SUI: Latest Developments, Price Trends, and Technical Analysis

A DeFi Powerhouse: TVL Growth and Expanding Ecosystem

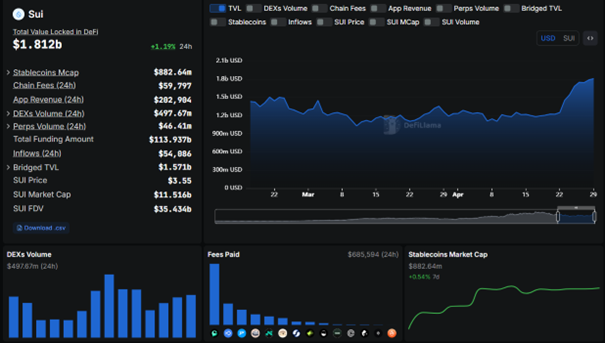

SUI’s explosive momentum in the DeFi space is backed by substantial growth in Total Value Locked (TVL), which currently stands at $1.812 billion—a 1.19% gain in the past 24 hours alone. Daily DEX volume has surged to nearly $497.7 million, while stablecoin market cap on the network sits at $882.64 million, showcasing rising liquidity and user engagement. Notably, Sui also processed over $202,000 in app revenue and $59,797 in chain fees in the last 24 hours, reflecting the economic activity flowing through its ecosystem.

Projects like Babylon Labs and Lombard Protocol continue to attract users by integrating advanced restaking and cross-chain liquidity solutions. With $54 million in inflows over the past day and a strong $1.571 billion in bridged TVL, the network is successfully drawing both retail and institutional capital. As SUI’s DeFi infrastructure matures, it’s evolving into a dynamic platform supporting not only financial primitives but also gaming, NFTs, and SocialFi innovations.

Source: DefiLlama

A Record-Breaking Rally: Price Outperformance and Trading Metrics

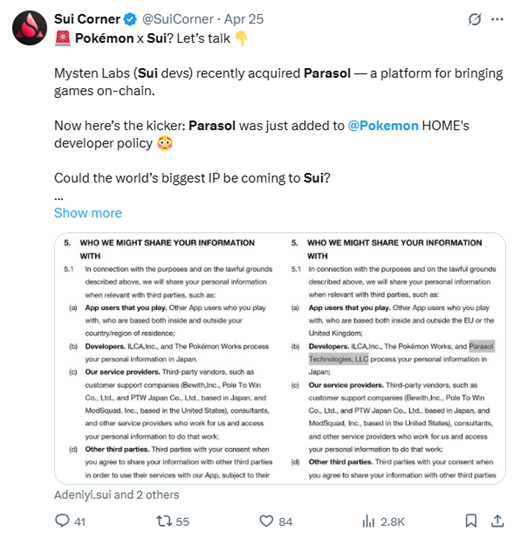

SUI has dramatically outperformed the broader crypto market in recent days, surging 72% weekly and eclipsing even Bitcoin in relative gains. The coin rallied past $3.70, boosted by both bullish momentum and heightened media attention. Interestingly, the rally has coincided with a surge in social interest, aided by speculative buzz around a potential partnership with Pokémon, following a mention of Parasol Technologies—linked to Sui—in Pokémon HOME’s privacy documentation.

Even beyond the hype, the fundamentals paint a bullish picture. Trading volumes have exploded, and search interest remains high, reflecting growing retail and institutional interest. The positive sentiment has pushed SUI to the 11th position in global crypto rankings by market cap, as investors increasingly view it as a breakout project in the 2025 bull cycle.

Source: X

Technical Analysis: Consolidation Phase as SUI Cools Off Post-Rally

The recent SUI chart indicates the token is consolidating near $3.52 following last week’s surge, suggesting the momentum is pausing rather than reversing. The Relative Strength Index (RSI) has cooled down to 46.21, moving away from previous overbought territory and signaling a more neutral sentiment in the short term. Trading volume has also declined significantly to 105.44 million, confirming reduced speculative interest and the onset of a cooling phase.

The price action over the past 5 days reveals a pattern of lower highs and sideways movement, which could develop into a range-bound base between $3.45 and $3.60. This could serve as a potential accumulation zone if support holds. Traders will likely look for a breakout above $3.60 for a renewed push toward $4.00, while failure to hold $3.45 could open a retest of deeper supports near $3.30.

