Crypto Weekly Wrap: 17th May 2024

U.S. Senate Votes to Overturn SEC's Crypto Accounting Policy

The U.S. Senate, in a notable bipartisan move, voted 60-38 to repeal the SEC's Staff Accounting Bulletin No. 121 (SAB 121), a policy mandating that companies holding customers' cryptocurrencies include them on their balance sheets. This vote followed a similar decision by the House of Representatives, despite President Biden's threat to veto the resolution. A dozen Democrats joined Republicans in this effort, signalling significant opposition within Biden’s party.

Sen. Cynthia Lummis (R-Wyo.), who spearheaded the Senate resolution, criticised SAB 121 as detrimental to financial innovation, arguing it failed to protect consumers. This legislative pushback highlights the tension between the SEC's regulatory approach and the broader financial industry's concerns. The policy's opponents argue that SAB 121, issued without the formal rulemaking process, imposes undue capital burdens on banks and stifles crypto industry growth. The Government Accountability Office sided with critics, emphasising procedural errors by the SEC.

DTCC and Chainlink's Successful Pilot for Fund Tokenization

The Depository Trust and Clearing Corporation (DTCC), in collaboration with blockchain oracle Chainlink and major financial institutions, has completed a successful pilot project aimed at accelerating the tokenization of funds. This initiative, known as Smart NAV, involved participants like JPMorgan, BNY Mellon, and Franklin Templeton, testing the use of Chainlink's interoperability protocol CCIP to distribute fund data across blockchains.

This project underscores the growing interest in blockchain technology's potential to improve operational efficiencies, speed up settlements, and enhance transparency in traditional finance. Following the pilot's success, Chainlink's native token, LINK, saw a 7% increase in value, reflecting market optimism about the project's implications for the broader financial ecosystem.

