Crypto Weekly Wrap: 14th June 2024

Ethereum ETFs Approaching Full Approval by September

Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), indicated that the final steps to approve ether-based exchange-traded funds (ETFs) are nearly complete. During a budget hearing, Gensler mentioned that the registration details are the last hurdle, with the process moving smoothly at the staff level.

This follows the SEC's initial approval of a group of ether ETFs, paving the way for them to be listed and traded similarly to the earlier established bitcoin spot ETFs. Gensler also reiterated his concerns about the non-compliant crypto industry and his reluctance to classify ETH as a commodity, a stance that contrasts with the Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam, who affirmed that ETH is a commodity.

EU Finalizes Technical Standards for Crypto Firms Under MiCA

The European Banking Authority (EBA) has published the final draft technical standards on prudential matters for crypto firms as part of the Markets in Crypto Assets (MiCA) legislation. MiCA, enforced last year, provides a comprehensive regulatory framework for the crypto sector in the European Union. The new standards cover stress testing programs, liquidity requirements, and recovery plans for stablecoin issuers, developed in collaboration with the European Securities and Markets Authority (ESMA) and the European Central Bank (ECB).

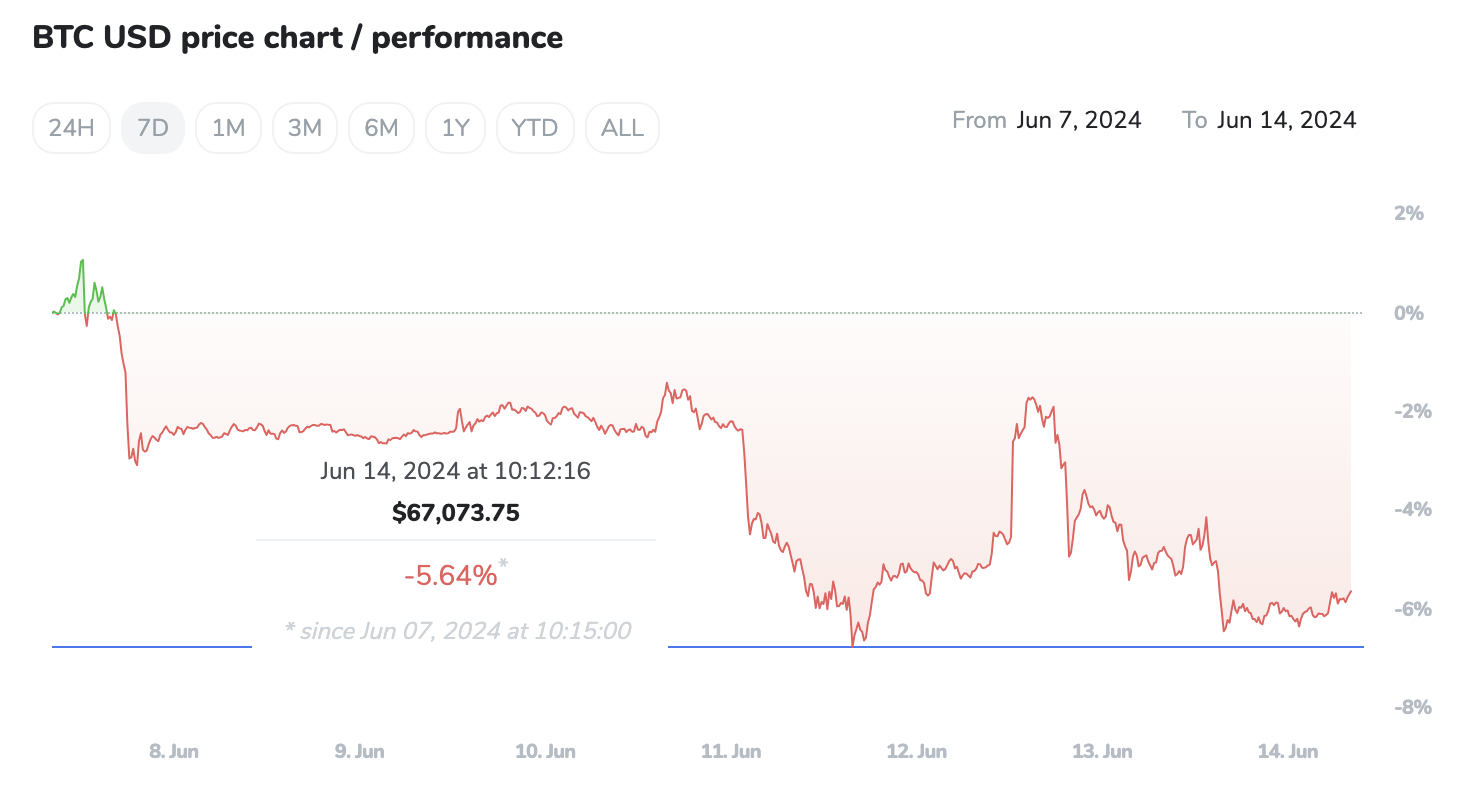

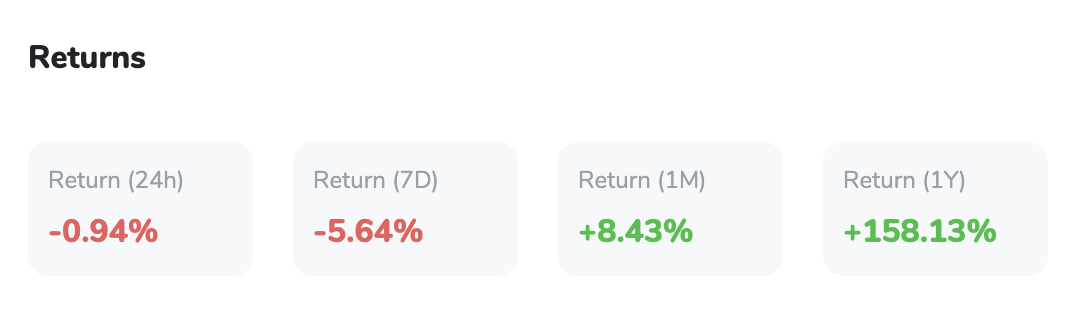

Bitcoin Price Analysis: Market Reactions and Investor Activity

Bitcoin (BTC), the leading cryptocurrency, has experienced bearish trends recently, dropping to around $66,680 from a high of $69,977.