Source: TradingView

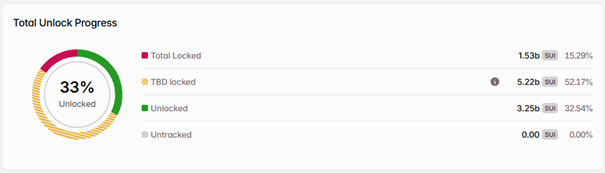

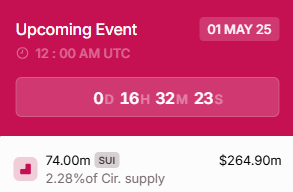

Token Unlock Ahead: Dilution Risk or Absorption Test?

Despite its impressive run, SUI faces a critical test with an impending $265 million token unlock on May 1. This release of 74 million new tokens—representing about 2.28% of circulating supply—has sparked concerns about potential price dilution. Historically, similar unlocks have led to notable pullbacks. For example, a $335 million unlock in January 2025 sent prices tumbling by over 50% in subsequent weeks.

Yet this time might be different. On-chain fundamentals are significantly stronger, and sentiment in the broader crypto space is improving. If traders interpret the unlock as an opportunity to accumulate rather than exit, SUI could hold its ground or even rally. Much will depend on how market makers and large holders handle the incoming supply.

Source: Tokenomist

Source: Tokenomist

Can SUI Flip TRX and Sustain Its Rally?

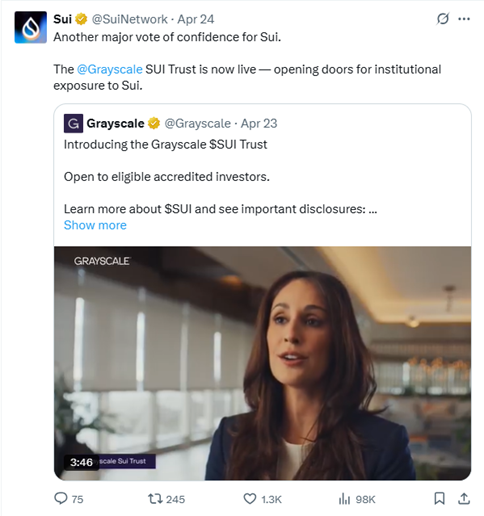

SUI is making headlines as the week’s top-performing large-cap cryptocurrency, soaring over 50% to $3.50. This impressive surge, driven by a combination of DeFi growth, major partnerships, and institutional interest like the Grayscale SUI Trust, positions SUI to challenge TRX’s spot in the rankings. The added momentum from the Cboe’s proposed SUI ETF and collaborations with Ant Digital and WLFI underscores its growing legitimacy as more than just another Layer-1 token.

If bulls can drive the price past the key $4.20 resistance, SUI could attempt a run toward the $5.00 level and potentially retest its previous all-time high at $5.35. Still, with a $310M token unlock looming, market reaction to the new supply will be critical. Should the unlock be absorbed without significant downside, SUI could firmly establish itself as a top-tier crypto asset—shifting from speculative play to a core pillar of the DeFi infrastructure.

Source: QuantifyCrypto

Grayscale SUI Trust Opens the Door to Institutional Investment

The launch of the Grayscale SUI Trust represents a major milestone in institutional crypto adoption, offering accredited investors regulated exposure to the SUI ecosystem. By converting SUI into a security-backed vehicle, the trust removes the technical hurdles of direct token ownership—such as private key management and secure storage—while still tracking the asset's market performance. This move not only validates SUI's growing relevance in the digital asset space but also aligns it with top-tier institutional investment frameworks, boosting credibility and long-term capital inflows.

Source: X

The performance of the Grayscale SUI Trust further illustrates growing investor confidence in the SUI ecosystem. As of April 28, 2025, the net asset value (NAV) per share has surged to $53.16, rebounding sharply from its March lows around $30. This recovery reflects renewed institutional interest following positive developments such as ETF filings, strong DeFi growth on the SUI network, and the introduction of the Grayscale Trust itself. The upward trend also indicates that investors are increasingly viewing SUI as a long-term digital asset rather than a speculative token, aligning with the broader narrative of SUI maturing into a serious player in Web3 finance.

Source: Grayscale