Crypto Weekly Wrap: 3rd October 2025

Uptober's Early Surge: When Greed Index Meets Government Gridlock

Another week, another twist in the crypto narrative. Just as the leaves start to turn, the crypto market decided to kick off its own version of "Uptober" with a decidedly bullish fervour. Despite the looming shadow of a potential U.S. government shutdown and persistent macroeconomic jitters, Bitcoin carved out new resistance tests, Ethereum continued its upward momentum, and altcoins generally followed suit, demonstrating a level of resilience that might surprise anyone not fully immersed in this particular corner of finance. The question on everyone’s mind: Is this a genuine breakout fueled by institutional appetite, or merely a spirited dance before reality sets in?

The Macro Lens

This past week, the macroeconomic backdrop offered a curious juxtaposition. On one hand, the U.S. dollar showed signs of weakening, buoyed by the whispers (and increasingly, shouts) of anticipated Federal Reserve interest rate cuts. This is typically music to the ears of risk assets, and crypto, ever the contrarian, appears to be no exception. A cheaper dollar tends to make alternative investments more attractive, and cryptocurrencies often get swept up in that "risk-on" tide.

However, casting a rather large shadow over this optimism was the very real possibility of a U.S. government shutdown. In traditional markets, such an event is usually met with a collective gasp of uncertainty. For crypto, the implications are a bit of a mixed bag. On one side, it introduces short-term volatility and can delay crucial regulatory processes (which, depending on your perspective, could be good or bad). On the other hand, Bitcoin, in particular, has sometimes been pitched as a "safe-haven" asset, a digital gold that thrives when traditional systems wobble. This week, it seems the market opted to focus on the former while subtly positioning for the latter, choosing to ride the prevailing bullish sentiment. Think of it as driving a sports car on a sunny day, enjoying the speed, but with one eye on the dark cloud gathering in the rearview mirror.

The Crypto Lens

In the digital asset realm, the week was dominated by a distinct sense of upward momentum. The Crypto Fear & Greed Index, a sort of collective emotional thermometer for the market, registered a comfortable "Greed" at 64 and 63, indicating a pervasive optimism among investors.

Bitcoin (BTC)

The undisputed market leader continued its charge, currently sitting around $120,110 with a 1.2% 24-hour gain. It wasn't just hovering; it aggressively tested and briefly surpassed the $121,000 mark, aligning perfectly with the historical "Uptober" rally narrative.

What's driving this? A substantial influx of institutional capital into Spot Bitcoin ETFs. Funds like IBIT and FBTC saw hundreds of millions in inflows, clearly demonstrating that traditional finance is increasingly comfortable parking significant sums in the king of crypto.

Bitcoin's journey resembles a seasoned mountaineer attempting to scale a new peak – persistent, steady, and eyeing those higher resistance levels like $122,500 and $125,000.

