Crypto Weekly Wrap: 25th July 2025

When the Market Feels Greedy, But Still Likes a Discount

This past week in crypto felt a bit like a seasoned angler patiently reeling in a big one: slow, steady, with moments of tension, but ultimately, a sense of underlying purpose.

While Bitcoin took a moment to catch its breath after a spirited sprint, settling into a range and shedding some overbought indicators, Ethereum continued its relentless climb, acting as the market's new leading indicator.

The overarching sentiment? "Greed," apparently. But it’s a nuanced greed, one that happily absorbs dips and celebrates consistent institutional inflows, especially into ETH. It suggests we're in a market where conviction is high, but participants are also disciplined enough to take profits and rebalance.

The Macro Lens

The broader macroeconomic currents continue to serve as crypto's invisible dance partner, though sometimes the crypto market seems to have its own rhythm.

This week, the consistent chatter around potential Federal Reserve interest rate cuts continued to underpin market optimism. Lower rates generally mean more liquidity flowing into riskier assets, and crypto, despite its growing maturity, still sits firmly in that camp. We're not seeing dramatic policy shifts, but anticipation acts as a tailwind.

This backdrop, combined with ongoing, albeit slow, regulatory clarity and increasing engagement from traditional financial institutions (like JPMorgan Chase exploring crypto-backed offerings), is steadily normalising crypto as a legitimate asset class. It’s less about a sudden external shock and more about a gradual, steady gravitational pull from the world of TradFi.

