Crypto Weekly Wrap: 10th May 2024

UAE Adopts Regulatory Flexibility to Boost Crypto Investment

The United Arab Emirates (UAE) continues to make strides in embracing the crypto industry, with recent reports highlighting its adoption of accommodative regulatory policies to encourage further investment. Aiming to capitalise on the potential of Web3 applications, the Dubai Multi Commodities Centre (DMCC) has outlined opportunities within the decentralised digital infrastructure, including cryptocurrencies, DeFi, and the metaverse.

The DMCC's report forecasts substantial growth in both the metaverse and DeFi markets, projecting a market size of $3.4 trillion for the metaverse by 2027 and a rise in the global DeFi market from $13.6 billion in 2022 to $600 billion by 2032. This growth trajectory underscores the increasing demand for innovative financial services and decentralised platforms.

Despite the optimism surrounding these developments, the trajectory of these markets heavily depends on regulatory approaches. Striking a balance between fostering innovation and ensuring consumer protection remains crucial. The UAE's regulatory flexibility signals a positive step towards fostering a conducive environment for crypto innovation and investment, potentially attracting further interest from both retail and institutional investors.

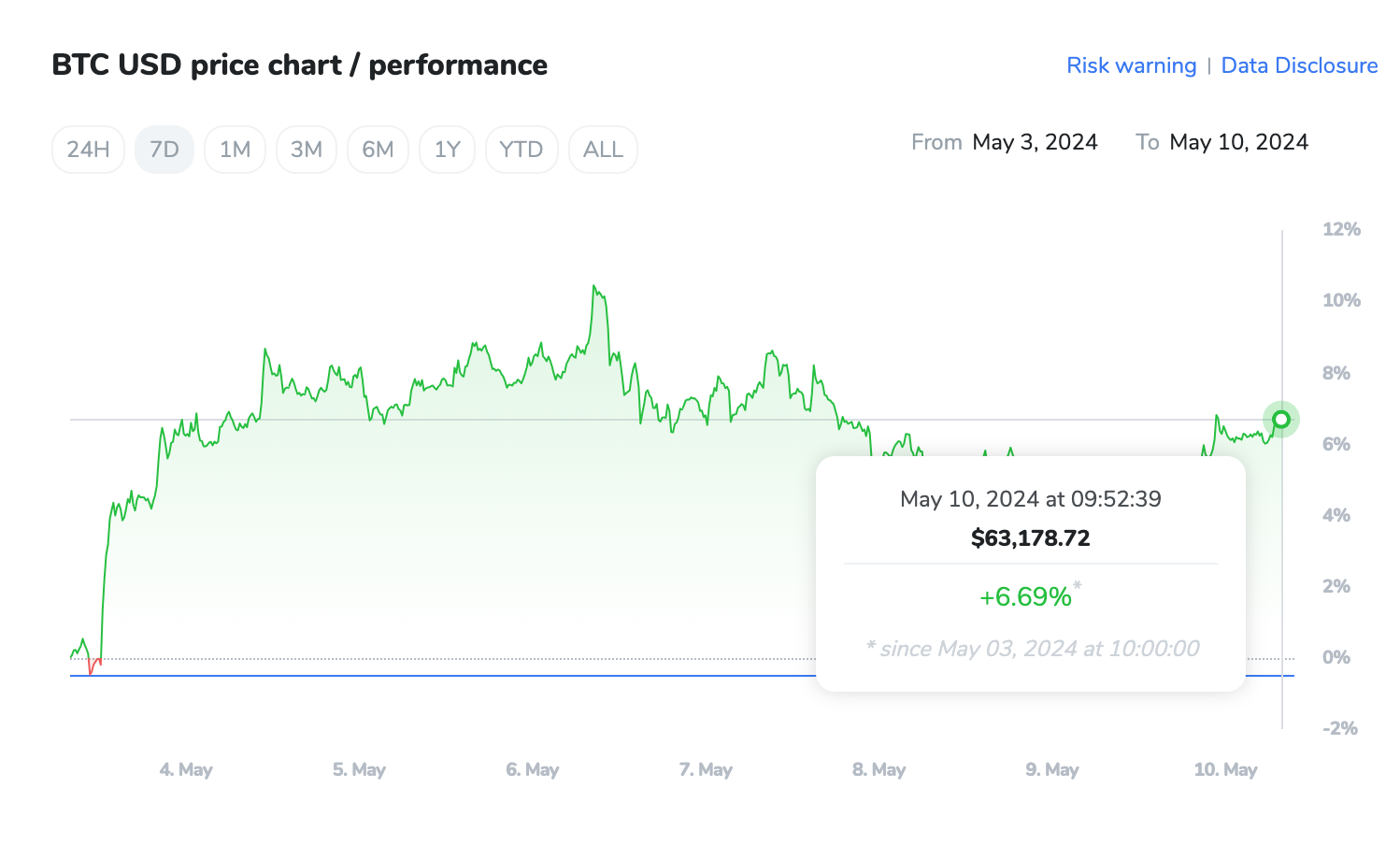

Bitcoin Technical Analysis: Bearish Signals Amidst Market Volatility

Bitcoin's recent price action reflects a mix of bullish and bearish signals, as the cryptocurrency struggles to maintain momentum amidst heightened market volatility. Currently trading around $63,178.72, BTC faces immediate resistance at $64,750, with another barrier at $67,150. Conversely, support levels are established at $60,930 and $58,930, providing fallback positions in case of price retractions.

