Crypto Weekly Wrap: 31st December 2025

The $88k Wall of Fear: A New Year’s Paradox

As we close the books on 2025, the market is handing us a riddle to ring in the New Year. Bitcoin is sitting comfortably above $88,000, and Ethereum is knocking on the door of $3,000. By almost any traditional metric, this is a bull market. Yet, the Fear & Greed Index is flashing a confused "21" - Extreme Fear.

We’ve seen euphoria at tops and panic at bottoms. But fear near the highs? That is a rare, distinct signal. It tells us that this rally isn't built on leverage and hype; it's built on a "wall of worry." For the Rational Investor, this disbelief suggests the tank isn't empty yet, even as the champagne creates a distraction.

The Macro Lens

The broader financial machine is taking a breather as 2025 fades out, but the signals under the surface are telling.

The "Hard Asset" Bid

While equities are relatively flat, Silver jumped +3.67% today. When precious metals move aggressively alongside digital assets, it usually signals a market-wide hedge against currency debasement or policy uncertainty heading into the new year.

VIX Comfort

The stock market’s fear gauge (VIX) is low at 13.06. This contrast is stark; equity investors are complacent, while crypto investors are terrified. Historically, crypto tends to violently correct the disparity eventually. The question for 2026 is: does crypto calm down, or do stocks wake up to the risk?

Forex Flows

The Dollar (USD) is showing weakness against the Euro and Pound today. A softer dollar is historically the green light for global liquidity to flow into risk assets like Bitcoin.

The Takeaway: The macro backdrop remains supportive of hard assets. If the dollar continues to slide in Q1 2026, Bitcoin's current "fearful" price level may look like a bargain in hindsight.

The Stocks Lens

The equity markets are wrapping up the year with a rotation, not a retreat.

The Divergence of the Giants: The "Magnificent Seven" aren't moving in lockstep anymore. Tesla (TSLA) surged +3.84% today, while NVIDIA (NVDA) dipped -1.56%.

Why It Matters: In previous years, crypto correlated strictly with the Nasdaq. Now, we are seeing crypto hold firm even when the AI-darling (NVDA) slips. This decoupling is vital. It means Bitcoin is behaving less like a tech stock derivative and more like a sovereign asset class.

Market Indices

S&P 500: -0.29%

Nasdaq 100: -0.19%

Dow: +0.04%

The Takeaway: Tech weakness usually drags crypto down. The fact that BTC gained +1.2% while the Nasdaq slipped suggests crypto is showing relative strength entering January.

The Crypto Lens

The digital asset market is ending the year with a quiet, upward grind, the kind that accumulation phases are made of.

