Crypto Weekly Wrap: 24th May 2024

SEC Approves Exchange Applications to List Spot Ethereum ETFs

The U.S. Securities and Exchange Commission (SEC) approved the applications from Nasdaq, CBOE, and NYSE to list exchange-traded funds (ETFs) linked to the price of ether. This landmark decision signals a significant victory for both the firms involved and the broader cryptocurrency industry, which had anticipated rejection just days prior.

The SEC's sudden request for exchanges to refine their filings at the start of the week led to a frenzied effort to complete the necessary adjustments. The agency's approval indicates a shift in its approach towards cryptocurrency-related financial products, echoing the earlier approval of spot bitcoin ETFs following Grayscale Investments' successful court challenge.

Despite the approval, the market response has been cautious. Ether's price saw a modest 2% increase, reflecting a wait-and-see approach from investors. The SEC's order doesn't guarantee the immediate launch of these funds, contributing to the subdued reaction. Additionally, Ethereum ETFs are expected to start on a smaller scale compared to Bitcoin ETFs, partly due to structural differences and regulatory uncertainties, particularly around staking services.

Biden's Stance on the House Crypto Market Structure Bill

The White House has recently expressed opposition to the U.S. House of Representatives passing the Financial Innovation and Technology for the 21st Century Act (FIT21), a bill aimed at redefining crypto market structures. Despite this opposition, President Joe Biden has not threatened to veto the bill, which is a somewhat positive sign for the crypto industry. The administration's main concern is the lack of investor protections in the current form of the bill.

They have indicated a willingness to collaborate with Congress on future legislation to ensure a comprehensive and balanced regulatory framework for digital assets. This approach contrasts with the stance of SEC Chair Gary Gensler, who has repeatedly stated that the industry does not need additional crypto-specific legislation. The House is set to vote on the FIT21 bill, which aims to create new definitions for digital assets and delineate the regulatory responsibilities of the SEC and Commodity Futures Trading Commission (CFTC).

Trump Accepts Crypto Donations

In a notable development for the 2024 U.S. presidential campaign, Donald Trump has become the first major party candidate to accept cryptocurrency donations. His campaign started accepting donations in bitcoin, ether, and other digital currencies. This move comes after Trump declared himself the "crypto candidate" at a Mar-a-Lago event, signalling a friendly stance towards digital currencies. While Trump has not yet proposed specific crypto policies, his acceptance of crypto donations marks a significant shift in the political landscape, especially given the Biden administration's generally anti-crypto stance. This move may influence the Democratic party's approach to crypto legislation, as indicated by the House Democratic leadership's recent decision not to push against a bill on crypto policy.

London Stock Exchange to List Crypto ETPs

The London Stock Exchange (LSE) is set to list crypto exchange-traded products (ETPs) for the first time. WisdomTree and 21Shares have received approval from the Financial Conduct Authority (FCA) to list their bitcoin and ether ETPs, which are expected to start trading on May 28. This approval follows the FCA's decision to relax its stance on crypto ETPs, which had been banned for retail investors since 2020. However, these products will only be available to professional investors. The LSE's move comes several months after the U.S. greenlit spot bitcoin ETFs, reflecting a growing acceptance of crypto assets in major financial markets.

