Crypto Weekly Wrap: 16th May 2025

Ethereum Technical Analysis: Bulls Take Charge

Ethereum (ETH) has delivered one of its strongest weekly performances since December 2020, with its price surging from $1,807 to approximately $2,501, representing a substantial 38% gain within a week.

However, the attached technical analysis shows a slight pullback as ETH currently trades around $2,516, indicating a temporary cooling off after the rapid ascent. The RSI indicator has declined to 39.31, signalling a potential shift in momentum, with bearish divergence suggesting that the bullish run may be losing steam.

Despite the strong rally, ETH is facing resistance at the $2,600 level, as evidenced by the recent price rejection at $2,525. Trading volume has also decreased to 396.51 million, hinting at fading buying pressure, while the formation of lower highs suggests a possible consolidation phase in the short term.

Traders should keep a close eye on the $2,500 support zone, as a break below this level could open the door to further declines toward the $2,400 range, while a successful bounce may reignite bullish momentum and potentially target the $2,600 resistance once again.

Source: TradingView

Nvidia’s AI Deal and the Crypto AI Sector: A New Wave of Investment?

Nvidia (NASDAQ: NVDA) has grabbed global attention with a landmark agreement to supply Saudi Arabia’s AI-focused investment initiative, HUMAIN, with hundreds of thousands of next-gen GPUs over the next five years. The deal, valued at $10 billion, includes the delivery of 18,000 GB300 Grace Blackwell AI supercomputers, positioning Nvidia as a key player in Saudi Arabia’s AI expansion. The project also involves constructing a 500-megawatt AI data center, the largest U.S.-Saudi tech deal to date.

Source: YouTube, SaudiUSForum2025

Nvidia’s stock surged by 6.93% following the announcement, closing at $132.69 and pushing its market cap to nearly $3.2 trillion. This bullish momentum spilled over into the crypto AI sector, with AI-focused tokens gaining 5.35% collectively. The market capitalization of AI and Big Data tokens has surged by 60.3% over the last 30 days, reaching $37.87 billion, while trading volume in the sector climbed by 139.8% to $4.81 billion.

Technically grounded projects like Render Network (RNDR), which uses Nvidia GPUs for decentralized AI rendering, rose by 35% in the last month, and NEAR increased by 46% over the same period. As Nvidia strengthens its AI infrastructure foothold, crypto AI projects that utilize its GPUs could become increasingly attractive investments for retail and institutional investors seeking exposure to the rapidly growing AI sector.

Source: Coinmarketcap

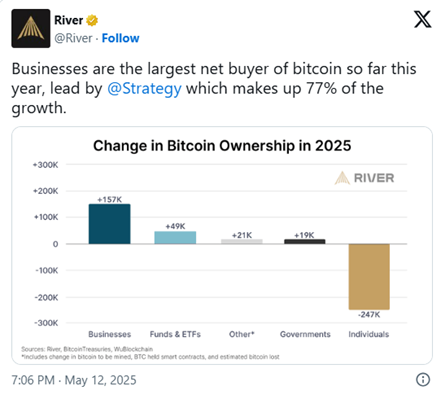

Bitcoin Eyes Key Resistance as Institutional Demand Grows

Bitcoin is currently trading near $103,384, showing signs of consolidation after a period of volatility. The RSI is hovering around 54.22, indicating mild bullish momentum but not yet entering overbought territory, suggesting that further upside is possible without a major correction. Trading volume has picked up to 808.27 million BTC, reflecting increased market participation as the asset approaches key resistance levels at $104,000 and $105,700.

The MACD shows a slight bullish crossover, with histogram bars turning positive, pointing towards the potential for upward momentum in the near term. However, a breakdown below the $102,500 support could open the door for a retest of the $101,900 level, which coincides with the 38.2% Fibonacci retracement, potentially acting as a pivot point for renewed buying pressure or a deeper decline toward $100,760. Additionally, institutional buying remains robust, with corporate holdings hitting $16 billion as firms seek to hedge against economic uncertainty, potentially fuelling further price strength.

Source: X

The confluence of institutional accumulation and limited supply post-halving has set the stage for a potential supply squeeze, which, if coupled with a break above $105,700, could propel Bitcoin towards the $110,000 mark in the coming weeks. The broader market sentiment remains cautiously optimistic, with analysts emphasizing the importance of maintaining key support levels to sustain the bullish narrative and avert a deeper correction.