This downturn is attributed to the Federal Reserve's unexpected hawkish stance, with policymakers predicting only one rate cut in 2024, contrary to earlier projections of three cuts. This stance, combined with stable inflation data, has pressured Bitcoin's price as increased U.S. Treasury yields and a stronger dollar reduce its appeal.

Source: TradingView

Technical indicators show Bitcoin struggling to maintain its position above the pivot point of $68,500. Immediate resistance levels are identified at $70,000, $71,700, and $72,900, while support levels are at $66,000, $64,600, and $63,200. The Relative Strength Index (RSI) stands at 41, indicating neutral momentum, and the 50-day Exponential Moving Average (EMA) is at $68,800, suggesting a bearish trend as the current price remains below this average. Despite the bearish outlook, significant accumulation by Bitcoin whales indicates strong investor confidence, hinting at potential support for Bitcoin's price amidst market fluctuations.

Biden Campaign Considers Crypto Donations

In an effort to demonstrate openness towards the crypto industry, President Joe Biden's re-election campaign team is reportedly exploring the possibility of accepting crypto donations via Coinbase Commerce. This move is seen as a way to show that the administration is not adversarial towards cryptocurrency. This consideration comes as Biden's campaign seeks financial support to compete with the Republican campaign, which has been actively embracing crypto donations. Former President Donald Trump, a presumptive Republican nominee, has already started accepting crypto donations and has promised to be a "crypto president" if re-elected.

