Crypto Weekly Wrap: 6th September 2024

Trump’s Promise to Make the U.S. the ‘Crypto Capital’

Former U.S. President Donald Trump has reiterated his goal to transform the United States into the global “crypto capital” if re-elected in 2024. Speaking at the Economic Club of New York, Trump highlighted his plans to foster a more crypto-friendly environment by eliminating regulations and embracing new technologies. His vision includes reducing regulatory hurdles, eliminating at least ten old regulations for every new one, and promoting innovation in sectors like cryptocurrency and blockchain. This announcement comes shortly after Trump's family teased a decentralised finance (DeFi) project, "World Liberty Financial," which will be built on Aave, a prominent Ethereum-based lending platform.

Trump’s proposal also included appointing Elon Musk, CEO of Tesla and SpaceX, as the head of a new “Government Efficiency Commission” tasked with auditing federal spending. The idea, originally suggested in an earlier discussion between Trump and Musk, aims to reduce inefficiencies and promote government accountability. If Trump’s economic plan is enacted, it could significantly impact the regulatory landscape for cryptocurrencies, fostering a more favourable environment for digital assets in the U.S.

Bitcoin and Ethereum Whale Activity Slows Down

Recent data shows a significant decline in whale activity across major cryptocurrencies, including Bitcoin and Ethereum. Transactions exceeding $100,000 have dropped sharply since earlier this year. Bitcoin transactions valued at over $100,000 each plummeted from 115,000 during a peak period in March to around 60,000 by the end of August. Similarly, Ethereum’s high-value transactions fell dramatically from 115,000 to just over 31,000 in the same timeframe.

This decline may not necessarily indicate a bearish trend, as lower whale activity often coincides with periods of market consolidation or reduced volatility. Analysts suggest that whales might be strategically accumulating assets in anticipation of future market movements. The current quiet period could reflect a more cautious and calculated approach by large investors, who are positioning themselves for potential gains in the months ahead.

