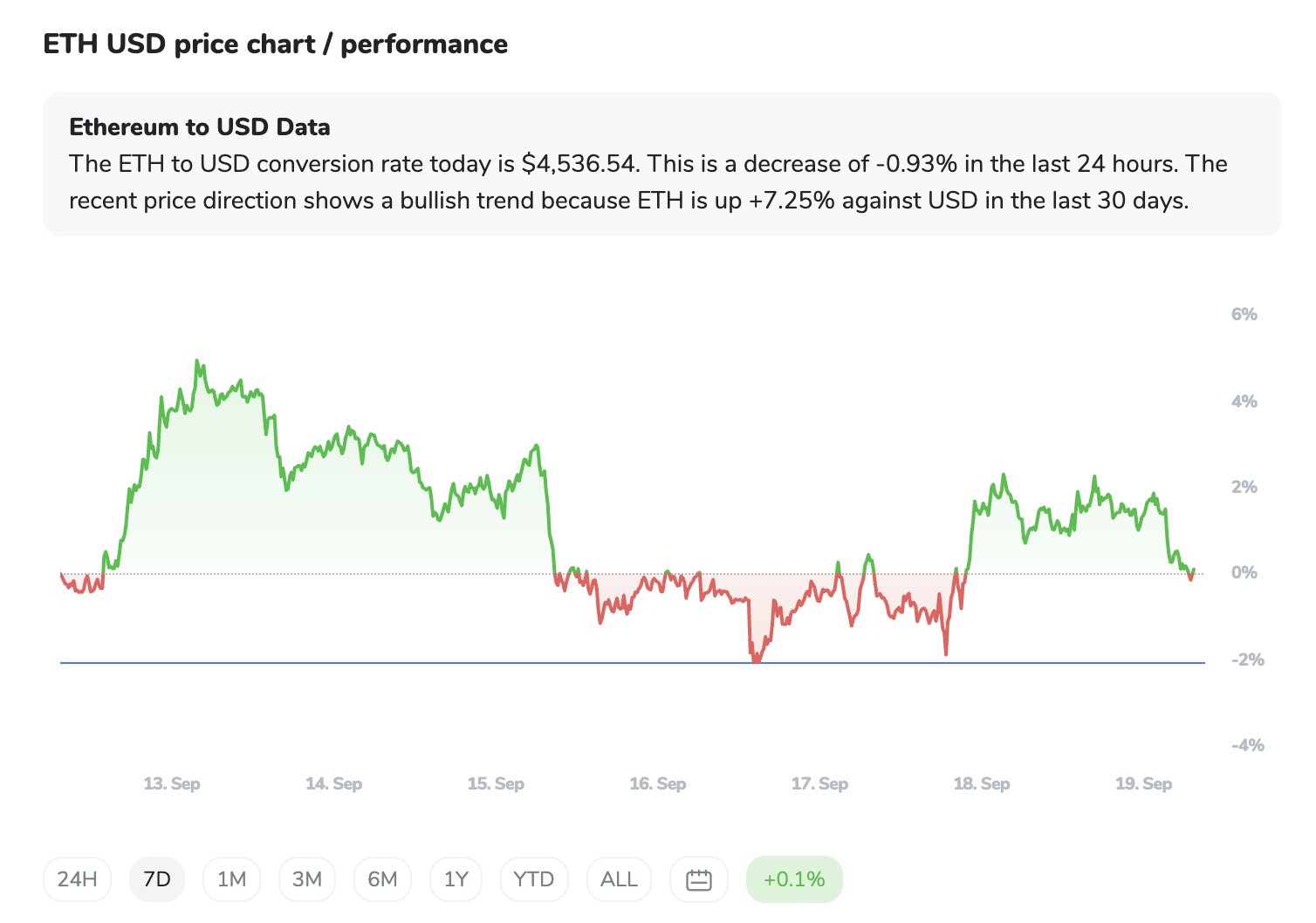

Ethereum (ETH)

Ethereum (ETH), trading at $4,521.21, displayed a slight 24-hour dip of -1.22%. However, this minor blip overshadowed a rather significant narrative shift: Ethereum spot ETFs collectively recorded over $2.131 billion in inflows on September 19, momentarily overshadowing Bitcoin ETF flows for the day. This suggests a burgeoning institutional appetite for Ethereum, perhaps recognising its utility beyond just "digital gold" – a shift from store-of-value to programmable infrastructure. It's a bit like discovering that the engine and the steering wheel are both valuable, not just the car itself.