Rising Bitcoin Trading Addiction Among Young Men in the UK

Amanda Pritchard, chief of the UK's National Health Service (NHS), expressed concerns about the increasing number of young men seeking treatment for Bitcoin trading addiction. She highlighted the role of unregulated crypto platforms in fostering gambling-like behaviour, which is straining NHS resources. This trend has led to calls for stricter regulation of the crypto market to prevent further harm. The UK Parliament's Treasury Committee has previously recommended treating speculative crypto investment as gambling, although this proposal has faced pushback from the UK Treasury, which argues that such treatment would conflict with international regulatory standards.

Conclusion

The crypto market continues to evolve with significant regulatory developments and market trends. The potential approval of Ethereum ETFs by the SEC, the implementation of MiCA standards in the EU, and notable price movements in Bitcoin highlight the dynamic nature of this sector. Meanwhile, political campaigns and public health concerns underscore the broader societal impact of cryptocurrency adoption. As these trends unfold, they will shape the future landscape of the crypto market and its regulatory environment.

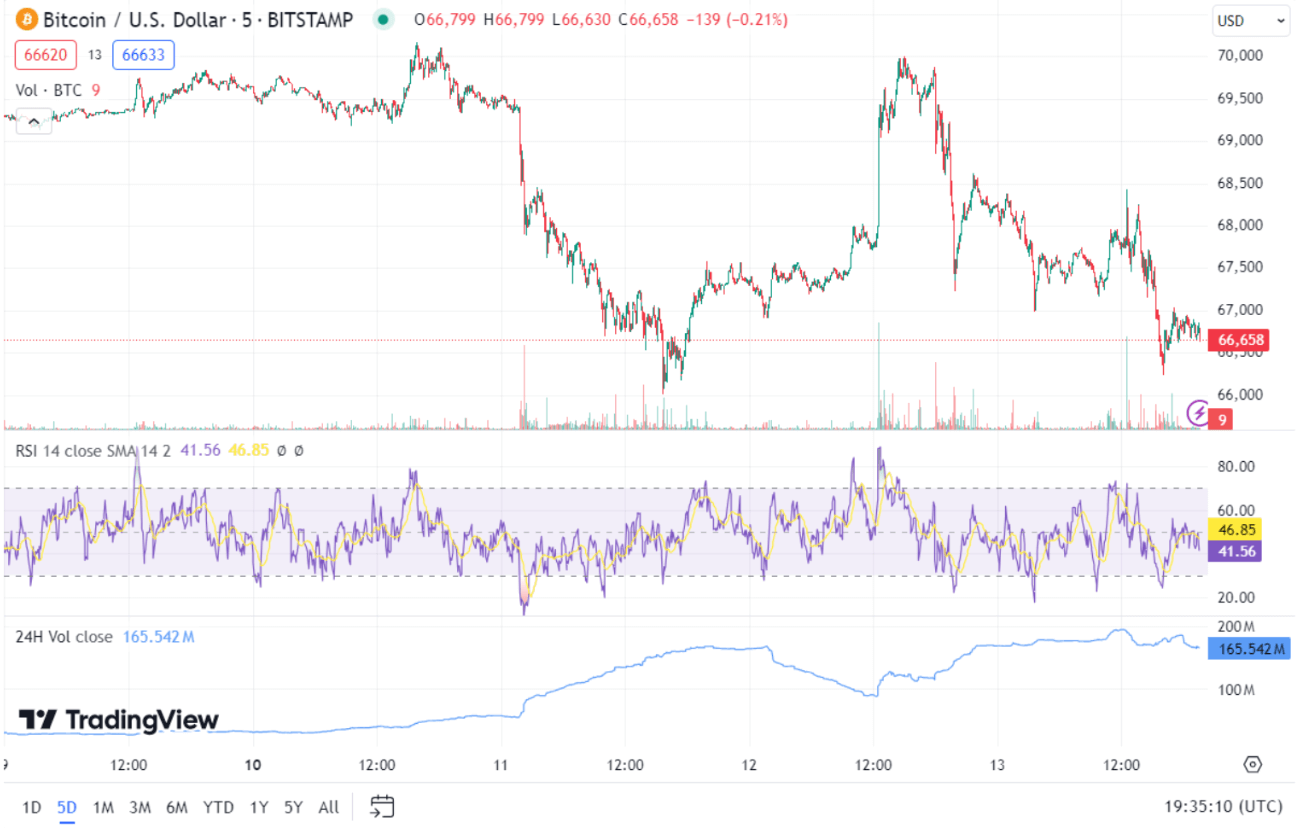

Best Cryptocurrencies by Return (24H)