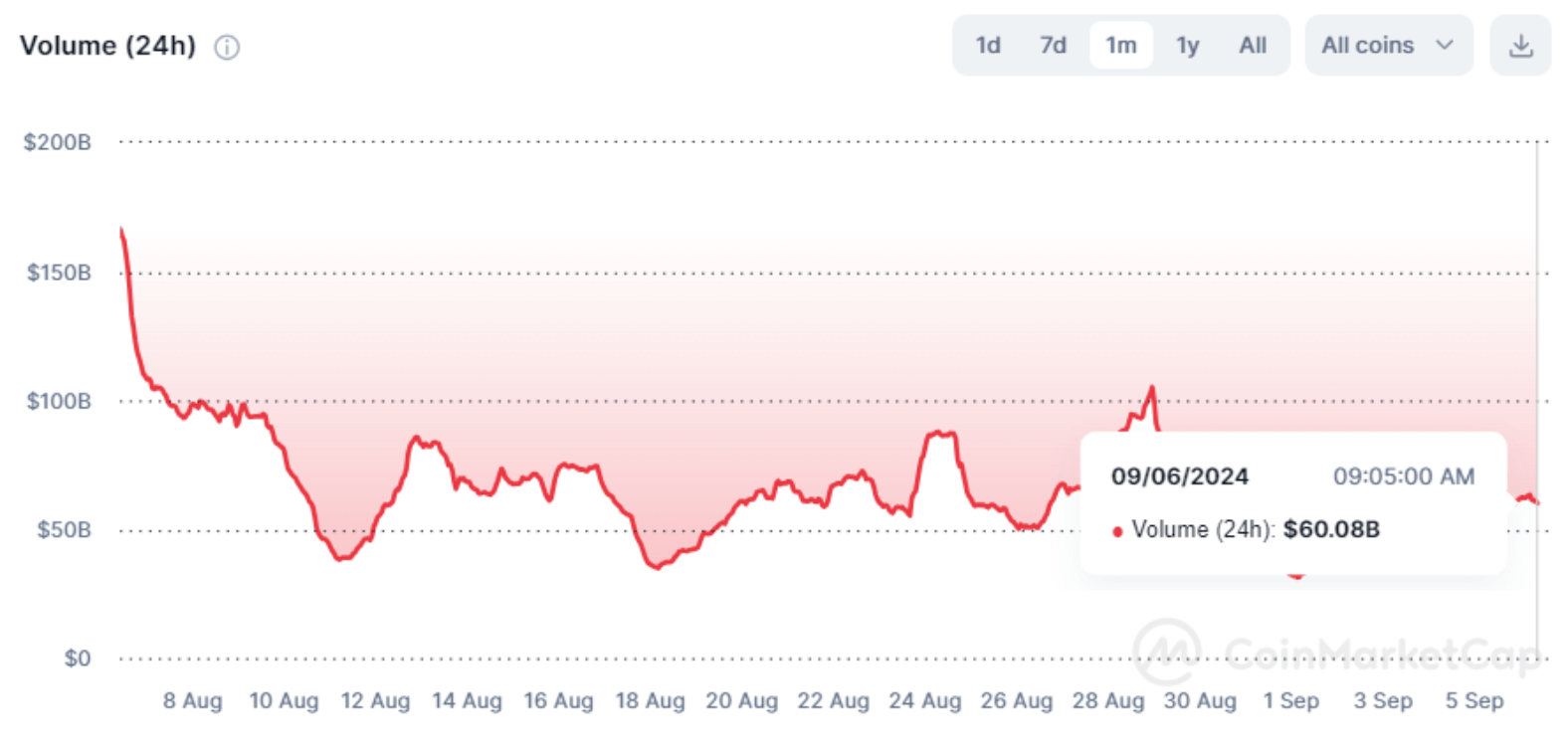

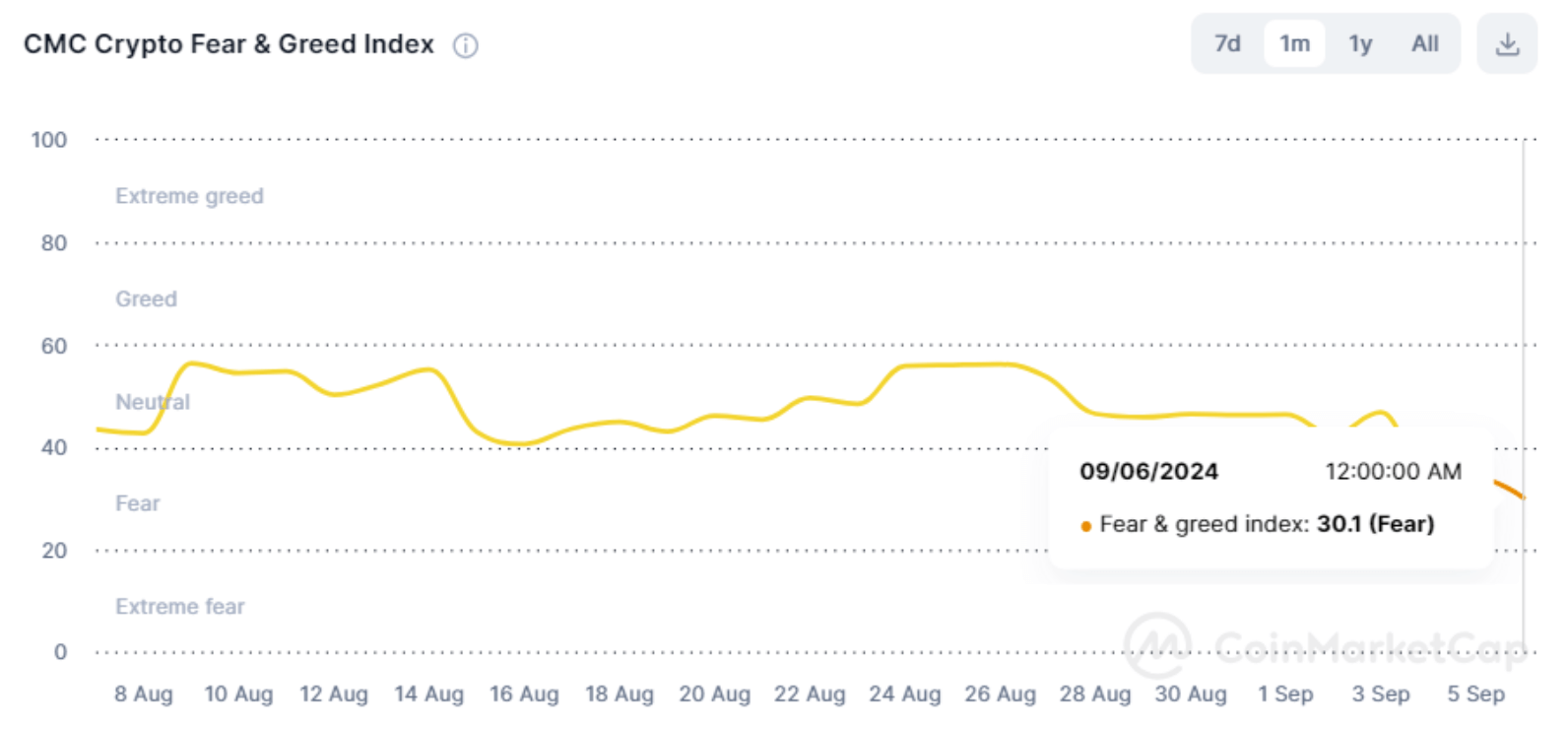

Source: Coinmarketcap

Source: Coinmarketcap

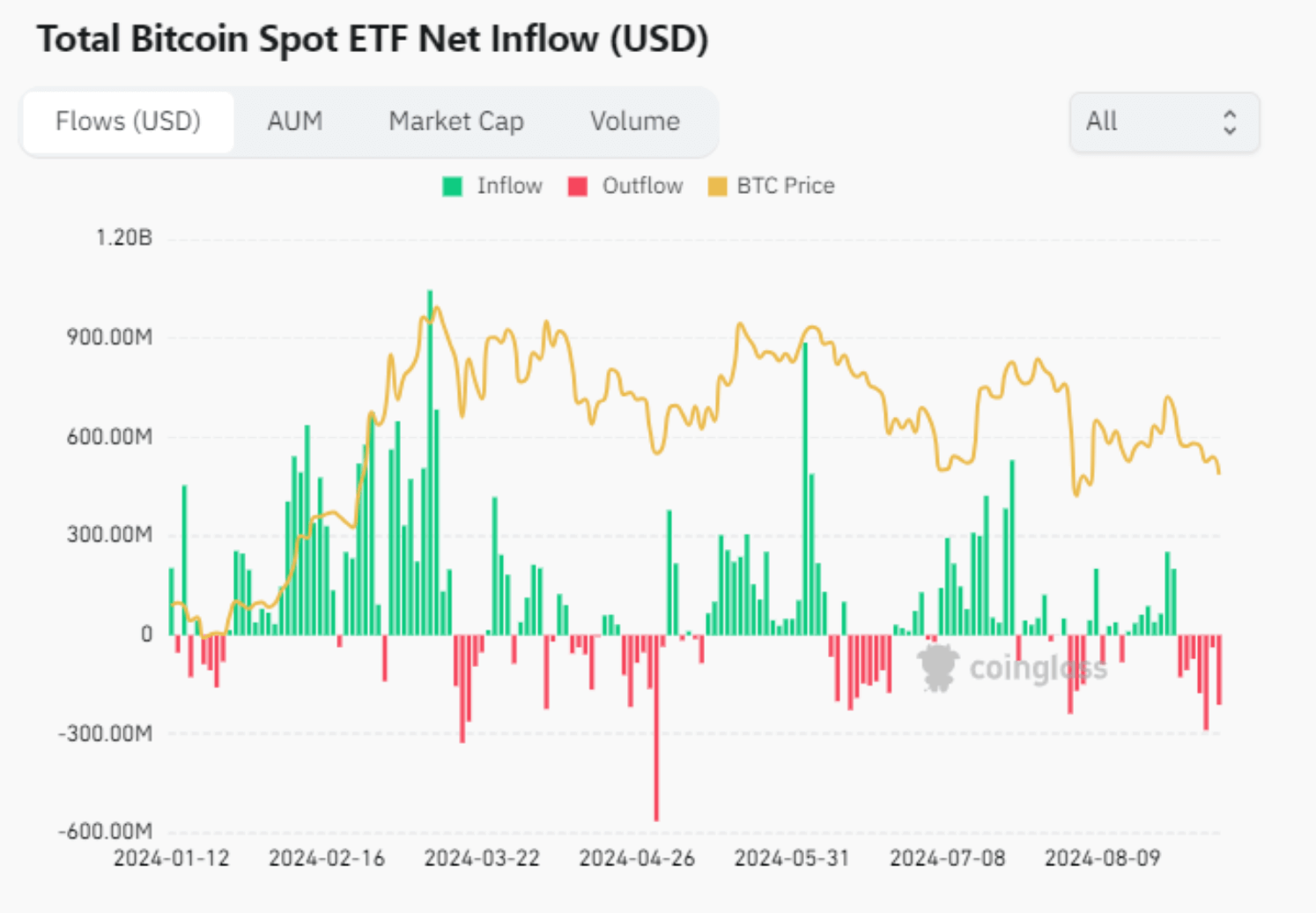

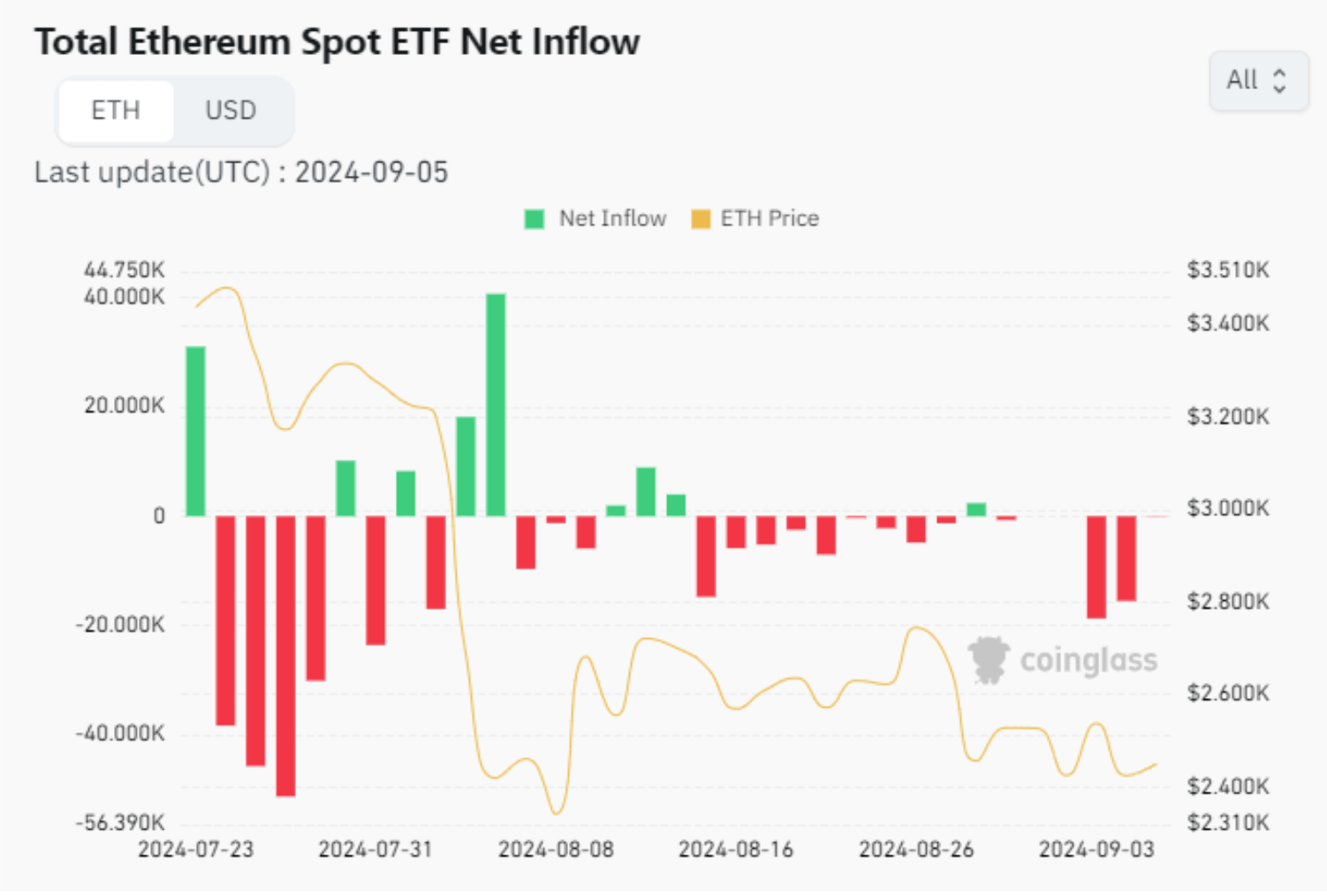

Significant Outflows Hit Ethereum and Bitcoin ETFs Amid Market Uncertainty

Recently, Ethereum and Bitcoin exchange-traded funds (ETFs) have experienced significant outflows, reflecting a shift in market sentiment amid broader economic uncertainties. U.S. spot Bitcoin ETFs, such as Fidelity's FBTC and Grayscale’s GBTC, saw their largest outflows since May 1, with a total of $287.78 million withdrawn in a single day. Similarly, Ethereum ETFs also faced notable outflows, with $47.4 million exiting the market, marking the most substantial single-day outflows since early August. These outflows are attributed to a combination of factors, including weaker-than-expected economic data, heightened concerns about potential interest rate cuts by the U.S. Federal Reserve, and overall caution among investors navigating a volatile market landscape. Despite this turbulence, the outflows may also signal a phase of repositioning, where investors strategically adjust their portfolios in anticipation of future market movements.