The Crypto Lens

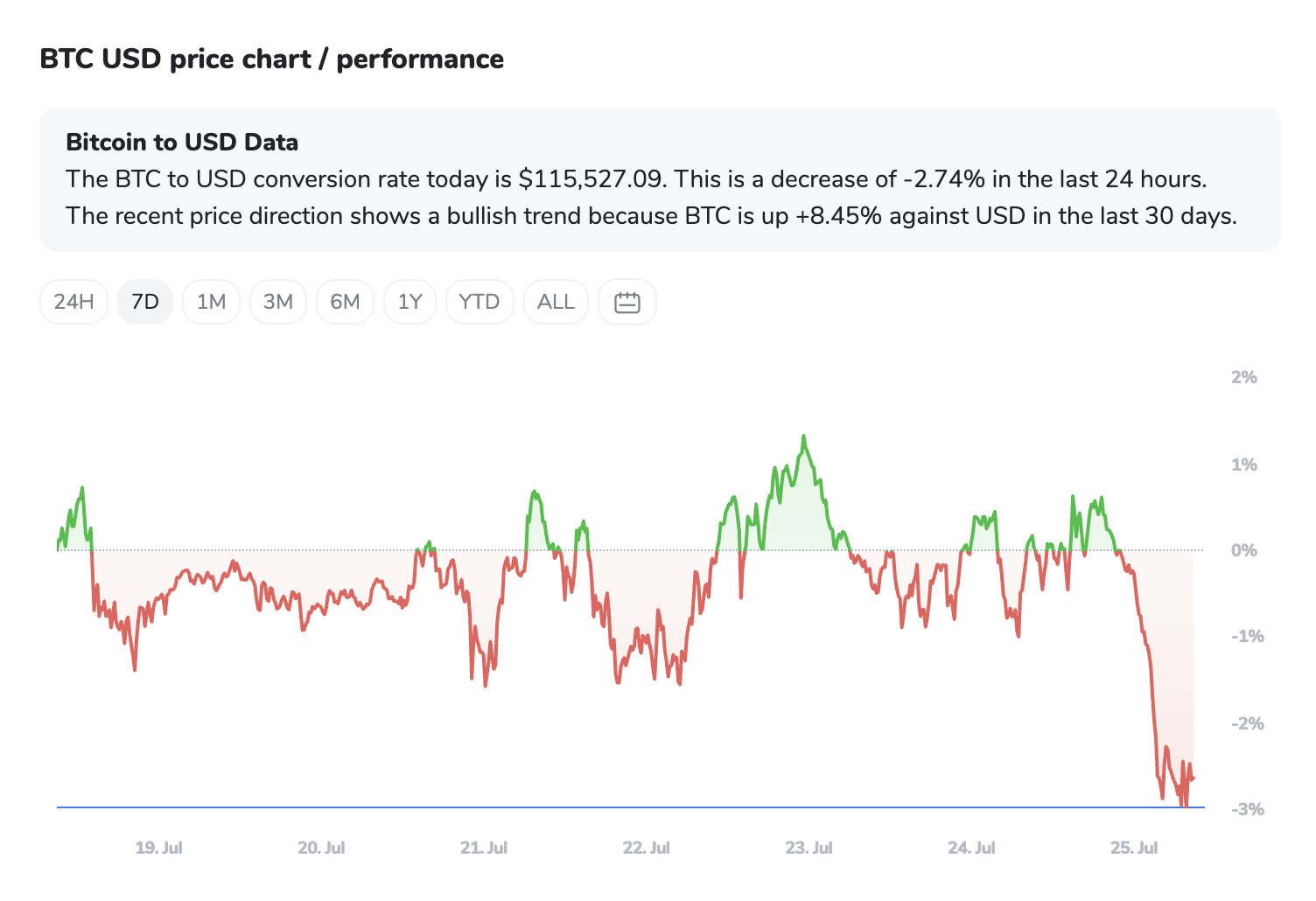

Bitcoin (BTC): The Disciplined Rebounder

Bitcoin, currently around $115,783, saw a modest -2.44% dip in the last 24 hours. After breaking past $123,000, it decided a minor correction was in order.

Think of it as a marathon runner pausing for water: the Relative Strength Index (RSI) pulled back from overbought territory, and the Stochastic RSI dipped into oversold, indicating a cooling-off period.

Crucially, despite some recent outflows (like a notable $77.46 million from ARK 21Shares ARKB), the underlying momentum appears intact as long as it holds key support levels around the $115,000-$116,000 range.

The good news? Bitcoin ETFs ended their three-day outflow streak, showing renewed institutional interest.

