Crypto Weekly Wrap: 6th June 2025

Ethereum Struggles to Maintain Momentum

Ethereum (ETH) continues to face downward pressure despite earlier gains, now trading at approximately $2,491—a decline of 0.63% on the day. While the price climbed 48% from early May to June 5, the recent pullback below the $2,500 level reflects waning bullish sentiment. Technical indicators reinforce this cautionary outlook: the Relative Strength Index (RSI) has dropped sharply to 24.27, signalling the asset is entering oversold territory. Trading volume over the past 24 hours sits at 358.52 million, also suggesting thinning momentum.

Source: TradingView

At a broader level, Ethereum's fundamentals remain mixed. Total Value Locked (TVL) has fallen 17% over the past month, dropping to 25.1 million ETH, as major DeFi protocols like Sky (formerly MakerDAO) and Curve Finance saw significant outflows. Meanwhile, Solana's TVL has gained 2%, underscoring Ethereum’s slipping grip on DeFi dominance.

Despite strong ETF inflows—totalling $700 million between May 22 and June 4 with no daily outflows—ETH has struggled to hold ground. On-chain fees are up 150% month-over-month, which bolsters Ethereum’s deflationary narrative, but the technical chart now suggests that bulls may need to defend key support zones aggressively. A bounce above $2,500 could re-ignite upside potential, but until then, the path to $3,000 remains unlikely in the short term.

Source: Coinmarketcap

Ethereum Foundation Treasury Policy

In a strategic pivot, the Ethereum Foundation has revamped its treasury policy to better manage risk and support ecosystem growth through the next two years. The update comes amid protocol layoffs and a restructuring of its research team, signalling a stronger focus on network sustainability and usability.

Key to the new strategy is the implementation of a 15% operating budget buffer and a 2.5-year reserve runway. Ether will be sold or deployed based on this formula, balancing fiat stability and ecosystem needs. While ETH will remain the primary asset, the Foundation plans to diversify into real-world tokenised assets and investment-grade bonds to reduce exposure and smooth out volatility.

Additionally, the Foundation reaffirmed its core principles—privacy, decentralisation, and permissionless access—committing to fund projects aligned with these values. Annual performance reports and quarterly internal reviews will now track treasury allocations and ensure transparency in operations.

Source: X

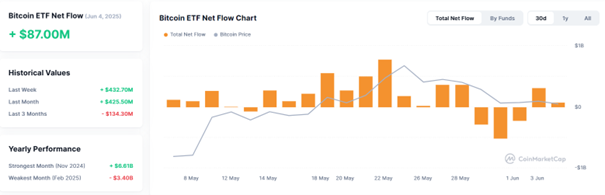

Bitcoin Faces Pressure Despite ETF Buzz and Institutional Moves

Bitcoin is currently trading near $101,110, marking a 0.12% decline on the day. Institutionally, however, developments are notable. JPMorgan has begun accepting Bitcoin ETF shares, such as BlackRock’s IBIT, as collateral for loans to high-net-worth clients. This move integrates crypto more deeply into the traditional financial system, treating Bitcoin ETFs similarly to stocks and real estate in terms of lending eligibility—even as regulatory grey areas remain.

Source: TradingView

Technically, BTC is under pressure. The price has sharply dropped from its recent highs, and RSI has sunk to 24.74—clearly in oversold territory, hinting at short-term weakness. Volume has ticked up to 909 million in the past 24 hours, suggesting some capitulation or stop-loss activity. BTC has broken down from the earlier symmetrical triangle pattern, and with no strong support above $100,958, bearish continuation could follow unless the asset reclaims $103,000 swiftly.

If BTC fails to hold above the $101,000 mark, key support zones lie at $100,000 and $98,700. On the flip side, a relief rally would need a firm 2-hour close above $103,500 to reopen upside targets toward $106,000 and $108,933. For now, the market remains on edge, balancing macro uncertainty and political developments.

Source: Coinmarketcap

Basel Loopholes and SEC’s New Tone: A Turning Point for Crypto Regulation

JPMorgan’s move to accept Bitcoin ETF shares as collateral represents a pivotal moment in crypto’s integration into mainstream finance. Since Bitcoin ETFs are classified as stocks rather than crypto-assets under Basel definitions, they avoid the harsh 1,250% capital requirement applied to direct crypto holdings. This allows banks to support lending against ETF positions with only 100% risk-weighted exposure. As a result, wealthy clients can leverage their Bitcoin exposure without liquidating, reinforcing the ETF model as the preferred gateway into traditional finance for crypto-backed assets.