Source: CoinGlass

Source: CoinGlass

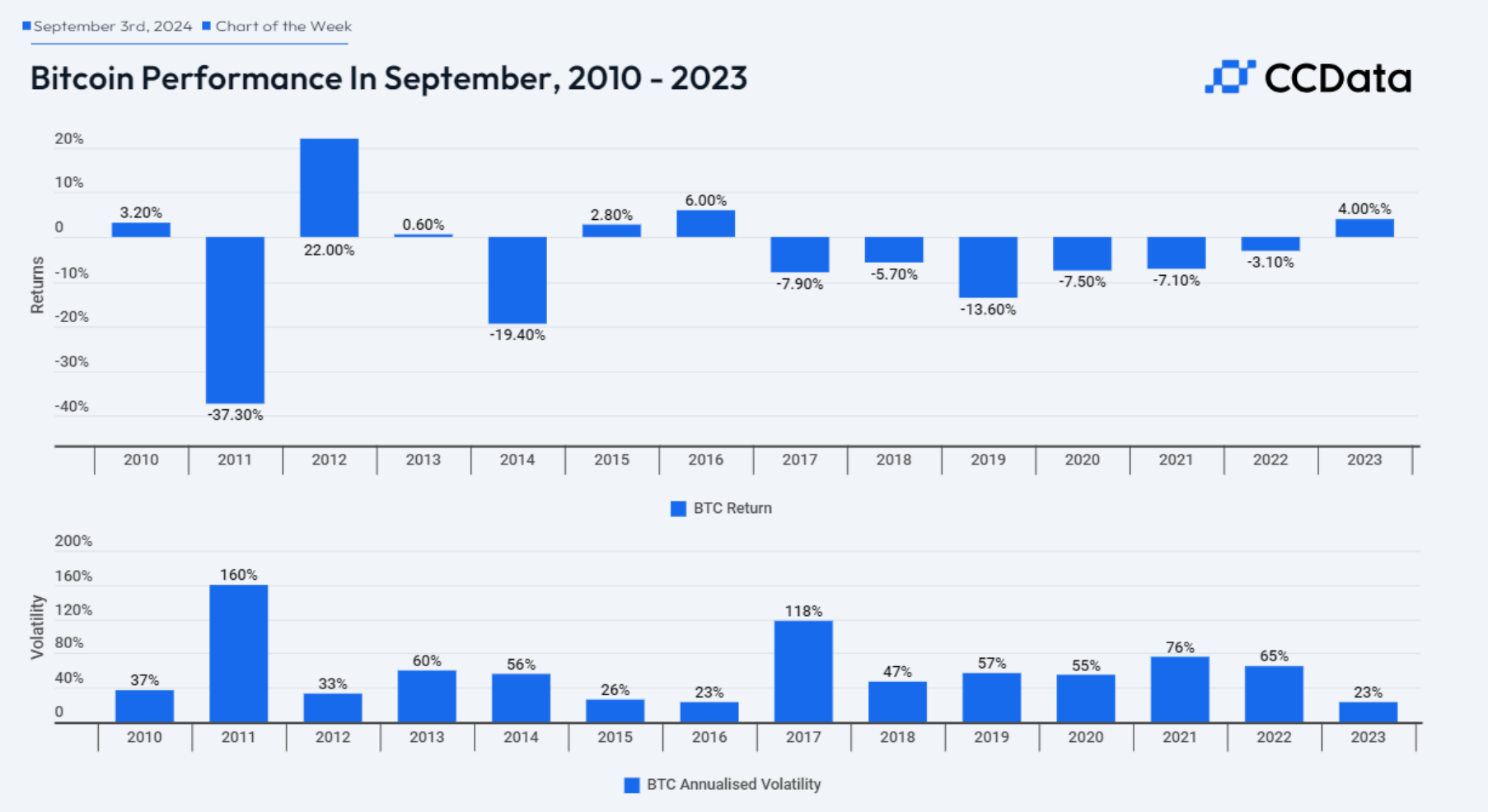

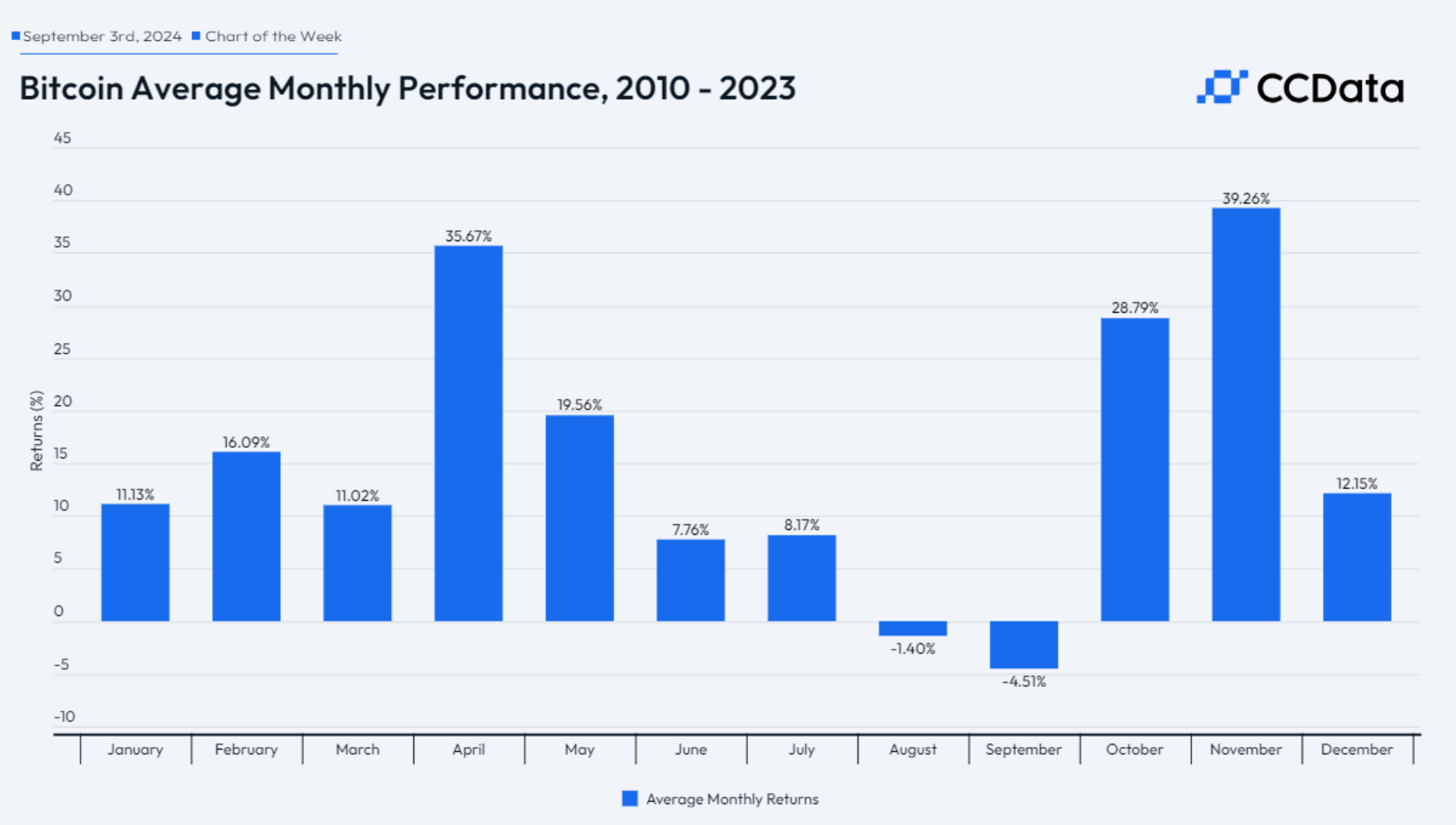

September: Bitcoin’s Historically Toughest Month with Surprising 2023 Upswing

September has historically been a challenging month for Bitcoin, with average returns of -4.51%, making it the worst-performing month for the cryptocurrency since 2010. Despite this trend, 2023 has deviated with a modest 4.00% gain, breaking a consistent pattern of negative returns observed since 2017, including sharp declines of -13.60% in 2019 and -19.40% in 2014. Interestingly, while September often yields poor performance, Bitcoin's annualised volatility during this month is not exceptionally high, averaging around 79.2%.

Source: Ccdata

Source: Ccdata

Market Reactions to Economic Policy Speculations

Market movements in the cryptocurrency sector have been heavily influenced by expectations surrounding U.S. economic policies, particularly potential interest rate cuts by the Federal Reserve. While a 25 basis point cut might offer long-term price appreciation by increasing liquidity and easing recession fears, a more substantial 50 basis point reduction could trigger a sharp correction, potentially driving Bitcoin’s price down by 15-20%.

Historical data shows that September has been a particularly volatile month for Bitcoin, and the anticipated Fed rate decision adds another layer of uncertainty. The broader market sentiment has been cautious, with traders preparing for possible downturns while remaining optimistic about long-term recovery. The evolving macroeconomic landscape will continue to play a critical role in shaping the future trajectory of cryptocurrencies.

