Crypto Weekly Wrap: 26th September 2025

September's Grip Tightens: When "Fear" Isn't Just a Feeling, It's a Market State

Another week, another reminder that gravity, both literal and metaphorical, tends to win in the end. The crypto market spent the past seven days doing its best impression of a nervous squirrel, scampering around but ultimately finding little comfort.

With Bitcoin, Ethereum, and Solana all registering declines, driven by a cocktail of macroeconomic anxieties and cooling institutional appetite, the prevailing mood is less "to the moon" and more "wait, where did my keys go?"

It seems September, true to its historical form, is proving to be less of a gentle nudge and more of a firm shove into a 'risk-off' posture.

The Macro Lens

If you've been wondering why your portfolio has felt like it's trying to win a limbo contest, look no further than the usual suspects in the broader economy.

The Crypto Fear and Greed Index has taken a rather dramatic dive, settling firmly in the "Fear" zone (28-32), which, if we're being honest, feels about right.

This isn't just arbitrary sentiment; it's a reaction to a perfect storm of macro pressures. We've had more hawkish statements from Federal Reserve officials, sounding like a broken record about "higher for longer" interest rates and inflation's stubborn refusal to play nice.

This, naturally, has investors "selling the Fed cut news" – essentially, pre-emptively bailing on risk assets because the promised liquidity injection isn't materialising as quickly as hoped.

Add to this a healthy dose of U.S. government shutdown fears – a recurring drama that never fails to sprinkle uncertainty on everything – and a strengthening U.S. dollar, which tends to act as a vacuum cleaner for global liquidity, sucking demand away from riskier assets like crypto.

The collective result? A significant wave of liquidations of leveraged positions across the market. Think of it like a chain reaction in a crowded room: one person stumbles, and suddenly everyone's falling over themselves, exacerbating the downward pressure.

It's a classic 'risk-off' environment, where safety, even if it’s just the perceived safety of cash, trumps potential upside.

The Crypto Lens

Bitcoin (BTC)

In the digital asset realm, the headwinds were clear. Bitcoin (BTC), currently around $109,530, is down 1.81% over 24 hours. Its recent performance could be described as "stubbornly resilient" for most of September, but even Bitcoin finds its limits.

We're seeing consolidation, and the technical signals hint at a short-term bearish bias. A break below the $107,000–$105,000 support could intensify selling pressure, and nobody wants that kind of intensity.

The all-time high region of $124,000 feels a distant memory for now, with resistance firmly planted around $114,000–$115,000.

Ethereum (ETH)

Ethereum (ETH), at $3,923.66 and down 1.84% in 24 hours, finally conceded the $4,000 psychological battleground. Its performance continues to diverge from Bitcoin, suggesting some different institutional calculus at play, perhaps related to ongoing regulatory jitters or specific ecosystem dynamics.

ETH needs to hold its $3,800 support level to avoid a deeper correction, as continued selling pressure makes every dollar count.

Solana (SOL)