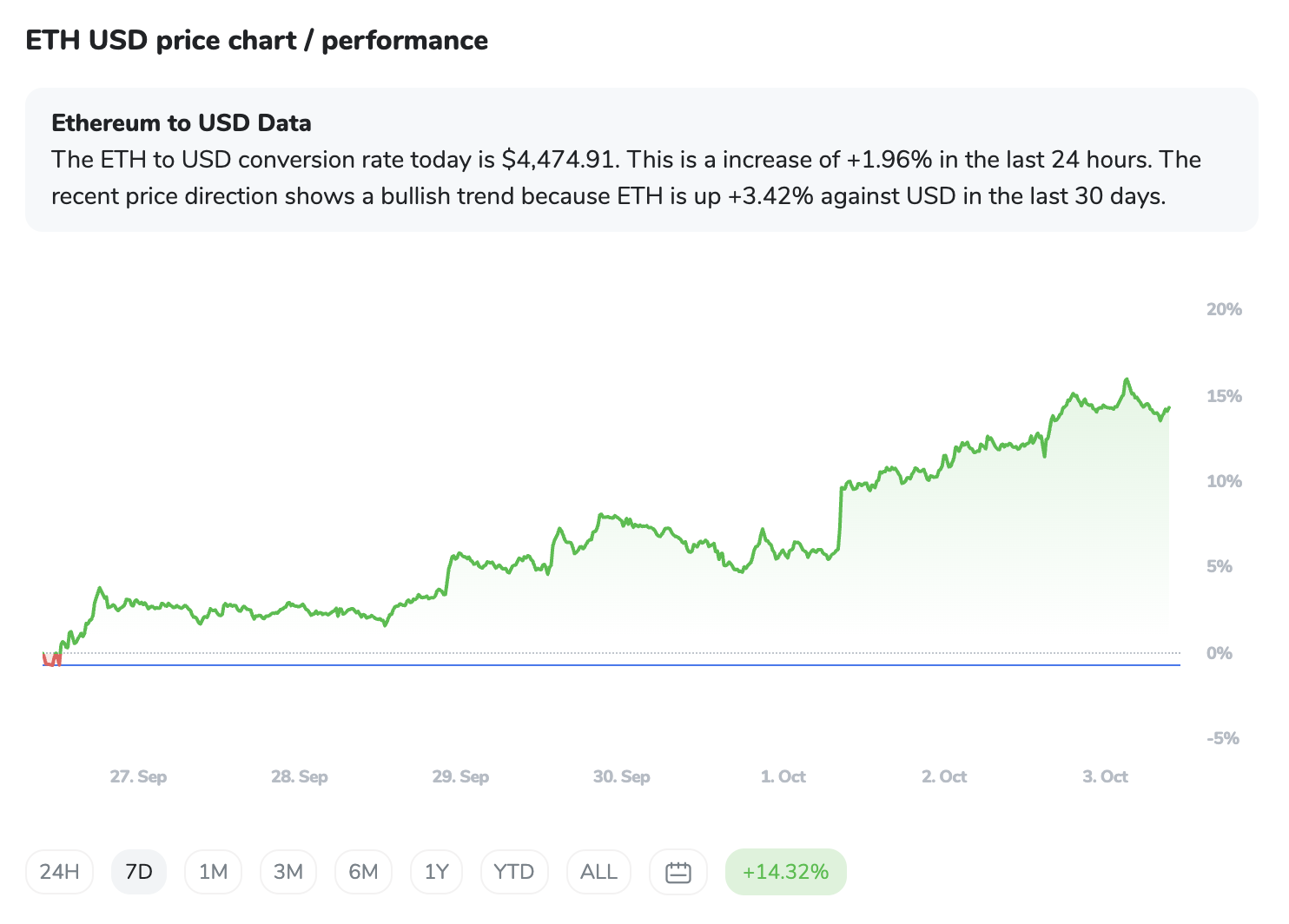

Ethereum (ETH)

Ethereum, not to be outdone, traded at $4,468.87, up 1.83% in 24 hours. It's showing strong bullish momentum, dancing above its major moving averages, and analysts are even pointing to a "Power of 3" pattern – a technical signal that has historically preceded considerable gains.

While recent daily ETF flows for ETH were positive (FETH saw $36.76 million), the overall picture for Ethereum ETFs since August has been more nuanced, with some significant cumulative outflows noted in the last week of September (e.g., $362M from FETH, $200M from ETHA, and $800M cumulatively).

This suggests a push-and-pull dynamic; fresh capital is entering, but some existing positions might be rotating or trimming.

