Crypto Strategy Rules

The crypto market is a fast-paced environment which never sleeps. It's open all day, every day and completely indifferent to big holidays, major world events, or when you go for a drink with friends. But keeping up with the fast-paced changes is vital to your success. Luckily, you don't need to be online and glued to your screen at all times, as you can let technology help you.

That help comes in the form of automated rebalances, and at ICONOMI, we call it Rules.

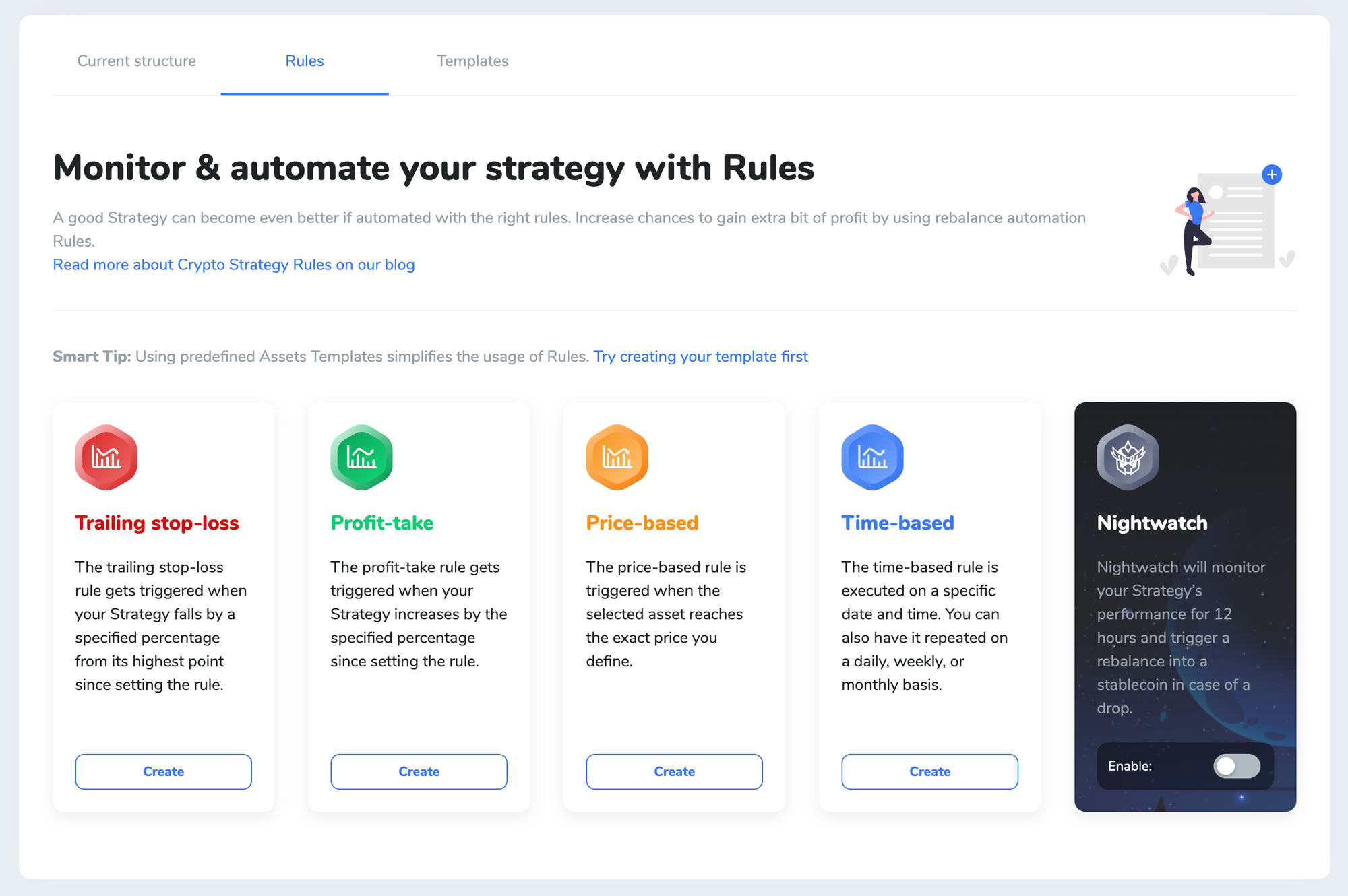

Rules are preset rebalances of your Strategy which get triggered when the conditions set by you are met. In other words, you set a structure, and it gets rebalanced when you want it to get rebalanced. Here's what you can do:

Strategy Rules

Trailing Stop-loss rule

It helps you when the market takes a sudden dive. This rule will be triggered when your Strategy falls by the percentage you specified and immediately initiates a rebalance. In practice, if you set the parameter to -5%, the Strategy will automatically rebalance to the predefined structure when your Strategy falls by 5%.

This rule is aptly named as it helps you stop your losses, as you can decide to rebalance to a safer structure in turbulent market conditions.

Profit-take rule

This rule guarantees that a position is closed at or greater than a predefined price point. In other words, it works as the exact opposite of the stop-loss rule – you define a percentage increase, and when your Strategy reaches that point, a rebalance will be made.

There are two ways to use this rule. The first one is straightforward: the Strategy went up by a good percentage, and you want to keep those gains, so you set it to rebalance into a stablecoin. Or, you could go full out into the market and catch a wave of increases, all the while having a second profit-take rule set up to rebalance into stablecoins when the Strategy increases even further.

Price-based rule

The price-based rule looks not at your Strategy's performance but instead at the market price of a specific asset or pairs of assets. It will start a rebalance when an asset you choose reaches a value you specified. This value can be more or less than the asset's current value, so it can be a positive or negative market sign – the way to use it is up to you and your analytics.

A simple use would be to escape an alt-coin you want to take some profit on. Due to some assets' volatility, it can be a good idea to set up a fail-safe if they start to fall.

Time-based rule

This one is based on a set time. You decide when, and the rule will automatically rebalance your Strategy to the defined structure. You can also set it to be repeated daily, weekly, or monthly, allowing for periodic rebalances.

Nightwatch is specifically designed to protect your assets over 12 hours, allowing you to have a quiet time of rest without worrying about your Strategy. It is similar to the stop-loss rule, but it can be set up in a few clicks and is turned off after the 12 hours pass. The way it functions is simple; if your Strategy falls by a certain percentage, it will rebalance the Strategy into either USDT or USDC, stabilising the Strategy.

Characteristics of all rules

Our rules feature similar setups and mechanics:

Setup

Setting them up is very simple; go to the structure tab of your Strategy and click on rules. There, you'll see which rules you can set and which rules you have active. You can also enable, disable or delete active rules here.

Mechanics

You have to specify a structure for each rule, and the rule will then rebalance to that structure when the rule conditions are met. To prevent unwanted rebalances caused by sudden spikes, a rule is triggered after conditions have been met for at least 5 minutes. Each time the criteria for a condition bounce back, the 5-minute timer is reset. Additionally, to prevent several rule condition resets, try experimenting with a little bit of "buffer" between obvious price resistance levels, where prices tend to oscillate a lot, resulting in unfavourable conditions to trigger the rule.

So next time you're managing your Strategy make sure to look into rules as they can help you out immensely!