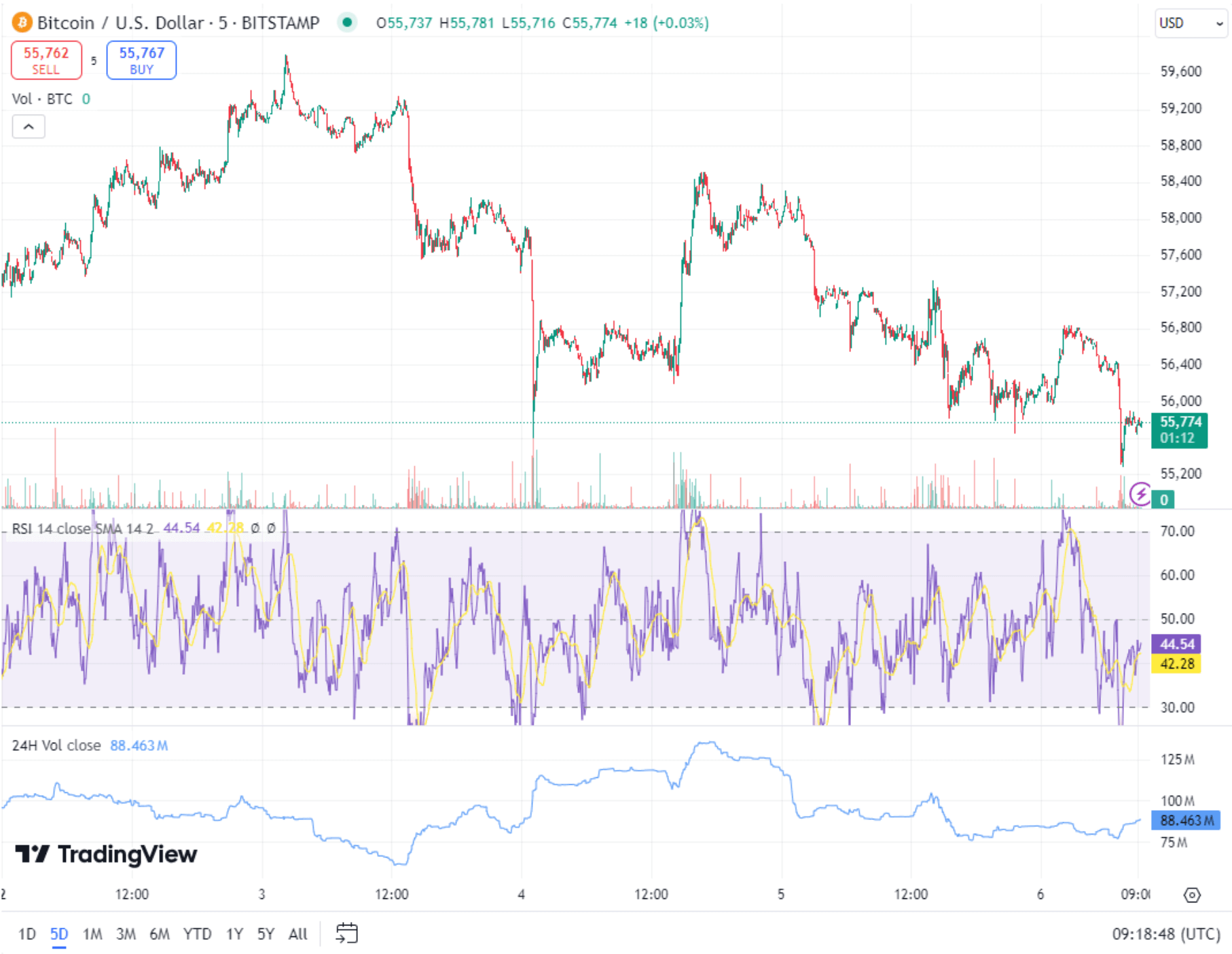

Technical Analysis: Bitcoin (BTC) Market Outlook

Bitcoin is currently experiencing a phase of consolidation after recent price declines. The asset has faced multiple resistance levels, particularly around the $57,619 and $59,992 marks. Failure to breach these resistance levels has led to a series of lower highs and a recent dip below $56,000. The asset found temporary support at $55,500, but bearish momentum suggests that further declines could be on the horizon.

Key support levels to watch are $55,246 and $52,873, which could provide a floor for Bitcoin’s price. A sustained break below these levels might trigger a more substantial sell-off, pushing Bitcoin toward the $50,000 mark.

Source: TradingView

On the other hand, if Bitcoin manages to hold above these support zones, it could signal a potential rebound. The Relative Strength Index (RSI) currently indicates neutral conditions, with neither overbought nor oversold signals, suggesting room for both upward and downward movement depending on market sentiment. Moving averages also show a mixed picture, with the 50-day moving average hovering above the 200-day moving average, indicating a possible continuation of the bearish trend unless a strong catalyst for upward momentum emerges.