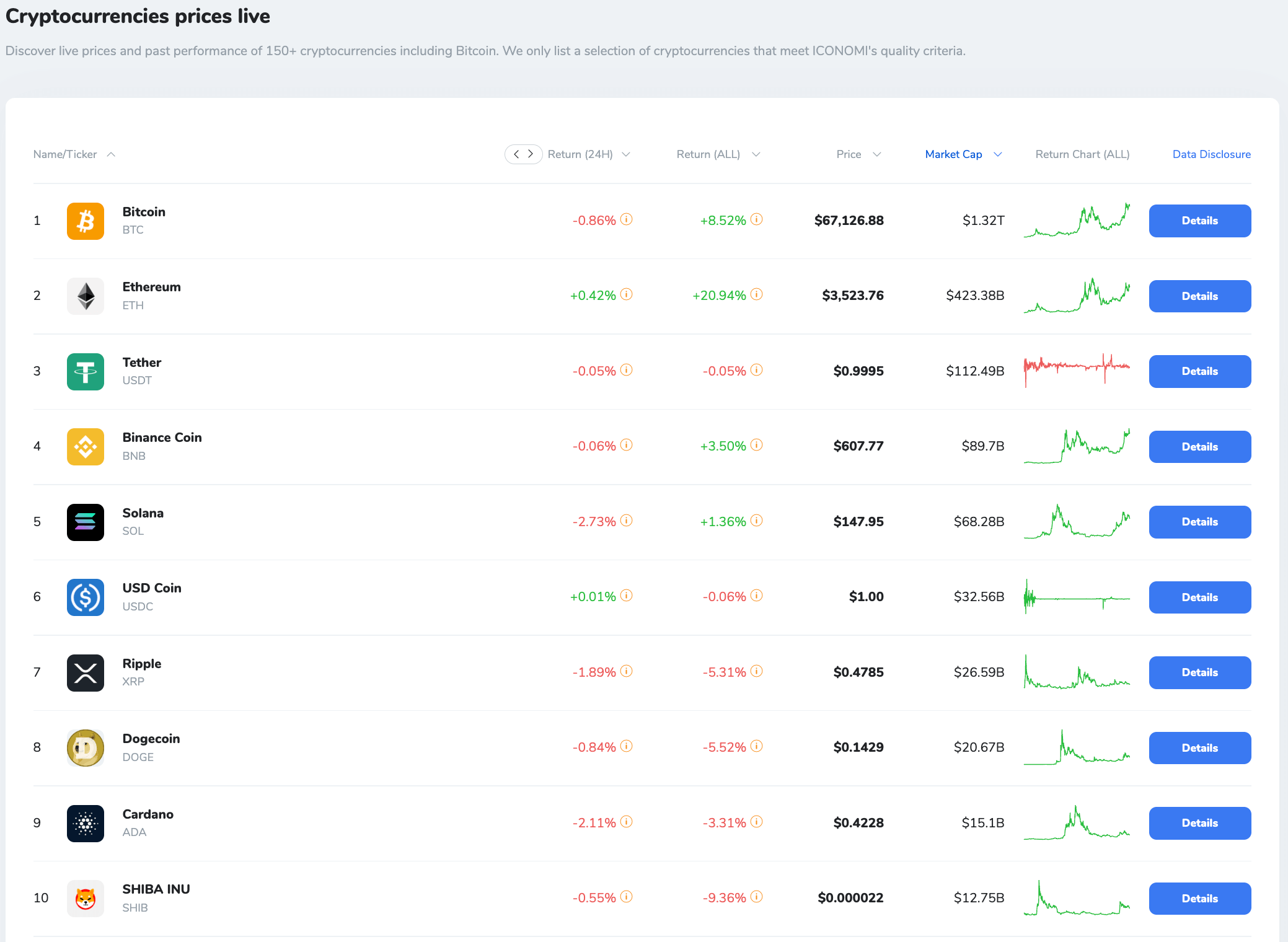

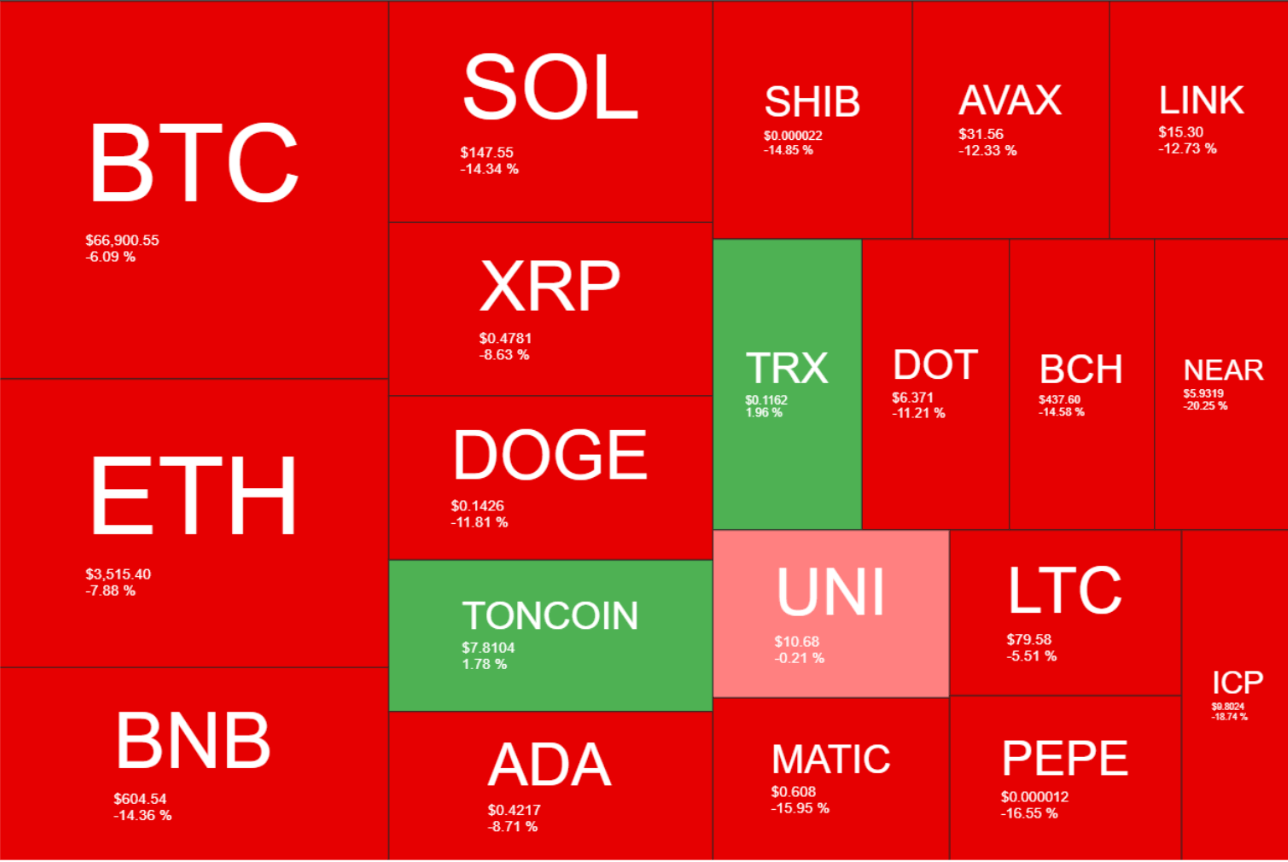

Weekly Crypto Heatmaps:

Source: Quantifycrypto