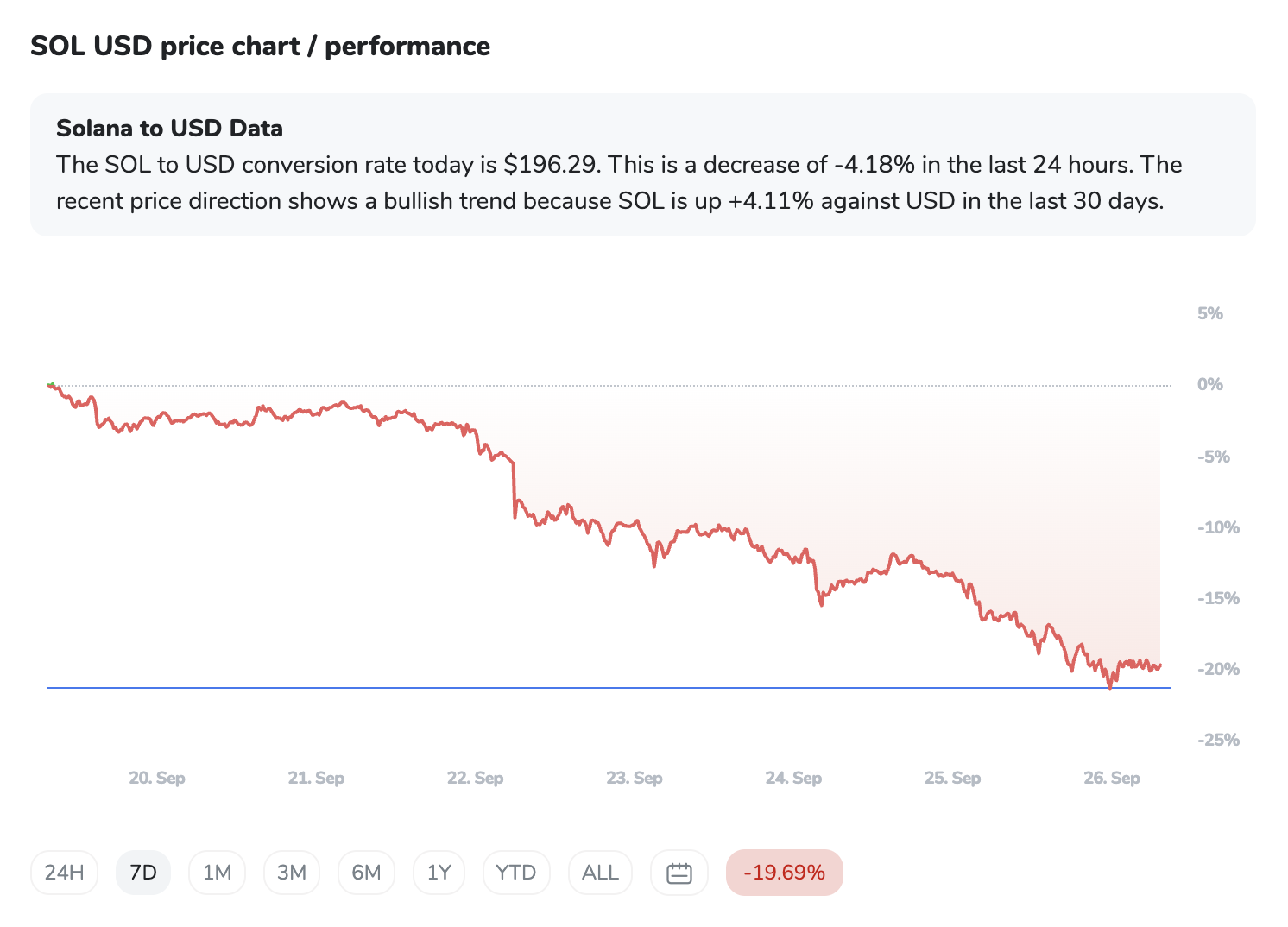

Solana (SOL), trading at $195.67 with a 3.97% 24-hour dip, is also feeling the squeeze. Despite its ecosystem showing strong recovery signs and developer interest, the price action is consolidating below key resistance.

Mixed momentum indicators mean it's dancing on a tightrope; a breach of critical support around $190 could spell further downside, even with its long-term potential.

ETF flows

As for ETF flows, the story is a tale of two digital cities. Spot Bitcoin ETFs saw a momentary sigh of relief on September 24th with a significant rebound in inflows ($128.9M for BlackRock's IBIT, $37.72M for Ark's ARKB, etc.).

This glimmer of renewed institutional confidence, however, was somewhat overshadowed by a broader cooling of demand for Bitcoin ETFs since early September, and fresh outflows on September 25th (Fidelity's FBTC losing $114.8M). Ethereum ETFs, meanwhile, continue to be the less favoured child, experiencing net outflows for multiple consecutive days (Fidelity's FETH, BlackRock's ETHA).

This divergence paints a picture where institutions, while perhaps still dipping a toe in BTC, are decidedly more cautious about ETH, reflecting a persistent undercurrent of concern across the board.

The ICONOMI Angle

In a market defined by "Fear," the performance of ICONOMI strategies offers a real-world look at how different approaches weathered the storm. It’s here that the value of diversification, especially into stable assets, becomes strikingly clear.

The Pecun.io Cryptocurrency strategy, for instance, posted a surprising +2.01% weekly return. How did it manage this feat when everything else was dipping? A quick glance at its composition (50.94% USDC, 49.04% PAXG, 0.02% BTC) reveals the secret: a near 100% allocation to stablecoins and PAX Gold. In a 'risk-off' environment, these assets tend to hold their value, or even appreciate relatively, as investors flee volatile options. It's the equivalent of having a sturdy umbrella when everyone else is caught in a downpour.