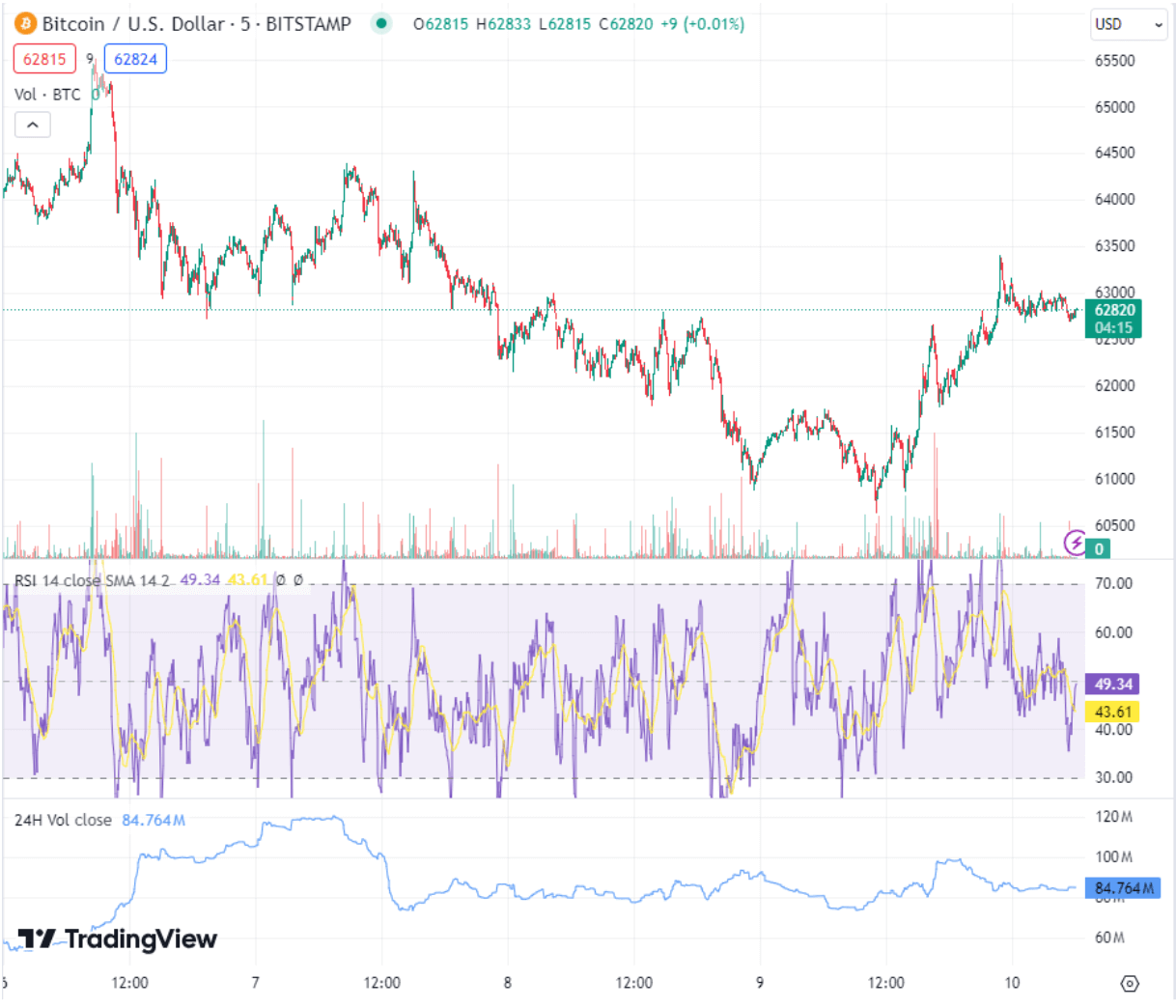

Technical indicators such as the Relative Strength Index (RSI) suggest a neutral momentum below the 50-day Exponential Moving Average (EMA), indicating potential downward pressure on prices. However, a decisive move above the 50 EMA could pivot towards a more bullish outlook. Traders should closely monitor BTC's price movements around the pivot point of $62,640, as it aligns with critical technical thresholds, reflecting the ongoing battle between bullish and bearish sentiments.

