Crypto Weekly Wrap: 14th November 2025

When the Market Catches a Chill, But Some Still See Sun

This week, the crypto markets decided to channel their inner Hamlet, grappling with a profound sense of "to fall or not to fall." While broader sentiment plunged into "Extreme Fear," pushing Bitcoin and Ethereum down significant percentages, a curious divergence emerged. Solana, despite the backdrop of broad outflows, managed to continue attracting capital.

Is this the market panicking, or just reallocating its chips while everyone else looks the other way? Let’s unravel what drove the market's jitters and where smart money might be looking.

The Macro Lens

The week's overarching theme could be summed up by the Crypto Fear & Greed Index, which plunged to a grim 15 points, signalling "Extreme Fear" – a level not seen since February. It’s as if the market collectively decided to don a tinfoil hat and prepare for the worst.

This isn't crypto-specific paranoia; it's a direct reflection of traditional finance's anxieties bleeding into the digital realm. Lingering uncertainty around upcoming CPI data, the stubborn climb of long-term Treasury yields, and the spectre of tightening financial conditions have combined to create a macroeconomic headwind that even Bitcoin couldn't escape.

Adding to the gloom, enthusiasm for the AI sector, which had been a quiet tailwind, appears to be waning, pulling some capital from risk assets. In essence, the global economy's indigestion gave crypto a bad case of the jitters.

The Crypto Lens

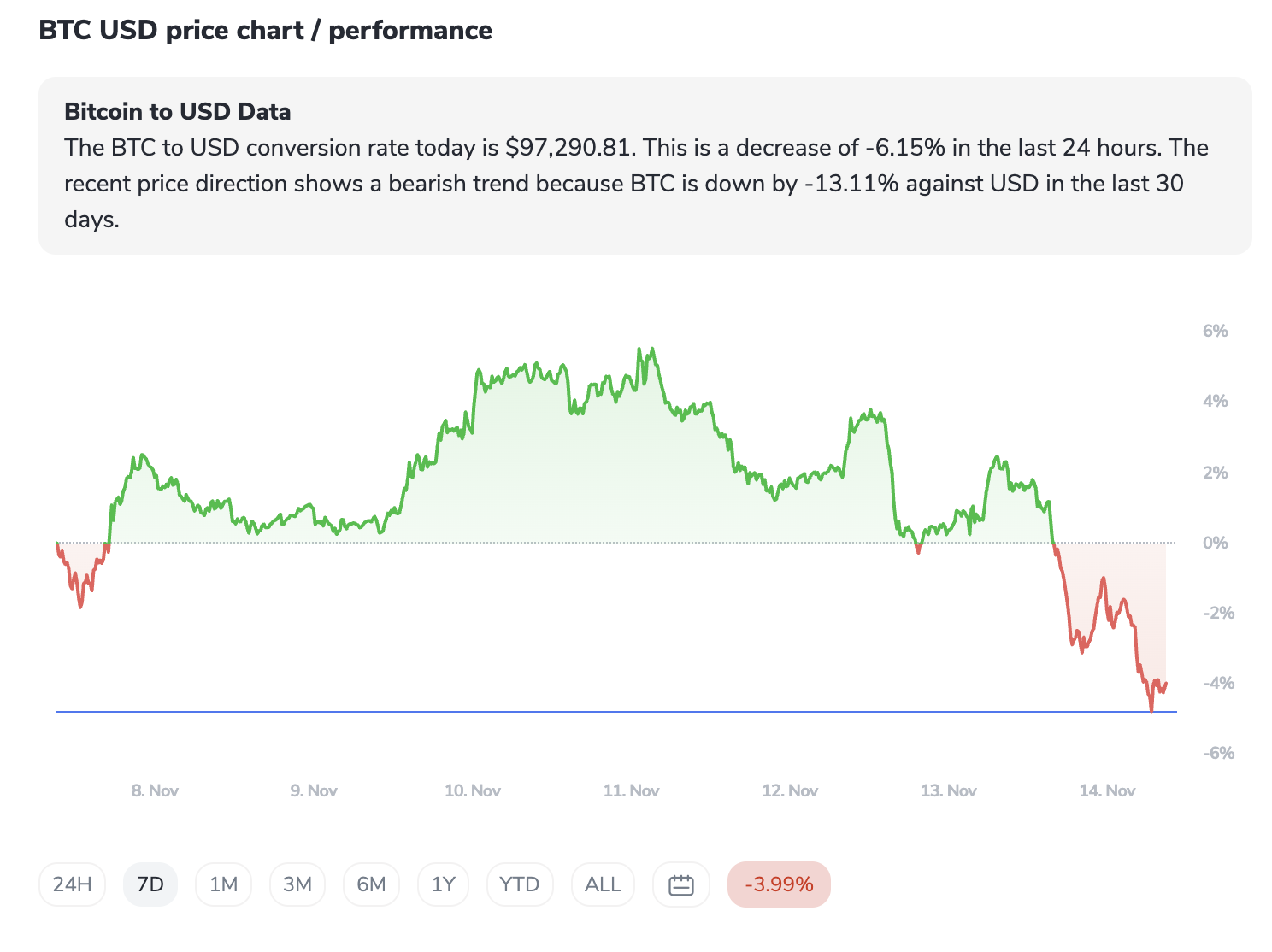

Bitcoin (BTC)