Bitcoin Rallies on Prospects of Central Bank Rate Cuts

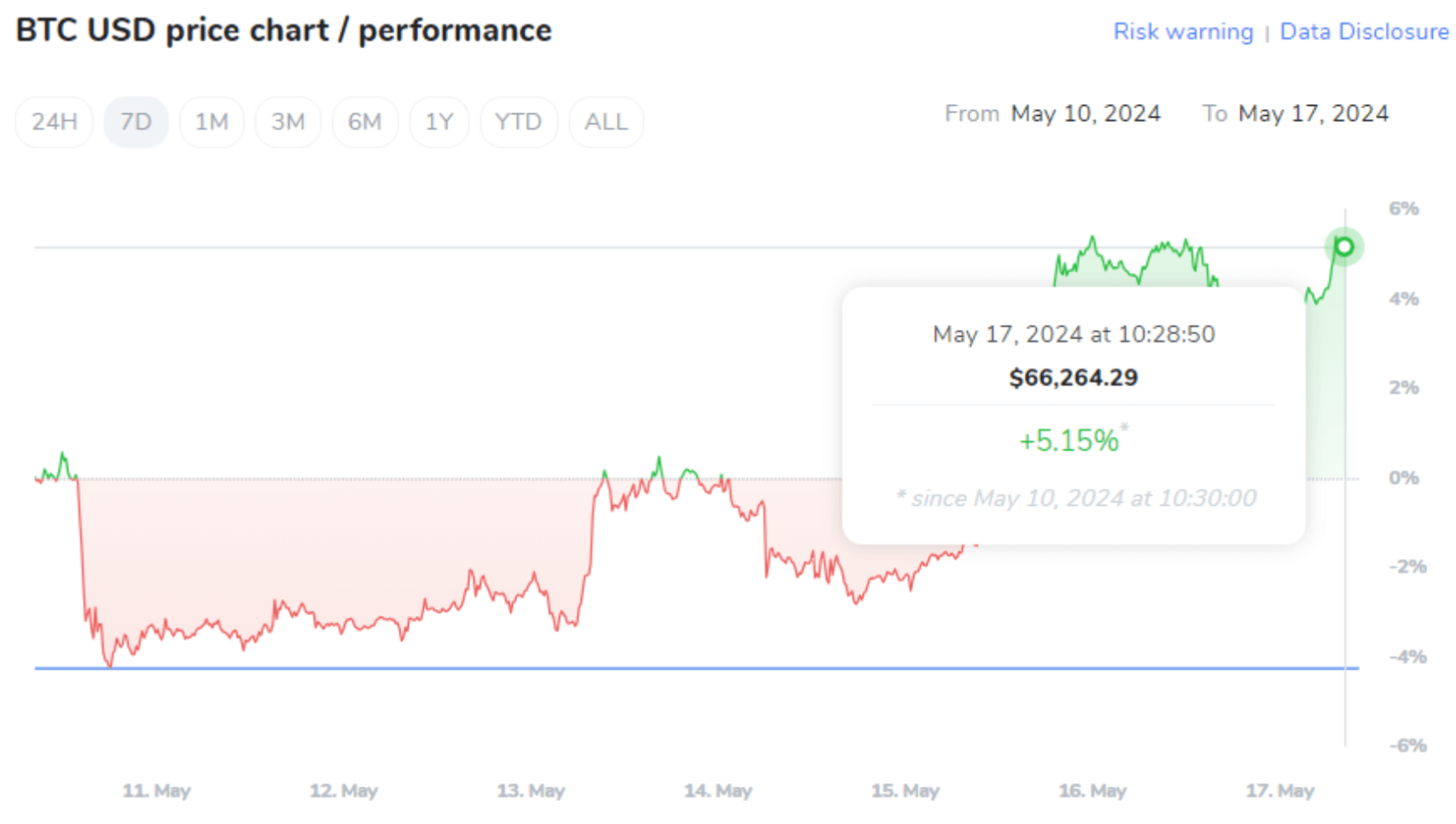

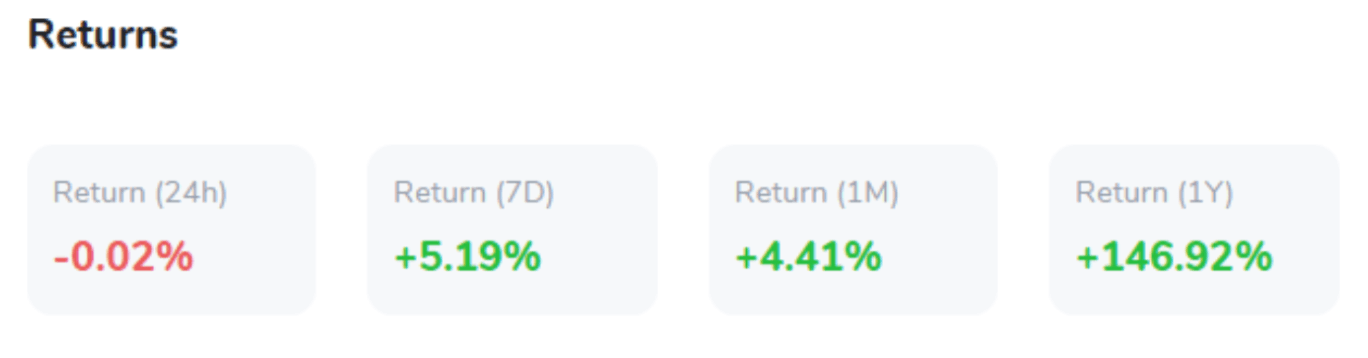

Bitcoin (BTC) experienced a significant surge, rising over 7.5% to $66,250, its best single-day performance in nearly two months. This rally was driven by weaker U.S. economic data, bolstering expectations of a Federal Reserve rate cut in September. Similar rate-cut expectations from the Bank of England and the European Central Bank in June have further fueled bullish sentiment for risk assets, including cryptocurrencies.