Source: TradingView

Market Sentiment and Whales' Impact on Bitcoin

Despite the challenging market conditions, large-scale Bitcoin investors, commonly known as "whales," continue to demonstrate confidence in the cryptocurrency. Recent data reveals significant whale activity, with investors accumulating approximately $971 million worth of Bitcoin amidst declining trading volumes. Wallets holding between 1,000 and 10,000 BTC have added over 15,000 BTC to their balances, underscoring a robust optimistic sentiment among major stakeholders.

Source: X

This surge in whale activity contrasts with the broader market sentiment, which remains cautious amidst regulatory uncertainties and macroeconomic factors. While Bitcoin's price struggles to maintain upward momentum, the confidence exhibited by whales suggests a long-term bullish outlook. Traders should consider the impact of whale accumulation on market dynamics, as it could influence short-term price fluctuations and broader market sentiment.

Regulatory Scrutiny and Market Dynamics

The crypto market continues to face regulatory scrutiny and evolving market dynamics, influencing price movements and investor sentiment. Recent developments, such as the closure of peer-to-peer exchange LocalMonero and regulatory actions against crypto projects, highlight the challenges posed by regulatory uncertainty. Additionally, market manipulation allegations and regulatory crackdowns on privacy-focused assets contribute to market volatility and investor concerns.

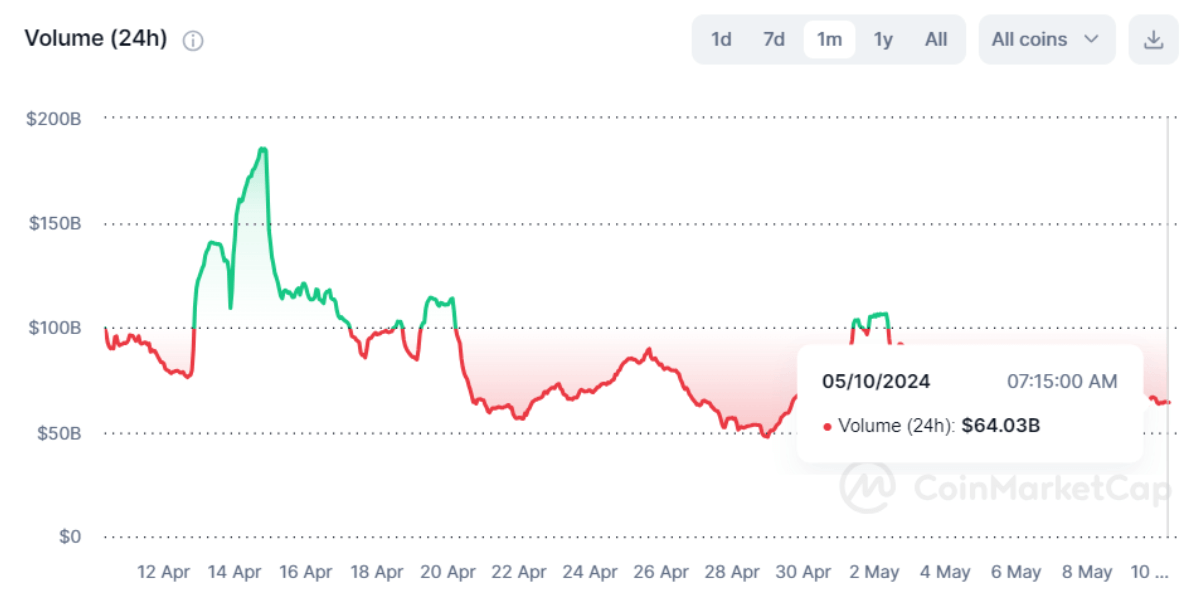

In April, the cryptocurrency market experienced its first decline in trading volume in seven months. Cumulative trading volume in both spot and derivatives markets fell sharply by 43.8% to $6.58 trillion, a significant retracement from the record high seen in March. This decline was driven by various factors including unexpected macroeconomic data, geopolitical tensions in the Middle East, and negative net flows from U.S.-listed spot bitcoin ETFs. Bitcoin, the leading cryptocurrency, saw a nearly 15% decline in April, breaking a seven-month winning streak amid broad-based risk aversion and strength in the dollar index. Despite remaining the largest exchange by volume, Binance's market share declined to 41.5%, coinciding with news of its founder's sentencing for money laundering violations. Nonetheless, Binance's spot market share has rebounded since then, indicating ongoing resilience within the cryptocurrency market amidst regulatory and geopolitical challenges.

Traders should remain vigilant and adapt to changing regulatory landscapes, as they play a significant role in shaping market sentiment and investment strategies. While regulatory clarity is essential for fostering industry growth and investor confidence, navigating regulatory complexities requires a thorough understanding of compliance requirements and proactive risk management strategies. As the crypto market matures, regulatory compliance will become increasingly integral to sustainable growth and market stability.