Latest News: Dogecoin Price Reacts to Whale Activity on Robinhood Amid SEC Wells Notice

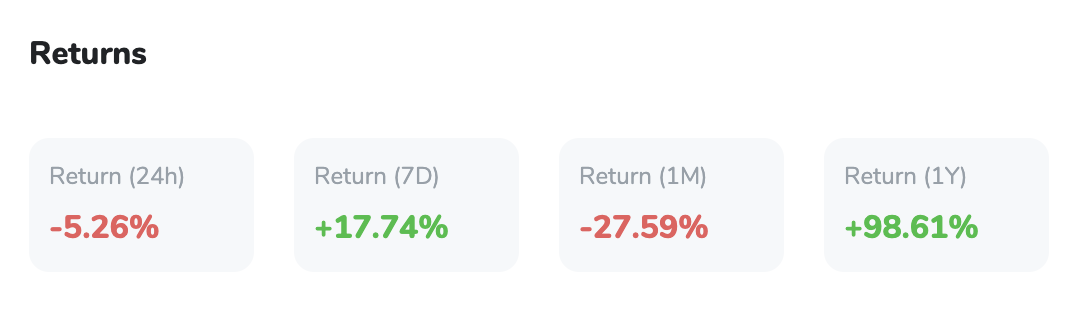

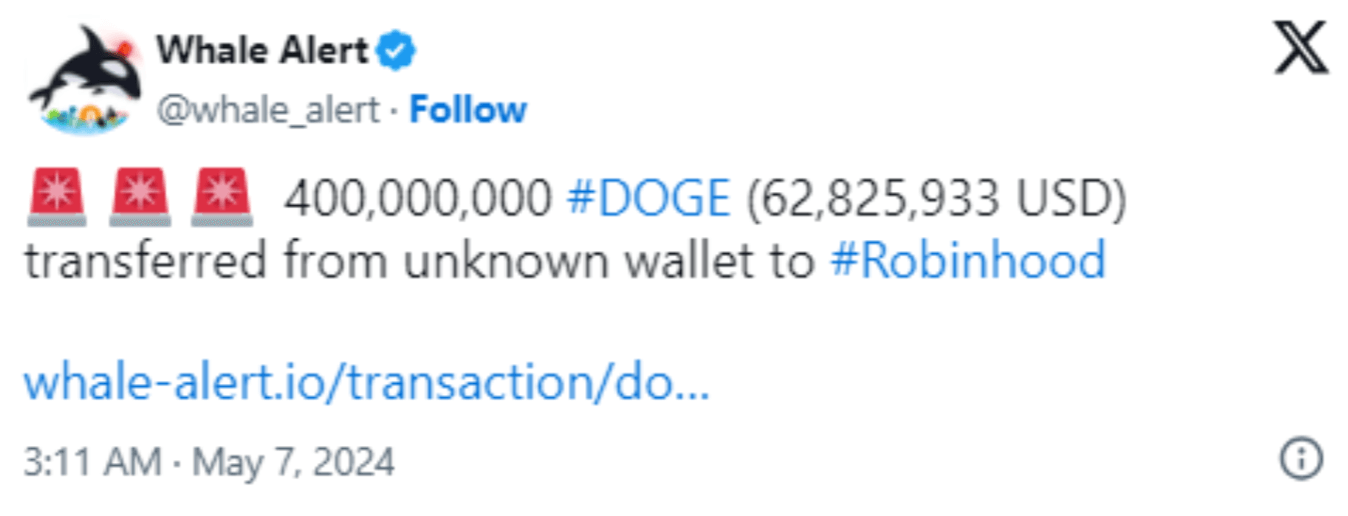

The Dogecoin price has encountered a slight dip of 5.26% over the past 24 hours, settling at $0.1482 as the broader crypto market experiences a 2% downturn. Despite this, DOGE has sustained an 18.6% increase over the past week, although it has faced a 27% decline over the last month. Notably, a significant whale transferred $60 million worth of DOGE to the Robinhood exchange, coinciding with Robinhood receiving a Wells notice from the SEC. This development raises concerns about potential legal actions, potentially impacting Dogecoin's short-term price trajectory.