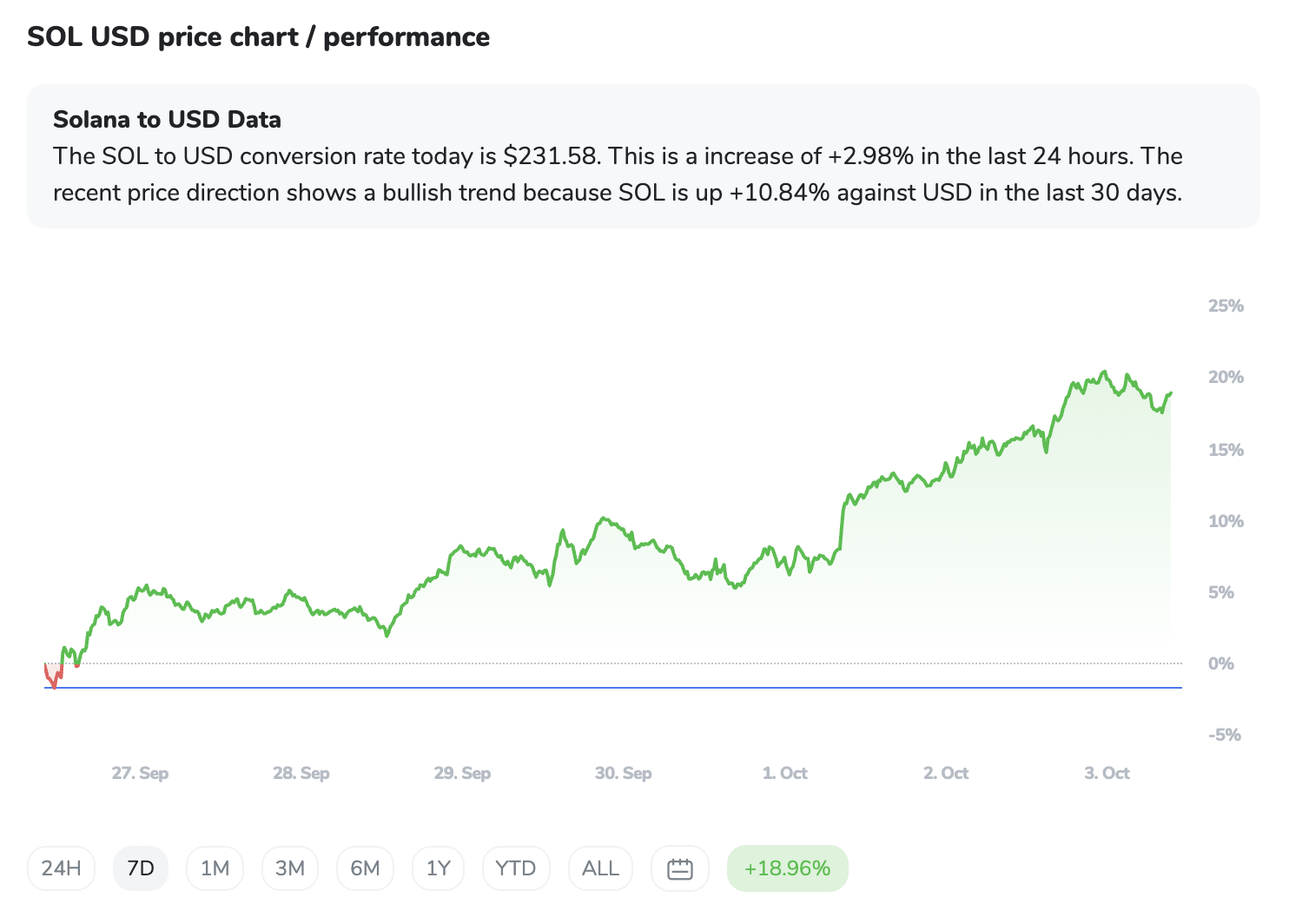

Solana (SOL)

It proved to be the week's nimble performer, boasting a 2.81% 24-hour increase to $230.95. It’s been maintaining a bullish trajectory within a clear rising channel, showcasing its resilience. While some technical signals hint at potentially weakening buying pressure in the very short term, SOL has consistently rebounded from previous lows, suggesting a robust underlying demand, possibly fueled by whispers of future spot ETF possibilities.