Against this backdrop of macro-induced anxiety, the major digital assets had a tough outing. Bitcoin (BTC), after flirting with its October peak near $126,000, saw a significant pullback, dipping below the psychologically critical $100,000 mark to trade around $97,032 – a 6.46% drop in 24 hours. It's currently testing key support levels, which are less fun to talk about than resistance levels when you're going down.

Ethereum (ETH)

Ethereum (ETH) fared even worse, shedding 9.82% in 24 hours to land at $3,196.33. It simply couldn't hold above $3,550 and has, at least for now, entered a short-term bearish zone.

But here's where the plot thickens, or thins, depending on your perspective: ETF flows. Spot Bitcoin ETFs had a rollercoaster week. They kicked off with a robust $524 million inflow on November 11th, giving a fleeting sense of hope. That hope was quickly dashed by dramatic outflows of $278 million on November 12th and a staggering $866.7 million on November 13th. Ouch. Spot Ethereum ETFs? Consistent outflows totalling over $360 million in just two days.

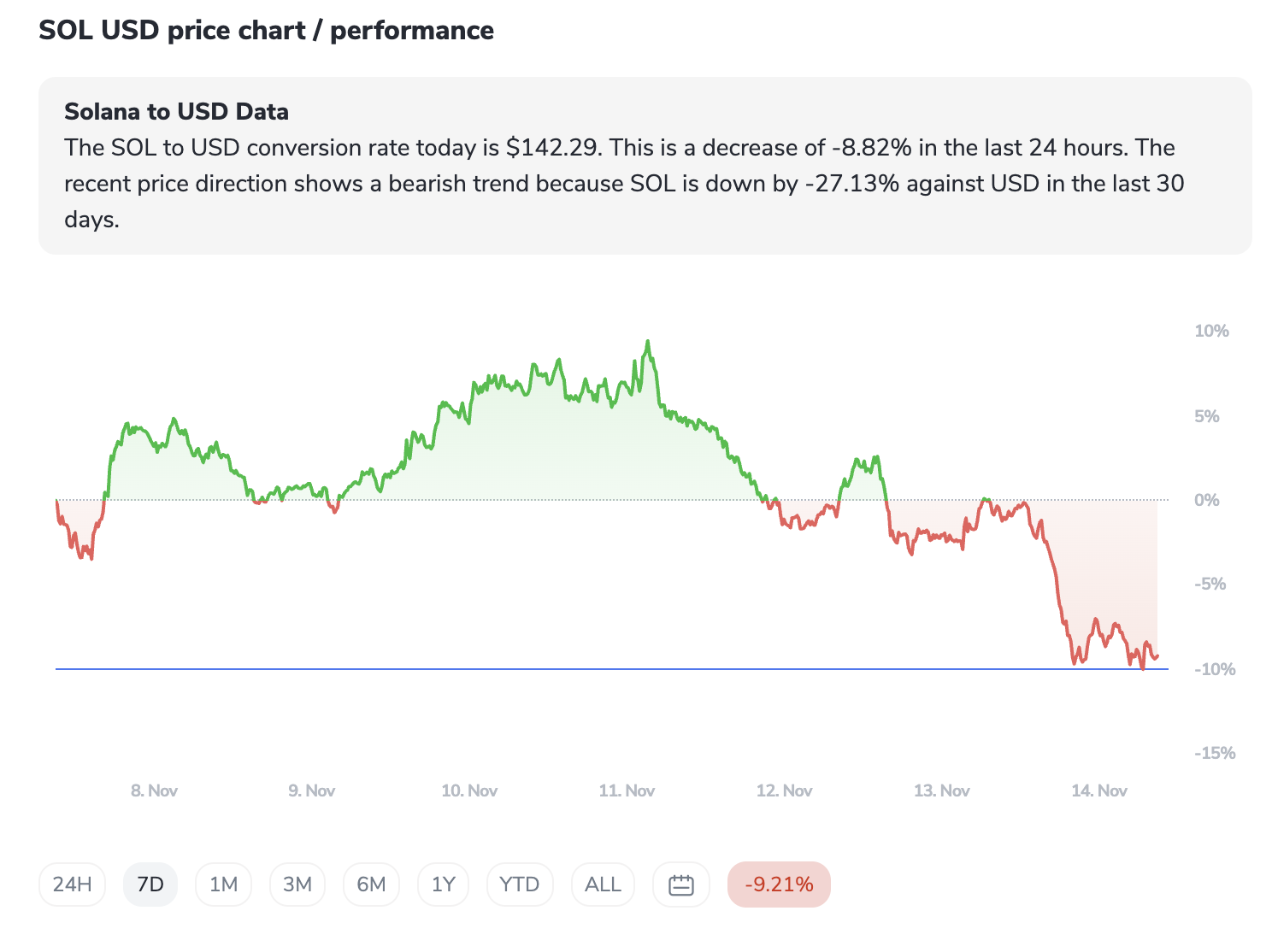

Solana (SOL)