At the same time, the SEC is signalling a softer regulatory stance under the Trump administration. This shift was highlighted by a rare enforcement win against Keith Crews, who was ordered to pay $1.1 million for promoting a fraudulent token called “Stemy Coin.” While the agency secured a victory in court, it has since dropped lawsuits against Coinbase and Uniswap, suggesting a broader shift from combative regulation to industry collaboration. With Paul Atkins now at the helm, the SEC appears to be prioritising a more constructive, pro-innovation framework for the digital asset space.

Source: X

Memecoin Mayhem

Solana-based memecoin Dogwifhat ($WIF) has plummeted below the critical $1 threshold, now hovering around $0.86—a 7.5% daily loss and over 12% decline for the week. The breakdown has triggered broader market concern, especially as $WIF had traded above $1.30 just weeks ago, with many eyeing a push toward $2.

Major tokens across the sector are also in retreat. PEPE is down over 10%, DOGE has fallen 8.48%, and SHIB dropped 4.98%, according to the latest data. This wave of red across popular meme assets reflects a deepening loss of confidence. Overall, the memecoin market cap has shrunk by 7.53% in 24 hours, standing at just $54.98 billion, even as trading volume rose 27.16% to $7.29 billion—suggesting panic-driven exits are underway. If memecoins like $WIF and PEPE fail to mount a rebound soon, the downturn could deepen, spelling more pain for holders.

Source: Coinmarketcap

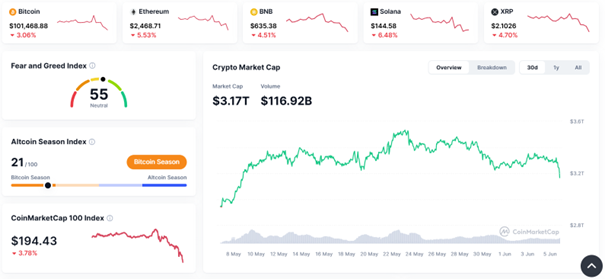

Broader Market Overview: Summer Slump or Strategic Pause?

The cryptocurrency market is facing renewed pressure as we head into June. The total market capitalisation now stands at $3.17 trillion—down 7.53% in the last 24 hours—despite a spike in trading volume to $116.92 billion, which suggests panic-driven activity rather than organic demand. The CoinMarketCap 100 Index has also slipped to $194.43, reflecting broad weakness across top crypto assets.

Key altcoins are in the red: BNB is down 4.51% to $635.38, Solana has lost 6.48% to sit at $144.58, and XRP has slid 4.70% to $2.1026. Despite these losses, the Fear and Greed Index remains neutral at 55, suggesting that sentiment has not yet turned decisively bearish.

The Altcoin Season Index currently reads 21/100, indicating that we are firmly in “Bitcoin Season”—a phase in which BTC is outperforming the broader altcoin market. This trend helps explain the muted performance across many alt tokens, even as Bitcoin struggles to regain momentum.

In regulatory news, the SEC secured a $1.1 million court ruling against a fraudulent crypto project (“Stemy Coin”), while also signalling a softer approach under the Trump administration. Lawsuits against major platforms like Coinbase and Uniswap have been dropped, suggesting a more lenient stance toward innovation may be emerging.

Source: Coinmarketcap

Conclusion

This past week’s red-drenched heatmaps underscore the sector’s fragility. Bitcoin (BTC) dropped 4.12% to $101,351, and Ethereum (ETH) fell 7.2% to $2,448—both losing key support levels. The pain was even sharper among altcoins: Dogecoin (DOGE) crashed 20.87%, Shiba Inu (SHIB) tumbled 13.91%, and Solana (SOL) declined 13.71%. Meanwhile, SUI, LINK, and AVAX all posted double-digit weekly losses, down 16.96%, 15.26%, and 16.29% respectively.

Only a handful of tokens defied the trend. TRX managed to limit losses to just 2.4%, and HYPE stood out with a 4.42% gain—one of the few green spots on an otherwise blood-red board.

As memecoins falter and sentiment shifts, the market is clearly entering a transitional phase. Institutional adoption continues through ETF innovations and new financial infrastructure like JPMorgan’s collateralisation of crypto ETF shares.

Whether this is a summer slump or the start of a more prolonged correction remains to be seen. What’s certain is that political influence, institutional moves, and macroeconomic shifts will increasingly shape the next wave of market momentum.

Source: Quantifycrypto