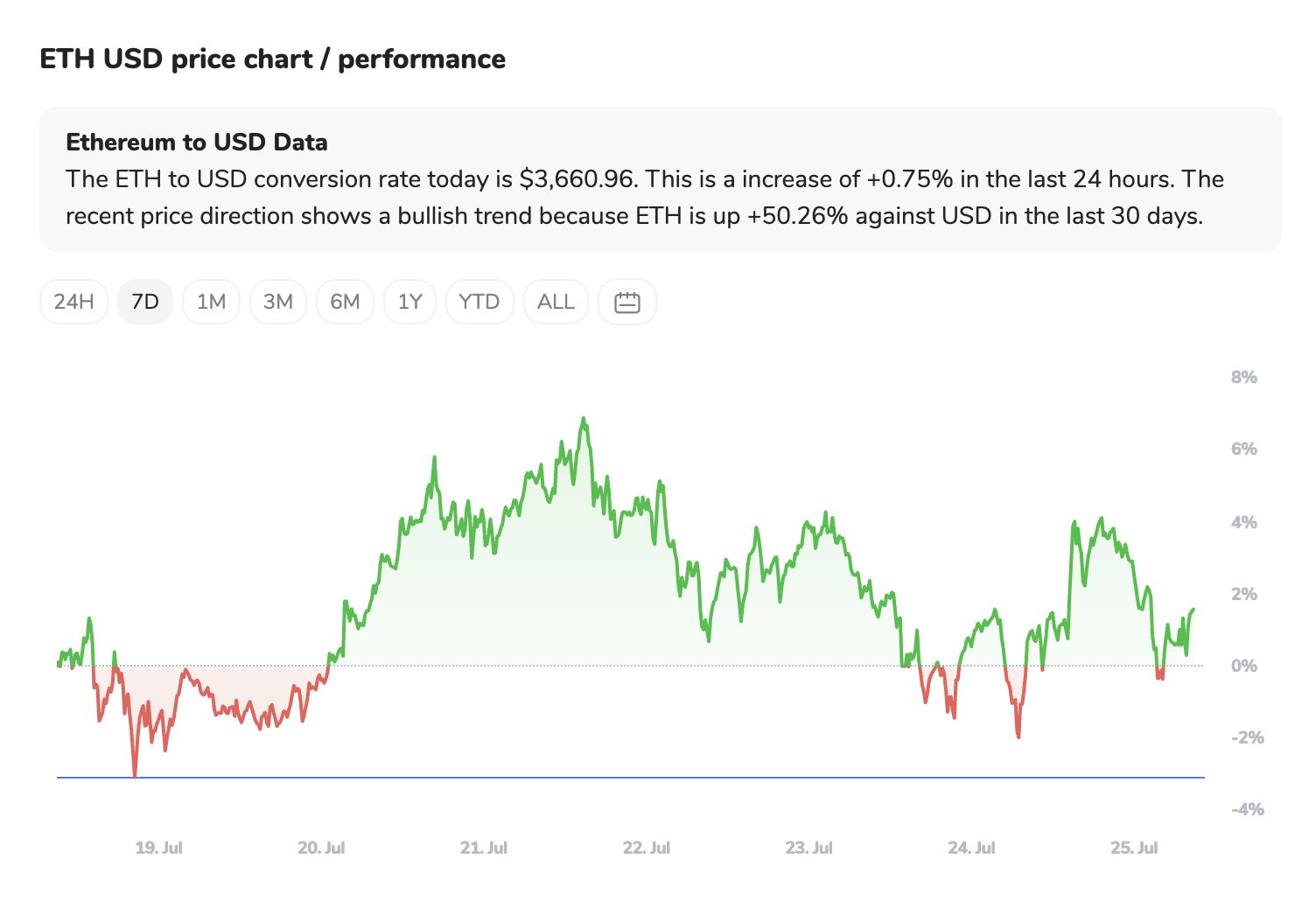

Ethereum (ETH): The Outperformer's Streak

Ethereum has been the week's quiet hero, trading at $3664.98 with a healthy 0.99% gain in the last 24 hours. It didn't just break $3,100; it confidently kept climbing.

Analysts are quick to point out its impressive 70% outperformance against Bitcoin since the April lows. Why the surge? A cocktail of factors: growing institutional trust, increasing transaction volumes, and robust on-chain activity.

But the headline act has been Ethereum Spot ETFs, which extended their positive inflow streak to an astounding 15 consecutive days, pulling in a combined $231.23 million, with BlackRock's product alone seeing $333.87 million. This signals a clear shift in institutional capital allocation, favouring ETH.