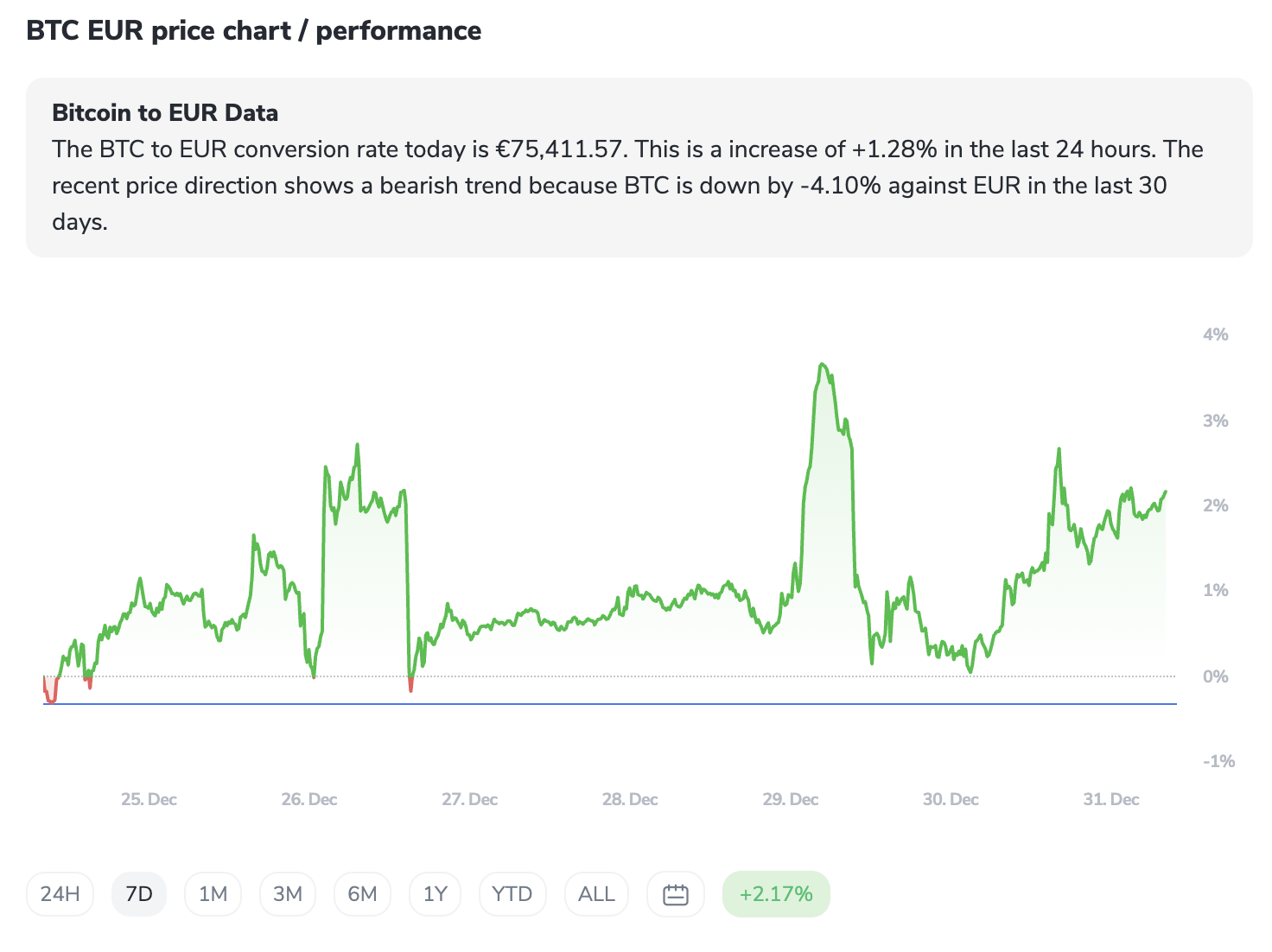

Bitcoin (BTC)

Trading at $88,476, up 1.2%. The chart shows a steady ladder up from the $86k range earlier this week. The lack of a euphoric "blow-off top" is healthy. It implies big hands are holding spot, rather than gamblers levering up on perps.

Ethereum (ETH)