Yet, ETH isn't without its peculiar challenges. There's a colossal $12 billion worth of ETH queued for unstaking, with an estimated 44-day wait time. This represents a potential overhang of selling pressure, a wall of supply waiting to hit the market. While a significant portion might be re-staked or held, it's a factor that keeps analysts on their toes, balancing the narrative of institutional adoption with the practicalities of token economics.

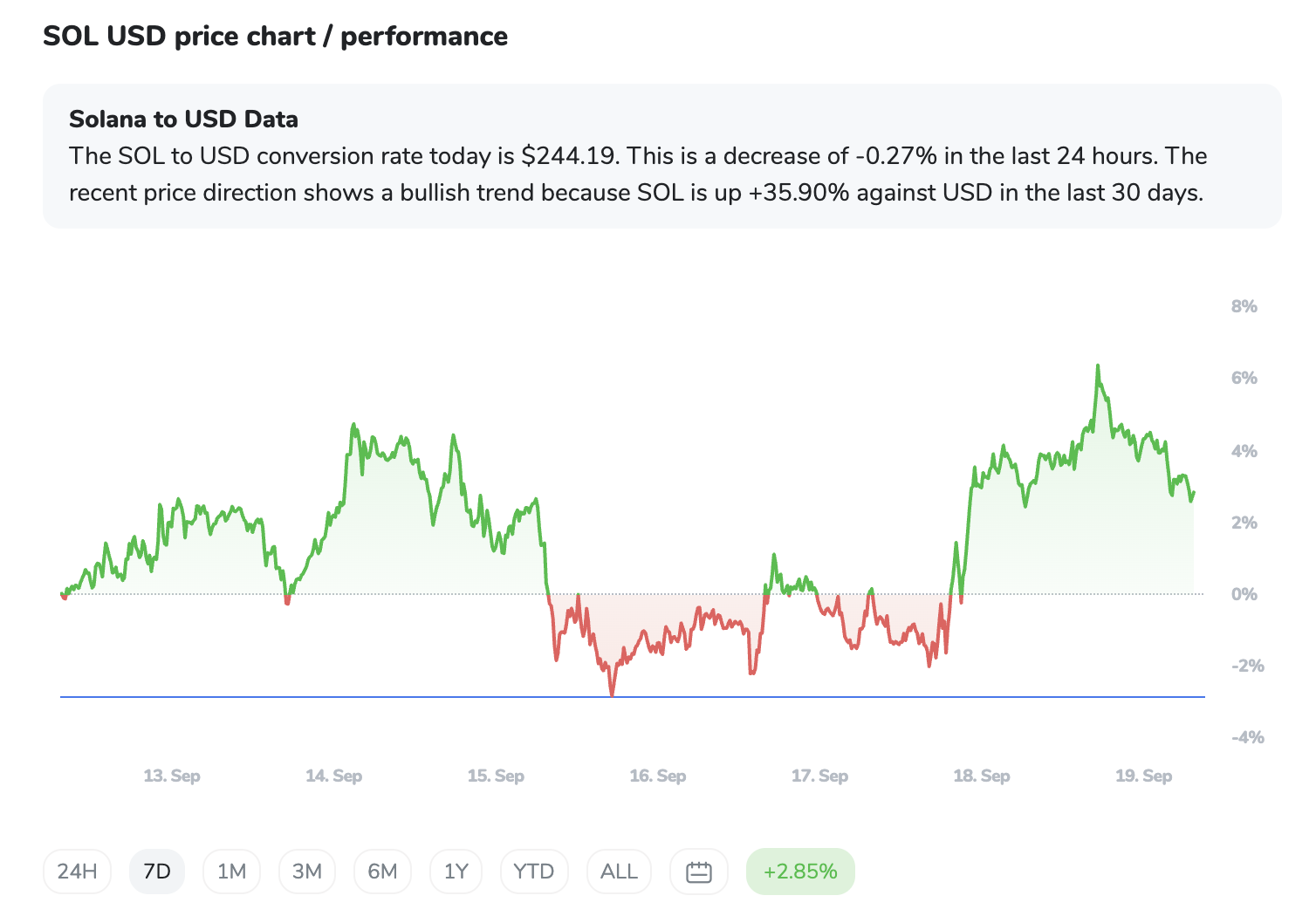

Solana (SOL)

Solana (SOL), currently at $243.51, continued its impressive upward trend, albeit with a slight 24-hour decline of -0.48%. SOL's price is testing resistance around $249.60, and its Relative Strength Index (RSI) is flirting with 70.30, traditionally signalling "overbought" conditions. This means it’s been a good run, but perhaps the market needs to catch its breath, or at least check if its shoelaces are tied before attempting another sprint. The positive volume balance, however, suggests persistent short-term strength for the "Ethereum-killer" narrative.