Broader Market Impacts: Institutional and Retail Responses

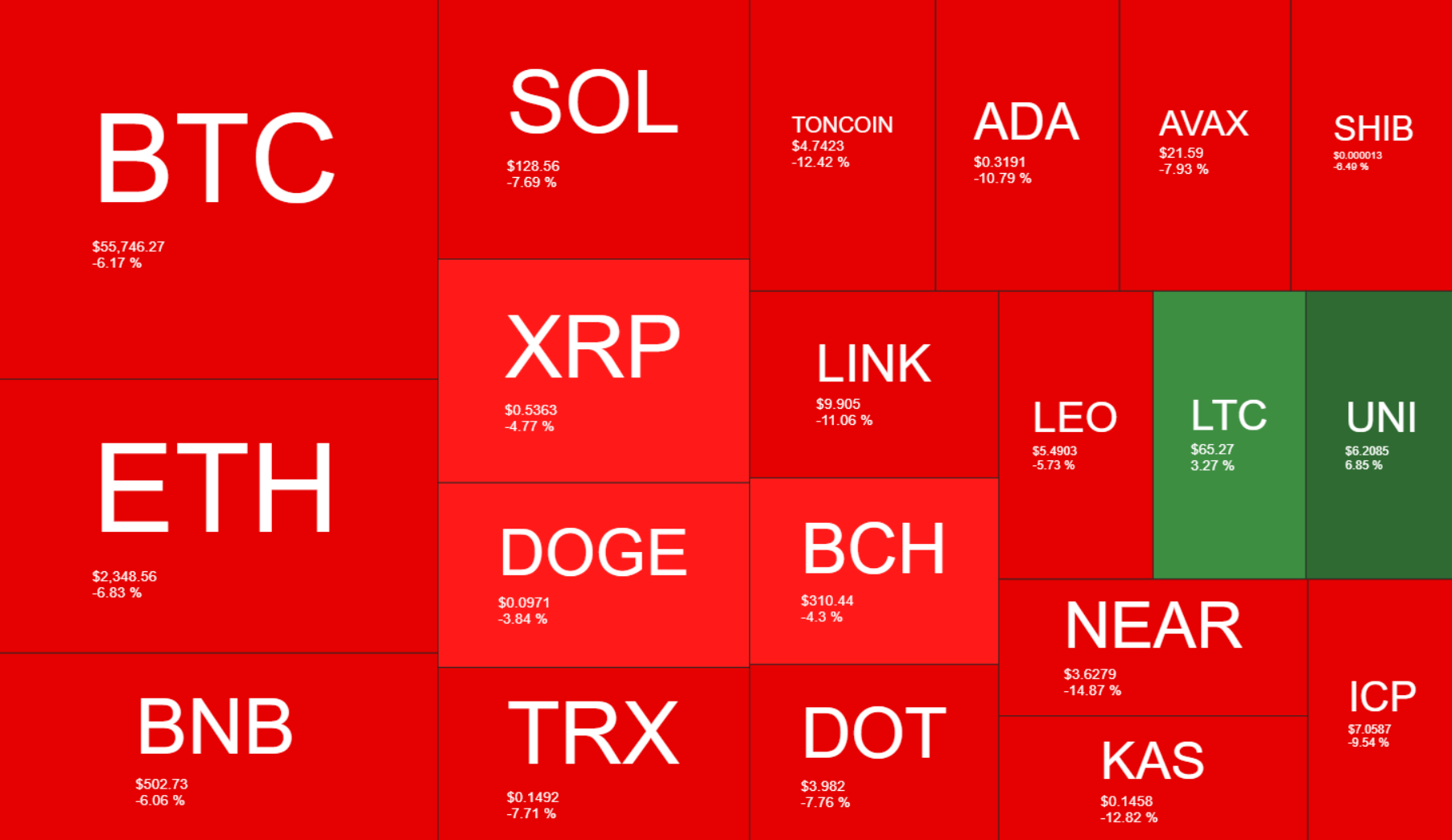

The recent crypto market turbulence has not been limited to Bitcoin alone. Other major cryptocurrencies, including Ethereum, Ripple (XRP), and Toncoin, have also seen significant declines. Ethereum has particularly struggled, dropping over 22% in the past month.

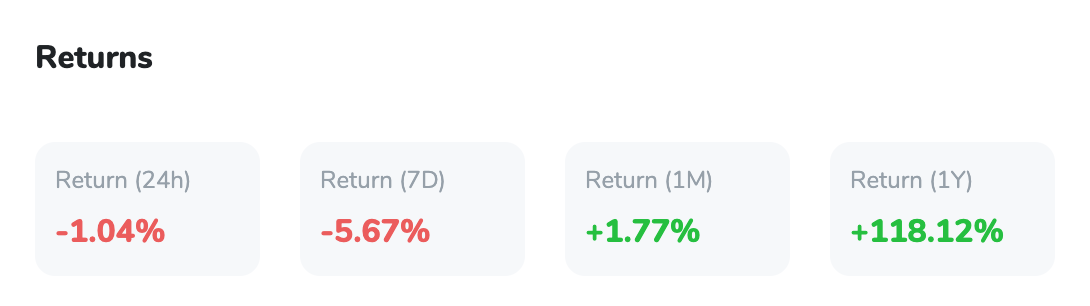

Source: Quantifycrypto

Retail investors, too, are feeling the heat, as overall market sentiment remains cautious. The ongoing consolidation phase and reduced volatility may lead to more strategic asset accumulation by both retail and institutional players. Market participants are closely monitoring macroeconomic indicators, such as U.S. employment data and inflation rates, which could further influence crypto market dynamics in the coming weeks.

Conclusion: Navigating a Volatile Landscape

The crypto market is currently navigating a period of uncertainty, influenced by macroeconomic factors, regulatory developments, and evolving investor sentiment. While there are signals of caution from both institutional and retail investors, the market's future direction remains uncertain. The potential for significant regulatory changes in the U.S., coupled with anticipated economic policy decisions, will likely play a pivotal role in shaping the market's outlook in the near term. As Bitcoin and other cryptocurrencies move through this consolidation phase, investors should remain vigilant, considering both technical indicators and broader market trends to make informed decisions.