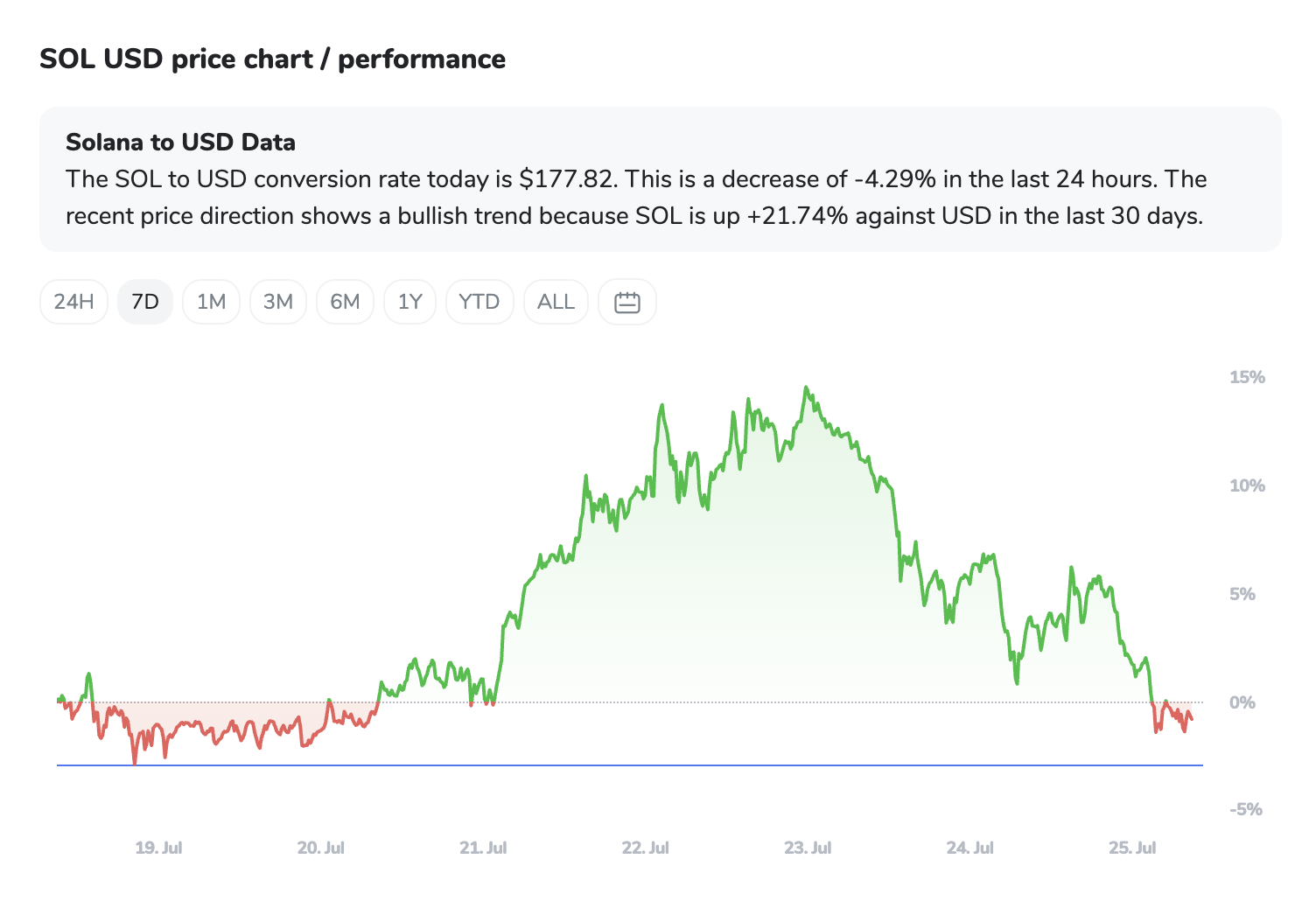

Solana (SOL): Riding the Bullish Wave

Solana, currently at $179 (down 3.27% in 24h), has been on a strong bullish run in recent weeks, even briefly touching $200. Technical indicators like MACD are flashing positive, and while its RSI is nearing overbought, the overall picture looks robust.

Analysts are eyeing a potential "cup and handle" pattern, which, if it plays out, could see SOL breaking above $185 and even challenging the $250 resistance. It's a reminder that beneath Bitcoin's steady hand and Ethereum's institutional charm, altcoins are still capable of their own powerful moves.

Market Sentiment: Greed with a Grain of Salt

The Crypto Fear & Greed Index stood at 70 ("Greed") on July 25th, a slight dip from 71, and down from 74 earlier in the month, but still a significant jump from "Neutral" a month ago. This sustained "Greed" is primarily fueled by renewed institutional interest and strong ETF demand. The slight cooling of sentiment and minor outflows from some Bitcoin ETFs suggest that while the market is optimistic, investors are also engaging in disciplined profit-taking and rebalancing — a healthy sign of maturity rather than irrational exuberance.