Technical Analysis: Dogecoin's Price Outlook Amidst Whales and Market Dynamics

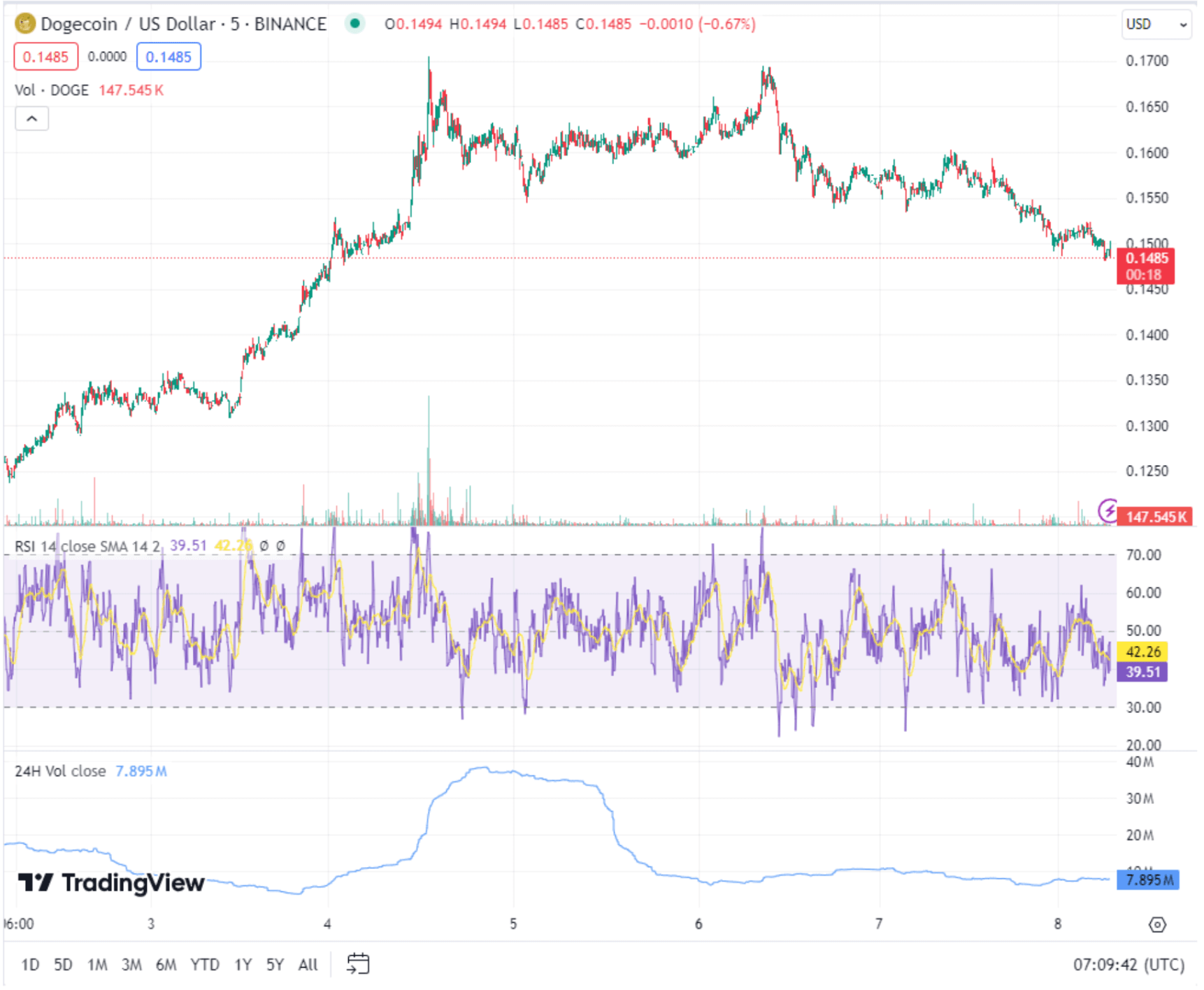

Analysing Dogecoin's price chart reveals a complex picture. While its 30-day average remains above the 200-day average, signalling potential upward movement, recent whale activity and regulatory uncertainties have introduced volatility. The breach of the bullish market structure indicates a shift in sentiment, with the potential for either a continued descent or a reversal towards higher levels. The Relative Strength Index (RSI) and Awesome Oscillator suggest a weakening of bullish momentum on a higher timeframe, potentially paving the way for a mean reversion play.

Source: TradingView

Analysing Dogecoin's price movement reveals several key technical indicators that can guide investor decisions. The breach of the bullish market structure, coupled with weakening momentum signals from the RSI and Awesome Oscillator, suggests a potential shift towards a bearish sentiment. Moreover, the convergence of significant support and resistance levels around $0.120 and $0.180 respectively underscores the importance of monitoring price action closely.

Source: X

As whales continue to influence market dynamics and regulatory uncertainties linger, Dogecoin's short-term outlook remains uncertain, with the potential for further downside moves before a potential reversal towards higher levels. Traders should exercise caution and implement risk management strategies to navigate the evolving landscape effectively.

Dogecoin On-Chain Metrics: Insights and Implications for Investors

Examining Dogecoin's on-chain metrics provides insights into investor sentiment and potential price movements. Currently, a majority of investors are "in the money," but the immediate support zone is relatively small and may not withstand significant selling pressure. Conversely, a strong support zone exists around $0.120, where a significant number of addresses purchased DOGE. However, resistance levels are also notable, particularly between $0.180, where a substantial number of addresses are "out of the money," potentially triggering sell-offs upon breakeven.

Market Analysis and Projection: Dogecoin's Path Forward Amidst Regulatory Concerns

Looking ahead, Dogecoin faces a critical juncture influenced by regulatory developments and market dynamics. The recent surge in trading volume and large transactions indicate heightened interest from major players, potentially leading to increased volatility. Technically, Dogecoin's price remains near the 50-day Exponential Moving Average, with further downside potential towards the 100-day EMA and potentially the 200-day Moving Average at $0.120. Investors should monitor whale activity and regulatory news closely, as they continue to shape Dogecoin's trajectory in the coming weeks.

Also, the recent surge in Dogecoin activity has been nothing short of extraordinary, with a staggering 28,000 new addresses created on May 2 alone, marking a remarkable 102% increase compared to previous lows. This surge reflects a growing interest in DOGE, bolstered by a 27% increase in non-empty crypto addresses over the past six months, now totaling 6.6 million active wallets. This renewed enthusiasm underscores Dogecoin's resilience and potential, as investors flock to this iconic cryptocurrency, driving its valuation higher. Moreover, Dogecoin's recent rise is part of a broader bullish trend in the crypto market, fueled by weaker-than-expected US economic data and the anticipation of a slower pace of interest rate hikes by the Federal Reserve.