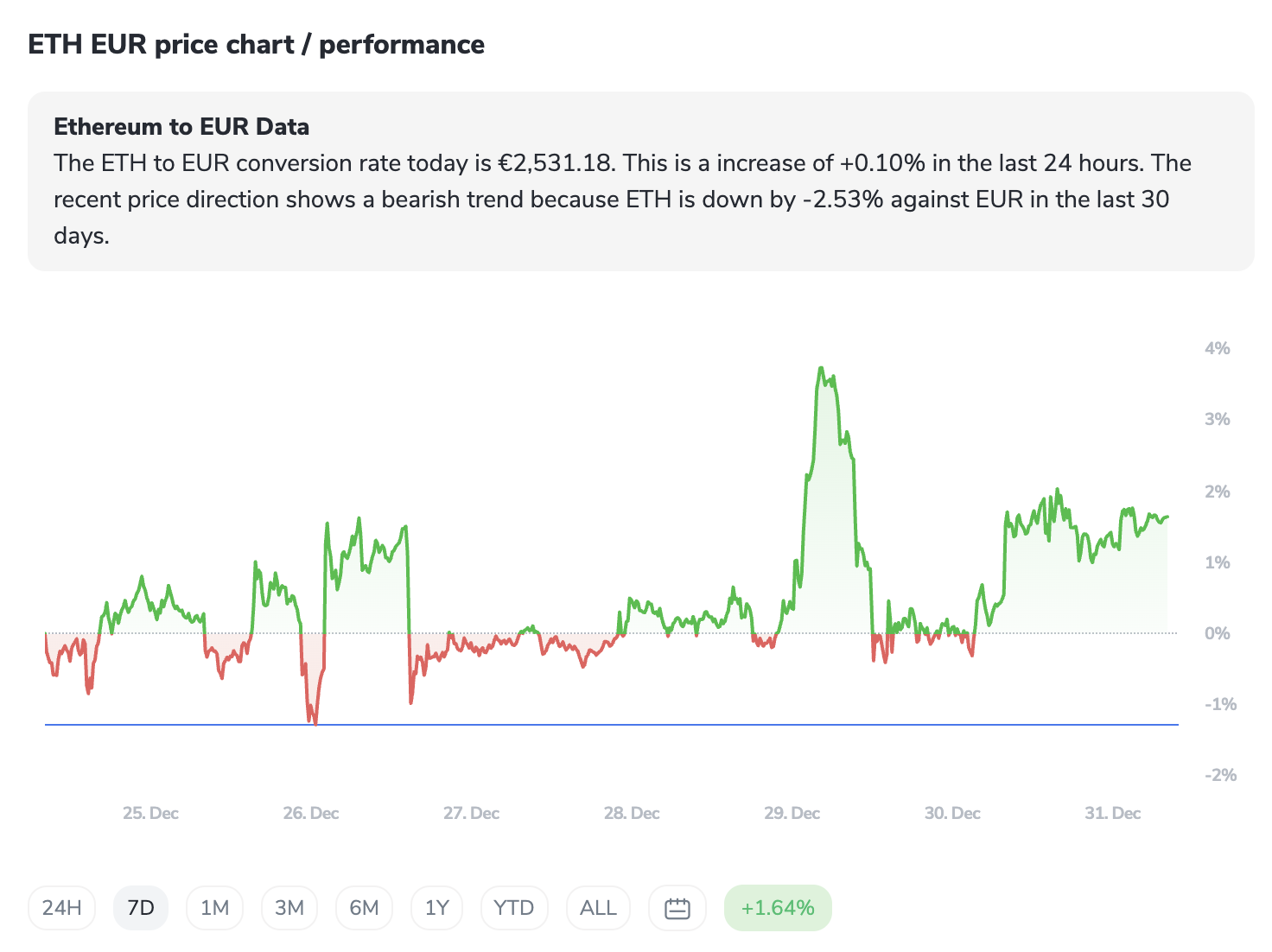

Currently $2,971. It has lagged Bitcoin relative to its historical beta, but it is coiling tightly below the psychological $3k barrier. A break above could trigger a rapid rotation of profits from BTC to ETH.

The Sentiment Anomaly

I cannot stress enough how strange a 21 (Extreme Fear) reading is at these price levels. This indicates "Post-Traumatic Bear Disorder." Investors are so scarred by previous drops that they are quick to sell rips, preventing bubbles from forming.

The Takeaway: Don't let the "Fear" reading scare you out of a position. In asset management, fear at highs is often a bullish signal because it means the market isn't crowded with overconfident tourists yet.

Notable Outliers

While the majors stabilised, specific pockets of the market delivered massive alpha this week.

The Winners

Zcash (ZEC): Despite a small dip today, ZEC is up nearly +28.4% on the week. This is likely a "flight to privacy" trade ahead of 2026 regulatory shifts.