Then there's Solana (SOL). Despite dropping 9.23% in 24 hours to $141.8 and currently testing its own critical support at $140, its spot ETFs have been a different story. They've maintained a positive inflow streak, extending what some might call a quiet rebellion against the prevailing market malaise. This suggests a potential rotation of capital, with some investors perhaps seeing opportunity in altcoins even as Bitcoin struggles for demand. The widespread "Extreme Fear" could be a capitulation point – the moment "weak hands" surrender to "strong hands" – but so far, that conviction hasn't quite translated into a market rebound for the big two.

The ICONOMI Angle

In a week marked by widespread market fear and red candles, a review of ICONOMI strategies provides some interesting insights into how various approaches navigated the turbulence. Strategies with diversified or defensive allocations showed relative resilience.

Wisdom DeFi, perhaps surprisingly given the overall market mood, posted a positive weekly return of +2.04%. This highlights a potential rotation or sustained interest in specific decentralised finance assets like Uniswap (UNI), Quant (QNT), and Polkadot (DOT), which make up significant portions of its composition. It seems some corners of DeFi are still finding pockets of opportunity even when the giants falter.

Similarly, Pecun.io (+0.96%) and Wisdom Stable (+0.61%) both managed to end the week in the green. Their secret? A healthy allocation to PAX Gold (PAXG) and stablecoins (USDC, USDT). This reinforces the classic flight-to-safety narrative, with investors seeking refuge in assets perceived as more stable during periods of high volatility. PAXG, essentially digital gold, lived up to its role as a hedge.

Meanwhile, strategies with higher crypto exposure, like Wisdom Balanced (-0.18%) and Wisdom Moderate (-0.99%), experienced slight drawdowns, though these were relatively contained compared to the broader market’s double-digit drops.

This demonstrates the inherent trade-off: higher potential returns come with greater sensitivity to market downturns. The divergence in performance across ICONOMI strategies this week perfectly illustrates the value of diversified approaches and the varied risk appetites among investors, with some finding strength in defensive plays and others in specific altcoin niches.

What to Watch Next

The Federal Reserve's next moves: Will the two anticipated rate cuts materialise this quarter, or will persistent inflation fears keep the Fed hawkish? This will be a primary driver for risk assets.

Regulatory Rhythms: Keep an eye on the SEC's decisions regarding the 16 altcoin ETF filings expected in late October/November 2025. Positive movement here could spark significant capital inflows beyond Bitcoin.

Ethereum's Evolution: The upcoming Fusaka upgrade will be critical for ETH's narrative and potential outperformance.

Solana's Staying Power: Can SOL maintain its positive ETF momentum and attract more capital, especially with potential selling pressure from the FTX/Alameda bankruptcy estate looming? Its ability to hold critical support will be key.

Macro Headwinds: Global trade friction, particularly between the US and China, and the ongoing saga of Treasury yields and CPI prints could continue to dictate overall market sentiment.

Leverage Levels: High leverage in crypto derivatives markets remains a systemic risk, capable of triggering cascading liquidations that exacerbate price movements.

FAQs

Why is market sentiment in "Extreme Fear" despite some bullish long-term predictions?

Short-term market sentiment is heavily influenced by immediate macroeconomic concerns like inflation, rising Treasury yields, and central bank hawkishness. While long-term catalysts (like ETF approvals and network upgrades) exist, current global economic uncertainties are overriding near-term optimism, leading to widespread risk aversion.

What do the divergent ETF flows for Bitcoin, Ethereum, and Solana tell us?

The volatile Bitcoin ETF flows (large inflow followed by even larger outflow) suggest a lack of sustained demand and potential profit-taking. Consistent Ethereum ETF outflows indicate broader bearish sentiment for ETH. Conversely, Solana's consistent ETF inflows suggest a belief in SOL's individual narrative and growth potential, possibly indicating a rotation of capital into specific altcoins.

Is the $100,000 level for Bitcoin significant?

Absolutely. $100,000 is a major psychological threshold. Breaking below it, as BTC did this week, often signals a loss of confidence and can accelerate selling pressure, making it a critical level for traders and investors to watch for potential reversals or further downward movement.