In essence, the market felt like a well-orchestrated ballet where the major players pirouetted past immediate concerns, fueled by a potent mix of institutional money, a weakening dollar narrative, and seasonal optimism.

The ICONOMI Angle

While the broader market played its bullish tune, ICONOMI strategies demonstrated a keen ability to capture this upward swing. It's a testament to both the market's strength and the strategic composition of these funds that we saw impressive double-digit weekly returns across the board.

The Ethereal Strategy led the pack with a remarkable +12.70% weekly return, composed entirely of Ethereum (ETH). This perfectly mirrored ETH's strong performance, proving that sometimes, conviction in a single asset, when timed right, can yield significant rewards. Similarly, WMX Crypto, with nearly 50% ETH and over 34% BTC, also posted a strong +12.04% return, capitalising on the strength of the two largest cryptocurrencies and a solid allocation to Solana.

For those favouring a more diversified approach, the Metastrategy returned +12.16%, cleverly allocating significant portions to ETH (28.63%) and SOL (22.01%), alongside BTC, XRP, and other prominent altcoins. This multi-asset exposure allowed it to benefit from broad market strength while mitigating individual asset risk. The 2100newsCryptoLargecapindex and Diversitas strategies, both achieving +11.65% returns, showcased the power of balanced portfolios. Diversitas, with its focus on BTC, ETH, SOL, and BNB, demonstrated how a strategic blend of majors can ride the wave. The 2100newsCryptoLargecapindex, being even more broadly diversified across over 30 assets, including BNB, SOL, and XRP, captured growth across a wider spectrum of the market, confirming that robust diversification remains a powerful tool in dynamic market conditions.

What to Watch Next

The Government Shutdown Saga: How long, how deep, and what impact will it have on traditional markets? A prolonged shutdown could test crypto's "safe-haven" narrative and potentially delay regulatory clarity.

Federal Reserve's Next Move: Any new hints or data regarding interest rate cuts will be closely scrutinised. Continued dovish sentiment could further fuel the "risk-on" appetite for crypto.

ETF Flow Persistence: Keep an eye on institutional inflows into Bitcoin ETFs. Will the strong momentum continue, or will we see a rotation or slowdown? Ethereum ETF flows also warrant attention – will the net outflows seen in late September reverse, or is the asset's accumulation plateauing?

Altcoin Season Watch: With Bitcoin dominance potentially easing (or at least stable), will capital rotate more aggressively into altcoins, pushing for a broader "altcoin season"? Look for SOL and XRP ETF discussions as potential catalysts.

On-Chain Activity Metrics: Beyond price action, is the underlying network activity, transaction volume, and user growth supporting the bullish sentiment, or is it merely speculative fervour? Weakening on-chain fundamentals could signal a wobbly foundation.

Key Resistance Tests: Bitcoin at $122,500 and $125,000, and Ethereum nearing $4,500 and potentially $4,800. Breaching these could signal further upside, while rejection could trigger pullbacks.

FAQs

Why is the crypto market rallying strongly despite concerns like a potential U.S. government shutdown?

The market appears to be primarily driven by strong institutional inflows into Bitcoin ETFs and expectations of future Federal Reserve interest rate cuts, which generally favour risk assets. The historical "Uptober" rally narrative also contributes to optimistic sentiment. While a government shutdown is a concern, some investors may view Bitcoin as a potential safe-haven asset, adding to its resilience.

What's the deal with Ethereum ETF flows? Are they all positive?

Not entirely. While Ethereum saw positive daily ETF inflows recently, the overall trend since August has been mixed. There were significant cumulative outflows from certain Ethereum ETFs in the last week of September. This suggests a more complex picture than Bitcoin, with some fresh capital entering while other investors might be trimming or reallocating positions.

What is the "Uptober" rally?

"Uptober" refers to a historical trend where October has often been a strong-performing month for Bitcoin and the broader cryptocurrency market. While past performance is no guarantee of future results, this narrative tends to boost market sentiment and investor expectations at the start of the month.