BlackRock's Spot Bitcoin ETF Sees Major Inflows

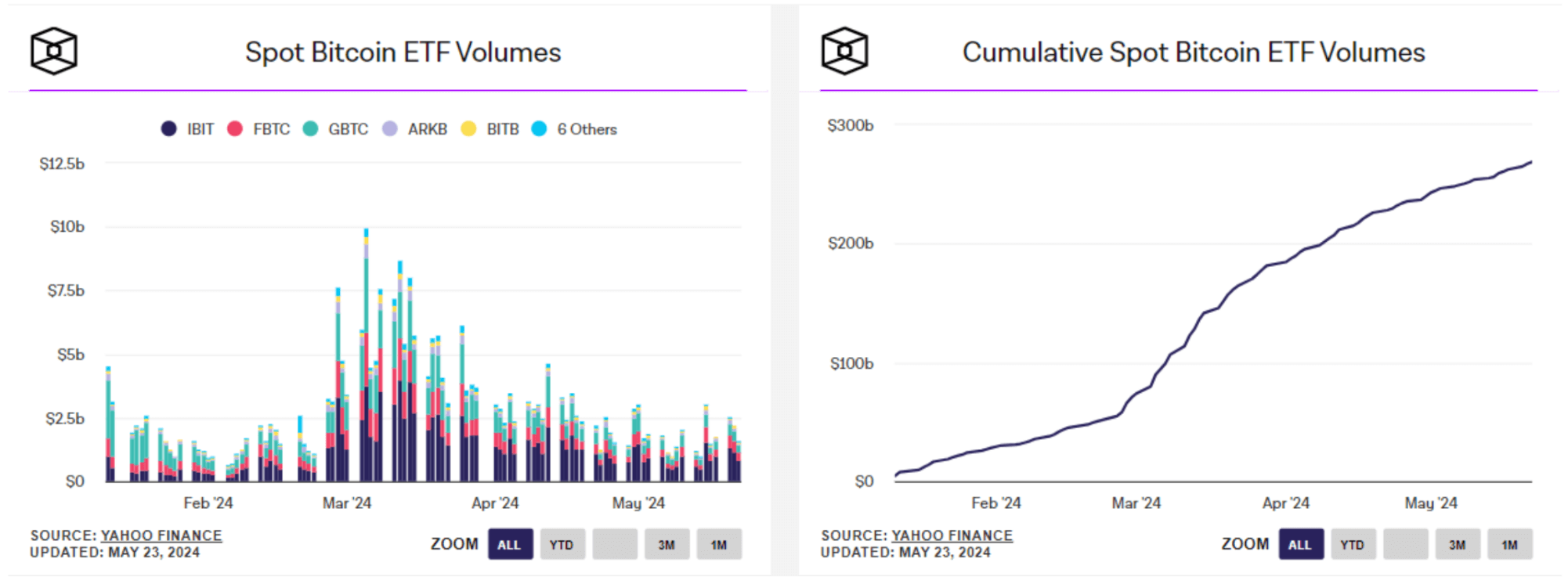

Bitcoin spot ETFs in the U.S. have experienced significant inflows recently, with BlackRock's IBIT product leading the way. The IBIT ETF saw an inflow of over $290 million in a single day, marking its highest one-day inflow since April. Overall, ETFs saw nearly $300 million in net inflows, with Grayscale’s GBTC showing a five-day streak of inflows. This surge in activity comes as bitcoin trades around the $70,000 level, driven by optimism for the approval of Ethereum spot ETFs and positive signals from Donald Trump’s campaign. The strong performance of BlackRock's IBIT, which now holds over $19 billion in assets, indicates growing institutional demand for bitcoin.

Source: TheBlock

Current Market Overview

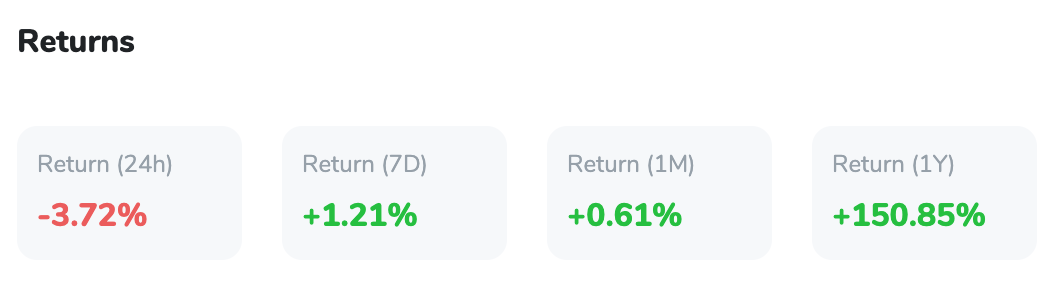

Bitcoin (BTC) is currently trading at $67,044.74, experiencing a 3.71% dip in the last 24 hours. With a market cap of $1.3 trillion and a 24-hour trading volume of $42.4 billion, Bitcoin's recent downward trend has sparked renewed interest in its future price predictions.