Canton (CC): Up +14.5% in 24h.

MemeCore (M): Up +12.2%. Speculation hasn't left the building; it's just concentrated in specific pockets.

The Defensive Play

LEO Token: Up +5.4%. When exchange tokens rise, it often signals that insiders expect high volatility and trading volume (revenue) in the coming weeks.

The Lesson: The massive move in Zcash suggests that "forgotten" legacy coins with real utility (privacy) are being repriced. The market is looking for value in older, tested protocols that haven't pumped yet.

Sector Spotlight

The Return of "Old Guard" Utility (Privacy & Payments)

Looking at the top-performing ICONOMI strategy this week, Metastrategy, which returned +7.43%, we see a fascinating allocation: heavy weights in ETH (25%), ZEC (20%), and SOL (16%).

This isn't a "degen" meme portfolio. This is a bet on infrastructure and privacy.

Why Now? As CBDC (Central Bank Digital Currency) conversations heat up globally for 2026, the value proposition of privacy coins like Monero (XMR) and Zcash (ZEC) becomes tangible, not theoretical. Smart capital is front-running this narrative.

The Takeaway: If your portfolio is only BTC and Memes, you might be missing the "Utility Rotation" currently boosting modest-cap legacy coins.

The Contrarian Take

The "Sell the News" Event That Won't Happen.

The consensus on the street is that Q1 brings a hangover. Tax-loss harvesting is done, and everyone expects a dip as people take profits in the new tax year.

However, the "Extreme Fear" reading suggests many have already sold or hedged. Markets rarely punish the prepared; they punish the complacent.

The risk isn't a crash; the risk is a "melt-up" that leaves defensive investors behind. With Gold and Silver moving, we might see an "inflation trade" in January that forces sidelined capital to chase BTC at $90k+.

Watching cash balances swell while the asset grinds up is the most painful trade in finance.

The ICONOMI Angle

Real user data from the platform reinforces the "Active Management" thesis this week.

Strategy Alpha: The Crypto Index 25 (+3.33%) and Blockchain Index (+2.49%) performed well, but they were outperformed by the more concentrated Metastrategy (+7.43%).

Interpretation: Broad indexing is working because the tide is rising, but curation is winning. Strategies that dared to overweight under-loved assets like Zcash or hold heavier Solana bags helped users beat the benchmark.

Year-End Action: We are seeing rebalancing into liquid staking tokens (STETH, wETH) as investors look to compound yield while waiting for the next leg up.

The Week Ahead

Jan 1 (New Year's Day): Traditional markets closed. Low liquidity in crypto often leads to "scam wicks" or volatility spikes. Watch out for fake-outs.

Jan 2-5 (ETF Flows Resume): As institutional desks return from holiday, we will get the first real signal of 2026 corporate demand for Bitcoin.

Jan 5 (First Weekend of 2026): Pay attention to retail volume. Does the "New Year's Resolution" crowd buy in?

What to Watch Next

The $3,000 ETH Ceiling: If ETH breaks this, capital will rotate aggressively into altcoins (The "Wealth Effect").

Silver/BTC Correlation: Watch if they continue to move together. If they do, the "Monetary Debasement" narrative is back in the driver's seat.

Volatility (VIX vs. Crypto): If equities succumb to gravity and the VIX spikes, watch if Bitcoin acts as a correlation (drops with stocks) or a hedge (holds value). This is the ultimate maturity test.

FAQs

Why is the Fear & Greed Index at "Extreme Fear" when prices are high?

It’s a divergence caused by scepticism. Investors are scarred from the last bear market and don't trust the rally. Ironically, this scepticism provides a stable foundation for price growth because there is less "froth" or leverage to flush out.

Is it too late to buy for the "January Effect"?

Historically, January sees fresh capital allocations from funds start to deploy. With BTC consolidating near highs rather than crashing, the setup for early 2026 deployment remains positive.