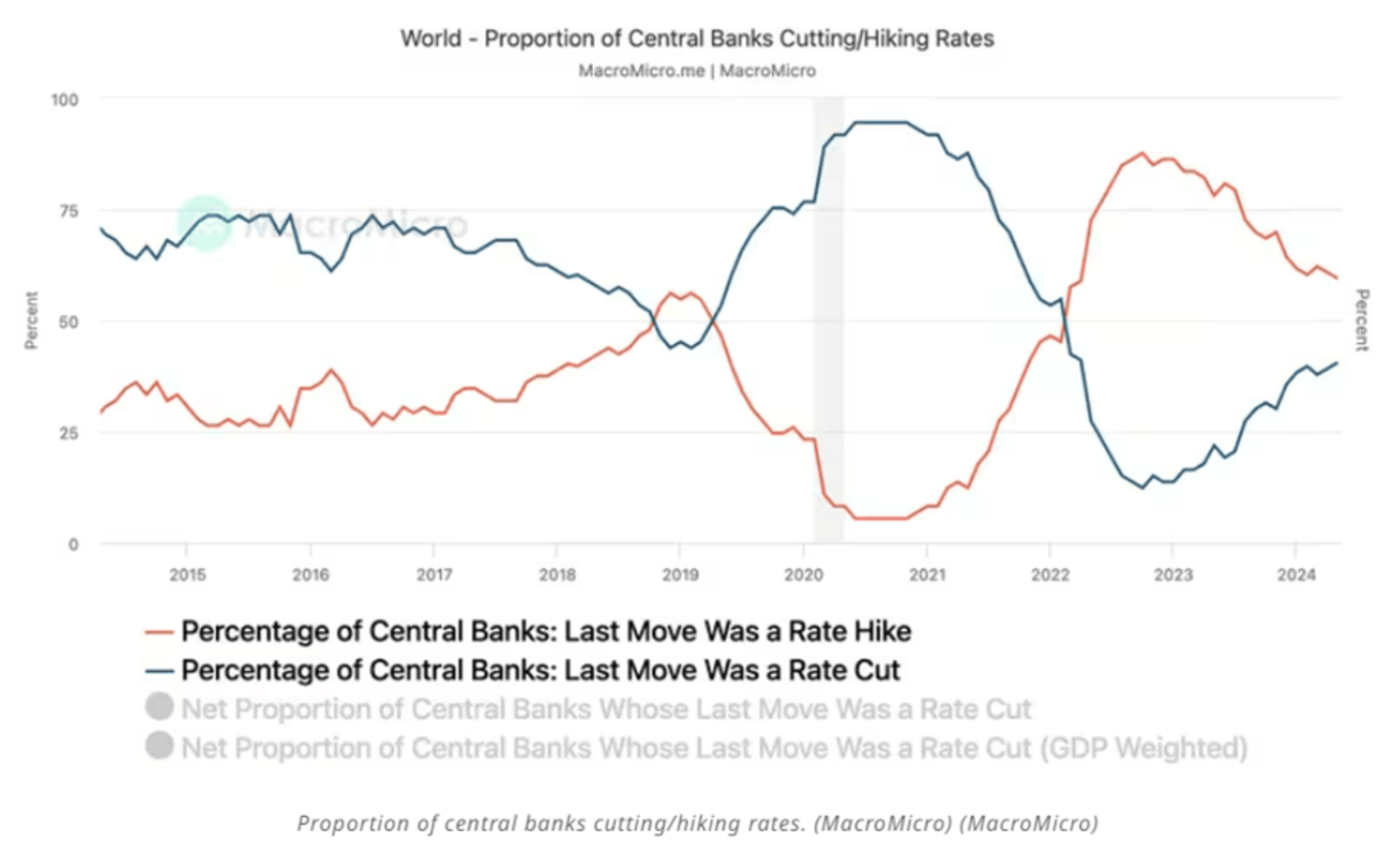

Source: MacroMicro

Recent U.S. Labor Department data indicated a slower-than-expected increase in the consumer price index (CPI) for April, supporting the case for monetary easing. As central banks globally pivot towards more accommodative policies, market liquidity is expected to improve, benefiting equities and cryptocurrencies alike. The net percentage of global central banks cutting rates is rising, a positive sign for market liquidity and investor confidence.

Former FTX Executive Seeks Leniency in Sentencing

Ryan Salame, a former executive at the defunct crypto exchange FTX, is seeking an 18-month prison sentence following his guilty plea to election fraud charges. Salame’s attorneys argue that his involvement in the fraud was peripheral and highlight his cooperation with authorities, remorse, and substantial personal financial losses due to FTX's collapse.

Salame, who managed wire deposits and fiat currency conversions at FTX, claims he was unaware of the fraudulent activities orchestrated by the company’s core leaders. His attorneys emphasise that Salame was the first to alert Bahamian authorities about the fraud, providing key documents without a grand jury subpoena. This cooperation, they argue, should be considered in his sentencing.