Technical Analysis

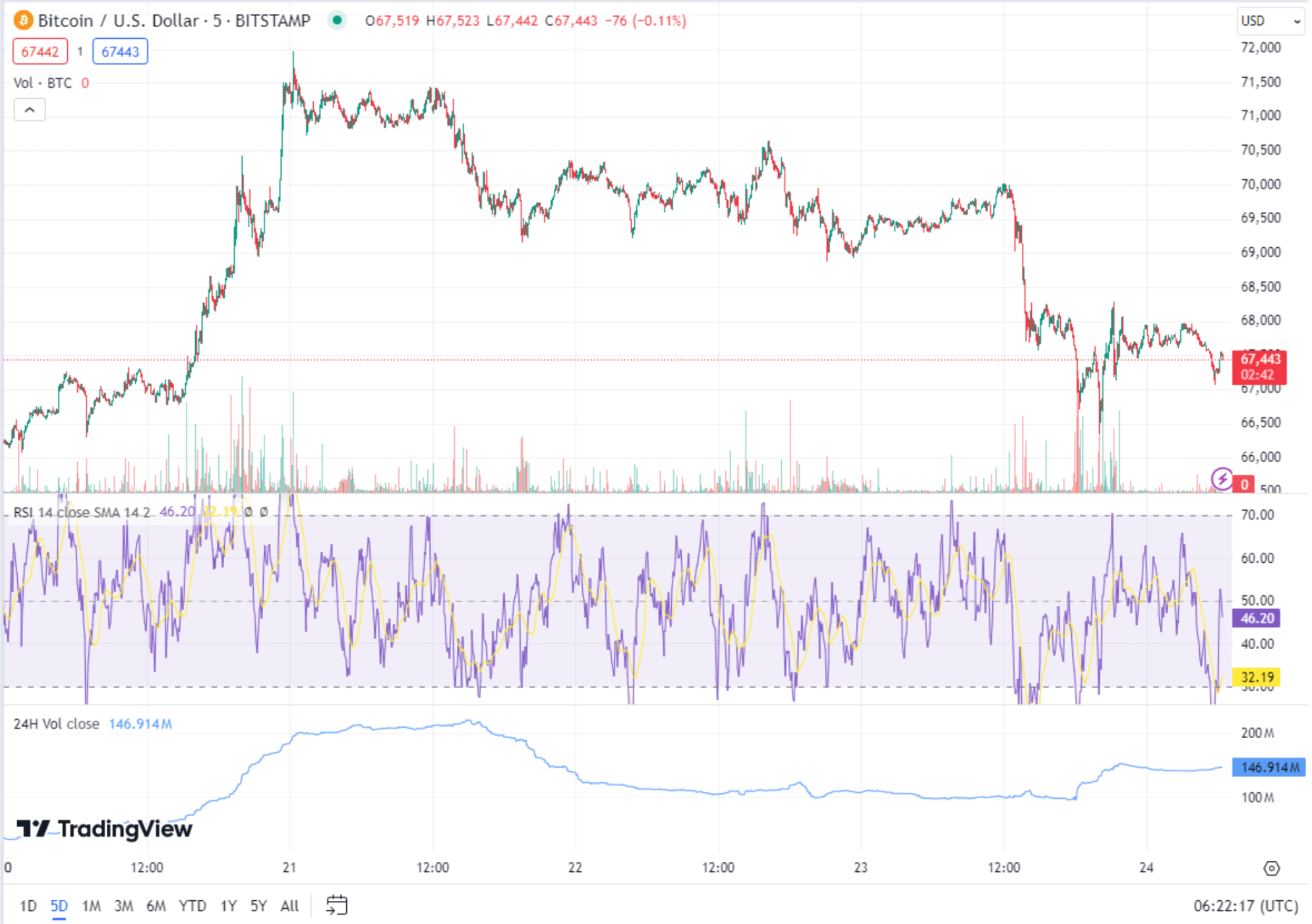

As of now, Bitcoin's price is hovering around $67,523, reflecting a slight bearish sentiment. The pivot point at $68,260 is crucial for determining the trend direction. Immediate resistance levels are identified at $70,030 and $71,460. These levels could act as significant barriers to upward movement.

On the downside, support levels are at $66,360 and $64,947. These levels offer potential buying opportunities if the price continues to decline. The Relative Strength Index (RSI) is at 46, indicating that Bitcoin is approaching oversold conditions, which could suggest a potential reversal or stabilisation around this level. The 50-day Exponential Moving Average (EMA) is at $68,615, acting as a resistance level close to the pivot point.

Price Prediction Strategy

Technically, Bitcoin shows signs of potential bearish movement as it trades below the pivot point. An effective entry strategy would be to sell below $68,263, targeting a take-profit level of $66,357 and setting a stop loss at $70,029. This approach leverages the potential for further decline while managing risk.

Traders should watch these key levels to make informed decisions, with a close eye on any signs of reversal at oversold conditions indicated by the RSI. As Bitcoin navigates these critical thresholds, its technical indicators suggest potential for continued bearish momentum, provided it maintains below the pivot point.