The ICONOMI Angle

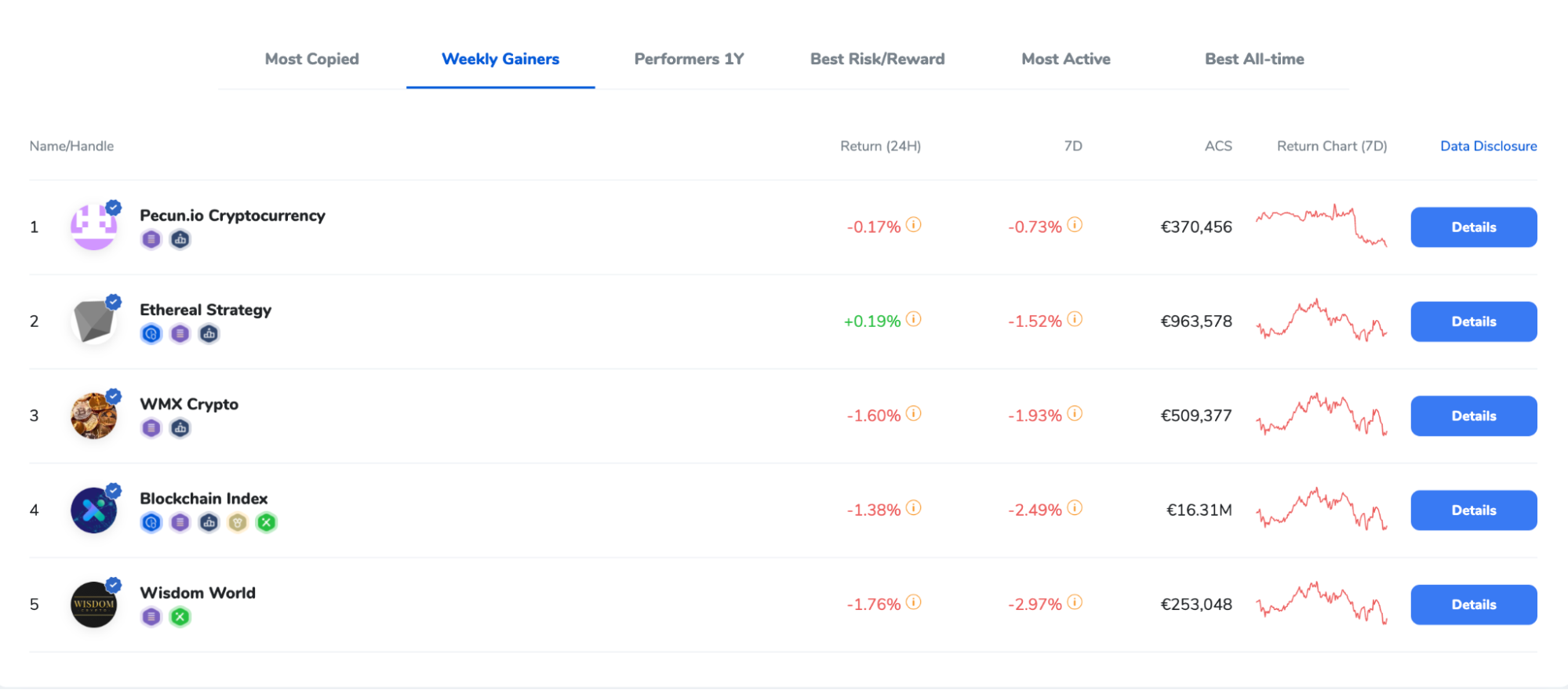

While the broader market sentiment flashes "Greed" and ETF inflows remain strong, ICONOMI's top strategies this week reflect a slightly more nuanced picture, perhaps indicating some internal rebalancing or the specific assets held.

Pecun.io Cryptocurrency, heavily weighted in stablecoins and PAX Gold, saw a modest -0.68% return, unsurprising given its defensive posture.

More aggressive strategies like CopyTrader, with its mix of BTC, ETH, BNB, SOL, and AVAX, registered a -1.03% weekly return.

Similarly, Ethereal Strategy (ETH-heavy) was down -0.96%, WMX Crypto (BTC, ETH, SOL) saw a -1.3% dip, and Blockchain Index was down -1.87%.

These slight negative returns, even as the market maintains a "Greed" outlook, suggest that smart money isn't just mindlessly chasing pumps. Instead, it indicates a period of slight consolidation or profit-taking within the portfolios, aligning with Bitcoin’s current retrace from its local highs.

It’s a good reminder that diversification and strategic adjustments are key even in an optimistic market.

What to Watch Next

Institutional Adoption & ETF Flows

Keep an eye on the sustained volume and direction of capital into Spot Bitcoin and Ethereum ETFs. Are Ethereum's 15-day inflow streaks merely a blip or the start of a long-term trend of ETH gaining institutional mindshare?

Regulatory Evolution

Any significant progress on U.S. crypto legislation could unlock a new wave of institutional capital. Still, evolving scrutiny on DeFi data governance and smart contract legalities bears watching for potential compliance burdens.

Ethereum's Pectra Upgrade

This significant network upgrade is anticipated to enhance staking capabilities and scalability, potentially bolstering ETH's utility and appeal to investors seeking yield.

Solana's Ambitious Roadmap

Monitor developments around Solana's plans to double block space, implement the Alpenglow consensus, and launch the Firedancer validator client. These technical advancements are crucial for its "Internet Capital Markets" vision.

Federal Reserve Action

The timing and magnitude of any interest rate cuts will be a significant factor in determining broader market liquidity and appetite for risk assets like crypto.

DeFi Innovation

Continued growth and new product launches within decentralised finance, especially on Ethereum and Solana, will be key indicators of genuine network utility and adoption.

FAQs

Why is Ethereum outperforming Bitcoin right now?

Ethereum's recent outperformance is primarily attributed to growing institutional interest, robust on-chain activity, and a consistent streak of inflows into Ethereum Spot ETFs. This suggests that a significant portion of institutional capital is increasingly favouring ETH, perhaps due to its robust DeFi ecosystem and anticipated network upgrades.

The market sentiment is "Greed," but some prices are down. What gives?

"Greed" sentiment reflects optimism and demand, often driven by strong ETF inflows and long-term bullish outlooks. However, it doesn't preclude short-term price corrections or profit-taking. Bitcoin, for example, saw a retrace after a strong rally, and some institutional investors are likely managing risk by taking profits, leading to a healthy rebalancing rather than a complete market reversal.

Are institutional investors still actively buying crypto?

Absolutely. Despite some short-term profit-taking, the overall trend of institutional capital flowing into crypto remains strong, particularly evident in the significant combined net inflows into Spot Bitcoin and Ethereum ETFs this week. Ethereum ETFs, particularly, are showing remarkable consistency in attracting new funds, highlighting continued institutional appetite.