Source: TradingView

Solana Targets $200 Amid Institutional Boost and Network Activity

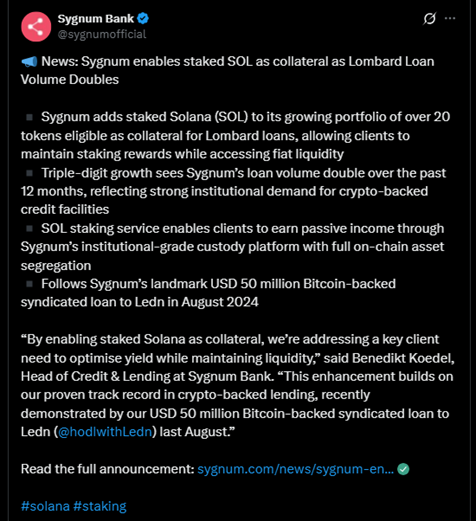

Solana (SOL) is currently trading around $172 after facing resistance at $180, as institutional interest continues to bolster its DeFi ecosystem. Over the past week, Solana has gained over 22%, driven by increased staking and lending activities, with Sygnum Bank integrating staked SOL as collateral for Lombard loans, allowing clients to earn staking rewards while accessing fiat liquidity.

Source: X

Technically, the RSI is now at 45.97, indicating neutral momentum, while trading volume has decreased to 212.64 million, suggesting reduced buying pressure. The $185 resistance remains a key barrier, with a breakout potentially pushing SOL toward the $200 mark. However, failure to hold above current levels could lead to a decline towards $157 or $130, previously established support zones.

Additionally, with trading volume showing a consistent downward trend, traders may interpret this as a sign of weakening bullish momentum. Meanwhile, the broader market sentiment remains mixed, as investors await a decisive move that could either validate Solana’s bullish outlook or trigger a corrective phase.

Source: TradingView

Cardano’s Midnight Sidechain and DeFi Prospects: Aiming for $3

Cardano (ADA) is positioning itself for a potential rally to $3 following a strategic integration with the Brave browser, which has over 85 million users. This integration allows users to interact with Cardano’s blockchain directly through Brave’s multi-chain wallet, expanding ADA’s visibility and potential user base.

Currently trading around $0.779, Cardano has rebounded by over 60% from its April lows, supported by a favorable macroeconomic backdrop that includes easing U.S. inflation and a truce in the U.S.-China trade conflict. The recent 5-day technical analysis shows ADA struggling to maintain upward momentum, with the RSI at 45.18, indicating neutral conditions, while trading volume has declined to 49.62 million, suggesting a potential slowdown in buying pressure.

Additionally, Cardano co-founder Charles Hoskinson has teased the development of the Midnight sidechain, a protocol designed to facilitate free NFT transactions using NFTs as access passes. This initiative could attract mainstream users accustomed to fee-free transactions while enhancing Cardano’s DeFi capabilities.

Source: TradingView

Hong Kong Launches ‘CryptoTrace’ to Combat Crypto Crimes

Hong Kong has launched a new virtual asset analysis tool called ‘CryptoTrace’ to combat crypto-related crimes, developed in collaboration with the University of Hong Kong. The tool is designed to provide advanced intelligence and investigative support to crime investigation units, as part of the Hong Kong Cyber Security and Technology Crime Bureau’s (CSTCB) broader initiative to secure the digital asset sector.

The initiative also includes comprehensive training sessions for frontline officers to enhance their ability to handle complex virtual asset cases. Additionally, CSTCB is actively engaging with stakeholders across various sectors to build a safer and more resilient Web3 ecosystem in Hong Kong.

Source: police.gov.hk

Weekly Overview: Altcoins Lead Gains Amid Bitcoin's Consolidation

The cryptocurrency market has experienced a notable divergence this week, with altcoins taking the lead in gains while Bitcoin consolidates just above the $103,000 mark. The attached weekly heatmap reveals significant movement across multiple assets, with Ethereum (ETH) up 19.6% to $2,536.02, driven largely by the successful implementation of the Pectra upgrade, which has improved staking and wallet functionality. XRP posted a substantial 8.09% gain, now trading at $2.4495, supported by increasing institutional interest and ongoing legal clarity in the Ripple vs. SEC case.

Dogecoin (DOGE) surged 16.98% to $0.2225, fuelled by renewed meme coin enthusiasm and potential speculative positioning ahead of anticipated announcements. Meanwhile, Solana (SOL) rose by 6.38% to $169.96, with increased activity in its DeFi ecosystem and the addition of staked SOL as collateral by Sygnum Bank enhancing investor confidence.

However, not all assets shared in the bullish momentum. Bitcoin Cash (BCH) slipped 4.84% to $397.28, as profit-taking and waning interest led to a decline in volume. Toncoin (TON) also dropped by 3% to $3.0921, reflecting broader market consolidation as traders rotated into outperforming assets.

Overall, the market shows mixed sentiment, with Bitcoin's 2.23% rise to $103,317.47 suggesting ongoing institutional demand but limited retail participation. The focus now shifts to whether Bitcoin can break through the critical $105,700 resistance, a move that could provide further momentum to altcoins, many of which are approaching key resistance levels amid heightened trading volumes and increasing speculative interest.

Source: Quantifycrypto

The cryptocurrency market continues to demonstrate strong momentum, with the global market cap reaching $3.31 trillion and 24-hour trading volume at $126.06 billion. The Fear and Greed Index currently stands at 71, indicating elevated greed among investors, while the Altcoin Season Index is at 25, suggesting that Bitcoin is dominating the market performance.

Source: Coinmarketcap