Conversely, strategies with higher crypto exposure felt the chill. Wisdom Stable (-2.04%) and Wisdom Balanced (-5.75%) both saw negative returns, though their significant allocations to PAXG and stablecoins (like Tether and USDC) likely cushioned the blow compared to a purely crypto-heavy portfolio. This demonstrates a strategic balancing act, aiming for growth but with a built-in safety net.

Then there’s HODLers, reporting a -5.48% return, despite its 100% USDC composition. This is an interesting data point, suggesting that even holding stablecoins can sometimes register a nominal negative return depending on the specific tracking or fee structures involved. More broadly, its composition signals a purely defensive stance, opting out of market volatility altogether.

Finally, COINBEST INDEX, with its substantial BTC (82.41%) and ETH (9.86%) allocation, reflected the broader market's decline with a -5.94% weekly return. This is a classic example of a strategy that tracks the pulse of the major cryptocurrencies, and when they sneeze, it catches a cold. These varying outcomes underscore the importance of understanding underlying asset allocations, particularly when market sentiment turns south.

What to Watch Next

Navigating these choppier waters requires a keen eye on a few key indicators and potential turning points. Don't predict, just monitor:

Federal Reserve's Next Move: Any hint of a shift from a hawkish stance to a more accommodative one, particularly regarding interest rate cuts, could inject much-needed liquidity and confidence into riskier assets. Keep an ear to their speeches and economic data releases.

Regulatory Rhapsody: The ongoing U.S. Senate discussions on crypto regulations, coupled with any coordinated clarity from the SEC and CFTC, could provide a foundation for renewed institutional trust and adoption. Uncertainty is kryptonite; clarity is rocket fuel.

Protocol Progress: Major upgrades, like Stellar Protocol 23, Solana's Alpenglow consensus overhaul, and Ethereum's Pectra upgrade, are foundational. Successful implementation can enhance network efficiency and scalability, proving tangible value amidst price fluctuations.

Institutional Adoption & ETF Expansion: Beyond Bitcoin, the approval of new spot ETFs for other cryptocurrencies (e.g., Solana, XRP) could open new floodgates of institutional capital, legitimising and broadening the market.

Whale Watching: Persistent accumulation by large holders ("whales") often signals long-term conviction, irrespective of short-term volatility. Their movements can be a quiet indicator of underlying confidence.

The "Uptober" Effect: Historically, October has sometimes brought positive momentum to crypto. While past performance is no guarantee, seasonal patterns can influence sentiment and trading behaviour.

Macro Headwinds Persistence: Continued fears of a U.S. government shutdown, stubbornly high inflation, and an unwavering hawkish Fed stance remain significant overhangs that could keep markets subdued.

Token Unlocks & Leverage: Watch out for large token unlocks (especially after September's record $4.5 billion), which can increase circulating supply and selling pressure. High leverage in the market means that small dips can still trigger cascading liquidations.

Geopolitical Jitters: Any escalation in global tensions tends to strengthen the U.S. dollar and push investors into traditional safe havens, away from volatile assets.

FAQs

Why is the crypto market currently dominated by "Fear"?

The prevailing "Fear" is a response to a combination of macroeconomic factors. Hawkish statements from the Federal Reserve about interest rates and inflation, looming fears of a U.S. government shutdown, and a strong U.S. dollar are all pushing investors into a "risk-off" mindset, favouring safety over growth. This has also led to significant liquidations of leveraged positions, further driving down prices and sentiment.

Are institutional investors still active in crypto, or are they pulling back?

Institutional sentiment is mixed and showing divergence. While spot Bitcoin ETFs saw a brief but notable surge in inflows on September 24th, overall institutional demand for Bitcoin has cooled since early September. Ethereum ETFs, on the other hand, have experienced consistent net outflows, suggesting a cautious approach or persistent concerns among institutional players regarding ETH specifically.

What are the key price levels to watch for Bitcoin and Ethereum in this environment?

For Bitcoin, critical support levels are around $109,314, and more significantly, the $107,000–$105,000 range. If these don't hold, selling pressure could intensify. Resistance is around $114,000–$115,000. For Ethereum, the psychological $4,000 mark has been breached, making $3,800 a crucial support level to prevent deeper corrections. Overhead resistance lies around $4,200.26 and the $4,400–$4,500 region.