Bitcoin Technical Analysis: Signs of Retracement and Support Levels

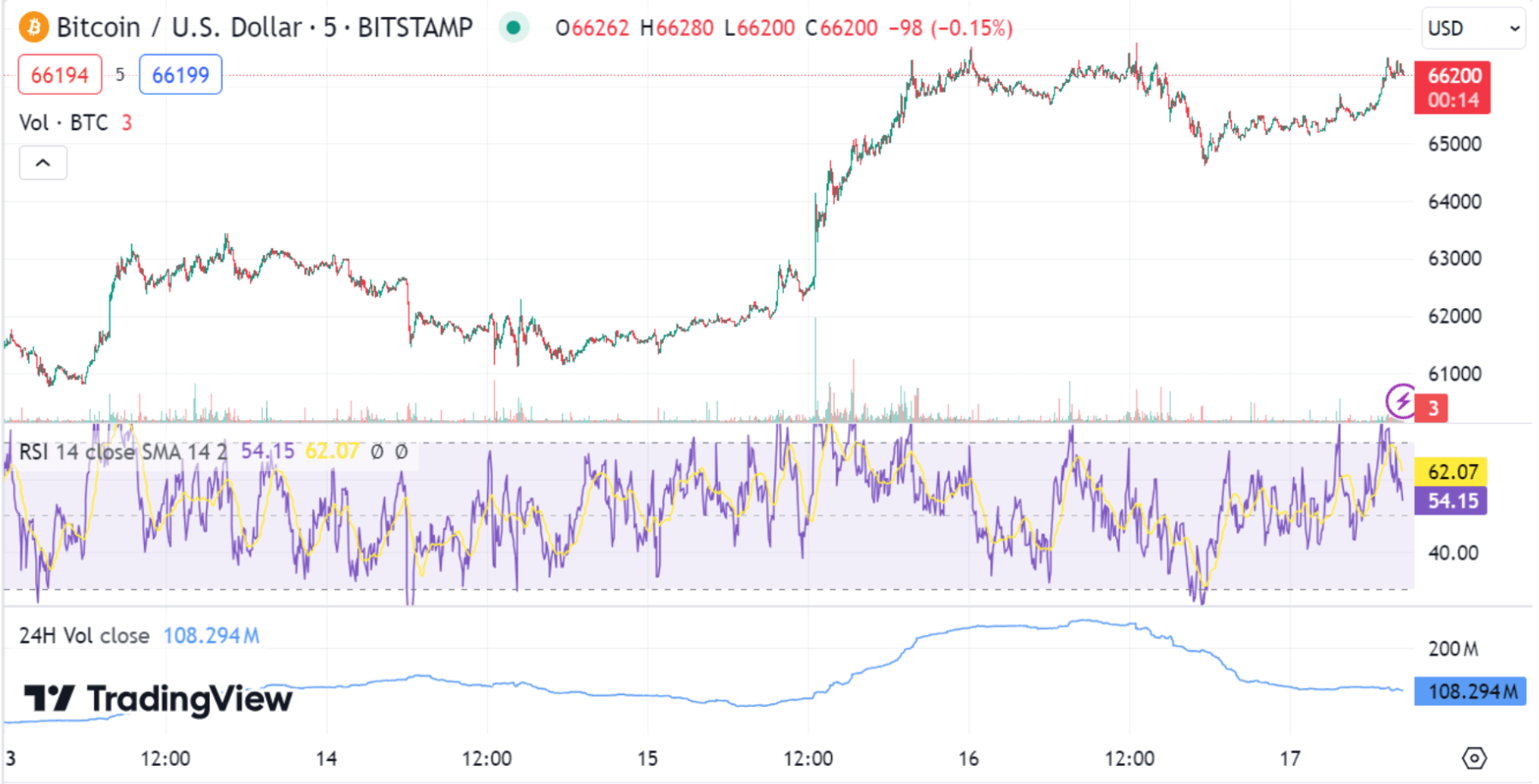

Bitcoin (BTC) has shown signs of a retracement after its recent surge, currently trading just above $66,000. This pullback follows a minor correction, with BTC completing a 38.2% Fibonacci retracement around the $64,750 level, which now acts as a critical support.

The $65,750 level serves as today's pivot point, and as long as Bitcoin holds above this threshold, a bullish bounce remains likely. Immediate resistance is anticipated around $67,600, with further resistance at $68,820. Conversely, if selling pressure intensifies, breaking below $64,750 could push BTC down to the $63,300 level, with additional support around $61,500.

Source: TradingView

The 50-day Exponential Moving Average (EMA) provides support at approximately $63,150, increasing the likelihood of a bullish rebound from this level. However, sustained selling pressure could lead to a bearish crossover below the 50-day EMA. The Relative Strength Index (RSI) has exited the overbought zone and currently sits around 62, still indicating bullish momentum.

In summary, Bitcoin's technical outlook suggests that the $64,750 and $63,300 levels are crucial for maintaining bullish sentiment. Investors should monitor these levels closely, as holding above them could sustain the upward trend.