Overall market sentiment, as reflected by the Crypto Fear & Greed Index, settled at a perfectly balanced 52 (Neutral). It seems investors are neither giddy with optimism nor paralysed by fear, a pragmatic stance in a market full of mixed signals.

The ICONOMI Angle

This week, ICONOMI strategies demonstrated that even in a consolidating market, strategic diversification can yield impressive results. Our top performers navigated the subtle shifts, often finding alpha in assets beyond the major two.

Leading the pack was Wisdom Ventures with a stellar +7.10% weekly return. Interestingly, its significant allocation to Wanchain (WAN, 60.19%), coupled with Bitcoin (19.99%) and Ethereum (19.82%), suggests a successful bet on a less conventional asset alongside the stalwarts. It's a reminder that sometimes, the true wisdom lies in exploring beyond the obvious.

The Blockchain Growth Index posted a robust +5.84%, showcasing the power of a diversified altcoin approach. With substantial exposure to Solana (28.31%), Avalanche (22.22%), and Chainlink (9.60%), this strategy clearly benefited from the underlying strength in utility-driven blockchains and decentralised infrastructure. When the tide doesn't dramatically rise, a broad net can still catch a lot of fish.

Wisdom Collectibles, focusing on the NFT, gaming, and metaverse sectors, returned +5.44%. Assets like Immutable (IMX, 12.84%), Gala (GALA, 9.96%), and Render Token (RNDR, 9.66%) were key contributors. This performance indicates that specific narratives within crypto, even while the broader market consolidates, can still attract significant interest and capital.

Even broader market index strategies like 2100newsCryptoLargecapindex (+2.10%) and Crypto Global Management (+2.02%) delivered positive returns, underscoring the resilience of diversified portfolios in the current market environment. They show that even if the leading giants are catching their breath, a portfolio spread across the top players can still inch forward.

What to Watch Next

The ETH Unstaking Tsunami (or Trickle?): Keep a close eye on the 2.6 million ETH ($12 billion) queue for unstaking. Will this become a significant selling event, or will most be re-staked, or absorbed by new demand from ETFs? The market's ability to digest this supply will be a key determinant of ETH's short-to-medium term trajectory.

Q4 Seasonality vs. Reality: History suggests Bitcoin often enjoys a strong Q4 performance (average 85.42% return since 2013). The question is whether this historical trend will hold amid current macroeconomic uncertainty and ETH-specific dynamics, or if the "sell-the-news" pattern from the Fed rate cut will linger.

The ETF Showdown: While Ethereum ETFs stole the show this week, watch how flows evolve. Will ETH continue to attract capital at this pace, or will Bitcoin ETFs reclaim their dominance? The relative performance and flows between these two giants could signal a significant rebalancing of institutional preference.

Solana's Endurance Test: With SOL’s RSI signalling overbought conditions, can it maintain its upward trajectory, or is a healthy correction in store? Its ability to break through current resistance levels will be critical for continued momentum.

Regulatory Rhymes: Any significant progress or setbacks in US crypto regulation (or lack thereof) will continue to influence institutional engagement. Clarity often precedes conviction.

Technological Undercurrents: Don't forget the quiet builders. Ethereum's AI team, advancements in DeFi, RWAs, and Layer 2s, and the burgeoning Solana ecosystem are all fundamental drivers that could create new narratives and attract fresh capital, regardless of short-term price movements.

FAQs

Why are Ethereum ETFs seeing such large inflows now, potentially surpassing Bitcoin's?

This week's significant inflows into Ethereum spot ETFs suggest a growing institutional recognition of ETH's utility and potential beyond just a store of value. Investors may be diversifying their crypto exposure, viewing Ethereum as a core building block for the decentralised internet, rather than solely focusing on Bitcoin as "digital gold." The approval and launch of these ETFs provide regulated avenues for this demand.

Is the $12 billion ETH unstaking queue a major concern for Ethereum's price?

It's certainly a factor to monitor. A $12 billion potential supply hitting the market could exert selling pressure. However, it's also important to consider that much of this ETH might be held by long-term investors, re-staked through different services, or absorbed by the increased demand shown by recent ETF inflows. The market's absorption capacity will be tested, but it's not necessarily a guaranteed sell-off.

Bitcoin is consolidating, but altcoins like Solana are showing strong trends. Does this mean an "altcoin season" is starting?

While Bitcoin is in a consolidation phase, and some altcoins like Solana are showing independent strength, it's premature to declare a full-blown "altcoin season." Often, altcoin seasons follow periods of Bitcoin dominance or stability, as capital rotates down the market cap ladder. However, the strong performance of specific altcoins and related ICONOMI strategies indicates that targeted opportunities exist, and investor interest is broadening beyond just BTC.